Human life approach insurance Idea

Home » Trending » Human life approach insurance IdeaYour Human life approach insurance images are ready in this website. Human life approach insurance are a topic that is being searched for and liked by netizens now. You can Download the Human life approach insurance files here. Download all free photos.

If you’re searching for human life approach insurance images information linked to the human life approach insurance topic, you have visit the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

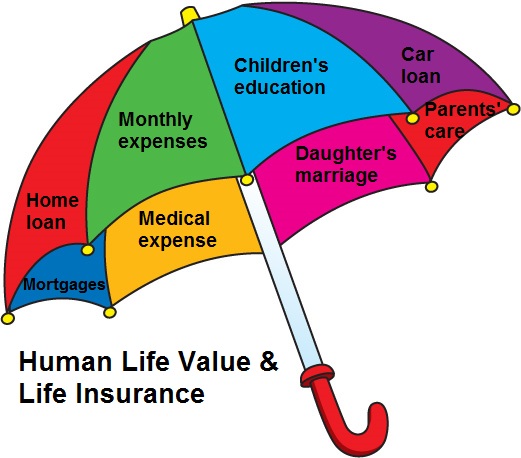

Human Life Approach Insurance. The human life value approach is a way to calculate the life insurance needs of an individual. A great resource for calculating life insurance needs is this human life value calculator here. Simply put, your human life value is the amount of income you will be expected to earn in your lifetime. Calculating one’s life insurance needs with this process involves multiple steps.

Human Life Value Approach Insurance Literacy Institute From tonysteuer.com

Human Life Value Approach Insurance Literacy Institute From tonysteuer.com

That said the human life value (hlv) or income replacement strategy is a technique for determining the right amount of insurance that a person should purchase now in the event of future income loss. With that concept as a baseline, the calculation is then used to assess “human life value” for insurance purposes. What is human life value? It can be calculated by the following steps: It provides only a rough estimate of your human life value, which can factor into how much insurance you need. A person earning $100,000 per year over a 30 year period, for example, would have an approximate human life value of $3,000.000.

Life insurance plans provide a high life risk cover to keep you and your loved ones protected against eventualities in life.

Human life value or income replacement method calculation for life insurance i will explain in this article. Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. The members who are not earning will be dependant on the members who are earning. Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member. To accomplish this, the agent evaluates the family’s current. Life insurance plans provide a high life risk cover to keep you and your loved ones protected against eventualities in life.

Source: slideshare.net

Source: slideshare.net

For example, adrian is 30 years old and makes $100,000 per year. Life insurance plans provide a high life risk cover to keep you and your loved ones protected against eventualities in life. In life insurance parlance, human life value or hlv, represents the amount that ensures a family�s standard of living does not get affected if the one who earns for the family dies or is unable to continue earning. The human life value approach is a way to calculate the life insurance needs of an individual. So if that person wanted to protect his entire human life value, he would need $3,000,000 in life insurance.

Source: tonysteuer.com

Source: tonysteuer.com

It goes beyond just the numbers and considers the overall impact of losing someone, especially the breadwinner. To accomplish this, the agent evaluates the family’s current. Your human life value (hlv) is a holistic approach to assessing how much life insurance an individual needs based on several factors, such as income, age, dependents, while also taking into account inflation and its effect on the future purchasing power of money. Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. The method takes into account a person’s income, expenses and.

Source: sludgeport512.web.fc2.com

Source: sludgeport512.web.fc2.com

The agent has decided to use the needs approach for kevin and patricia. The latter two methods are more sophisticated and allow you to address the specific needs and concerns of your clients’ survivors. It goes beyond just the numbers and considers the overall impact of losing someone, especially the breadwinner. Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn during his or her lifetime.

Source: finmantra.co.in

Source: finmantra.co.in

The human life value approach to calculating life insurance needs: The two methods of calculating life insurance needs will result in different estimates. Called the human life value approach, it’s a method of deciding how much life insurance an individual might require. This calculator is designed to determine the amount of money needed for life insurance. There are three common ways to determine a client’s life insurance needs:

Source: mymoneysage.in

Source: mymoneysage.in

The human life value concept is a universally adopted approach utilized by underwriters as well as courts when establishing the economic value of a human life. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn during his or her lifetime. Factors like an individual’s age, gender, when he/she wants to retire, occupation, annual wage etc, determine hlv. The human life value approach is a way to calculate the life insurance needs of an individual. A great resource for calculating life insurance needs is this human life value calculator here.

