Ibnr insurance information

Home » Trending » Ibnr insurance informationYour Ibnr insurance images are available in this site. Ibnr insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Ibnr insurance files here. Find and Download all free photos.

If you’re searching for ibnr insurance pictures information linked to the ibnr insurance keyword, you have visit the ideal site. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Ibnr Insurance. In addition to this provision for late reported claims, we also estimate, and make a provision for, the extent to which the case reserves on known claims may develop and for additional payments on closed claims, known as “reopening.” Amount owed by an insurer to all valid claimants who have had a covered loss but have not yet reported it. The ibnr, which is the abbreviated form of incurred but not reported reserves (ibnr), are the reserves for claims that become due with the occurrence of the events covered under the insurance policy, but have not been reported yet. If forced to assign it to either case reserves or ibnr reserves, some will assign it to

Slides ibnrbelohorizontemaster From slideshare.net

Slides ibnrbelohorizontemaster From slideshare.net

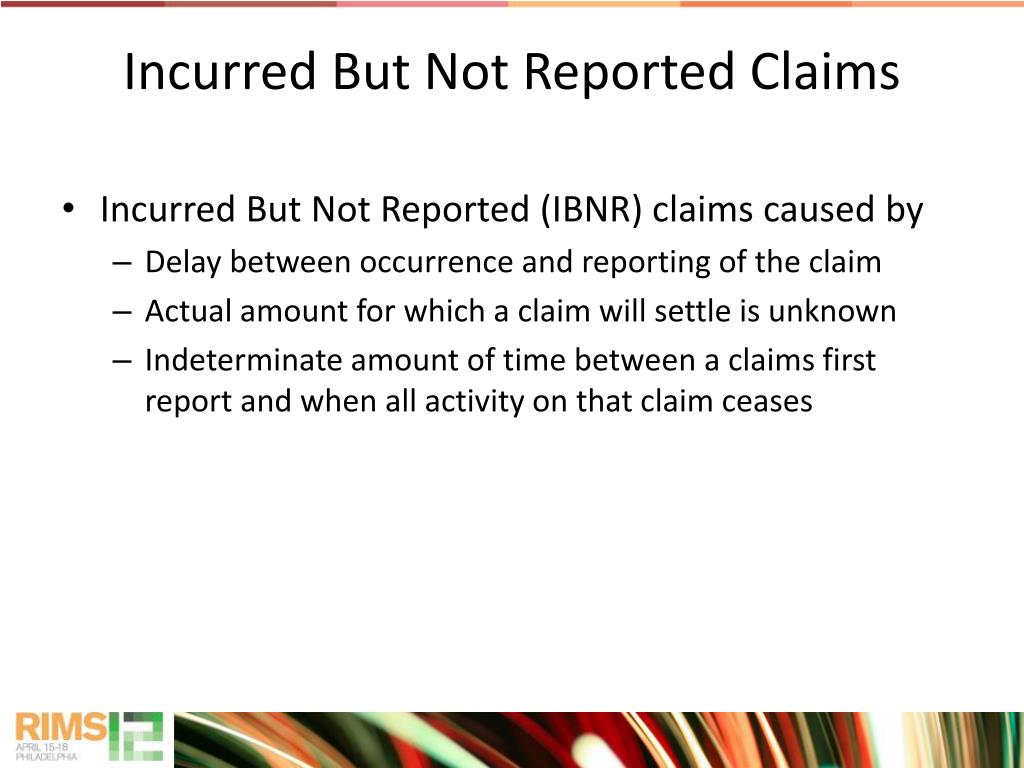

In the end, this exposure is added to the actual realized losses when premiums are developed for their insureds. • a description of the methods, and any significant changes to such methods, for determining (1) both ibnr and expected development on reported claims and (2) cumulative claim frequency. Insurance carriers must account for the ibnr exposure they carry on their books and will use a range of actuarial services to accurately represent this figure. The chain ladder method (clm) is a popular way that insurance companies estimate their required claim reserves. Incurred but not reported refers to a reserve account type which is used the insurance sector to document claims and and events that have transpired on a client, but has not been reported to the insurance firm. Ibnr is an acronym for “incurred but not reported” insurance claims.

Since the insurer knows neither how many of these losses have occurred, nor the severity of each loss, ibnr is necessarily an estimate.

