If insurance policy holder dies information

Home » Trending » If insurance policy holder dies informationYour If insurance policy holder dies images are available. If insurance policy holder dies are a topic that is being searched for and liked by netizens now. You can Download the If insurance policy holder dies files here. Find and Download all royalty-free vectors.

If you’re searching for if insurance policy holder dies pictures information linked to the if insurance policy holder dies interest, you have visit the right site. Our site always gives you hints for refferencing the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

If Insurance Policy Holder Dies. Registered in england and wales with registration number 4390. Caution is needed in saying the policy just passes to the executors. Should one beneficiary predecease the insured, that individual�s share would normally pass to any other named beneficiaries to be shared equally among them. However, occasionally, the applicant unexpectedly dies prior to the policy’s issuance.

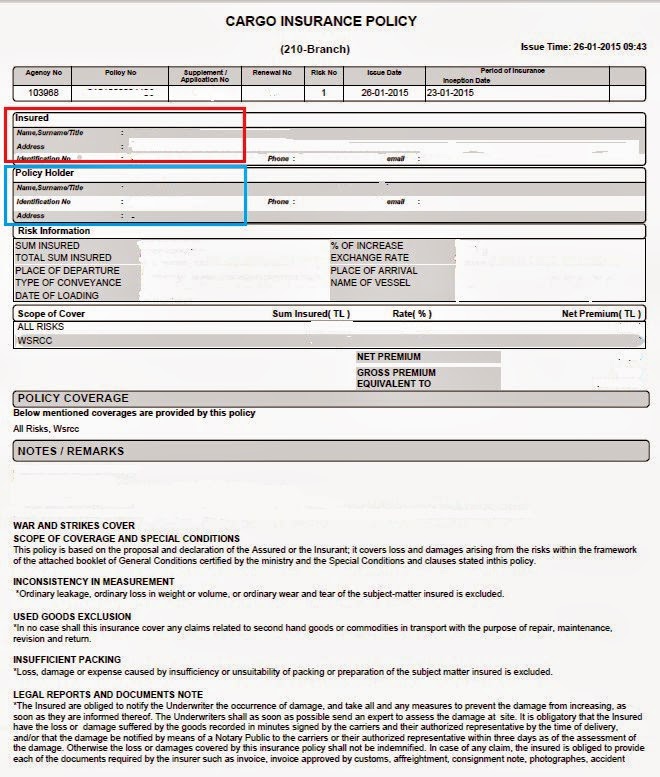

If Insurance Policy Holder Dies / PPT Integrated From mymuseandmore.blogspot.com

If Insurance Policy Holder Dies / PPT Integrated From mymuseandmore.blogspot.com

In almost all cases, insurance companies are. She has happily dedicated many hours to helping her clients understand how the insurance marketplace works so they can find the best car, home, and life insurance products for their needs. However, occasionally, the applicant unexpectedly dies prior to the policy’s issuance. Policy changes, including the addition or removal of a vehicle or driver and cancellation of coverage, must be authorized by the policyholder. Within the policy definitions, the policy will remain valid until a new policy is purchased by the new owner. A landlords policy will be needed since that would be the correct form of insurance for a tenant.

Should one beneficiary predecease the insured, that individual�s share would normally pass to any other named beneficiaries to be shared equally among them.

In case a loan is taken against an insurance cover, the. The money is normally divided equally among them when this is the case. Within the policy definitions, the policy will remain valid until a new policy is purchased by the new owner. Generally, an applicant can apply for a policy and be approved within a short period of time; When the owner of a life insurance policy dies, nothing may happen unless the owner is also the insured. Under motor insurance plans, since the vehicle is insured, in case of death of the policyholder, no claim is payable.

