Illinois department of insurance pension calculator Idea

Home » Trend » Illinois department of insurance pension calculator IdeaYour Illinois department of insurance pension calculator images are ready. Illinois department of insurance pension calculator are a topic that is being searched for and liked by netizens now. You can Find and Download the Illinois department of insurance pension calculator files here. Get all royalty-free photos and vectors.

If you’re searching for illinois department of insurance pension calculator pictures information connected with to the illinois department of insurance pension calculator keyword, you have pay a visit to the right blog. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Illinois Department Of Insurance Pension Calculator. You receive an additional 9% if you have a dependent spouse and an additional 17.9% per a dependent child. Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7. Using the state pension as the foundation of your pension pot, you will also want to have an idea of your planned retirement age, how much mortgage you need to pay off, and. The retirement cost of living adjustment (cola) applicable to tier 2 participants, and

Retirement Savings Spreadsheet in 2021 Saving for From pinterest.com

Retirement Savings Spreadsheet in 2021 Saving for From pinterest.com

Please choose the appropriate tier below to perform the benefit estimate and click �go to estimator� tier: To estimate the value of your firefighters’ pension scheme benefits on any retirement date selected by you, just download our handy calculator. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. The resulting total is the claimant�s weekly benefit amount. The retirement cost of living adjustment (cola) applicable to tier 2 participants, and Please click the �select� link below to view other pension data documents that have been uploaded.

However, if the pension is paid from an employer.

To use the calculator, you must know your hire date, retire date, annual salary, reciprocity type, unpaid break days and the effective date of the benefit. Illinois department of insurance announces the start of open enrollment on the aca health insurance marketplace. Pension actuary home enrolled actuary home. Using the state pension as the foundation of your pension pot, you will also want to have an idea of your planned retirement age, how much mortgage you need to pay off, and. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. The pension code and in the glossary of this publication.

