If life insurance is convertible the policy can be Idea

Home » Trend » If life insurance is convertible the policy can be IdeaYour If life insurance is convertible the policy can be images are ready. If life insurance is convertible the policy can be are a topic that is being searched for and liked by netizens now. You can Download the If life insurance is convertible the policy can be files here. Download all free vectors.

If you’re searching for if life insurance is convertible the policy can be pictures information connected with to the if life insurance is convertible the policy can be topic, you have pay a visit to the right blog. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

If Life Insurance Is Convertible The Policy Can Be. Transferred to the life of another person. All or part of it can be converted within a. On the other hand, a. It’s important to note that many insurers put an age limit on when a convertible policy can be taken out.

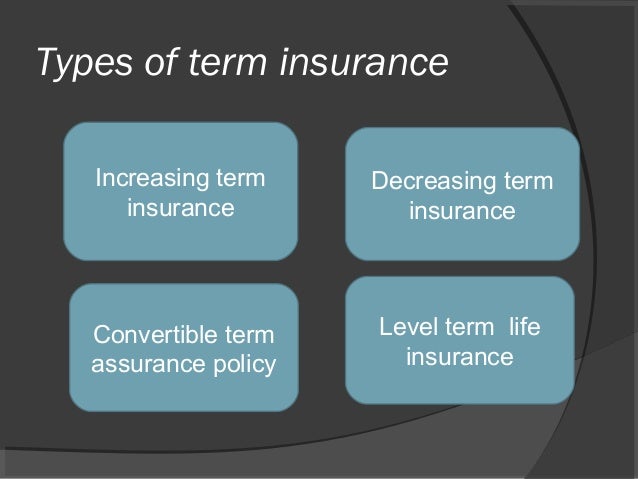

Life insurance products From slideshare.net

Life insurance products From slideshare.net

A term conversion option gives you more ways to protect yourself from life risks and uncertainties. During the conversion period, you have the option to turn the term life insurance into a permanent life policy with the same death benefit. The main advantage of convertible term life insurance is that you can purchase a temporary life insurance policy, which costs less than a permanent one but leave the option open to convert to a permanent policy at a later date. If life insurance is convertible, the policy can be a. A convertible term life insurance policy is term insurance with an expiration date and a conversion period. A convertible term policy gives the insured an option to covert a term policy to a permanent, whole life policy at a later date.

It lets you convert some or all of your term life insurance policy into a permanent life policy so that your coverage lasts for your entire life.