You’ll typically see an ibnr reserve for companies in the insurance industry. The sum of ibnr losses plus reported losses yields an estimate of the total eventual liabilities the insurer will cover, known as. We help businesses move forward towards customer engagement and profit. Like most companies, insurance companies are required to hold liabilities on their books for the unpaid costs of claims that have occurred as of the accounting date. Feel free to share it with others, including your board of directors. They are the claims for which, in symbols:

Source: abbreviations.com

Source: abbreviations.com

Incurred but not reported refers to a reserve account type which is used the insurance sector to document claims and and events that have transpired on a client, but has not been reported to the insurance firm. Feel free to share it with others, including your board of directors. Ibnr is an acronym for “incurred but not reported” insurance claims. Even if you already understand ibnr, this short narrative might enable you to save some time. Ibnr is an acronym standing for incurred but not reported.

Source: slideshare.net

Source: slideshare.net

Incurred but not reported refers to a reserve account type which is used the insurance sector to document claims and and events that have transpired on a client, but has not been reported to the insurance firm. Using a traditional approach, there would be two options: In ibnr cases, an actuary will calculate and approximate the cost for potential or possible damages, and the insurance firm would. Ibnr claims are thus that group which are incurred before the reserving date, but not reported until after it. Feel free to share it with others, including your board of directors.

Source: researchgate.net

Source: researchgate.net

Where a] = accident date, v] = reserving date, r] = reporting date. For instance, suppose you work at a small insurance company and you are interested in reviewing the incurred claims by month, including ibnr, for individually insured members ages 55 to 64 in a particular geographic region. Since the insurer knows neither how many of these losses have occurred, nor the severity of each loss, ibnr is necessarily an estimate. Where a] = accident date, v] = reserving date, r] = reporting date. We help businesses move forward towards customer engagement and profit.

Source: universalcpareview.com

Source: universalcpareview.com

You’ll typically see an ibnr reserve for companies in the insurance industry. Ibnr is an actuarial estimate of future payments on claims that have occurred but have not yet been reported to us. Established in 2009, ibnr insurance consulting limited is a specialist insurance management consulting and sales support firm with an asian reach, offering leading claims and fraud performance gap analysis solutions across asia. Ibnr claims are thus that group which are incurred before the reserving date, but not reported until after it. Ibnr is an acronym for “incurred but not reported” insurance claims.

Source: ibnrinsurance.com

Source: ibnrinsurance.com

The insurer also must perform They are the claims for which, in symbols: The ibnr reserve estimate, on the other hand, is usually determined/advised by an actuary. Anyone involved in risk management or property and casualty insurance very long will hear the term ibnr used by actuaries, underwriters, brokers, accountants, and risk managers. Ibnr is an acronym standing for incurred but not reported.

The insurer also must perform Established in 2009, ibnr insurance consulting limited is a specialist insurance management consulting and sales support firm with an asian reach, offering leading claims and fraud performance gap analysis solutions across asia. The picture is simple enough, but as always in general. The reserve is a provision for insurance claims that their customers have incurred but not yet reported to the insurance company (similar to knowing you have to pay an invoice, but you […] • a description of the methods, and any significant changes to such methods, for determining (1) both ibnr and expected development on reported claims and (2) cumulative claim frequency.

Source: studylib.net

Source: studylib.net

The reserve is a provision for insurance claims that their customers have incurred but not yet reported to the insurance company (similar to knowing you have to pay an invoice, but you […] Even if you already understand ibnr, this short narrative might enable you to save some time. If forced to assign it to either case reserves or ibnr reserves, some will assign it to Where a] = accident date, v] = reserving date, r] = reporting date. What exactly do actuaries and other risk management professionals mean when.

Source: sec.gov

Source: sec.gov

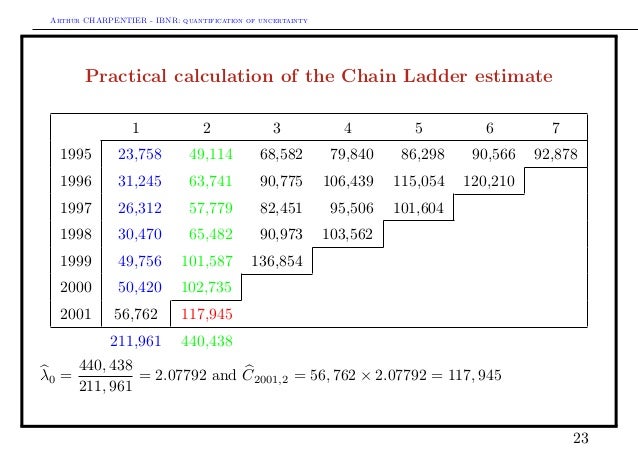

The chain ladder method (clm) is a popular way that insurance companies estimate their required claim reserves. The sum of ibnr losses plus reported losses yields an estimate of the total eventual liabilities the insurer will cover, known as. We help businesses move forward towards customer engagement and profit. The ibnr reserve estimate, on the other hand, is usually determined/advised by an actuary. Using a traditional approach, there would be two options:

Source: slideserve.com

Source: slideserve.com

We help businesses move forward towards customer engagement and profit. Established in 2009, ibnr insurance consulting limited is a specialist insurance management consulting and sales support firm with an asian reach, offering leading claims and fraud performance gap analysis solutions across asia. They are the claims for which, in symbols: The insurer also must perform The focus of this post is on the latter estimate.