Source: identity-links.com

Source: identity-links.com

When a home insurance policy holder dies, the original policy will no longer be valid in its current state. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. Some policies name more than one individual to receive the death benefit proceeds when the insured dies. Caution is needed in saying the policy just passes to the executors. She has happily dedicated many hours to helping her clients understand how the insurance marketplace works so they can find the best car, home, and life insurance products for their needs.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

If the owner is not the insured, the policyholder becomes the new owner and should transferring ownership to a successor. If the spouse of a deceased policy. It is important to note that if the deceased owner was living in the home and upon death, the home will be held as a rental property; When a home insurance policy holder dies, the original policy will no longer be valid in its current state. How to claim death insurance benefits if nominee dies.

Source: identity-links.com

Source: identity-links.com

If the owner is the insured the policy is terminated and the proceeds are paid to the beneficiary. If the spouse of a deceased policy. Most insurance companies give at least 30 days to the family to inform about the policy holder’s death to the insurer. If the current policy holder dies, what happens to the policy? Caution is needed in saying the policy just passes to the executors.

Source: identity-links.com

Source: identity-links.com

What happens when a life insurance policy holder dies? If the current policy holder dies, what happens to the policy? In case the car insurance policy gets expired after the policyholder’s death and the heir is unable to get the policy transferred before the expiry date, he/ she can get the policy renewed in his/ her name. In almost all cases, insurance companies are. Under motor insurance plans, since the vehicle is insured, in case of death of the policyholder, no claim is payable.

Source: vinyform.com

Source: vinyform.com

When a home insurance policy holder dies, the original policy will no longer be valid in its current state. If the current policy holder dies, what happens to the policy? I would like to understand who has the right to claim death insurance benefits if both policy holder as well as nominee dies. Similarly, the car insurance policy (after the death of the car’s owner) will also be transferred in that person’s (legal heir) name if the policy is valid. When a home insurance policy holder dies, the original policy will no longer be valid in its current state.

Source: identity-links.com

Source: identity-links.com

She has happily dedicated many hours to helping her clients understand how the insurance marketplace works so they can find the best car, home, and life insurance products for their needs. When the policy holder dies or can no longer drive because of health problems then a local broker should be able to help get the ncd transferred to a spouse etc who has been a named driver. In case the car insurance policy gets expired after the policyholder’s death and the heir is unable to get the policy transferred before the expiry date, he/ she can get the policy renewed in his/ her name. If the owner is not the insured, the policyholder becomes the new owner and should transferring ownership to a successor. Life insurance policies should be setup in very specific ways so that loved ones can access them for end of life necessities.

Source: minespress.com

Source: minespress.com

Within the policy definitions, the policy will remain valid until a new policy is purchased by the new owner. However, occasionally, the applicant unexpectedly dies prior to the policy’s issuance. She has happily dedicated many hours to helping her clients understand how the insurance marketplace works so they can find the best car, home, and life insurance products for their needs. Ncb can�t be transfered and if the main policy holder dies i�d imagine the policy would be voided since it would be incorrect. Life insurance can provide financial protection for family members and loved ones when a person dies.

Source: aginginplaceplanning.blogspot.com

Source: aginginplaceplanning.blogspot.com

Within the policy definitions, the policy will remain valid until a new policy is purchased by the new owner. Under motor insurance plans, since the vehicle is insured, in case of death of the policyholder, no claim is payable. A landlords policy will be needed since that would be the correct form of insurance for a tenant. If the current policy holder dies, what happens to the policy? But if the policyholder dies, the loan needs to be repaid first.

Source: informalnewz.com

Source: informalnewz.com

When the owner of a life insurance policy dies, nothing may happen unless the owner is also the insured. It is important to note that if the deceased owner was living in the home and upon death, the home will be held as a rental property; I would like to understand who has the right to claim death insurance benefits if both policy holder as well as nominee dies. The money is normally divided equally among them when this is the case. In case the car insurance policy gets expired after the policyholder’s death and the heir is unable to get the policy transferred before the expiry date, he/ she can get the policy renewed in his/ her name.

