How to recover depreciation from insurance claim Idea

Home » Trending » How to recover depreciation from insurance claim IdeaYour How to recover depreciation from insurance claim images are available in this site. How to recover depreciation from insurance claim are a topic that is being searched for and liked by netizens now. You can Get the How to recover depreciation from insurance claim files here. Download all royalty-free vectors.

If you’re searching for how to recover depreciation from insurance claim pictures information related to the how to recover depreciation from insurance claim topic, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

How To Recover Depreciation From Insurance Claim. To your shock, however, the settlement check was less than you expected it to be. In some cases, it is called a depreciation expense in your insurance claim. Here is the usual process for recovering depreciation on a home insurance claim: How is depreciation calculated for an insurance claim?

Recoverable Depreciation Definition and Example REthority From rethority.com

Recoverable Depreciation Definition and Example REthority From rethority.com

Here is the short version: The very first thing that licensed public adjusters will tell you to do is check. A claims adjuster will visit your home or business and. You can recover this amount by showing that a replacement or repair has been completed. Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. The policyholder will receive a check from the insurance company for the actual cash.

After three years when you file your claim, the insurance company only reimburses $700 for the tv.

Be sure to file the necessary paperwork to recover the depreciation, and make sure you know the deadlines. You can recover this amount by showing that a replacement or repair has been completed. Thankfully, you purchased insurance on the. Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. Due to property depreciation, every year the acv (adjusted cash value) of the tv decreases by $100. Based on this definition, recoverable depreciation is the portion of the depreciated amount that you can get back or “recover” from your insurance company when you make a claim on a policy with replacement cost coverage.

Source: americaninsurance.com

If you changed the scope of repairs, the insurance company will only pay for replacement in kind. Be sure to file the necessary paperwork to recover the depreciation, and make sure you know the deadlines. When you file an insurance claim, your insurer will take the depreciation into account when cutting you a check. Provide receipts to your adjuster to recover your property�s depreciated value. Thankfully, you purchased insurance on the.

Source: rethority.com

Source: rethority.com

A lot of homeowners and business owners that advocate claims public adjusters come across wonder how to recover depreciation from an insurance claim. Thankfully, you purchased insurance on the. How is depreciation calculated for an insurance claim? Due to property depreciation, every year the acv (adjusted cash value) of the tv decreases by $100. Every insurance company has its own policies for submitting a claim, but generally, to recover the cost of depreciation , you must repair or replace the damaged asset, save all invoices and receipts so you can submit them with the claim, provide original claim forms and receipts, and contact an.

