Hurricane insurance florida information

Home » Trending » Hurricane insurance florida informationYour Hurricane insurance florida images are ready. Hurricane insurance florida are a topic that is being searched for and liked by netizens now. You can Find and Download the Hurricane insurance florida files here. Get all free images.

If you’re searching for hurricane insurance florida pictures information connected with to the hurricane insurance florida keyword, you have come to the ideal blog. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

Hurricane Insurance Florida. In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. Download the dolman law group accident injury lawyers, pa app for direct contact with our firm. • it is actually the law in florida for all insurance companies to offer hurricane deductibles. It does cover property damages to a residential and commercial property caused by a tropical storm or named hurricane.

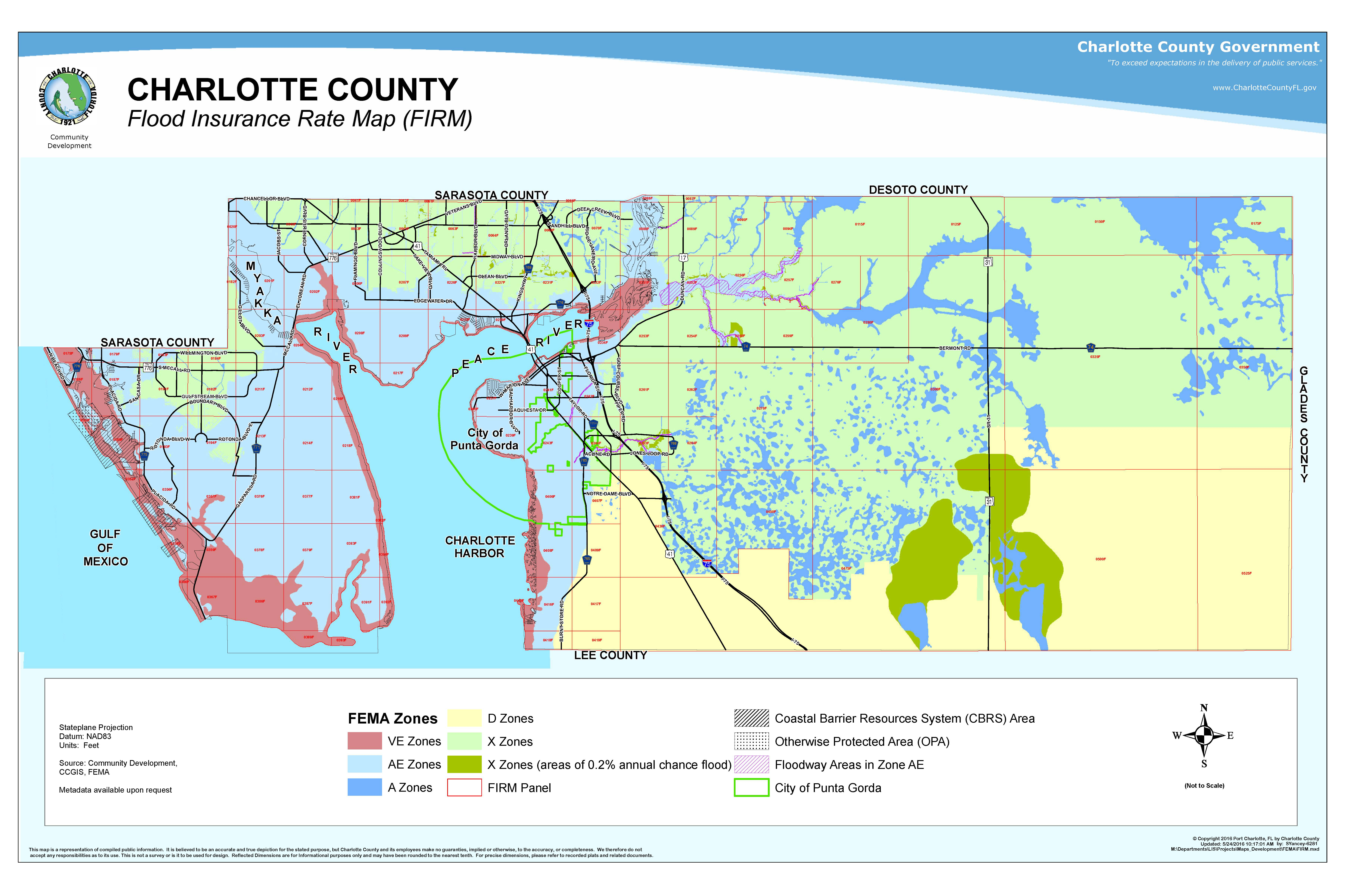

Flood Insurance Rate Map Florida Printable Maps From 4printablemap.com

Flood Insurance Rate Map Florida Printable Maps From 4printablemap.com

One of the ways a person can prepare for hurricane season in florida is by purchasing or reviewing their insurance policy. While there is no such thing as specific “hurricane insurance,” standard homeowners policies tend to cover damage caused by a hurricane. Coverage protects your home from damage caused by the high winds and potential hail that can accompany hurricanes. Under florida law, you have three years after the hurricane to file an insurance claim or any supplemental claims. Dolman law group accident injury lawyers, pa. The average cost of nfip flood insurance in florida is $599, while homeowners insurance costs $2,155 a year on average, according to nerdwallet’s rate.

Florida is a unique state that is surrounded by water on three.

Hurricane coverage is included in your standard homeowners insurance policies in florida, since the state is so accustomed to these natural disasters being a common issue for residents. One of the ways a person can prepare for hurricane season in florida is by purchasing or reviewing their insurance policy. The deductible ranges from 1 to 5 percent of the value of a home. These protections do not extend to damage caused by flooding. What does hurricane insurance cover? • it is actually the law in florida for all insurance companies to offer hurricane deductibles.