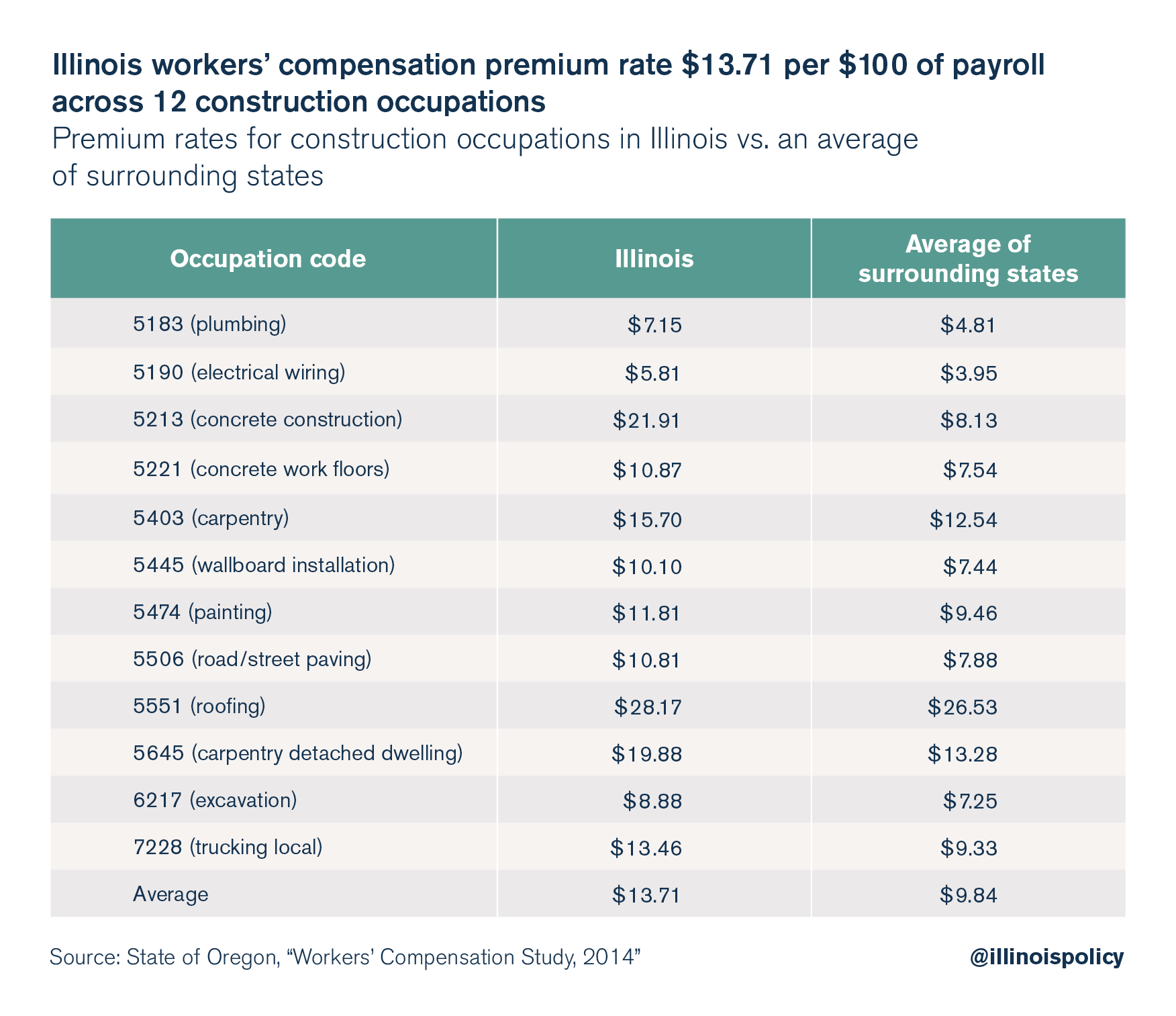

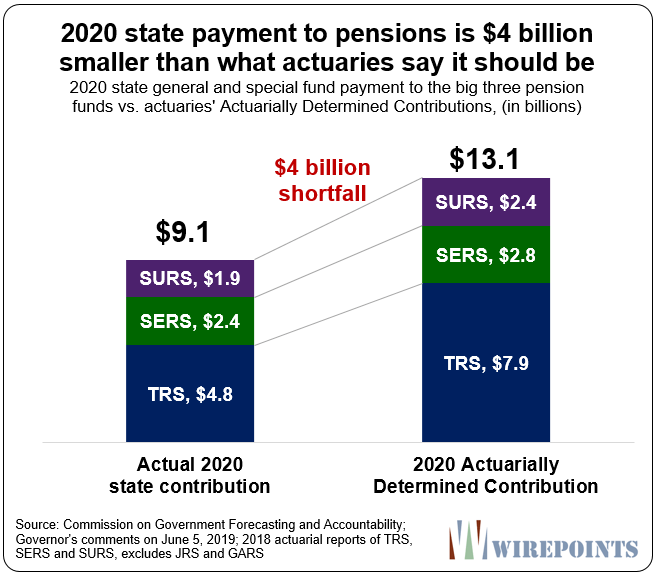

Source: illinoispolicy.org

Source: illinoispolicy.org

Please click the �select� link below to view other pension data documents that have been uploaded. In accordance with state law, the illinois department of insurance annually determines certain annuity limitations for use in benefit determinations by the retirement systems and pension funds operating under the illinois pension code. Pension annual statement system upgrade for the pension annual statement system: The reason for this is your pension and group insurance begin with sers on the first of the month following your resignation. However, if the pension is paid from an employer.