Source: goodshepherdroofing.com

Source: goodshepherdroofing.com

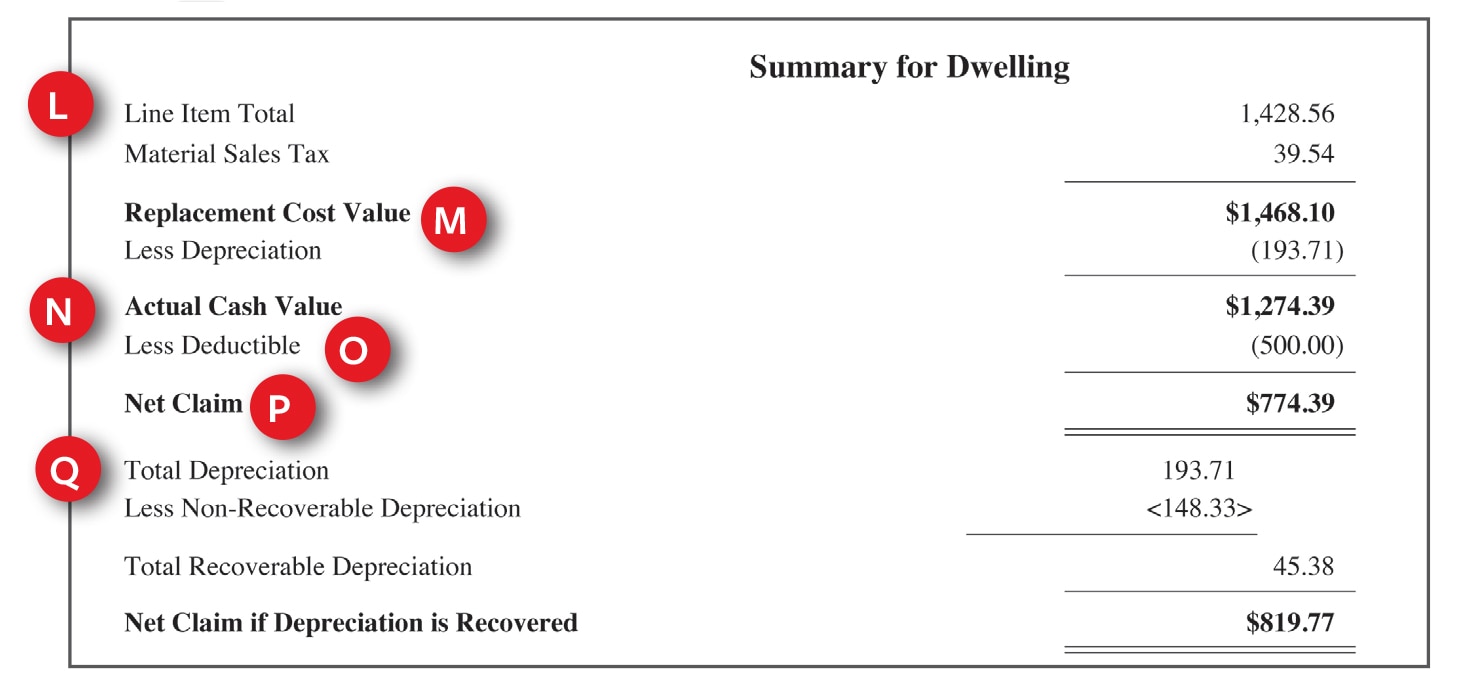

Such claims will generally be paid by the insurer in two parts. Such claims will generally be paid by the insurer in two parts. The invoice may indicate any payments, however, the total payments and remaining balance must equal the replacement cost value in order to receive the total. For example, if you have a roof from 2015, the item’s value is lowered throughout the years. The invoice may indicate any payments, however the total payments and remaining balance must equal the replacement cost value in order to receive the total available recoverable depreciation.

Source: travelers.com

Source: travelers.com

Due to property depreciation, every year the acv (adjusted cash value) of the tv decreases by $100. Thankfully, you purchased insurance on the. Just like with any contract, the parties can agree to change some of the terms if it is agreed to. However, you should be able to file a second claim for recoverable depreciation. A claims adjuster will visit your home or business and.

You can have a recoverable depreciation clause in your insurance policy. Just like with any contract, the parties can agree to change some of the terms if it is agreed to. With recoverable depreciation, the claim is adjusted upwards to include the depreciation amount: Due to property depreciation, every year the acv (adjusted cash value) of the tv decreases by $100. In addition, you can always ask for more time.

Source: rethority.com

Source: rethority.com

Providing the signed contract to your insurance company should allow them to release your recoverable depreciation. Then the company will send you a check for the acv amount, minus your insurance deductible. A recoverable depreciation clause allows the homeowners to claim the depreciation of certain assets along with their actual cash value. Provide receipts to your adjuster to recover your property�s depreciated value. Net claim with recoverable depreciation = $1,300 + depreciation =.

Source: rethority.com

Source: rethority.com

Such claims will generally be paid by the insurer in two parts. Providing the signed contract to your insurance company should allow them to release your recoverable depreciation. Based on this definition, recoverable depreciation is the portion of the depreciated amount that you can get back or “recover” from your insurance company when you make a claim on a policy with replacement cost coverage. If you’re like many of our customers you may wonder how to recover depreciation from an insurance claim. A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you.

Source: earlytoshare.blogspot.com

Source: earlytoshare.blogspot.com

A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you. If you’re like many of our customers you may wonder how to recover depreciation from an insurance claim. Thankfully, you purchased insurance on the property, so you filed a claim with your insurance company. A roof claim with recoverable depreciation generally involves the following details: After loss or damage occurs, call and initiate the claim process with your insurance provider.

