Ifrs 17 life insurance Idea

Home » Trend » Ifrs 17 life insurance IdeaYour Ifrs 17 life insurance images are ready. Ifrs 17 life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Ifrs 17 life insurance files here. Get all royalty-free photos.

If you’re searching for ifrs 17 life insurance images information related to the ifrs 17 life insurance keyword, you have come to the right blog. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

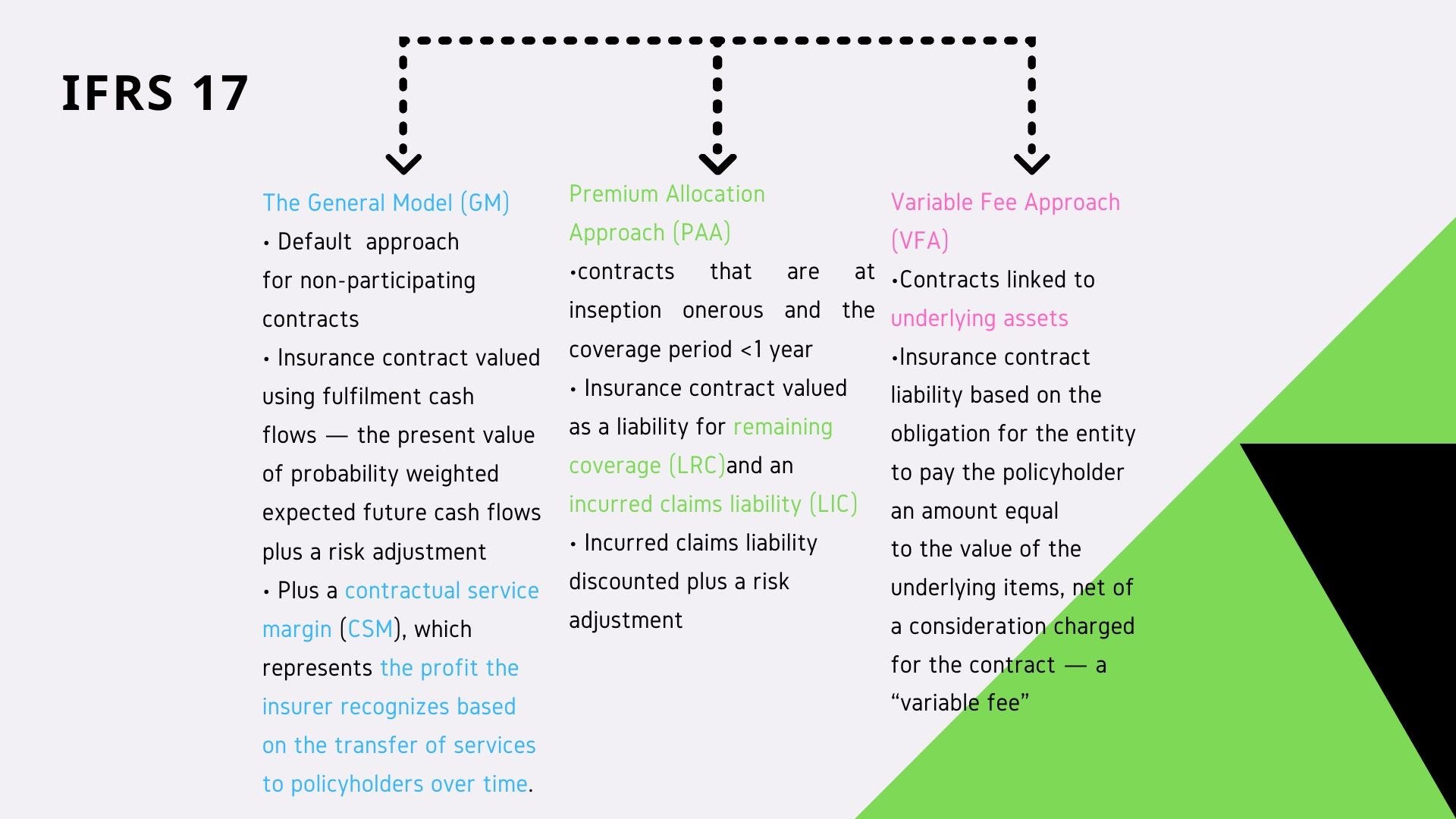

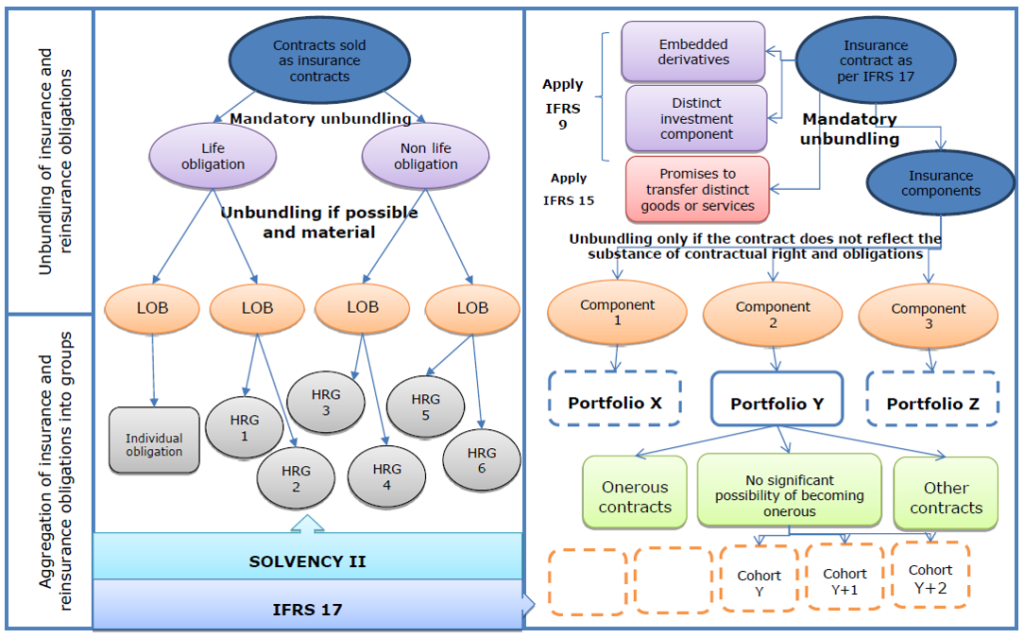

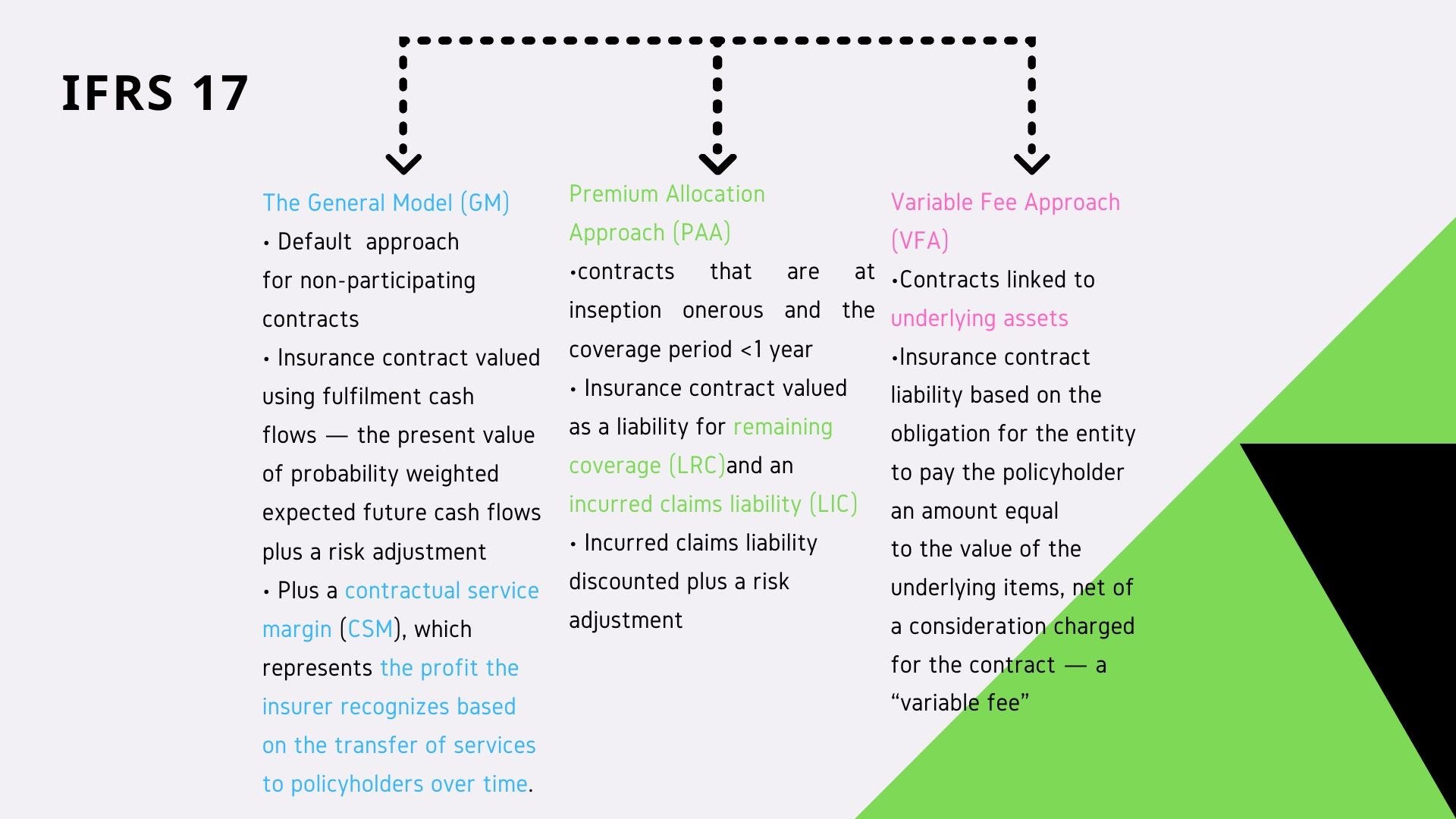

Ifrs 17 Life Insurance. Exposure on the ifrs 17. We consider the adjustments currently made by life insurers and the potential adjustments which it may be appropriate to make under the new standard. The objective of ifrs 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. In addition, many insurance contracts generate.

