Hybrid long term care insurance pros and cons Idea

Home » Trending » Hybrid long term care insurance pros and cons IdeaYour Hybrid long term care insurance pros and cons images are ready. Hybrid long term care insurance pros and cons are a topic that is being searched for and liked by netizens today. You can Get the Hybrid long term care insurance pros and cons files here. Download all free vectors.

If you’re searching for hybrid long term care insurance pros and cons pictures information linked to the hybrid long term care insurance pros and cons keyword, you have visit the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

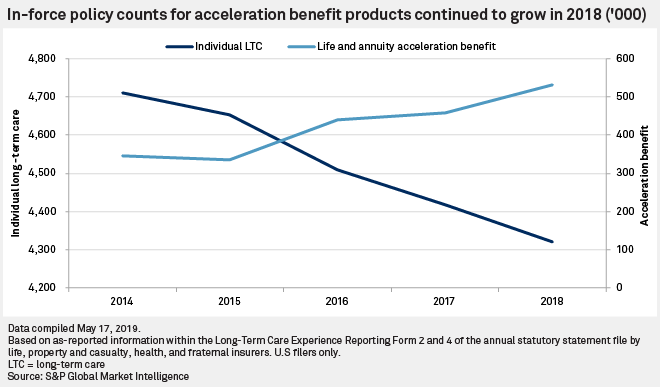

Hybrid Long Term Care Insurance Pros And Cons. The cons of hybrid ltci. But whatever gains you make are eaten away by ltc rider fees. But long term care insurance is not for everybody. However, this depends on the individual, and the difference in the amount of coverage is often negligible.

Coverage Options for LongTerm Care Insurance Policies, Pt From mcleanam.com

Coverage Options for LongTerm Care Insurance Policies, Pt From mcleanam.com

If you think that you will need to rely on care services for an extended period of time, a combination product may not work. With 23 years of experience in the long. The maximum benefit is then based on the monthly benefit amount and benefit period. And any difference in total benefit amount must be weighed against the risk of. But whatever gains you make are eaten away by ltc rider fees. Pay over 5 or 10 years.

The maximum benefit is then based on the monthly benefit amount and benefit period.

But whatever gains you make are eaten away by ltc rider fees. That is why you must be certain that the hybrid policy you purchase is guaranteed to stay in force until age 100 (or longer). Hybrid long term care insurance policies typically are funded with a single upfront premium and offer the benefits associated with the life/annuity policy base, together with additional benefits of long term care coverage. Pay over 5 or 10 years. Less total coverage (in some cases) for some people, hybrid long term care insurance may not provide as much total ltc coverage as a traditional policy. The maximum benefit is then based on the monthly benefit amount and benefit period.

Source: blog.orlandoguardian.com

Source: blog.orlandoguardian.com

Long term care insurance benefits may never be needed. With annuity hybrids, you get a guaranteed returns rate. Many or all of the products featured here. The cons of hybrid ltci. Ltc hybrid products guarantee return of premium either in the form of long term care benefits or a death benefit.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

However, after viewing the benefits of a hybrid life/long. That figure is based on a policy that provides a pool of benefits equal to $180,000. Less total coverage (in some cases) for some people, hybrid long term care insurance may not provide as much total ltc coverage as a traditional policy. Sure, you may die and never need to. But long term care insurance is not for everybody.

Source: ohioinsureplan.com

Source: ohioinsureplan.com

Let�s take a look at the pros and the cons of long term care insurance. Let�s take a look at the pros and the cons of long term care insurance. Hybrid long term care insurance policies typically are funded with a single upfront premium and offer the benefits associated with the life/annuity policy base, together with additional benefits of long term care coverage. However, this depends on the individual, and the difference in the amount of coverage is often negligible. Pay over 5 or 10 years.

Source: nesgroup.us

Source: nesgroup.us

With annuity hybrids, you get a guaranteed returns rate. Long term care insurance can help protect your retirement assets. Less total coverage (in some cases) for some people, hybrid long term care insurance may not provide as much total ltc coverage as a traditional policy. That means you receive a portion of the face value of the policy each. That is why you must be certain that the hybrid policy you purchase is guaranteed to stay in force until age 100 (or longer).

Source: blog.hybridpolicy.com

Source: blog.hybridpolicy.com

Many or all of the products featured here. Pay over 5 or 10 years. The maximum benefit is then based on the monthly benefit amount and benefit period. And a potential return of your premium if you change your mind down the road. If you think that you will need to rely on care services for an extended period of time, a combination product may not work.

