How to take a loan from life insurance Idea

Home » Trending » How to take a loan from life insurance IdeaYour How to take a loan from life insurance images are available. How to take a loan from life insurance are a topic that is being searched for and liked by netizens now. You can Download the How to take a loan from life insurance files here. Download all royalty-free photos and vectors.

If you’re looking for how to take a loan from life insurance images information related to the how to take a loan from life insurance topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

How To Take A Loan From Life Insurance. You can use the funds to pay for a childs college tuition, make a down payment on a new home or pay for other financial obligations. Take into account the downside to borrowing against your life insurance. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. The rules vary by insurer, but a.

How much can I Borrow from my Life Insurance Policy? From theinsuranceproblog.com

How much can I Borrow from my Life Insurance Policy? From theinsuranceproblog.com

In most cases, taking a loan from your life insurance policy allows more flexibility in repayment. How do life insurance loans work? Take out a loan from your life insurance policy. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. To initiate a policy loan, you’ll need to contact your life insurance company.

If you don�t pay the interest on your loan, the insurance company will add that unpaid interest to your loan amount.

You can only borrow against a permanent or whole life insurance policy. Depending on the state, collateral assignment occurs when a policyholder assigns the lender. But life insurance loans come with some stipulations that make them more complex than standard bank loans. You can take out a loan from the policy, cancel it, “surrender” a portion of it, or sell it. You can only borrow against a permanent or whole life insurance policy. Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan.

Source: globelifeofnewyork.com

Source: globelifeofnewyork.com

Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan. After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. You should monitor the loan and ensure that it does not affect your life insurance policy. But life insurance loans come with some stipulations that make them more complex than standard bank loans. Once your insurance policy has a useful amount of cash value, you can use that as collateral for a loan.

Source: youtube.com

Source: youtube.com

One option for accessing the cash value in your life insurance is to take out a loan from your insurer. You can only borrow against a permanent or whole life insurance policy. Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan. How long does it take to borrow money from life insurance? In addition to these, you might also be asked to submit copies of your identity proof and your address proof.

Source: livemint.com

Source: livemint.com

After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. Usually, the money can be accessed quickly and is often used to pay for emergency expenses. There is a way for policyholders to use their life insurance policy as collateral for a loan by utilizing the value of the policy. Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan. It can take anywhere from one day to 15 days to receive funds from a life insurance loan, depending on.

Source: housing.com

Source: housing.com

All you need to do is fill and submit your loan application form along with the original life insurance policy document and an assignment deed that assigns the benefits of the policy to the lender. Monitor the loan balance regularly and compare it with the policy’s cash value. People who hold a life insurance plan and/or ulips (unit linked insurance plans) can apply for this loan. How much you can borrow from your life insurance policy depends on your cash value amount. Some insurers allow loan requests online in the same portal mentioned above that you can use to check your policy values.

Source: skloff.com

Source: skloff.com

After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. Your insurance company charges you interest like any other lender, but repayment for life insurance loans is much more flexible than for traditional loans. How much you can borrow from your life insurance policy depends on your cash value amount. Your insurance company can provide you with a figure, called the cash surrender value, that tells you how much your policy is worth if you close it and take out the money. Usually, the money can be accessed quickly and is often used to pay for emergency expenses.

Source: easyworknet.com

Source: easyworknet.com

Should i take a loan out from my policy? Should i take a loan out from my policy? Monitor the loan balance regularly and compare it with the policy’s cash value. But life insurance loans come with some stipulations that make them more complex than standard bank loans. Take out a loan from your life insurance policy.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

A variable life insurance loan is a loan that your insurance company extends to you using your cash value as collateral. Take out a loan from your life insurance policy. If you don�t pay the interest on your loan, the insurance company will add that unpaid interest to your loan amount. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. Your permanent life insurance policy may allow you to take a loan against your cash balance.

Source: oneinsure.com

Source: oneinsure.com

Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan. Should i take a loan out from my policy? If you don�t pay the interest on your loan, the insurance company will add that unpaid interest to your loan amount. Once a person decides that borrowing against life insurance makes sense, the cash they�ve built up acts as loan collateral. Monitor the loan balance regularly and compare it with the policy’s cash value.