Source: finance.cantik.co.id

Source: finance.cantik.co.id

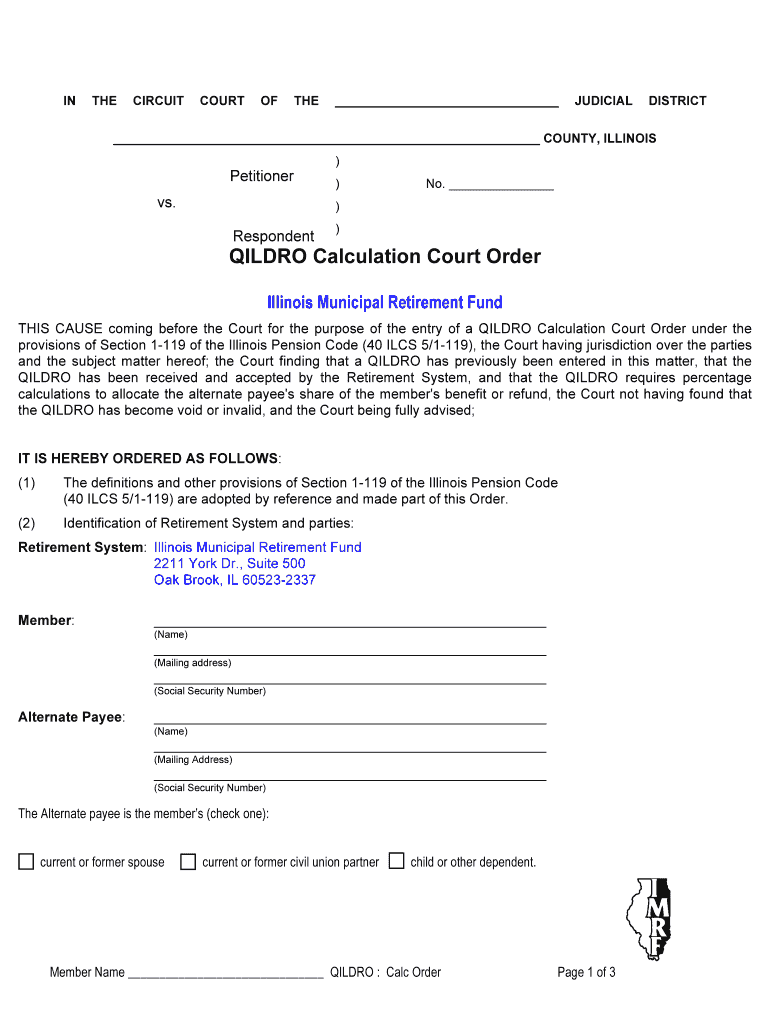

Tier 2 salary limitation calculation for 2011 large funds. Qualified illinois domestic relations orders (qildros) are court orders that direct sers to pay a portion of a member’s retirement benefit or refund to an alternate payee, typically a former spouse. Pension from the firefighters pension fund? Pension actuary home enrolled actuary home. Tier 2 salary limitation calculation for 2011 large funds.

Source: pdffiller.com

Source: pdffiller.com

Illinois department of insurance announces the start of open enrollment on the aca health insurance marketplace. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. Refer to the fy21 rate sheet and fy22 rate sheet pages for contribution amounts. However, if the pension is paid from an employer. The resulting total is the claimant�s weekly benefit amount.

Source: retirementes.com

Source: retirementes.com

You might be wondering how to calculate your pension amount. Please click the �select� link below to view other pension data documents that have been uploaded. The retirement cost of living adjustment (cola) applicable to tier 2 participants, and You receive an additional 9% if you have a dependent spouse and an additional 17.9% per a dependent child. You might be wondering how to calculate your pension amount.

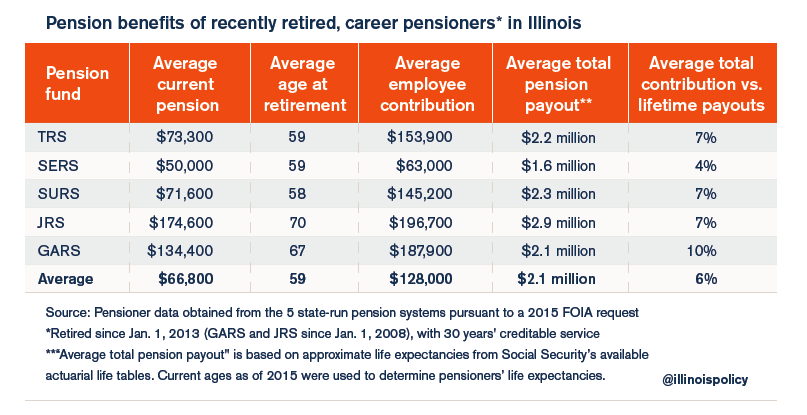

Source: illinoispolicy.org

Source: illinoispolicy.org

Refer to the fy21 rate sheet and fy22 rate sheet pages for contribution amounts. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. Qualified illinois domestic relations orders (qildros) are court orders that direct sers to pay a portion of a member’s retirement benefit or refund to an alternate payee, typically a former spouse. Welcome to the doi public pension division�s website. Our goals are to ensure pension fund integrity and to educate participants about retirement and disability benefits.

Source: ippfa.org

Source: ippfa.org

Please contact the illinois department of insurance public pension division at. You receive an additional 9% if you have a dependent spouse and an additional 17.9% per a dependent child. Each plan year (july 1 through june 30) the health, dental and life coverage rates may change. If you resign too soon in the first pay period of a month, your insurance would be terminated, you would have a lapse in coverage (unless you pay a cobra premium), and insurance benefits would not start until the first. In accordance with state law, the illinois department of insurance annually determines certain annuity limitations for use in benefit determinations by the retirement systems and pension funds operating under the illinois pension code.

Source: bankrate.com

Source: bankrate.com

Welcome to the doi public pension division�s website. To use the calculator, you must know your hire date, retire date, annual salary, reciprocity type, unpaid break days and the effective date of the benefit. In accordance with state law, the illinois department of insurance annually determines certain annuity limitations for use in benefit determinations by the retirement systems and pension funds operating under the illinois pension code. Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7. Each plan year (july 1 through june 30) the health, dental and life coverage rates may change.

Source: newyorklife.com

Source: newyorklife.com

Estimated weekly benefit rate (wba) the calculator returns your estimated wba based on your average weekly wage during the base period. Qualified illinois domestic relations orders (qildros) are court orders that direct sers to pay a portion of a member’s retirement benefit or refund to an alternate payee, typically a former spouse. Welcome to the doi public pension division�s website. Pension from the firefighters pension fund? Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7.