Source: allianztravelinsurance.com

Source: allianztravelinsurance.com

Coverage protects your home from damage caused by the high winds and potential hail that can accompany hurricanes. In florida, you only have to pay one hurricane deductible within the calendar year, provided you are insured with the same insurance company or group of companies for the second or subsequent hurricanes during the same calendar year. The annual average cost for windstorm insurance in coastal florida is $2600. Generally speaking, there is no such thing as “hurricane insurance,” or a specific policy that florida homeowners can purchase to protect against these storms. What does hurricane insurance cover?

Source: activerain.com

Source: activerain.com

If the governor declares a state of emergency because of a hurricane, florida � s insurance commissioner may order insurers to not cancel or nonrenew a property insurance policy covering a dwelling or residential property damaged by the hurricane for at least 90 days after the property has been repaired (i.e., substantially completed and restored so that it is. The annual average cost for windstorm insurance in coastal florida is $2600. How much is hurricane insurance? How much is hurricane insurance in florida? In florida, the average home insurance policy costs around $1,117 a year.

Source: capecoralrealestatenow.com

Source: capecoralrealestatenow.com

You will only have to pay this deductible annually per season—not for every storm that pops up (thank goodness). In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. What does hurricane insurance cover? You will only have to pay this deductible annually per season—not for every storm that pops up (thank goodness). In florida, as in other states, there is a time limit for filing an insurance claim.

Source: flindependentagents.com

Source: flindependentagents.com

It applies to damage specific to hurricanes and is triggered by specific criteria, such as severe weather alerts. In florida, the average home insurance policy costs around $1,117 a year. It does cover property damages to a residential and commercial property caused by a tropical storm or named hurricane. The average cost of nfip flood insurance in florida is $599, while homeowners insurance costs $2,155 a year on average, according to nerdwallet’s rate. Coverage protects your home from damage caused by the high winds and potential hail that can accompany hurricanes.

