If a life insurance policy develops cash value information

Home » Trend » If a life insurance policy develops cash value informationYour If a life insurance policy develops cash value images are ready. If a life insurance policy develops cash value are a topic that is being searched for and liked by netizens now. You can Get the If a life insurance policy develops cash value files here. Get all free photos and vectors.

If you’re searching for if a life insurance policy develops cash value pictures information linked to the if a life insurance policy develops cash value keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

If A Life Insurance Policy Develops Cash Value. There are two different types of cash value terms used by life insurance carriers in policy contracts: The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date. It provides a savings component for the policy owner, and maintains a guaranteed rate throughout the lifetime of the policy so long as the premiums are paid. It generally only applies to cash value life insurance.

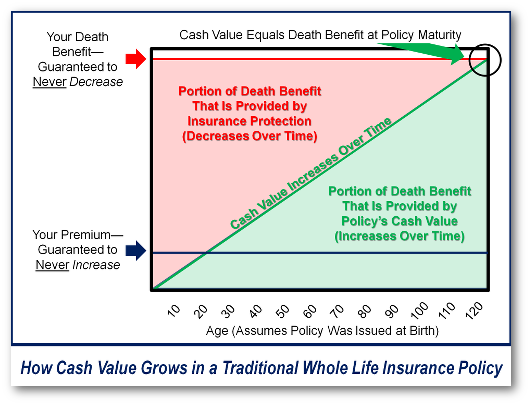

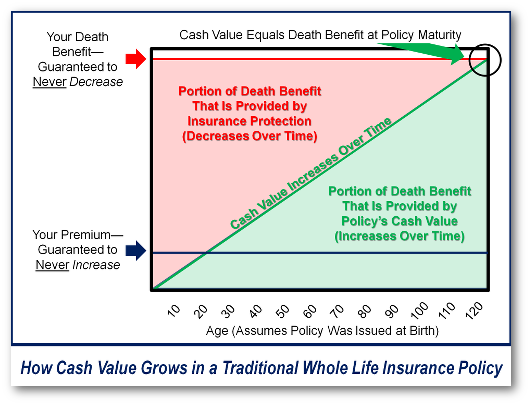

How Whole Life Insurance Works Bank On Yourself From bankonyourself.com

How Whole Life Insurance Works Bank On Yourself From bankonyourself.com

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to. What is cash value life insurance? When a policy is surrendered before the death of the insured, the cash surrender value is paid to the owner. Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted. Contrarily, permanent life insurance policies, such as whole or universal life insurance, build cash value and commonly have a smaller death benefit. It generally only applies to cash value life insurance.