IFRS 17, FPSL and SAP for PAA insurance contracts Elena From medium.com

IFRS 17, FPSL and SAP for PAA insurance contracts Elena From medium.com

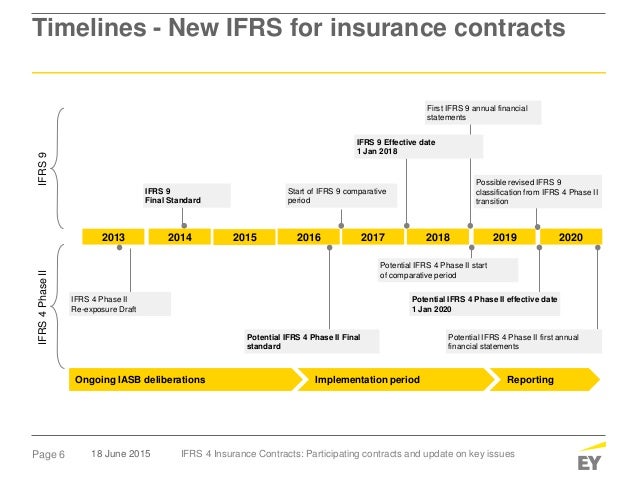

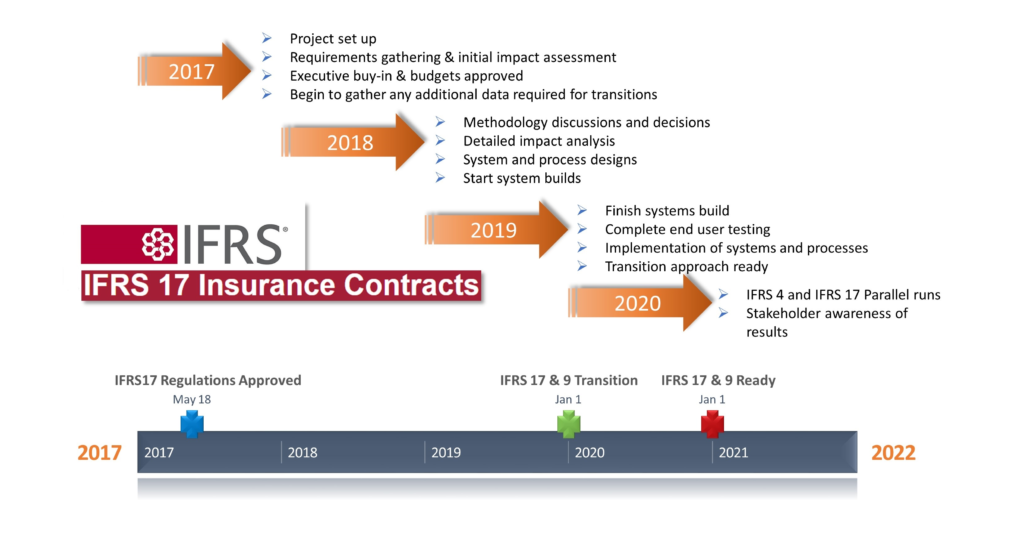

Ifrs 17 supersedes ifrs 4 and completes the board’s project to establish a specific ifrs model for the accounting for insurance contracts. Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied. Ifrs 17 is effective from 1 january 2021. An illustration (all amounts in cu thousands unless otherwise stated) pwc 2.6. Insurance contracts combine features of both a financial instrument and a service contract. Ifrs 17 began as an iasb project to undertake a comprehensive review of accounting for insurance contracts when the iasb added the project to its agenda in september 2001, taking over the equivalent project started in april 1997 by the iasb�s predecessor body.

6 | ifrs 17, insurance contracts:

Ifrs 17 is effective from 1 january 2021. This publication provides illustrative disclosures to meet the requirements of ifrs 17 insurance contracts and ifrs 9 financial instruments related to groups of insurance contracts accounted for under the default measurement model described in ifrs 17 (the general model). Page 2 agenda 2 building block approach 3 premium allocation approach 4 reinsurance ceded 5 presentation and disclosure 6 transition 7 issues from a general insurance perspective 8 operational implications 1 overview of ifrs 17. †“basis for conclusions on exposure draft amendments to ifrs 17” as issued in june 2019. Development of a comprehensive ifrs standard for insurance contracts. On 19 november 2021, the european commission passed regulation (eu) 2021/2036.

Source: blogs.sap.com

Source: blogs.sap.com

At this stage, insurers have no worries about what the standard will say, and Excellent remuneration package based on experience. Our research of leading european insurers has made it clear that preparing aop under ifrs 17 will create significant new challenges and could also demand investment in models, data, systems and. Insurers have to cope with specific complex and changing ifrs themes. A company can choose to apply ifrs 17 before that date but only if it also applies

Source: gaapdynamics.com

Opportunity to work with a leading life insurance company with a wonderful history, culture and reputation. Opportunity to work with a leading life insurance company with a wonderful history, culture and reputation. †“basis for conclusions on ifrs 17” as issued in may 2017. This is a sessional event run by the institute and faculty of. Ifrs 17 is effective from 1 january 2021.