Source: slideshare.net

Source: slideshare.net

Capital retention approach human life value approach hlv can be defined as the present value of the family’s share of the deceased breadwinner’s future earnings. In life insurance parlance, human life value or hlv, represents the amount that ensures a family�s standard of living does not get affected if the one who earns for the family dies or is unable to continue earning. It goes beyond just the numbers and considers the overall impact of losing someone, especially the breadwinner. What is human life value? Life insurance provides a support for taking care of the financial crisis arising out of the death of the insured person.

Source: advisorkhoj.com

Source: advisorkhoj.com

This method considers the level of financial loss a family will suffer in the event of the demise of the insured person. The human life value approach to calculating life insurance needs: Factors like an individual’s age, gender, when he/she wants to retire, occupation, annual wage etc, determine hlv. By focusing only on a family breadwinner’s expected future earnings stream, the human life value provides a fairly rough estimate of life insurance needs. His income provides his family’s ability to live in a specific neighborhood, attend private school, drive a new car, eat an organic diet, and vacation in florida each year.

Source: paisahealth.in

Source: paisahealth.in

It’s particularly relevant in terms of applications to life insurance. Your human life value (hlv) is a holistic approach to assessing how much life insurance an individual needs based on several factors, such as income, age, dependents, while also taking into account inflation and its effect on the future purchasing power of money. This method considers the level of financial loss a family will suffer in the event of the demise of the insured person. The amount required to cover the needs and goals of the life insured in the event of the demise of the earning member is calculated. It goes beyond just the numbers and considers the overall impact of losing someone, especially the breadwinner.

Source: youtube.com

Source: youtube.com

There are three common ways to determine a client’s life insurance needs: It can be calculated by the following steps: The two methods of calculating life insurance needs will result in different estimates. The agent has decided to use the needs approach for kevin and patricia. This method simply called an hlv method also.

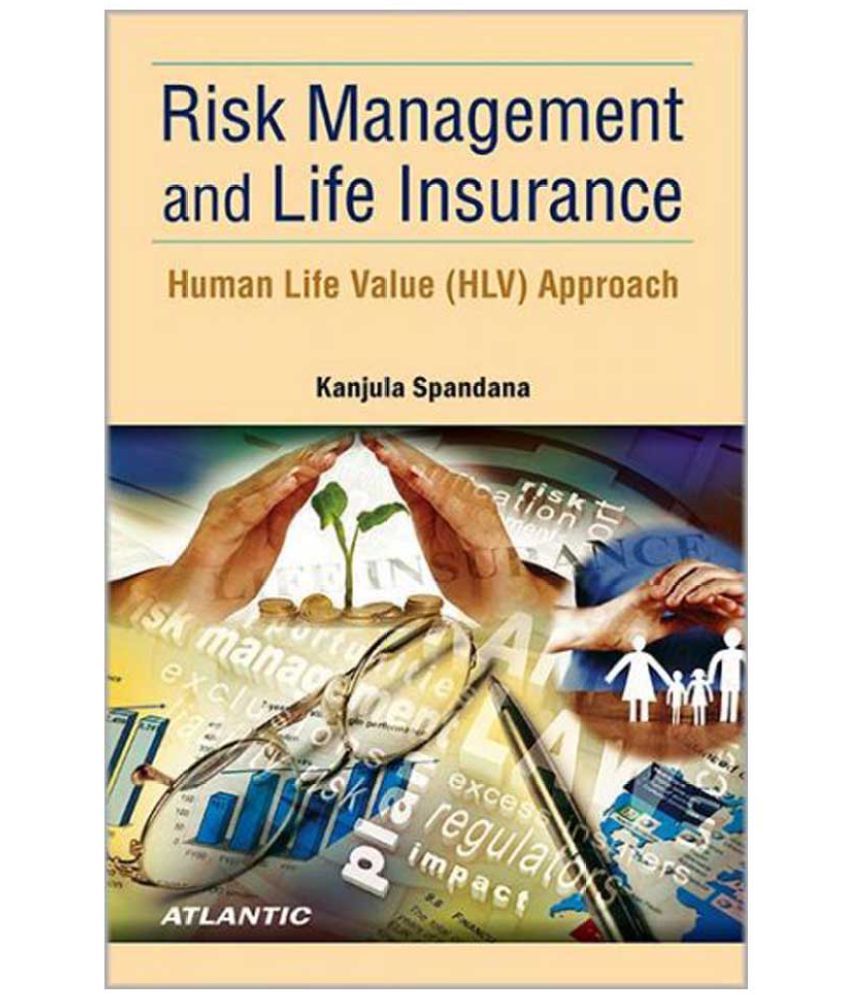

Source: snapdeal.com

Source: snapdeal.com

Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member. Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. Factors like an individual’s age, gender, when he/she wants to retire, occupation, annual wage etc, determine hlv. The net value of a person�s future earning potential is used to assess human life value for insurance purposes. Three various approaches are used to determine the amount of life insurance to own:

Source: slideshare.net

Source: slideshare.net

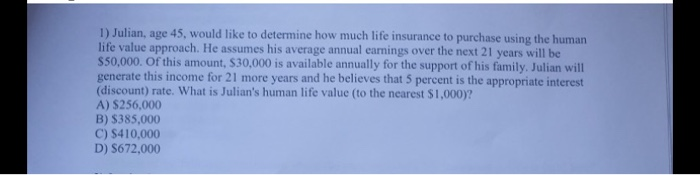

Human life value approach 2. Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. The human life value approach is a way to calculate the life insurance needs of an individual. Calculating one’s life insurance needs with this process involves multiple steps. The members who are not earning will be dependant on the members who are earning.

Source: sias.org.sg

Source: sias.org.sg

Calculating one’s life insurance needs with this process involves multiple steps. Factors like an individual’s age, gender, when he/she wants to retire, occupation, annual wage etc, determine hlv. That said the human life value (hlv) or income replacement strategy is a technique for determining the right amount of insurance that a person should purchase now in the event of future income loss. After calculating a typical lifetime income based on your specific circumstances, you’ll see a final number that gives an approximate measure of your net contribution to your family—your human life value. Some people in the family will earn and some members will not earn.

Source: slideshare.net

Source: slideshare.net

After calculating a typical lifetime income based on your specific circumstances, you’ll see a final number that gives an approximate measure of your net contribution to your family—your human life value. Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member. Your human life value (hlv) is a holistic approach to assessing how much life insurance an individual needs based on several factors, such as income, age, dependents, while also taking into account inflation and its effect on the future purchasing power of money. What is human life value? Human life value or income replacement method calculation for life insurance i will explain in this article.

Source: chegg.com

Source: chegg.com

Human life value approach 2. Factors like an individual’s age, gender, when he/she wants to retire, occupation, annual wage etc, determine hlv. The members who are not earning will be dependant on the members who are earning. The human life approach is more sensative to the age of the insured, whereas the capitalized earnings approach will be sensitive to the expected. So if that person wanted to protect his entire human life value, he would need $3,000,000 in life insurance.

Source: canarahsbclife.com

Source: canarahsbclife.com

The net value of a person�s future earning potential is used to assess human life value for insurance purposes. The human life value approach to calculating life insurance needs: Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn during his or her lifetime. It is the capitalized value of an individual for the rest of their life and is calculated on the basis of current inflation. A person earning $100,000 per year over a 30 year period, for example, would have an approximate human life value of $3,000.000.

Source: bsmg.net

Source: bsmg.net

In life insurance parlance, human life value or hlv, represents the amount that ensures a family�s standard of living does not get affected if the one who earns for the family dies or is unable to continue earning. By focusing only on a family breadwinner’s expected future earnings stream, the human life value provides a fairly rough estimate of life insurance needs. A person earning $100,000 per year over a 30 year period, for example, would have an approximate human life value of $3,000.000. With that concept as a baseline, the calculation is then used to assess “human life value” for insurance purposes. This method simply called an hlv method also.

![]() Source: dreamstime.com

Source: dreamstime.com

According to this method, the amount of life insurance coverage one should buy is directly proportionate to the economic value, otherwise called human life value (hlv). That said the human life value (hlv) or income replacement strategy is a technique for determining the right amount of insurance that a person should purchase now in the event of future income loss. The human life approach is more sensative to the age of the insured, whereas the capitalized earnings approach will be sensitive to the expected. The method takes into account a person’s income, expenses and. Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member.

Source: youtube.com

Source: youtube.com

Human life value approach 2. The human life value approach to calculating life insurance needs: Using the human life value approach , the value of a human�s life is calculated on net future earnings potential and may be determined by discounting a person�s future net earnings at a reasonable rate of interest. By focusing only on a family breadwinner’s expected future earnings stream, the human life value provides a fairly rough estimate of life insurance needs. This method simply called an hlv method also.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title human life approach insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.