How to renew car insurance philippines Idea

Home » Trending » How to renew car insurance philippines IdeaYour How to renew car insurance philippines images are available in this site. How to renew car insurance philippines are a topic that is being searched for and liked by netizens today. You can Get the How to renew car insurance philippines files here. Find and Download all royalty-free images.

If you’re searching for how to renew car insurance philippines images information related to the how to renew car insurance philippines topic, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

How To Renew Car Insurance Philippines. Below is the inspection process in securing an mvir. A 2016 toyota fortuner with 2.4l g 4x2 engine with automatic transmission can be insured for ₱1,165,756 (without acts of nature) for a premium of ₱29,144*. Access the lto online pass. You just need to submit a few documents, and we will gladly help you settle them as quick as possible.

A Helpful Guide For The Renewal Of Car Insurance for First From a1articles.org

A Helpful Guide For The Renewal Of Car Insurance for First From a1articles.org

Nothing beats being first in line! Print and you’re all set. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. It’s your solid game plan on the road that’s fast and easy to buy. Now, you can buy or renew car insurance online in a convenient manner through your laptop, desktop, tablet, or mobile phone. Provide the original copy or photocopy of your official receipt (or) or certificate of registration (cr).

Now, you can buy or renew car insurance online in a convenient manner through your laptop, desktop, tablet, or mobile phone.

According to the lto, motorists can renew their vehicle registration using the ltms starting in september 2020. Provide the original copy or photocopy of your official receipt (or) or certificate of registration (cr). A month before your policy expires, you’ll get a letter from your insurance company about renewal, along with info about your new car insurance premium, a new declarations page and new insurance cards. How to renew your car insurance? So for now, car owners may use the lto online personal appointment & scheduling system (pass), which was launched in 2018 and is still working, to set an appointment for car registration renewal. Photocopy of previous motor vehicle policy insurance;

Source: a1articles.org

Source: a1articles.org

To renew an insurance, you used to have to go to the branch or rely on a middleman.the best approach to renew your motor car insurance is to go on the main branch of our company. Wait for your name to be called by the cashier to receive your i.d. How to renew your car insurance? Bring with you a face mask and face shield as lto requires you to wear these within its premises. Ask about the renewal process (or requirements are needed if you want to upgrade) your coverage.

Source: alamy.com

Source: alamy.com

If you do nothing (and keep making payments), your policy will automatically be renewed and new premium rates will apply on your renewal dates. You can renew your car registration at any lto online district or extension branch. You’ll be asked to provide key details [1] such as your vehicle’s year, make, model, and variant, its age, your location, and your claims history. Having insurance protects their asset until the borrower has completed the payments. How to apply for a car insurance in the philippines.

Source: youtube.com

Source: youtube.com

Photocopy of certificate of registration (cr) and latest or from the land transportation office; Finally, claim the lto sticker at the releasing counter if it’s available. If you do nothing (and keep making payments), your policy will automatically be renewed and new premium rates will apply on your renewal dates. However, with today’s technology, you can easily select and purchase an insurance policy suited for your needs on the internet, which makes the car insurance renewal process easier and quicker. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto.

Source: sgautoconcierge.com

Source: sgautoconcierge.com

Comprehensive car insurance can also be purchased for extra protection, but isn’t required by law. Provide the original copy or photocopy of your official receipt (or) or certificate of registration (cr). Car insurance renewal does not have to be a difficult procedure. Photocopy of previous motor vehicle policy insurance; Wait for your name to be called by the cashier to receive your i.d.

Source: jmjfamily.com

Source: jmjfamily.com

To renew an insurance, you used to have to go to the branch or rely on a middleman.the best approach to renew your motor car insurance is to go on the main branch of our company. Print and you’re all set. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. You can renew your car registration at any lto online district or extension branch. According to the lto, motorists can renew their vehicle registration using the ltms starting in september 2020.