Ifrs 17 will fundamentally change the accounting for all entities that issue contracts within the scope of the standard. This major change program to implement ifrs 17 will extend beyond the finance and actuarial The paper references ifrs 17 paragraphs from the following sources: 6 | ifrs 17, insurance contracts: This is a sessional event run by the institute and faculty of.

Source: interquestgroup.com

Source: interquestgroup.com

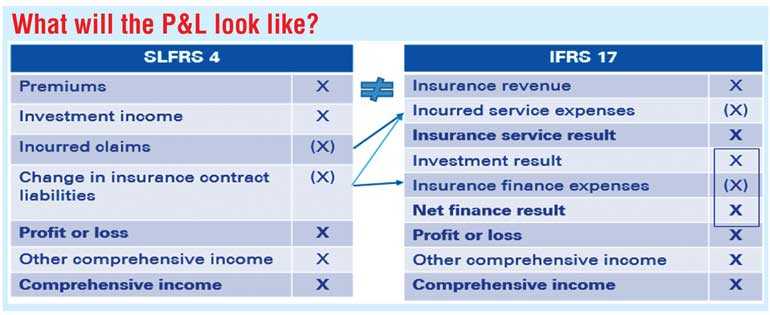

At this stage, insurers have no worries about what the standard will say, and Furthermore, asset and liability movements should be aligned—meaning that ifrs 9 and ifrs 17 are aligned in terms of how interest rates, currencies, and spread movements are booked in the p&l. This information gives a basis for users of financial statements to assess the effect that. The disclosures are presented as a series of extracts from a set of financial. Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied.

An illustration (all amounts in cu thousands unless otherwise stated) pwc 2.6. The objective of ifrs 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. Reconciliation of the liability for remaining coverage and the liability for incurred claims 72 Ifrs 17 is effective from 1 january 2021. Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied.

Source: theactuary.net

Source: theactuary.net

Ifrs 17 began as an iasb project to undertake a comprehensive review of accounting for insurance contracts when the iasb added the project to its agenda in september 2001, taking over the equivalent project started in april 1997 by the iasb�s predecessor body. In addition, many insurance contracts generate. Ifrs 17 will fundamentally change the accounting for all entities that issue contracts within the scope of the standard. This major change program to implement ifrs 17 will extend beyond the finance and actuarial †“basis for conclusions on ifrs 17” as issued in may 2017.

Source: interquestgroup.com

Source: interquestgroup.com

In addition, many insurance contracts generate. Our research of leading european insurers has made it clear that preparing aop under ifrs 17 will create significant new challenges and could also demand investment in models, data, systems and. Deloitte’s ifrs 17 life insurance application has been created to assess tentative decisions made by the international accounting standard board (iasb) in relation to its proposal for a new standard for insurance contracts related to ifrs17. Ifrs 17 is effective from 1 january 2021. This is a sessional event run by the institute and faculty of actuaries (ifoa) on the topic of the “ifrs 17 contractual service margin:

Source: medium.com

Source: medium.com

In addition, many insurance contracts generate. At this stage, insurers have no worries about what the standard will say, and Ifrs 17 will fundamentally change the accounting for all entities that issue contracts within the scope of the standard. An illustration (all amounts in cu thousands unless otherwise stated) pwc 2.6. Exposure on the ifrs 17.

Source: calameo.com

Source: calameo.com

†“basis for conclusions on ifrs 17” as issued in may 2017. Exposure on the ifrs 17. Ifrs 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. Page 3 section 1 overview of ifrs 17. Ifrs 17 is effective from 1 january 2021.

Source: slideshare.net

Source: slideshare.net

Opportunity to work with a leading life insurance company with a wonderful history, culture and reputation. This is a sessional event run by the institute and faculty of actuaries (ifoa) on the topic of the “ifrs 17 contractual service margin: Ifrs 17 began as an iasb project to undertake a comprehensive review of accounting for insurance contracts when the iasb added the project to its agenda in september 2001, taking over the equivalent project started in april 1997 by the iasb�s predecessor body. 6 | ifrs 17, insurance contracts: Ifrs 17 will fundamentally change the accounting for all entities that issue contracts within the scope of the standard.