For instance, suppose you work at a small insurance company and you are interested in reviewing the incurred claims by month, including ibnr, for individually insured members ages 55 to 64 in a particular geographic region. We help businesses move forward towards customer engagement and profit. The reserve is a provision for insurance claims that their customers have incurred but not yet reported to the insurance company (similar to knowing you have to pay an invoice, but you […] Established in 2009, ibnr insurance consulting limited is a specialist insurance management consulting and sales support firm with an asian reach, offering leading claims and fraud performance gap analysis solutions across asia. In particular, this guide focuses on the development of confidence intervals around ibnr estimates.

Source: ibnrinsurance.com

Source: ibnrinsurance.com

Since the insurer knows neither how many of these losses have occurred, nor the severity of each loss, ibnr is necessarily an estimate. Ibnr is an acronym standing for incurred but not reported. The sum of ibnr losses plus incurred losses provides an estimate of the total eventual liabilities for. Ibnr is an acronym for “incurred but not reported” insurance claims. Insurance carriers must account for the ibnr exposure they carry on their books and will use a range of actuarial services to accurately represent this figure.

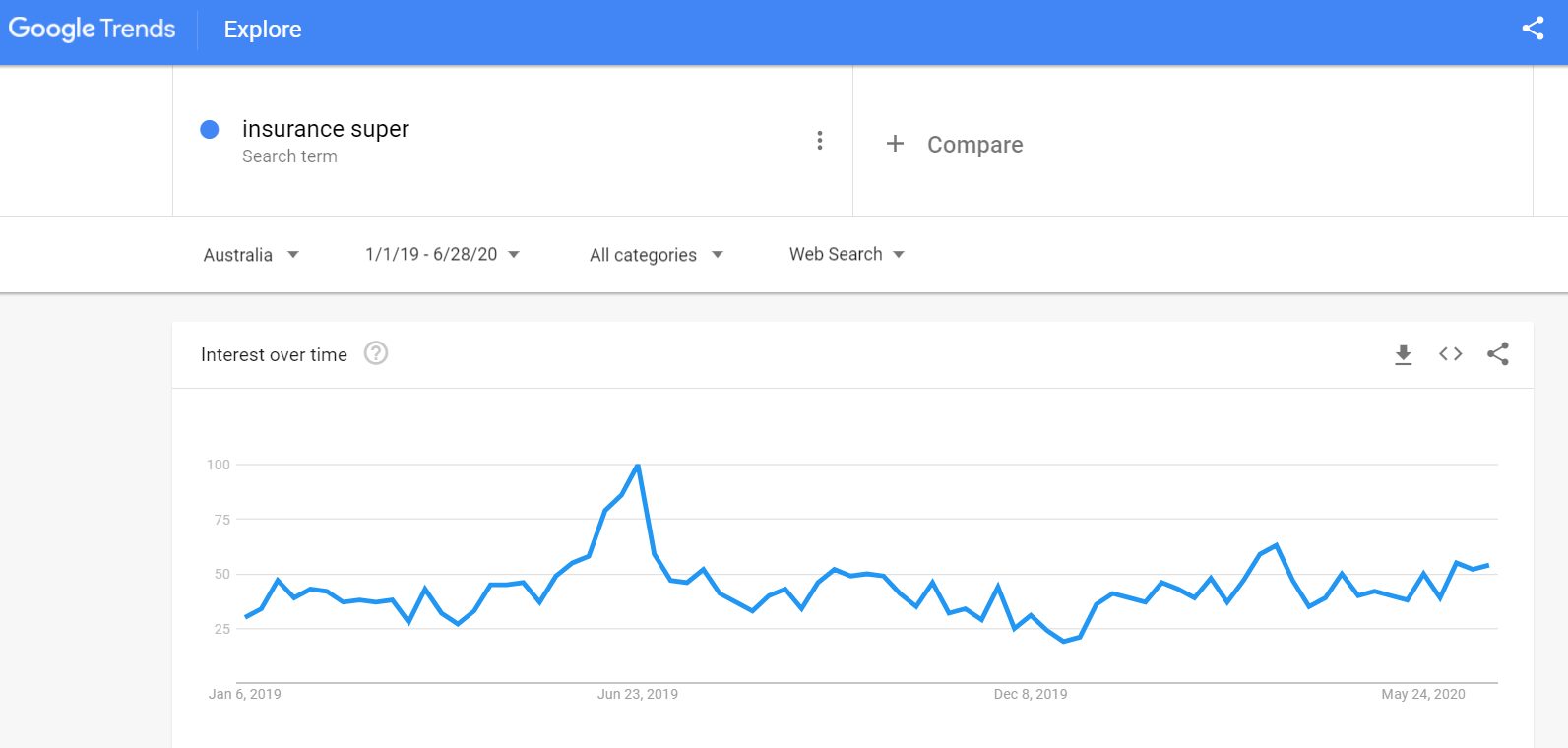

Source: actuaries.digital

Source: actuaries.digital

Sharia insurance reserving | 3 ujrah as part of the income for the insurer and the acquisition cost as part of the insurer’s liability are recognised on a straight line basis over the coverage period. Feel free to share it with others, including your board of directors. In particular, this guide focuses on the development of confidence intervals around ibnr estimates. Insurance carriers must account for the ibnr exposure they carry on their books and will use a range of actuarial services to accurately represent this figure. The chain ladder method (clm) is a popular way that insurance companies estimate their required claim reserves.

Source: youtube.com

Source: youtube.com

Amount owed by an insurer to all valid claimants who have had a covered loss but have not yet reported it. Feel free to share it with others, including your board of directors. The picture is simple enough, but as always in general. Using a traditional approach, there would be two options: Incurred but not reported refers to a reserve account type which is used the insurance sector to document claims and and events that have transpired on a client, but has not been reported to the insurance firm.

Source: ewfrees.github.io

Source: ewfrees.github.io

Like most companies, insurance companies are required to hold liabilities on their books for the unpaid costs of claims that have occurred as of the accounting date. Where a] = accident date, v] = reserving date, r] = reporting date. The focus of this post is on the latter estimate. In the end, this exposure is added to the actual realized losses when premiums are developed for their insureds. Using a traditional approach, there would be two options:

Source: sec.gov

Source: sec.gov

If forced to assign it to either case reserves or ibnr reserves, some will assign it to Ibnr is an acronym for “incurred but not reported” insurance claims. Sharia insurance reserving | 3 ujrah as part of the income for the insurer and the acquisition cost as part of the insurer’s liability are recognised on a straight line basis over the coverage period. Since the insurer knows neither how many of these losses have occurred, nor the severity of each loss, ibnr is necessarily an estimate. The chain ladder method (clm) is a popular way that insurance companies estimate their required claim reserves.

Source: slideshare.net

Source: slideshare.net

Ibnr is an acronym for “incurred but not reported” insurance claims. Amount owed by an insurer to all valid claimants who have had a covered loss but have not yet reported it. For instance, suppose you work at a small insurance company and you are interested in reviewing the incurred claims by month, including ibnr, for individually insured members ages 55 to 64 in a particular geographic region. You’ll typically see an ibnr reserve for companies in the insurance industry. Even if you already understand ibnr, this short narrative might enable you to save some time.

Source: slideshare.net

Source: slideshare.net

Where a] = accident date, v] = reserving date, r] = reporting date. The chain ladder method (clm) is a popular way that insurance companies estimate their required claim reserves. Established in 2009, ibnr insurance consulting limited is a specialist insurance management consulting and sales support firm with an asian reach, offering leading claims and fraud performance gap analysis solutions across asia. • a description of the methods, and any significant changes to such methods, for determining (1) both ibnr and expected development on reported claims and (2) cumulative claim frequency. The sum of ibnr losses plus incurred losses provides an estimate of the total eventual liabilities for.

The insurer also must perform In ibnr cases, an actuary will calculate and approximate the cost for potential or possible damages, and the insurance firm would. Anyone involved in risk management or property and casualty insurance very long will hear the term ibnr used by actuaries, underwriters, brokers, accountants, and risk managers. What exactly do actuaries and other risk management professionals mean when. The ibnr, which is the abbreviated form of incurred but not reported reserves (ibnr), are the reserves for claims that become due with the occurrence of the events covered under the insurance policy, but have not been reported yet.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ibnr insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.