Source: slideserve.com

Source: slideserve.com

Contact your chosen car insurance provider or broker to start your car insurance renewal process. Ask about the renewal process (or requirements are needed if you want to upgrade) your coverage. Photocopy of previous motor vehicle policy insurance; Tpl provides compensation to the third party in case of an accident. You can renew your car registration at any lto online district or extension branch.

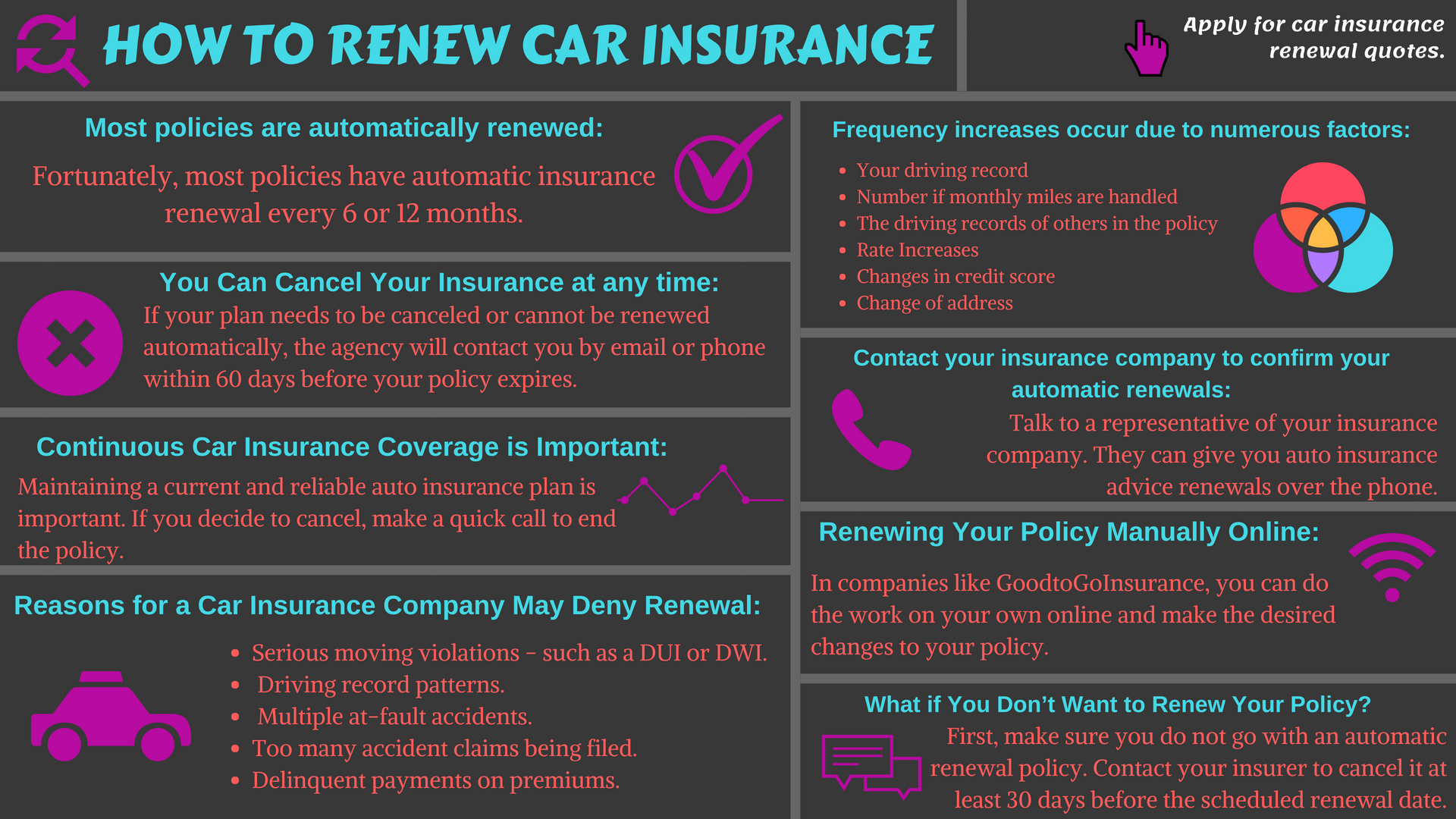

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

Once you’ve decided on an insurance company, you either visit the nearest branch or connect with them by phone or online to ask for the requirements. The process is quick and easy in the mgs insurance agency. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. How to renew your car insurance? This package covers liabilities arising from damage to someone else’s vehicle or property, and bodily injury or death to a third party.

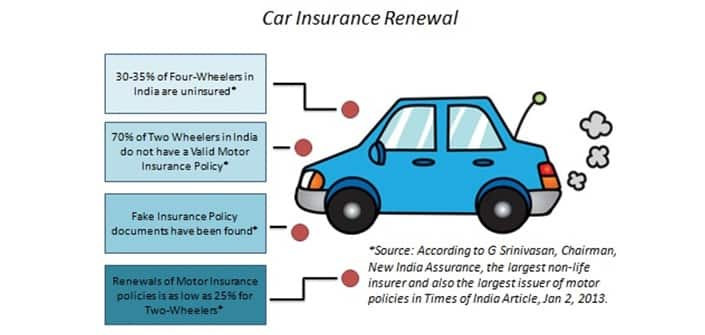

Source: comparepolicy.com

Source: comparepolicy.com

You’ll be asked to provide key details [1] such as your vehicle’s year, make, model, and variant, its age, your location, and your claims history. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. How to apply for a car insurance in the philippines. Once you’ve decided on an insurance company, you either visit the nearest branch or connect with them by phone or online to ask for the requirements. After finding out when your policy ends, talk to your car insurance agent.

Source: policybazaar.com

Source: policybazaar.com