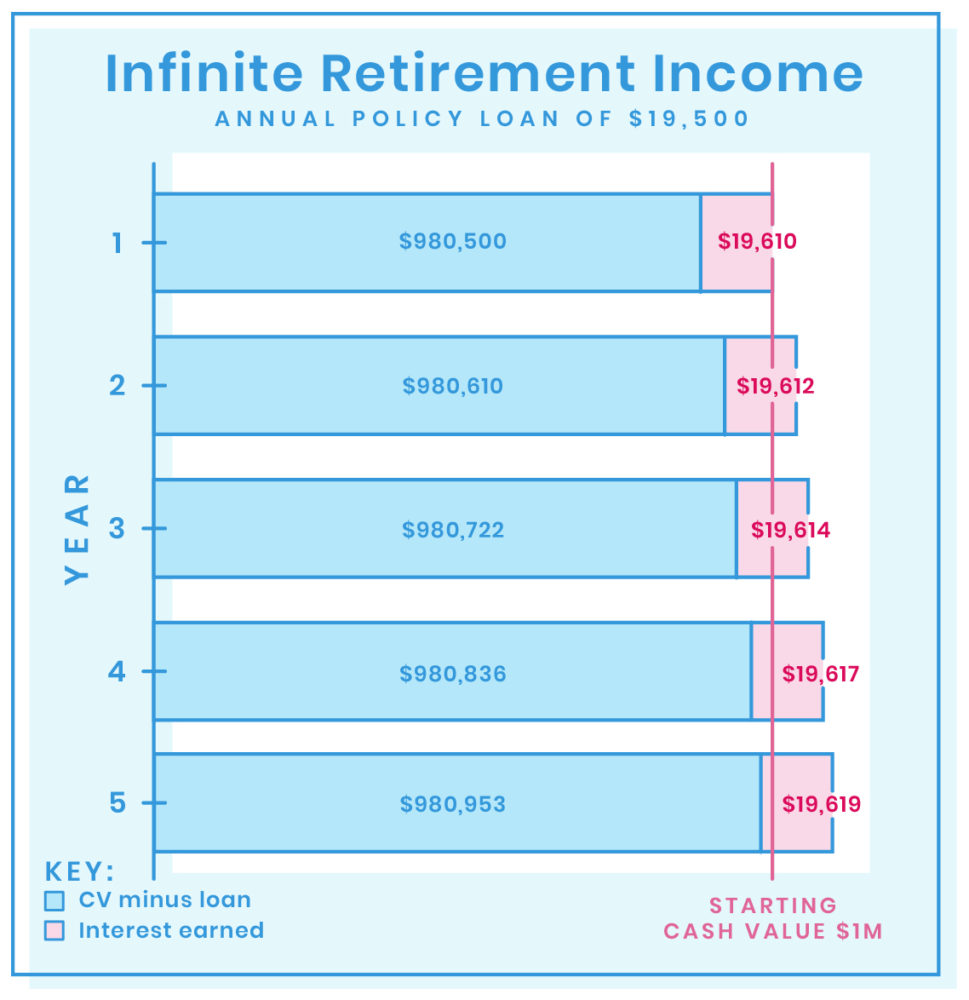

At some companies, a portion of the premiums are put into a cash savings account, earning interest with potential tax savings.

At the maturity age of a permanent life insurance policy, the cash value equals the face amount(the amount of the coverage) and it gets paid out to the. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value. Policies built to grow cash value use part of the premium to build a cash reserve that can be accessed during the life of the policyholder. If you have a term life insurance policy, then you are probably not a candidate for this type of analysis; But if your life insurance policy has a large pool of cash, you’ll most likely be able to withdraw part of it. At the maturity age of a permanent life insurance policy, the cash value equals the face amount(the amount of the coverage) and it gets paid out to the.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

That potential growth is referred to as cash value accumulation. Return of premium (rop) term is one type of term that could have a cash surrender value if you kept the policy long enough. In the early years of a policy, life insurance companies can deduct fees upon cash surrender. Permanent life insurance policies typically have a cash value, which is an account that can gain or lose value inside the policy. The cash value component offers a handful of small benefits to policyholders.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

When a policy is surrendered before the death of the insured, the cash surrender value is paid to the owner. Term policies do not, but permanent forms of life insurance do. That potential growth is referred to as cash value accumulation. If you have a term life insurance policy, then you are probably not a candidate for this type of analysis; The cash value component offers a handful of small benefits to policyholders.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

Not every type of life insurance has a cash value component. Depending on the type of policy, the cash value. Not all life insurance policies come with a cash value component. Cash value is also tax deferred, like an ira or a 401. That potential growth is referred to as cash value accumulation.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

That potential growth is referred to as cash value accumulation. A life insurance policy with cash value may be considered to be an investment. But some examples of ones that do are whole life insurance, universal life and variable universal life. Not every type of life insurance has a cash value component. It generally only applies to cash value life insurance.

Source: websmostpopular.com

Source: websmostpopular.com

Each term refers to a different type of accumulation structure that can affect the final policy value for your beneficiaries and how your money that is paid into the policy is used. Not all life insurance has a cash value. Some of this money paid through premiums is allocated by your insurance provider toward investments. Cash value life insurance generally costs more than term life insurance. A method used in actuarial analysis, which is often used in the insurance industry.