Excellent remuneration package based on experience. Reconciliation of the liability for remaining coverage and the liability for incurred claims 72 Our research of leading european insurers has made it clear that preparing aop under ifrs 17 will create significant new challenges and could also demand investment in models, data, systems and. Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied. Furthermore, asset and liability movements should be aligned—meaning that ifrs 9 and ifrs 17 are aligned in terms of how interest rates, currencies, and spread movements are booked in the p&l.

Source: theactuary.net

Source: theactuary.net

An illustration (all amounts in cu thousands unless otherwise stated) pwc 2.6. Ifrs 17 supersedes ifrs 4 and completes the board’s project to establish a specific ifrs model for the accounting for insurance contracts. This publication provides illustrative disclosures to meet the requirements of ifrs 17 insurance contracts and ifrs 9 financial instruments related to groups of insurance contracts accounted for under the default measurement model described in ifrs 17 (the general model). Ifrs 17 began as an iasb project to undertake a comprehensive review of accounting for insurance contracts when the iasb added the project to its agenda in september 2001, taking over the equivalent project started in april 1997 by the iasb�s predecessor body. Development of a comprehensive ifrs standard for insurance contracts.

Source: theactuary.com

Source: theactuary.com

The disclosures are presented as a series of extracts from a set of financial. The objective of ifrs 17 is to ensure that an entity provides relevant information that faithfully represents those Page 2 agenda 2 building block approach 3 premium allocation approach 4 reinsurance ceded 5 presentation and disclosure 6 transition 7 issues from a general insurance perspective 8 operational implications 1 overview of ifrs 17. This is a sessional event run by the institute and faculty of. †“basis for conclusions on ifrs 17” as issued in may 2017.

Opportunity to work with a leading life insurance company with a wonderful history, culture and reputation. Ifrs 17 will fundamentally change the accounting for all entities that issue contracts within the scope of the standard. Furthermore, asset and liability movements should be aligned—meaning that ifrs 9 and ifrs 17 are aligned in terms of how interest rates, currencies, and spread movements are booked in the p&l. In addition, many insurance contracts generate. This publication provides illustrative disclosures to meet the requirements of ifrs 17 insurance contracts and ifrs 9 financial instruments related to groups of insurance contracts accounted for under the default measurement model described in ifrs 17 (the general model).

Source: slideshare.net

Source: slideshare.net

This information gives a basis for users of financial statements to assess the effect that. We consider the adjustments currently made by life insurers and the potential adjustments which it may be appropriate to make under the new standard. This is a sessional event run by the institute and faculty of actuaries (ifoa) on the topic of the “ifrs 17 contractual service margin: At this stage, insurers have no worries about what the standard will say, and Insurers have to cope with specific complex and changing ifrs themes.

At this stage, insurers have no worries about what the standard will say, and 6 | ifrs 17, insurance contracts: This information gives a basis for users of financial statements to assess the effect that. This means that ifrs 17, the new international accounting standard for insurance contracts, is now european law. This major change program to implement ifrs 17 will extend beyond the finance and actuarial

Source: gaapdynamics.com

Source: gaapdynamics.com

At this stage, insurers have no worries about what the standard will say, and Excellent remuneration package based on experience. 6 | ifrs 17, insurance contracts: Ifrs 17 began as an iasb project to undertake a comprehensive review of accounting for insurance contracts when the iasb added the project to its agenda in september 2001, taking over the equivalent project started in april 1997 by the iasb�s predecessor body. Page 3 section 1 overview of ifrs 17.

Source: ft.lk

Source: ft.lk

We consider the adjustments currently made by life insurers and the potential adjustments which it may be appropriate to make under the new standard. This information gives a basis for users of financial statements to assess the effect that. †“basis for conclusions on ifrs 17” as issued in may 2017. The complex set of regulations ifrs 17 will enter into force on 1 january 2023 and replace. Excellent remuneration package based on experience.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ifrs 17 life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.