Source: promotionsnow.com

Source: promotionsnow.com

Registered in england and wales with registration number 4390. If the owner is not the insured, the policyholder becomes the new owner and should transferring ownership to a successor. Similarly, the car insurance policy (after the death of the car’s owner) will also be transferred in that person’s (legal heir) name if the policy is valid. Registered in england and wales with registration number 4390. The money is normally divided equally among them when this is the case.

Source: advancedontrade.com

Source: advancedontrade.com

If the owner of the car insurance policy dies, what happens to the policy? The policy owner is not always the insured so preparing the documents in a way that smoothly transfers the ownership at the time of death to the intended person is important. The heir can either renew the same policy or compare car insurance plans to find a more suitable policy. In a scenario where there is a time gap between such transfer and the policy’s expiry date has been crossed, the legal heir can renew the policy in their name. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy.

Source: minespress.com

Source: minespress.com

In case the car insurance policy gets expired after the policyholder’s death and the heir is unable to get the policy transferred before the expiry date, he/ she can get the policy renewed in his/ her name. Under motor insurance plans, since the vehicle is insured, in case of death of the policyholder, no claim is payable. Some policies name more than one individual to receive the death benefit proceeds when the insured dies. Similarly, the car insurance policy (after the death of the car’s owner) will also be transferred in that person’s (legal heir) name if the policy is valid. At the death of an owner, the policy passes as a probate estate asset to the next owner either by will or by intestate succession, if no successor owner is named.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

Caution is needed in saying the policy just passes to the executors. I would like to understand who has the right to claim death insurance benefits if both policy holder as well as nominee dies. Caution is needed in saying the policy just passes to the executors. Life insurance can provide financial protection for family members and loved ones when a person dies. However, occasionally, the applicant unexpectedly dies prior to the policy’s issuance.

How to claim death insurance benefits if nominee dies. However, death of the policyholder results in change in ownership of the policy as well as the vehicle. If the current policy holder dies, what happens to the policy? It is important to note that if the deceased owner was living in the home and upon death, the home will be held as a rental property; Most policies terminate on the death of the main policy holder and will leave named drivers uninsured.

Source: qualitylogoproducts.com

Source: qualitylogoproducts.com

If the person who owns the car insurance policy dies, technically the policy ends and is no longer valid. If the spouse of a deceased policy. Most policies terminate on the death of the main policy holder and will leave named drivers uninsured. In a scenario where there is a time gap between such transfer and the policy’s expiry date has been crossed, the legal heir can renew the policy in their name. If the owner of the car insurance policy dies, what happens to the policy?

Source: identity-links.com

Source: identity-links.com

However, if there is more than one name to the policy, then the other party must inform the insurance company as soon as possible. The car insurance policy can be passed on to the surviving spouse or estate executor after notifying the insurance company of the policyholder’s death. A former insurance producer, laura understands that education is key when it comes to buying insurance. Ncb can�t be transfered and if the main policy holder dies i�d imagine the policy would be voided since it would be incorrect. When the owner of a life insurance policy dies, nothing may happen unless the owner is also the insured.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

Every car insurance policy has a policyholder — the driver who purchased and is covered by the insurance. A former insurance producer, laura understands that education is key when it comes to buying insurance. Should one beneficiary predecease the insured, that individual�s share would normally pass to any other named beneficiaries to be shared equally among them. The heir can either renew the same policy or compare car insurance plans to find a more suitable policy. In case the car insurance policy gets expired after the policyholder’s death and the heir is unable to get the policy transferred before the expiry date, he/ she can get the policy renewed in his/ her name.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

In almost all cases, insurance companies are. When the policy holder dies or can no longer drive because of health problems then a local broker should be able to help get the ncd transferred to a spouse etc who has been a named driver. It is important to note that if the deceased owner was living in the home and upon death, the home will be held as a rental property; When the owner of a life insurance policy dies, nothing may happen unless the owner is also the insured. In almost all cases, insurance companies are.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title if insurance policy holder dies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.