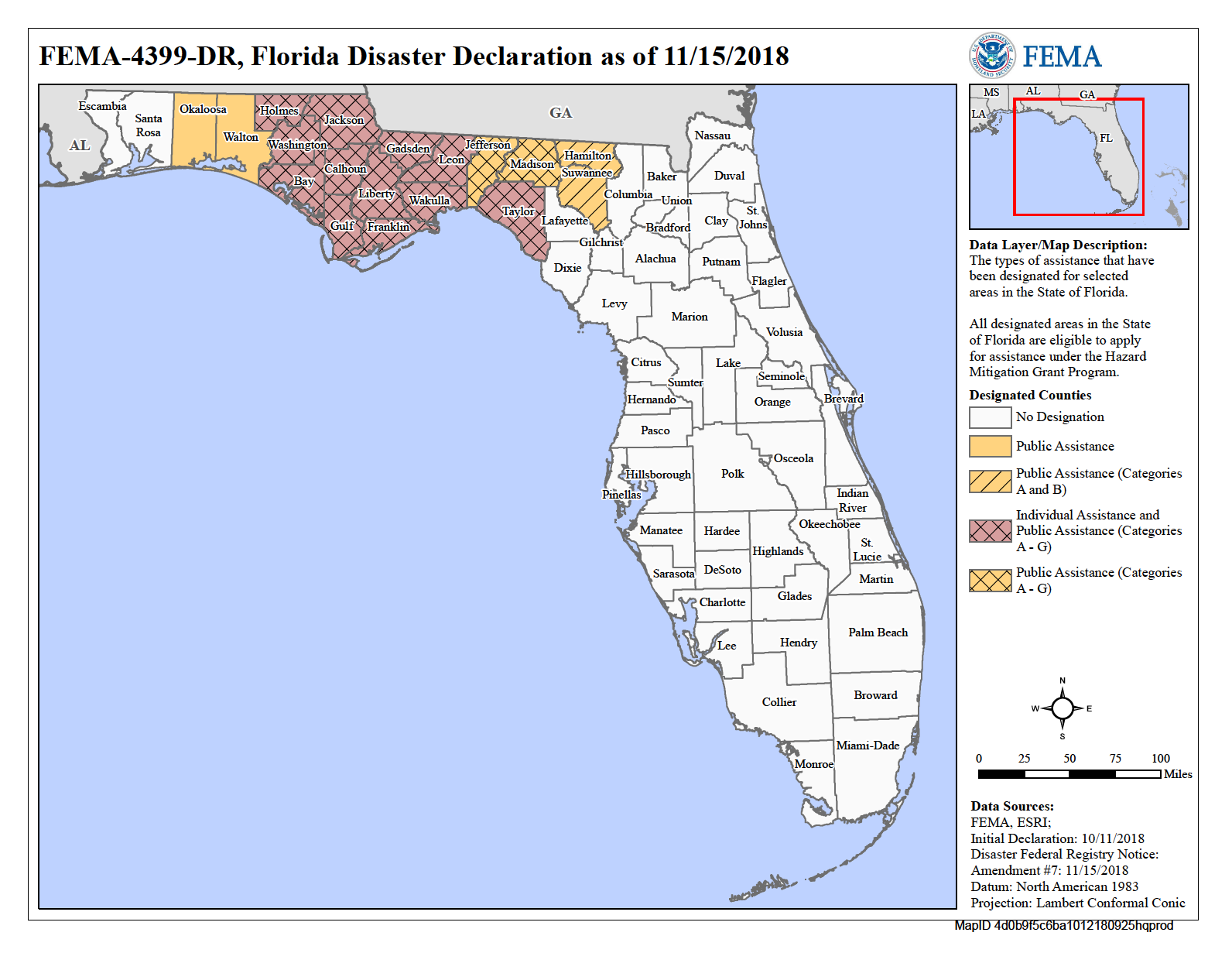

Source: fema.gov

Source: fema.gov

Dolman law group accident injury lawyers, pa. The deductible ranges from 1 to 5 percent of the value of a home. Hurricane insurance is a necessary insurance policy in the state of florida; Keep in mind that this typically just covers damages from hurricane winds. The florida legislature began requiring this policy, which is bundled into florida homeowners , condo and landlord insurance policies at the time of purchase.

Source: floridainsurance.ws

Source: floridainsurance.ws

While there is no such thing as specific “hurricane insurance,” standard homeowners policies tend to cover damage caused by a hurricane. How much is hurricane insurance? Hurricane coverage — or any condo insurance, for that matter — is not required by law in florida. Hurricane insurance is a necessary insurance policy in the state of florida; A hurricane insurance policy is the best solution to offset hurricane losses and receive compensation for necessary repairs to your home or your commercial properties in florida.