Source: heksawal.blogspot.com

Source: heksawal.blogspot.com

Hybrid long term care insurance policies typically are funded with a single upfront premium and offer the benefits associated with the life/annuity policy base, together with additional benefits of long term care coverage. Long term care insurance pros and cons. The high costs of long term care can wipe out your nest egg in a hurry. The maximum benefit is then based on the monthly benefit amount and benefit period. That figure is based on a policy that provides a pool of benefits equal to $180,000.

Source: afterfiftyliving.com

Source: afterfiftyliving.com

If you think that you will need to rely on care services for an extended period of time, a combination product may not work. The maximum benefit is then based on the monthly benefit amount and benefit period. Ltc hybrid products guarantee return of premium either in the form of long term care benefits or a death benefit. And any difference in total benefit amount must be weighed against the risk of. Long term care insurance can help protect your retirement assets.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

And any difference in total benefit amount must be weighed against the risk of. And a potential return of your premium if you change your mind down the road. Best hybrid long term care insurance plans for 2021. Less total coverage (in some cases) for some people, hybrid long term care insurance may not provide as much total ltc coverage as a traditional policy. Let�s take a look at the pros and the cons of long term care insurance.

Source: insurance.com

Source: insurance.com

And a potential return of your premium if you change your mind down the road. That figure is based on a policy that provides a pool of benefits equal to $180,000. Many or all of the products featured here. Ltc hybrid products guarantee return of premium either in the form of long term care benefits or a death benefit. That is why you must be certain that the hybrid policy you purchase is guaranteed to stay in force until age 100 (or longer).

Source: ltcshop.com

Source: ltcshop.com

With 23 years of experience in the long. Less total coverage (in some cases) for some people, hybrid long term care insurance may not provide as much total ltc coverage as a traditional policy. But whatever gains you make are eaten away by ltc rider fees. The cons of hybrid ltci. The high costs of long term care can wipe out your nest egg in a hurry.

Source: herwealth.com

Source: herwealth.com

Let�s take a look at the pros and the cons of long term care insurance. Many or all of the products featured here. Its coverage may be only good for a few years, typically between two to four. And any difference in total benefit amount must be weighed against the risk of. That is why you must be certain that the hybrid policy you purchase is guaranteed to stay in force until age 100 (or longer).

Source: mcleanam.com

Source: mcleanam.com

That means you receive a portion of the face value of the policy each. The high costs of long term care can wipe out your nest egg in a hurry. Long term care insurance benefits may never be needed. Consumers should weigh the pros and cons for each policy type. However, after viewing the benefits of a hybrid life/long.

Source: clips-hardcore.blogspot.com

Source: clips-hardcore.blogspot.com

Many or all of the products featured here. Let�s take a look at the pros and the cons of long term care insurance. The maximum benefit is then based on the monthly benefit amount and benefit period. With annuity hybrids, you get a guaranteed returns rate. Pay over 5 or 10 years.

Source: fiphysician.com

Source: fiphysician.com

With annuity hybrids, you get a guaranteed returns rate. And a potential return of your premium if you change your mind down the road. If you think that you will need to rely on care services for an extended period of time, a combination product may not work. Pay over 5 or 10 years. That means you receive a portion of the face value of the policy each.

Source: pinterest.com

Source: pinterest.com

Let�s take a look at the pros and the cons of long term care insurance. Long term care insurance can help protect your retirement assets. Consumers should weigh the pros and cons for each policy type. Ltc hybrid products guarantee return of premium either in the form of long term care benefits or a death benefit. Pay over 5 or 10 years.

Source: prinvestadvisors.com

Source: prinvestadvisors.com

Pros and cons of hybrid long term care policies. If you think that you will need to rely on care services for an extended period of time, a combination product may not work. But long term care insurance is not for everybody. Long term care insurance pros and cons. And a typical plan pays out $3,500 to $5,000 a month in benefits.

Source: trustedchoice.com

Source: trustedchoice.com

Best hybrid long term care insurance plans for 2021. Long term care insurance can help protect your retirement assets. Best hybrid long term care insurance plans for 2021. That is why you must be certain that the hybrid policy you purchase is guaranteed to stay in force until age 100 (or longer). In addition, you also get the cash value component to use in life and death benefit payout to your beneficiary when you die.

Source: trustedchoice.com

Source: trustedchoice.com

Long term care insurance pros and cons. Hybrid long term care insurance policies typically are funded with a single upfront premium and offer the benefits associated with the life/annuity policy base, together with additional benefits of long term care coverage. If you think that you will need to rely on care services for an extended period of time, a combination product may not work. However, after viewing the benefits of a hybrid life/long. The high costs of long term care can wipe out your nest egg in a hurry.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hybrid long term care insurance pros and cons by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.