To renew an insurance, you used to have to go to the branch or rely on a middleman.the best approach to renew your motor car insurance is to go on the main branch of our company. And pay the renewal fees which could go from p1,260 to around p5,000, depending on the vehicle class. However, you can save money by visiting the branch you initially registered in. However, with today’s technology, you can easily select and purchase an insurance policy suited for your needs on the internet, which makes the car insurance renewal process easier and quicker. Below is the inspection process in securing an mvir.

Source: thepinayinvestor.com

Source: thepinayinvestor.com

Car insurance for vehicle owners looking for extra liability coverage on top of the compulsory third party liability or for liability coverage even for vehicles over 8 years of age. Now, you can buy or renew car insurance online in a convenient manner through your laptop, desktop, tablet, or mobile phone. Bring with you a face mask and face shield as lto requires you to wear these within its premises. Car insurance renewal does not have to be a difficult procedure. Print and you’re all set.

Source: ecomparemo.com

Source: ecomparemo.com

You just need to submit a few documents, and we will gladly help you settle them as quick as possible. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. Nothing beats being first in line! Car insurance for vehicle owners looking for extra liability coverage on top of the compulsory third party liability or for liability coverage even for vehicles over 8 years of age. However, with today’s technology, you can easily select and purchase an insurance policy suited for your needs on the internet, which makes the car insurance renewal process easier and quicker.