Source: blog.homesalesoftallahassee.com

Source: blog.homesalesoftallahassee.com

Generally speaking, there is no such thing as “hurricane insurance,” or a specific policy that florida homeowners can purchase to protect against these storms. Best overall for hurricane insurance: The deductible ranges from 1 to 5 percent of the value of a home. It is because of this that it is essential to know how to prepare. That being said, all florida residents should have it.

Source: responsiveinsurance.com

Source: responsiveinsurance.com

Best overall for hurricane insurance: Coverage protects your home from damage caused by the high winds and potential hail that can accompany hurricanes. Under florida law, you have three years after the hurricane to file an insurance claim or any supplemental claims. That being said, all florida residents should have it. Best overall for hurricane insurance:

Source: printablemapforyou.com

Source: printablemapforyou.com

What does hurricane insurance cover? The annual average cost for windstorm insurance in coastal florida is $2600. The deductible ranges from 1 to 5 percent of the value of a home. Hurricane coverage is included in your standard homeowners insurance policies in florida, since the state is so accustomed to these natural disasters being a common issue for residents. Do i have to have hurricane coverage in florida?

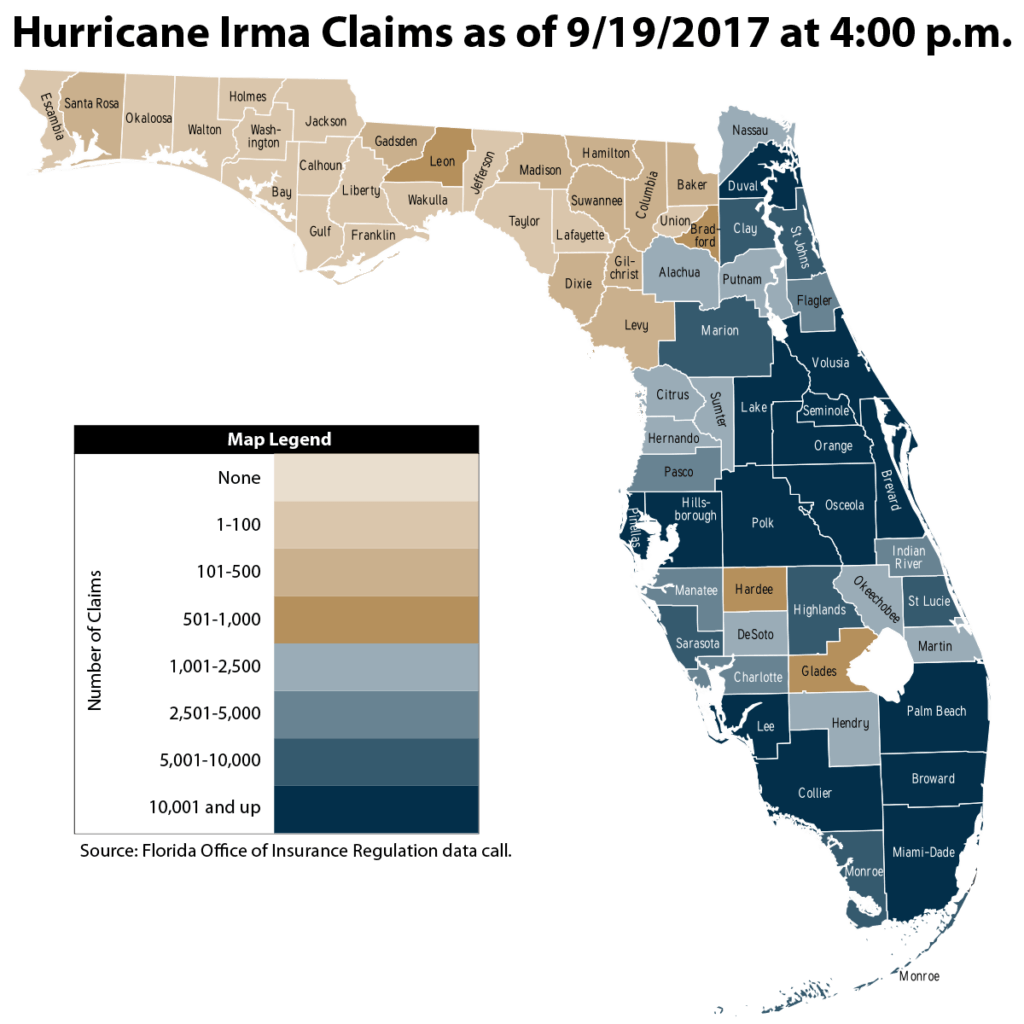

Source: iii.org

Source: iii.org

It is because of this that it is essential to know how to prepare. In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. Best overall for hurricane insurance: Hurricane coverage is included in your standard homeowners insurance policies in florida, since the state is so accustomed to these natural disasters being a common issue for residents. Do i have to have hurricane coverage in florida?