Source: srs.illinois.gov

Source: srs.illinois.gov

You receive an additional 9% if you have a dependent spouse and an additional 17.9% per a dependent child. If you resign too soon in the first pay period of a month, your insurance would be terminated, you would have a lapse in coverage (unless you pay a cobra premium), and insurance benefits would not start until the first. Tier 2 salary limitation calculation for 2011 large funds. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. Welcome to the doi public pension division�s website.

Source: royfmc.com

Source: royfmc.com

You might be wondering how to calculate your pension amount. Our website provides a portal to the web based annual statement filing system and gives you easy access to a variety of information regarding your pension benefits. If you resign too soon in the first pay period of a month, your insurance would be terminated, you would have a lapse in coverage (unless you pay a cobra premium), and insurance benefits would not start until the first. Please choose the appropriate tier below to perform the benefit estimate and click �go to estimator� tier: You might be wondering how to calculate your pension amount.

Source: davidmoquinn76.blogspot.com

Source: davidmoquinn76.blogspot.com

The resulting total is the claimant�s weekly benefit amount. Illinois department of insurance announces the start of open enrollment on the aca health insurance marketplace. To estimate the value of your firefighters’ pension scheme benefits on any retirement date selected by you, just download our handy calculator. Please contact the illinois department of insurance public pension division at. Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7.

Source: retirementes.com

Source: retirementes.com

Please choose the appropriate tier below to perform the benefit estimate and click �go to estimator� tier: Refer to the fy21 rate sheet and fy22 rate sheet pages for contribution amounts. Illinois department of insurance, public pension division date: Estimated weekly benefit rate (wba) the calculator returns your estimated wba based on your average weekly wage during the base period. The reason for this is your pension and group insurance begin with sers on the first of the month following your resignation.

Source: pinterest.com

Source: pinterest.com

Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7. Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7. The pension calculator in member access lets you create pension estimates at any time, and you can see your results right away. You can create an unlimited number of retirement scenarios, such as using: However, if the pension is paid from an employer.

Source: 22wealth.com

Source: 22wealth.com

You receive an additional 9% if you have a dependent spouse and an additional 17.9% per a dependent child. The reason for this is your pension and group insurance begin with sers on the first of the month following your resignation. Illinois law reduces benefits using a formulaic calculation whereby the monthly pension payment is divided by 30 and multiplied by 7. To use the calculator, you must know your hire date, retire date, annual salary, reciprocity type, unpaid break days and the effective date of the benefit. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount.

Source: aramilaw.com

Source: aramilaw.com

To estimate the value of your firefighters’ pension scheme benefits on any retirement date selected by you, just download our handy calculator. Using the state pension as the foundation of your pension pot, you will also want to have an idea of your planned retirement age, how much mortgage you need to pay off, and. You can create an unlimited number of retirement scenarios, such as using: The reason for this is your pension and group insurance begin with sers on the first of the month following your resignation. Estimated weekly benefit rate (wba) the calculator returns your estimated wba based on your average weekly wage during the base period.

Source: bankrate.com

Source: bankrate.com

You might be wondering how to calculate your pension amount. Our goals are to ensure pension fund integrity and to educate participants about retirement and disability benefits. If you resign too soon in the first pay period of a month, your insurance would be terminated, you would have a lapse in coverage (unless you pay a cobra premium), and insurance benefits would not start until the first. Welcome to the doi public pension division�s website. Using the state pension as the foundation of your pension pot, you will also want to have an idea of your planned retirement age, how much mortgage you need to pay off, and.

Source: illinois-calculating-support.pdffiller.com

Source: illinois-calculating-support.pdffiller.com

Tier 2 salary limitation calculation for 2011 large funds. You can create an unlimited number of retirement scenarios, such as using: If you’ve already checked your state pension (external website), this pension calculator by moneyhelper (external website) can help you understand how much you could get from your total pension pot. The pension code and in the glossary of this publication. Our goals are to ensure pension fund integrity and to educate participants about retirement and disability benefits.

Source: newyorklife.com

Source: newyorklife.com

Refer to the fy21 rate sheet and fy22 rate sheet pages for contribution amounts. The illinois state retirement system offers an illinois state retirement calculator that will help you determine your benefit amount. Qualified illinois domestic relations orders (qildros) are court orders that direct sers to pay a portion of a member’s retirement benefit or refund to an alternate payee, typically a former spouse. Tier 2 salary limitation calculation for 2011 large funds. Annual salary limitation and annual increase to the monthly pension for new hires onor after january 1, 2011 in accordance with state law, the department of insurance (“department”) is to annually calculate the

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title illinois department of insurance pension calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.