Source: mychampionroofing.com

Source: mychampionroofing.com

After three years when you file your claim, the insurance company only reimburses $700 for the tv. Likewise, if the company receives an insurance claim from the insurance company amounting to 100% of the loss value of the fixed asset, it can make the journal entry for insurance claim received by debiting the cash account and the accumulated depreciation account and crediting the fixed asset account. Talk to your insurance agent about what is needed and always get copies of your receipts. A lot of homeowners and business owners that advocate claims public adjusters come across wonder how to recover depreciation from an insurance claim. However, you should be able to file a second claim for recoverable depreciation.

Source: quietskydesign.blogspot.com

Source: quietskydesign.blogspot.com

Thankfully, you purchased insurance on the property, so you filed a claim with your insurance company. Due to property depreciation, every year the acv (adjusted cash value) of the tv decreases by $100. When you file an insurance claim, your insurer will take the depreciation into account when cutting you a check. A lot of homeowners and business owners that advocate claims public adjusters come across wonder how to recover depreciation from an insurance claim. A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you.

Source: rethority.com

Source: rethority.com

Likewise, if the company receives an insurance claim from the insurance company amounting to 100% of the loss value of the fixed asset, it can make the journal entry for insurance claim received by debiting the cash account and the accumulated depreciation account and crediting the fixed asset account. A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you. This will make it easier if you ever need to file a claim. Every insurance company has its own policies for submitting a claim, but generally, to recover the cost of depreciation , you must repair or replace the damaged asset, save all invoices and receipts so you can submit them with the claim, provide original claim forms and receipts, and contact an. A recoverable depreciation clause allows the homeowners to claim the depreciation of certain assets along with their actual cash value.

Source: roparoofing.com

Source: roparoofing.com

Claiming recoverable depreciation from your insurance company begins with filing a claim. Here is the usual process for recovering depreciation on a home insurance claim: However, if your insurance policy allows you to recover the depreciation on your lost items, the insurer is required to pay you an additional $5,000 once the work has been completed. A lot of homeowners and business owners that advocate claims public adjusters come across wonder how to recover depreciation from an insurance claim. Thankfully, you purchased insurance on the.

Source: blog.higginbotham.net

Source: blog.higginbotham.net

Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. If your depreciation is recoverable then you will need to spend the amount that your insurance adjustment indicates as the replacement cost value of the repairs (7). Here is the usual process for recovering depreciation on a home insurance claim: Thankfully, you purchased insurance on the property, so you filed a claim with your insurance company. A lot of homeowners and business owners that advocate claims public adjusters come across wonder how to recover depreciation from an insurance claim.

Source: teambeck.com

Source: teambeck.com

The invoice may indicate any payments, however the total payments and remaining balance must equal the replacement cost value in order to receive the total available recoverable depreciation. Here is the short version: When you file an insurance claim, your insurer will take the depreciation into account when cutting you a check. In some cases, it is called a depreciation expense in your insurance claim. Thankfully, you purchased insurance on the.

.jpg “Roofing Contractor Forms for Insurance Restoration”) Source: actcontractorsforms.com

If you’re like many of our customers you may wonder how to recover depreciation from an insurance claim. If you changed the scope of repairs, the insurance company will only pay for replacement in kind. Thankfully, you purchased insurance on the. When you file an insurance claim, your insurer will take the depreciation into account when cutting you a check. Net claim with recoverable depreciation = $1,300 + depreciation =.

Source: rethority.com

Source: rethority.com

Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. In addition, you can always ask for more time. If you’re like many of our customers you may wonder how to recover depreciation from an insurance claim. A copy of the contractor’s invoice is submitted to the insurance company, which indicates the work was completed and the insurance company will release the recoverable depreciation to you. While the insurance company says the tv is only worth $700 because of depreciation, the store is still charging $1,000 for that same model.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The very first thing that licensed public adjusters will tell you to do is check. The very first thing that licensed public adjusters will tell you to do is check. Talk to your insurance agent about what is needed and always get copies of your receipts. How is depreciation calculated for an insurance claim? In some cases, it is called a depreciation expense in your insurance claim.

Source: btins.com

Source: btins.com

Here is the short version: Here is the short version: Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. An insurance adjuster will calculate the rcv, acv and depreciation of the property that was lost or damaged. However, if your insurance policy allows you to recover the depreciation on your lost items, the insurer is required to pay you an additional $5,000 once the work has been completed.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to recover depreciation from insurance claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.