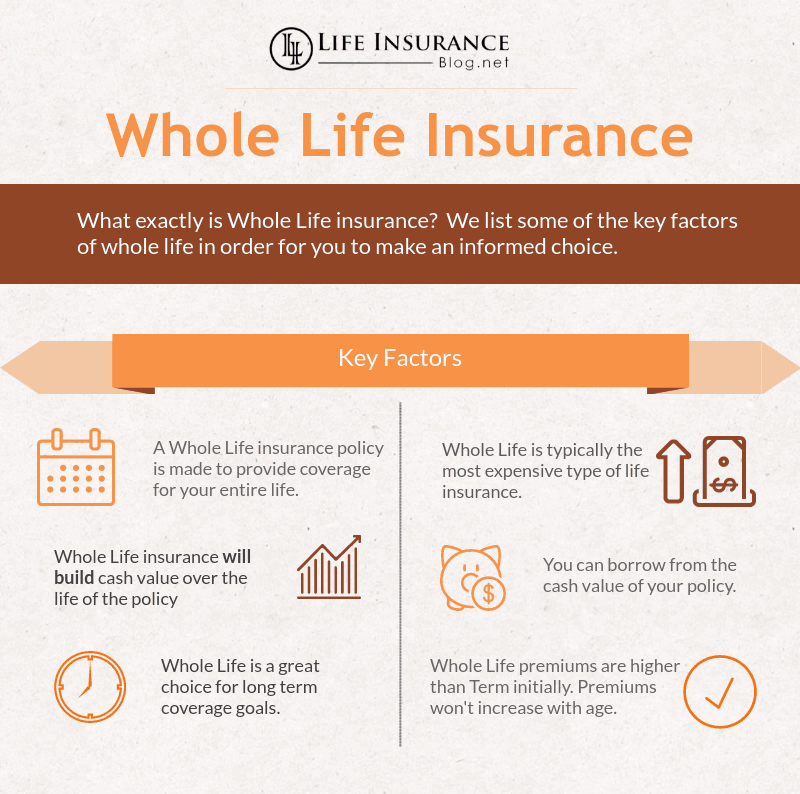

Your policy will then remain in effect until you die and begin accumulating a cash value. A convertible insurance policy is a term related to life insurance. Term life insurance is a policy that provides the insured person coverage for a certain period of time. How it works is that if you pass away during the period you are covered your beneficiary will receive payout benefits that will help your family financially. All convertible life insurance starts as term life insurance. A term conversion option gives you more ways to protect yourself from life risks and uncertainties.

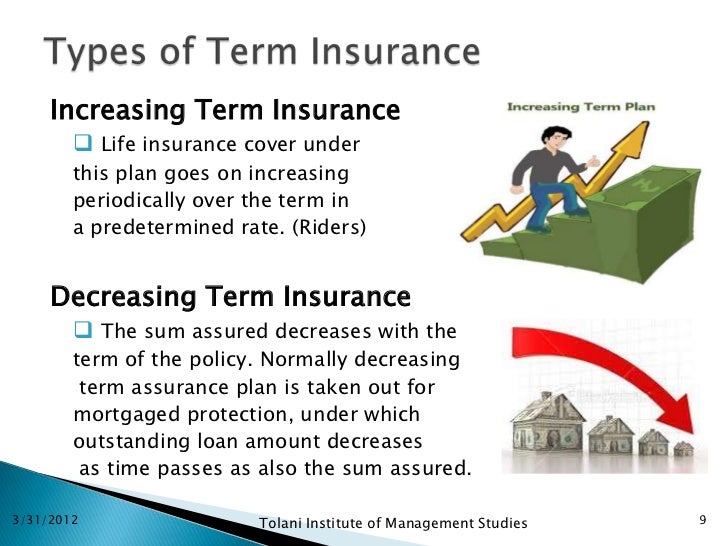

Source: slideshare.net

Source: slideshare.net

Is there an age limit on purchasing convertible term life insurance? Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe. So, you’ll have a $150,000 term life. It’s important to note that many insurers put an age limit on when a convertible policy can be taken out. If life insurance is convertible, the policy can be a.

Source: everquote.com

Source: everquote.com

A convertible term life insurance policy allows you to make the most of low premiums now while knowing you’ll still qualify for permanent coverage later — regardless of your health. As with renewable policies, you can do this without requalifying, which is a good choice if your health has deteriorated. A convertible term policy is typically a level term life insurance policy (with a level death benefit for a specific term or length of time, such as $500,000 for 20 years). During the conversion period, you have the option to turn the term life insurance into a permanent life policy with the same death benefit. Let’s say you’re looking to convert your $250,000 term life insurance policy.

Source: slideshare.net

Source: slideshare.net

The duration period can be 10, 20, or 30 years. A convertible term policy is typically a level term life insurance policy (with a level death benefit for a specific term or length of time, such as $500,000 for 20 years). All or part of it can be converted within a. A convertible policy is one that can be converted from term life into a whole or universal life policy. It lets you convert some or all of your term life insurance policy into a permanent life policy so that your coverage lasts for your entire life.

Source: motogp-news-hot.blogspot.com

Source: motogp-news-hot.blogspot.com

A convertible term life insurance policy is term insurance with an expiration date and a conversion period. A convertible term policy is typically a level term life insurance policy (with a level death benefit for a specific term or length of time, such as $500,000 for 20 years). Rodney and toni are a young couple with two small children. Plus, you don’t have to go through the underwriting process—health questions and possibly a medical exam. If you don’t want $250,000 in permanent coverage or the premiums are too expensive, you might decide to convert just $100,000.