Source: floridahurricaneclaim.org

Source: floridahurricaneclaim.org

As another hurricane season barrels toward the sunshine state, florida regulators have cleared the way for three insurance companies to cancel, or decline to renew, policies for more than 50,000. The average cost of nfip flood insurance in florida is $599, while homeowners insurance costs $2,155 a year on average, according to nerdwallet’s rate. In florida, as in other states, there is a time limit for filing an insurance claim. Hurricane insurance is a necessary insurance policy in the state of florida; Best overall for hurricane insurance:

Source: insurancejournal.com

Source: insurancejournal.com

The deductible ranges from 1 to 5 percent of the value of a home. Hurricane coverage — or any condo insurance, for that matter — is not required by law in florida. In florida, you only have to pay one hurricane deductible within the calendar year, provided you are insured with the same insurance company or group of companies for the second or subsequent hurricanes during the same calendar year. Download the dolman law group accident injury lawyers, pa app for direct contact with our firm. A hurricane insurance policy is the best solution to offset hurricane losses and receive compensation for necessary repairs to your home or your commercial properties in florida.

Source: floridapublicadjusters.org

Source: floridapublicadjusters.org

Best overall for hurricane insurance: As another hurricane season barrels toward the sunshine state, florida regulators have cleared the way for three insurance companies to cancel, or decline to renew, policies for more than 50,000. In florida, insurance for hurricane damage and flood damage are not the same. These protections do not extend to damage caused by flooding. In florida, as in other states, there is a time limit for filing an insurance claim.

Source: floridainsurancelawattorney.com

Source: floridainsurancelawattorney.com

Download the dolman law group accident injury lawyers, pa app for direct contact with our firm. Hurricane coverage — or any condo insurance, for that matter — is not required by law in florida. In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. Hurricane coverage is included in your standard homeowners insurance policies in florida, since the state is so accustomed to these natural disasters being a common issue for residents. The worst thing you can do when you need to file a florida hurricane insurance claim is to wait.

Source: floridapeninsula.com

While there is no such thing as specific “hurricane insurance,” standard homeowners policies tend to cover damage caused by a hurricane. The florida legislature began requiring this policy, which is bundled into florida homeowners , condo and landlord insurance policies at the time of purchase. One of the ways a person can prepare for hurricane season in florida is by purchasing or reviewing their insurance policy. That being said, all florida residents should have it. It does cover property damages to a residential and commercial property caused by a tropical storm or named hurricane.

Source: claimsjournal.com

Source: claimsjournal.com

As another hurricane season barrels toward the sunshine state, florida regulators have cleared the way for three insurance companies to cancel, or decline to renew, policies for more than 50,000. In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. If you also want flooding insurance, then you will likely need to. A hurricane insurance policy is the best solution to offset hurricane losses and receive compensation for necessary repairs to your home or your commercial properties in florida. Keep in mind that this typically just covers damages from hurricane winds.

Source: floridainsurancequotes.net

Source: floridainsurancequotes.net

Hurricane insurance is a necessary insurance policy in the state of florida; That being said, all florida residents should have it. • it is actually the law in florida for all insurance companies to offer hurricane deductibles. It applies to damage specific to hurricanes and is triggered by specific criteria, such as severe weather alerts. What does hurricane insurance cover?

Source: florinroebig.com

Source: florinroebig.com

Florida is a unique state that is surrounded by water on three. While there is no such thing as specific “hurricane insurance,” standard homeowners policies tend to cover damage caused by a hurricane. In florida, hurricane insurance is required for people who own and carry a mortgage on houses or condos, including landlords, in the form of a windstorm insurance policy. Do i have to have hurricane coverage in florida? The deductible ranges from 1 to 5 percent of the value of a home.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hurricane insurance florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.