If a life insurance policy has an irrevocable beneficiary designation Idea

Home » Trending » If a life insurance policy has an irrevocable beneficiary designation IdeaYour If a life insurance policy has an irrevocable beneficiary designation images are available in this site. If a life insurance policy has an irrevocable beneficiary designation are a topic that is being searched for and liked by netizens now. You can Find and Download the If a life insurance policy has an irrevocable beneficiary designation files here. Get all royalty-free vectors.

If you’re looking for if a life insurance policy has an irrevocable beneficiary designation images information linked to the if a life insurance policy has an irrevocable beneficiary designation topic, you have come to the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

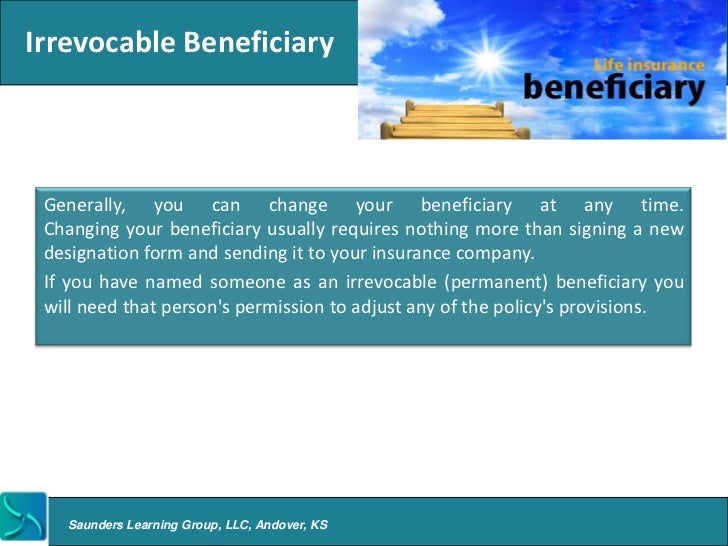

If A Life Insurance Policy Has An Irrevocable Beneficiary Designation. Spouse, estate, or family member. Irrevocable (beneficiary designation can only be changed with the written consent of the designated beneficiary(ies) *in quebec, when no beneficiary status is specified, designation of the legal spouse is irrevocable and designation of any other beneficiary is revocable. Person designated by the insured to receive policy proceeds in the event that the primary beneficiary dies before the insured. When the beneficiary designation is revocable, the policyholder may change the beneficiary designation at any time without the former beneficiary’s consent or even knowledge.

Should I make my wife an irrevocable beneficiary in my From quora.com

Their mother was named contingent beneficiary. When purchasing or registering for life insurance, the insured may choose to make a beneficiary revocable or irrevocable. Ownership by an irrevocable life insurance trust (ilit): An irrevocable beneficiary is named a beneficiary with guaranteed rights to a life insurance policy’s payouts. If a life insurance policy has an irrevocable beneficiary designation, a) the beneficiary cannot be changed. When designating a beneficiary, you must indicate whether the designation is revocable or irrevocable.

Person designated by the insured to receive policy proceeds in the event that the primary beneficiary dies before the insured.

An irrevocable beneficiary requires the beneficiary to sign off on any. An irrevocable beneficiary is guaranteed to receive part of a life insurance policy’s death benefit. When designating a beneficiary, you must indicate whether the designation is revocable or irrevocable. An irrevocable beneficiary has a vested property interest in the life insurance death benefit (effective immediately upon being named as a beneficiary). A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefits after you pass. The instructions within the trust then direct the trustee where to send the money.

Source: lodesignsllc.blogspot.com

Source: lodesignsllc.blogspot.com

When purchasing or registering for life insurance, the insured may choose to make a beneficiary revocable or irrevocable. A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefits after you pass. If a life insurance policy has an irrevocable beneficiary designation, a) the beneficiary cannot be changed. Their mother was named contingent beneficiary. Some loans let you use life insurance as collateral.

Source: archstoneinsurance.com

Source: archstoneinsurance.com

What is irrevocable is the beneficiary status. When you name an irrevocable beneficiary on your policy, you give that beneficiary specific rights to your policy, which can impact you in a number of ways. In cases of separation, life insurance is an important protection for dependant support, and an irrevocable beneficiary designation necessitates consent before the designation can be legally revoked. Their mother was named contingent beneficiary. This is by far the most common type of beneficiary.

Source: warnocklawgroup.com

Source: warnocklawgroup.com

A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefits after you pass. Irrevocable (beneficiary designation can only be changed with the written consent of the designated beneficiary(ies) *in quebec, when no beneficiary status is specified, designation of the legal spouse is irrevocable and designation of any other beneficiary is revocable. What is irrevocable is the beneficiary status. An irrevocable beneficiary has a vested property interest in the life insurance death benefit (effective immediately upon being named as a beneficiary). In cases of separation, life insurance is an important protection for dependant support, and an irrevocable beneficiary designation necessitates consent before the designation can be legally revoked.

Source: templateroller.com

Source: templateroller.com

The life insurance benefit is paid out to your designated beneficiary in the event of your death. The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder. The irrevocable designation can mitigate future uncertainties, but is still limited in specific circumstances such as unjust enrichment or. An irrevocable beneficiary must agree to any changes made to a policy, and they can’t be removed from a policy without consent. They may even change the life insurance beneficiary just before they die.

Source: themoneyalert.com

Source: themoneyalert.com

Life insurance policies can have either a revocable or irrevocable beneficiary designation. You cannot change an irrevocable beneficiary. The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder. Due to the serious implications of an irrevocable designation, it is often preferable to use a revocable beneficiary designation. An irrevocable beneficiary is a person or entity designated to receive the assets in a life insurance policy or a segregated fund contract.