Source: slideshare.net

Source: slideshare.net

Convertible term life insurance policies allow you to change them over to a permanent policy at a designated time. During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. A convertible term life insurance policy allows you to make the most of low premiums now while knowing you’ll still qualify for permanent coverage later — regardless of your health. It’s also known as a ‘conversion option’ as part of a term life insurance policy. A convertible life insurance policy is one that you can turn into a permanent or whole life insurance policy, either at the end of your term, or at certain anniversaries (eg.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. The good news is, a convertible term life insurance policy can give you the best of both worlds: Reasons to consider getting a convertible term life policy. A convertible term policy is typically a level term life insurance policy (with a level death benefit for a specific term or length of time, such as $500,000 for 20 years). The duration period can be 10, 20, or 30 years.

Source: slideshare.net

Source: slideshare.net

On the other hand, a. A convertible term life insurance policy is different than a term policy—the option to convert has to be present when you buy the policy. Changed to another type of life insurance. A convertible term policy gives the insured an option to covert a term policy to a permanent, whole life policy at a later date. Alternatively, permanent life insurance never expires so long as premiums are paid.

![Famers Life Insurance Review [Is It Your Best Bet?] Famers Life Insurance Review [Is It Your Best Bet?]](https://topwholelife.com/wp-content/uploads/2017/05/Farmers_WL_Review_1.jpg) Source: topwholelife.com

Source: topwholelife.com

The duration period can be 10, 20, or 30 years. A convertible term life insurance policy allows you to make the most of low premiums now while knowing you’ll still qualify for permanent coverage later — regardless of your health. Your policy will then remain in effect until you die and begin accumulating a cash value. During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. It gives you the flexibility to keep your life cover in place if your needs change in the future.

Source: boatinsurancesouthfloridachikaeta.blogspot.com

Source: boatinsurancesouthfloridachikaeta.blogspot.com

A convertible term policy gives the insured an option to covert a term policy to a permanent, whole life policy at a later date. They are doing well financially but their life. If life insurance is convertible then the policy can be changed to permanent insurance. A convertible term policy is typically a level term life insurance policy (with a level death benefit for a specific term or length of time, such as $500,000 for 20 years). A convertible term life insurance policy allows you to make the most of low premiums now while knowing you’ll still qualify for permanent coverage later — regardless of your health.

Source: myfasttermquotes.com

Source: myfasttermquotes.com

Most term life insurance is convertible. Convertible term life insurance policies allow you to change them over to a permanent policy at a designated time. A convertible policy can give you the flexibility needed to adapt to changing situations, e.g. It’s important to note that many insurers put an age limit on when a convertible policy can be taken out. The good news is, a convertible term life insurance policy can give you the best of both worlds:

Source: lowcostlifeinsuranceketanru.blogspot.com

Source: lowcostlifeinsuranceketanru.blogspot.com

A convertible insurance policy is a term related to life insurance. Rodney and toni are a young couple with two small children. Convertible insurance is a type of life insurance that allows the policyholder to change a term policy into a whole or universal policy without. Transferred to the life of another person. Reasons to consider getting a convertible term life policy.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

The duration period can be 10, 20, or 30 years. Term life insurance covers and protects you and your family temporarily and for a specific window of time. How it works is that if you pass away during the period you are covered your beneficiary will receive payout benefits that will help your family financially. So, you’ll have a $150,000 term life. If life insurance is convertible, the policy can be a.

Source: nilife.com

Source: nilife.com

Convertible insurance is a type of life insurance that allows the policyholder to change a term policy into a whole or universal policy without. If life insurance is convertible, the policy can be a. A type of life insurance that allows the policyholder to change a term policy into a whole or universal policy without going through the health qualification process again. A convertible life insurance policy is one that you can turn into a permanent or whole life insurance policy, either at the end of your term, or at certain anniversaries (eg. How it works is that if you pass away during the period you are covered your beneficiary will receive payout benefits that will help your family financially.