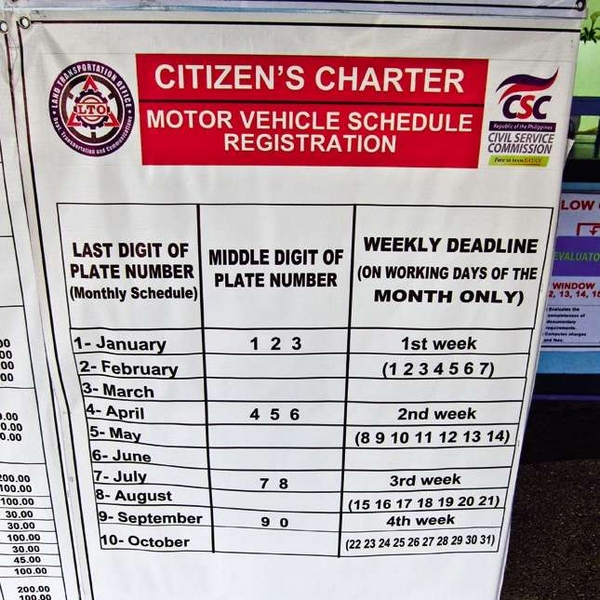

Source: pinterest.com

Source: pinterest.com

Contact your chosen car insurance provider or broker to start your car insurance renewal process. First of all you need to know your insurance renewal schedule and two months beforehand, start researching other possible options. Tpl provides compensation to the third party in case of an accident. A car bought through an auto loan or some other financing scheme is required to be kept insured until the amortization has been fully paid for, since the car legally remains the property of the bank or the lending institution that granted the loan. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto.

Source: thecuriousdaddy.com

Source: thecuriousdaddy.com

A 2016 toyota fortuner with 2.4l g 4x2 engine with automatic transmission can be insured for ₱1,165,756 (without acts of nature) for a premium of ₱29,144*. Tips for car registration renewal in the philippines. In doing so, you won’t have to pay a php 100 change venue fee to transfer your records to the local database. Regardless of insurance providers, insuring your car in the philippines will require you to do some basic procedures such as submitting important documents and providing your vehicle details. Nowadays, the rise of car insurance comparison sites such as ecomparemo allow people to compare the premium rates from several different companies in the.

Source: reviewmotors.co

Source: reviewmotors.co

You’ll be asked to provide key details [1] such as your vehicle’s year, make, model, and variant, its age, your location, and your claims history. Confirmation of cover (coc) and ctpl insurance policy are instantly sent via email. Tips for car registration renewal in the philippines. Photocopy of previous motor vehicle policy insurance; Bring with you a face mask and face shield as lto requires you to wear these within its premises.

Source: astig.ph

Source: astig.ph

However, with today’s technology, you can easily select and purchase an insurance policy suited for your needs on the internet, which makes the car insurance renewal process easier and quicker. The easiest way is by checking the effective date of your policy. Print and you’re all set. A car bought through an auto loan or some other financing scheme is required to be kept insured until the amortization has been fully paid for, since the car legally remains the property of the bank or the lending institution that granted the loan. Comprehensive car insurance can also be purchased for extra protection, but isn’t required by law.

Source: shriramgi.com

Source: shriramgi.com

One of the most important requirements in the lto car registration and renewal process is the mvir or motor vehicle inspection report. Services like autodeal insurance will automatically send you renewal quotes from which you can choose from. Ask about the renewal process (or requirements are needed if you want to upgrade) your coverage. This quote is based on the pricing of auto security Print and you’re all set.

Source: management.ind.in

Source: management.ind.in

A month before your policy expires, you’ll get a letter from your insurance company about renewal, along with info about your new car insurance premium, a new declarations page and new insurance cards. A month before your policy expires, you’ll get a letter from your insurance company about renewal, along with info about your new car insurance premium, a new declarations page and new insurance cards. And pay the renewal fees which could go from p1,260 to around p5,000, depending on the vehicle class. Submit your documents to the lto receiving clerk. A 2016 toyota fortuner with 2.4l g 4x2 engine with automatic transmission can be insured for ₱1,165,756 (without acts of nature) for a premium of ₱29,144*.

Source: auto.hindustantimes.com

Source: auto.hindustantimes.com

Finally, claim the lto sticker at the releasing counter if it’s available. You can renew your car registration at any lto online district or extension branch. Philippine law requires all vehicle owners to purchase a compulsory third party liability (tpl) insurance policy before they register or renew their vehicles at the lto. Here are the 4 main requirements for applying for a car insurance. This quote is based on the pricing of auto security

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to renew car insurance philippines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.