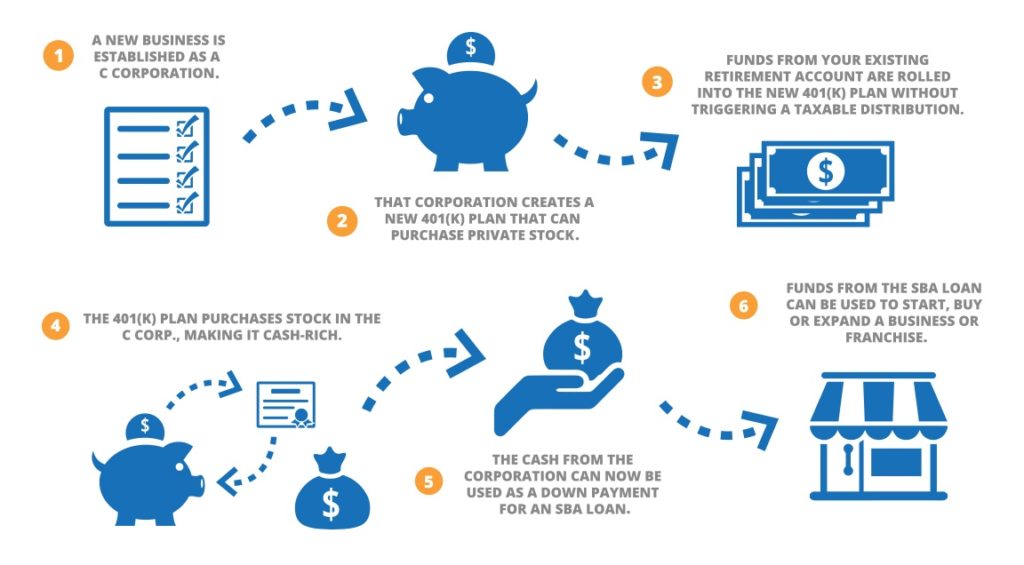

Source: guidantfinancial.com

Source: guidantfinancial.com

Your permanent life insurance policy may allow you to take a loan against your cash balance. Your permanent life insurance policy may allow you to take a loan against your cash balance. Loans and withdrawals from life insurance policies that are classified as modified endowment contracts may be subject to tax at the time that the loan or withdrawal is taken and, if taken prior to age 59½, a 10 percent federal tax penalty may apply. You can only borrow against a permanent or whole life insurance policy. In most cases, taking a loan from your life insurance policy allows more flexibility in repayment.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

The easiest and quickest way to initiate the loan process is to call the life insurance company and request a loan from a customer service representative. In most cases, taking a loan from your life insurance policy allows more flexibility in repayment. If the documents state that your policy will only acquire a minimum surrender value when you have paid premiums for at least three years, then you can get a loan only after ensuring premiums are paid for the three years. Take out a loan from your life insurance policy. Generally, your cash balance must grow to a certain amount before you can take a loan out.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Before buying a life insurance plan, make sure to read through the policy documents to understand the terms and conditions associated with it. Once your insurance policy has a useful amount of cash value, you can use that as collateral for a loan. Ensure you pay the loan as per the repayment plan. After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. Should i take a loan out from my policy?

A variable life insurance loan is a loan that your insurance company extends to you using your cash value as collateral. Depending on the state, collateral assignment occurs when a policyholder assigns the lender. One option for accessing the cash value in your life insurance is to take out a loan from your insurer. Things to know before you decide for a loan against insurance policy: Loans and withdrawals from life insurance policies that are classified as modified endowment contracts may be subject to tax at the time that the loan or withdrawal is taken and, if taken prior to age 59½, a 10 percent federal tax penalty may apply.

Source: youtube.com

Source: youtube.com

How much you can borrow from your life insurance policy depends on your cash value amount. How much you can borrow from your life insurance policy depends on your cash value amount. After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. In addition to these, you might also be asked to submit copies of your identity proof and your address proof. Before taking out a policy loan, find out what will happen to the.

Source: bestinsurancecenter.com

Source: bestinsurancecenter.com

One option for accessing the cash value in your life insurance is to take out a loan from your insurer. Usually, the money can be accessed quickly and is often used to pay for emergency expenses. If you don�t pay the interest on your loan, the insurance company will add that unpaid interest to your loan amount. Take into account the downside to borrowing against your life insurance. If the documents state that your policy will only acquire a minimum surrender value when you have paid premiums for at least three years, then you can get a loan only after ensuring premiums are paid for the three years.

Source: wikihow.com

Source: wikihow.com

A policy loan is issued by an insurance company and uses the cash value of a persons life insurance policy as collateral. Usually, the money can be accessed quickly and is often used to pay for emergency expenses. One option for accessing the cash value in your life insurance is to take out a loan from your insurer. Monitor the loan balance regularly and compare it with the policy’s cash value. All you need to do is fill and submit your loan application form along with the original life insurance policy document and an assignment deed that assigns the benefits of the policy to the lender.

![]() Source: paisabazaar.com

Source: paisabazaar.com

Once you reach that threshold, a loan against your policy could be easier than getting a traditional loan. One option for accessing the cash value in your life insurance is to take out a loan from your insurer. The easiest and quickest way to initiate the loan process is to call the life insurance company and request a loan from a customer service representative. Your insurance company charges you interest like any other lender, but repayment for life insurance loans is much more flexible than for traditional loans. How do life insurance loans work?

Source: youtube.com

Source: youtube.com

And taking a loan against your insurance policy is no exception. There is a way for policyholders to use their life insurance policy as collateral for a loan by utilizing the value of the policy. People who hold a life insurance plan and/or ulips (unit linked insurance plans) can apply for this loan. Once a person decides that borrowing against life insurance makes sense, the cash they�ve built up acts as loan collateral. When you take a life loan, also called a loan on life insurance, the policy loan money can be used for anything.

Source: einsurance.com

Source: einsurance.com

Unlike the traditional insurance policies, ulips offer life insurance risk covers that provide options to invest in areas like shares, stocks and bonds. After the cash value of your permanent policy reaches a certain amount — the exact minimum varies by insurer — you can take out a loan against your policy. In most cases, taking a loan from your life insurance policy allows more flexibility in repayment. Rather than making monthly payments to a bank on a fixed term, you can pay back as little or as much as you want, and at any time interval. You can only borrow against a permanent or whole life insurance policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to take a loan from life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.