Source: everquote.com

Source: everquote.com

If you don’t want $250,000 in permanent coverage or the premiums are too expensive, you might decide to convert just $100,000. Most term life insurance is convertible. A convertible policy can give you the flexibility needed to adapt to changing situations, e.g. During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. Term life insurance is a policy that provides the insured person coverage for a certain period of time.

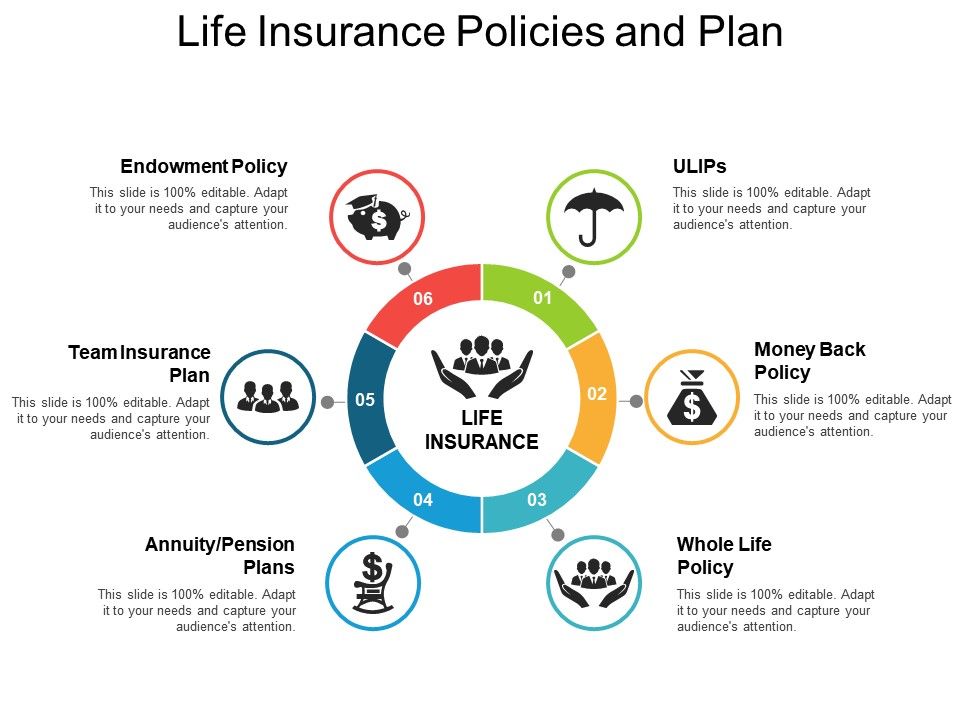

Source: slideteam.net

Source: slideteam.net

On the other hand, a. During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. The duration period can be 10, 20, or 30 years. All or part of it can be converted within a. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe.

Source: noclutter.cloud

Source: noclutter.cloud

Convertible insurance is a type of life insurance that allows the policyholder to change a term policy into a whole or universal policy without. Convertible insurance is a type of life insurance that allows the policyholder to change a term policy into a whole or universal policy without. Is there an age limit on purchasing convertible term life insurance? Most term life insurance is convertible. Reasons to consider getting a convertible term life policy.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

If life insurance is convertible, the policy can be a. Convertible life insurance allows you to transition your term life policy into a permanent life policy. Is there an age limit on purchasing convertible term life insurance? A convertible term life insurance policy is term insurance with an expiration date and a conversion period. It’s also known as a ‘conversion option’ as part of a term life insurance policy.

Source: slideshare.net

Source: slideshare.net

Changed to health or disability protection d. On the other hand, a. During that policy term, the policy owner pays a fixed premium in exchange for a fixed death benefit should the insured die. A convertible term life insurance policy is term insurance with an expiration date and a conversion period. But in reality, convertible term life insurance is just a term life insurance policy with a conversion option.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title if life insurance is convertible the policy can be by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.