Source: slideshare.net

Source: slideshare.net

When designating a beneficiary, you must indicate whether the designation is revocable or irrevocable. Their mother was named contingent beneficiary. An irrevocable beneficiary requires the beneficiary to sign off on any. Spouse, estate, or family member. With life insurance, you have a few common options for.

Source: quora.com

Ownership by an irrevocable life insurance trust (ilit): Revocable beneficiary of life insurance. The life insurance benefit is paid out to your designated beneficiary in the event of your death. What is a life insurance beneficiary? To do this, your lender is the irrevocable beneficiary of a life insurance.

Source: enprocesodenacer.blogspot.com

Source: enprocesodenacer.blogspot.com

Person designated by the insured to receive policy proceeds in the event that the primary beneficiary dies before the insured. You can name one or more individuals to receive your basic and optional life insurance benefits, eg. If this is the case then the beneficiary is called a revocable beneficiary. They may even change the life insurance beneficiary just before they die. An irrevocable beneficiary has a vested property interest in the life insurance death benefit (effective immediately upon being named as a beneficiary).

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

When designating a beneficiary, you must indicate whether the designation is revocable or irrevocable. The facts underlying moore v. Whenever a divorce decree specifies the beneficiary of a life insurance policy, the beneficiary becomes “irrevocable.”. When you name an irrevocable beneficiary on your policy, you give that beneficiary specific rights to your policy, which can impact you in a number of ways. When the insured did not expressly reserve his right to revoke the designation of his beneficiary, such designation is irrevocable and he cannot change his beneficiary without the consent of the latter.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Irrevocable (beneficiary designation can only be changed with the written consent of the designated beneficiary(ies) *in quebec, when no beneficiary status is specified, designation of the legal spouse is irrevocable and designation of any other beneficiary is revocable. Many hong kong life insurance plans will enable the policyholder to change the plan’s beneficiaries whilst the policy is in force. If this is the case then the beneficiary is called a revocable beneficiary. However, alternate plans will make the beneficiary irrevocable, meaning that any change in the beneficiary designation must first be. D) the owner can always change the beneficiary at will.

Source: bmolawfirm.com

Source: bmolawfirm.com

Whenever a divorce decree specifies the beneficiary of a life insurance policy, the beneficiary becomes “irrevocable.”. If a life insurance policy has an irrevocable beneficiary designation, a) the beneficiary cannot be changed. They may even change the life insurance beneficiary just before they die. This interest cannot be taken away or decreased without his or her consent. The facts underlying moore v.

Source: quora.com

You can name one or more individuals to receive your basic and optional life insurance benefits, eg. A life insurance policy allows the policyholder to name an irrevocable or revocable beneficiary who will receive a payout if the insured dies. A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefits after you pass. An irrevocable beneficiary is guaranteed to receive part of a life insurance policy’s death benefit. To do this, your lender is the irrevocable beneficiary of a life insurance.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

Some loans let you use life insurance as collateral. When purchasing or registering for life insurance, the insured may choose to make a beneficiary revocable or irrevocable. An irrevocable beneficiary must agree to any changes made to a policy, and they can’t be removed from a policy without consent. What is a life insurance beneficiary? Life insurance policies can have either a revocable or irrevocable beneficiary designation.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

An irrevocable beneficiary is named a beneficiary with guaranteed rights to a life insurance policy’s payouts. An irrevocable beneficiary is named a beneficiary with guaranteed rights to a life insurance policy’s payouts. You can name one or more individuals to receive your basic and optional life insurance benefits, eg. Revocable beneficiary of life insurance. Their mother was named contingent beneficiary.

Source: lsminsurance.ca

Source: lsminsurance.ca

As you go through the process of purchasing a life insurance policy, take the time to consider exactly who you�d like to designate as your beneficiary. When you name an irrevocable beneficiary on your policy, you give that beneficiary specific rights to your policy, which can impact you in a number of ways. This is by far the most common type of beneficiary. B) the beneficiary can only be changed with written permission of the beneficiary. The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder.

Source: revisi.net

Source: revisi.net

The life insurance benefit is paid out to your designated beneficiary in the event of your death. The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder. An irrevocable beneficiary is guaranteed to receive part of a life insurance policy’s death benefit. An irrevocable beneficiary has a vested property interest in the life insurance death benefit (effective immediately upon being named as a beneficiary). As you go through the process of purchasing a life insurance policy, take the time to consider exactly who you�d like to designate as your beneficiary.

Source: legalyaar.com

Source: legalyaar.com

Irrevocable (beneficiary designation can only be changed with the written consent of the designated beneficiary(ies) *in quebec, when no beneficiary status is specified, designation of the legal spouse is irrevocable and designation of any other beneficiary is revocable. Some loans let you use life insurance as collateral. An irrevocable beneficiary is a person or entity designated to receive the assets in a life insurance policy or a segregated fund contract. A revocable beneficiary can be changed by the owner of the policy without the signature of the beneficiary. To do this, your lender is the irrevocable beneficiary of a life insurance.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Irrevocable (beneficiary designation can only be changed with the written consent of the designated beneficiary(ies) *in quebec, when no beneficiary status is specified, designation of the legal spouse is irrevocable and designation of any other beneficiary is revocable. An irrevocable beneficiary is a person or entity designated to receive the assets in a life insurance policy or a segregated fund contract. Whenever a divorce decree specifies the beneficiary of a life insurance policy, the beneficiary becomes “irrevocable.”. As you go through the process of purchasing a life insurance policy, take the time to consider exactly who you�d like to designate as your beneficiary. What is irrevocable is the beneficiary status.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title if a life insurance policy has an irrevocable beneficiary designation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.