Source: termlife2go.com

Source: termlife2go.com

That potential growth is referred to as cash value accumulation. 1 aflac’s plans function differently, but still offer a variety of benefits like portability and renewability. Some of this money paid through premiums is allocated by your insurance provider toward investments. Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Term insurance has no cash value and only affords pure death benefit protection.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Each term refers to a different type of accumulation structure that can affect the final policy value for your beneficiaries and how your money that is paid into the policy is used. Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted. Building up the cash value component of your life insurance policy takes years. If you have a term life insurance policy, then you are probably not a candidate for this type of analysis; The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw.

Source: bankonyourself.com

Source: bankonyourself.com

Term policies do not, but permanent forms of life insurance do. At the maturity age of a permanent life insurance policy, the cash value equals the face amount(the amount of the coverage) and it gets paid out to the. The cash value is the accumulation of funds that remains after your premiums pay for policy fees and expenses, including the cost of insurance. It provides a savings component for the policy owner, and maintains a guaranteed rate throughout the lifetime of the policy so long as the premiums are paid. Not every type of life insurance has a cash value component.

Source: daveramsey.com

Source: daveramsey.com

Not all life insurance has a cash value. If you have a term life insurance policy, then you are probably not a candidate for this type of analysis; In the early years of a policy, life insurance companies can deduct fees upon cash surrender. Keep in mind that taxes may be due on the amount of cash you withdraw from your policy, so speak with a tax professional to know what to expect. A life insurance policy covers you in a way that savings can’t.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Building up the cash value component of your life insurance policy takes years. Contrarily, permanent life insurance policies, such as whole or universal life insurance, build cash value and commonly have a smaller death benefit. Your benefits and your cash value in your life insurance policy grow value much faster over time than interest gained on a savings account. Depending on the type of policy, the cash value. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to.

Source: slideserve.com

Source: slideserve.com

Term policies differ from permanent policies in. Term insurance buys pure protection rather than building up a cash value, and that is why the costs of term life insurance is usually lower than policies that have cash value. What is cash value life insurance? When a policy is surrendered before the death of the insured, the cash surrender value is paid to the owner. Cash value is also tax deferred, like an ira or a 401.

Source: wealthpilgrim.com

Source: wealthpilgrim.com

At the maturity age of a permanent life insurance policy, the cash value equals the face amount(the amount of the coverage) and it gets paid out to the. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Some of this money paid through premiums is allocated by your insurance provider toward investments. Each term refers to a different type of accumulation structure that can affect the final policy value for your beneficiaries and how your money that is paid into the policy is used.

Source: kitces.com

Source: kitces.com

Not every type of life insurance has a cash value component. A method used in actuarial analysis, which is often used in the insurance industry. But some examples of ones that do are whole life insurance, universal life and variable universal life. A life insurance policy with cash value may be considered to be an investment. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value.

Source: consumerreports.org

Source: consumerreports.org

The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value. Your benefits and your cash value in your life insurance policy grow value much faster over time than interest gained on a savings account. The cash value in life insurance is simply what your policy is worth.

Source: bankonyourself.com

Source: bankonyourself.com

When a policy is surrendered before the death of the insured, the cash surrender value is paid to the owner. Yearly price of protection method: Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Your benefits and your cash value in your life insurance policy grow value much faster over time than interest gained on a savings account. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value.

Source: kitces.com

Source: kitces.com

Not all life insurance policies come with a cash value component. Not all life insurance policies come with a cash value component. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value. A method used in actuarial analysis, which is often used in the insurance industry. Term insurance has no cash value and only affords pure death benefit protection.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Policies built to grow cash value use part of the premium to build a cash reserve that can be accessed during the life of the policyholder. Only permanent life insurance policies, which are designed to protect you over your lifetime, have a cash value. The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date. Term policies do not, but permanent forms of life insurance do. At some companies, a portion of the premiums are put into a cash savings account, earning interest with potential tax savings.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title if a life insurance policy develops cash value by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.