Ils insurance market Idea

Home » Trend » Ils insurance market IdeaYour Ils insurance market images are available. Ils insurance market are a topic that is being searched for and liked by netizens now. You can Get the Ils insurance market files here. Find and Download all free vectors.

If you’re looking for ils insurance market images information related to the ils insurance market interest, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Ils Insurance Market. Ils is able to offer agents proven, successful sales solutions across the united states. Hannover re has said it expects volume in excess of $100bn for the ils market this year, compared with around $95bn in 2021, with the carrier anticipating increased volume for catastrophe bonds. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. Ledger investing is a technology marketplace that matches insurance risk to capital markets.

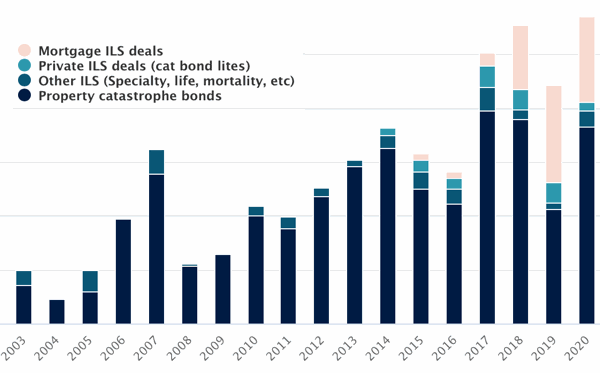

Resurgence of ILS market From bermudareinsurancemagazine.com

Resurgence of ILS market From bermudareinsurancemagazine.com

Ils advisers is the first asia based investment consultant focusing exclusively on insurance linked investment. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. What it needs now to take it to the next level is a liquid secondary market. In summary, these risks include (but are not limited to): The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding. Nonetheless, even with a healthy amount of issuance, the ils market (measured by notional outstanding) has shrunk by 1.35% since the end of 2019, which can be seen in figure 2.

As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class.

As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. Hannover re has said it expects volume in excess of $100bn for the ils market this year, compared with around $95bn in 2021, with the carrier anticipating increased volume for catastrophe bonds. Recent market developments have reiterated the need of stable investment returns uncorrelated to traditional asset classes also in asia. The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. These companies are therefore often referred to as “protection buyers”. Markel ransomware has become a grim reality for many companies around the globe as cyber criminals have developed increasingly sophisticated methods of extorting businesses, markel’s jess cardoso tells bermuda:re+ils.

Source: youtube.com

Source: youtube.com

In comparison to last year, the amount of new issuance during 2020 has far surpassed the total of 2019 (about usd 5.5bn). As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. Essentially, ils is a way for companies to buy protection against the risk of incurring a loss as a result of an event. Hannover re has said it expects volume in excess of $100bn for the ils market this year, compared with around $95bn in 2021, with the carrier anticipating increased volume for catastrophe bonds. In summary, these risks include (but are not limited to):

Source: artemis.bm

Source: artemis.bm

- an investment in insurance linked securities involves potentially significant risks for an investor. They provide accurate data at an affordable price with an easy to use interface which allows dedicated agents to realize turnkey, top line growth! This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. The lloyd�s ils platform, london bridge risk pcc limited, has the potential to attract investors away from the more established regimes and into the uk. Markel ransomware has become a grim reality for many companies around the globe as cyber criminals have developed increasingly sophisticated methods of extorting businesses, markel’s jess cardoso tells bermuda:re+ils.

Source: revisi.net

Source: revisi.net

•investors may lose all or a portion of their investment in insurance linked securities if a natural catastrophe or other event triggers a payment The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. •investors may lose all or a portion of their investment in insurance linked securities if a natural catastrophe or other event triggers a payment Ils value is influenced by an insured loss event underlying the security. In summary, these risks include (but are not limited to):

Source: insuranceday.maritimeintelligence.informa.com

Source: insuranceday.maritimeintelligence.informa.com

The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. The ils market has become an increasingly important feature in the risk transfer landscape in recent years, and is growing increasingly diverse, encompassing not only catastrophe risks but cyber and other forms of coverage. The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. The chinese insurance market has a 13% compound annual growth rate; Ils is able to offer agents proven, successful sales solutions across the united states.

Source: bermudareinsurancemagazine.com

Source: bermudareinsurancemagazine.com

What it needs now to take it to the next level is a liquid secondary market. * an investment in insurance linked securities involves potentially significant risks for an investor. The chinese insurance market has a 13% compound annual growth rate; •investors may lose all or a portion of their investment in insurance linked securities if a natural catastrophe or other event triggers a payment Ils advisers is the first asia based investment consultant focusing exclusively on insurance linked investment.

The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. These companies are therefore often referred to as “protection buyers”. Ils value is influenced by an insured loss event underlying the security. •investors may lose all or a portion of their investment in insurance linked securities if a natural catastrophe or other event triggers a payment The ils funds have in the last ten years changed the face of reinsurance market to become an integral part of client’s reinsurance asset base, we have been at the heart of this change by delivering high value collateralised reinsurance products to satisfy our clients’ needs.

Source: gccapitalideas.com

Source: gccapitalideas.com

Essentially, ils is a way for companies to buy protection against the risk of incurring a loss as a result of an event. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. Ils, both from the life and property/casualty (p/c). Markel ransomware has become a grim reality for many companies around the globe as cyber criminals have developed increasingly sophisticated methods of extorting businesses, markel’s jess cardoso tells bermuda:re+ils. In summary, these risks include (but are not limited to):

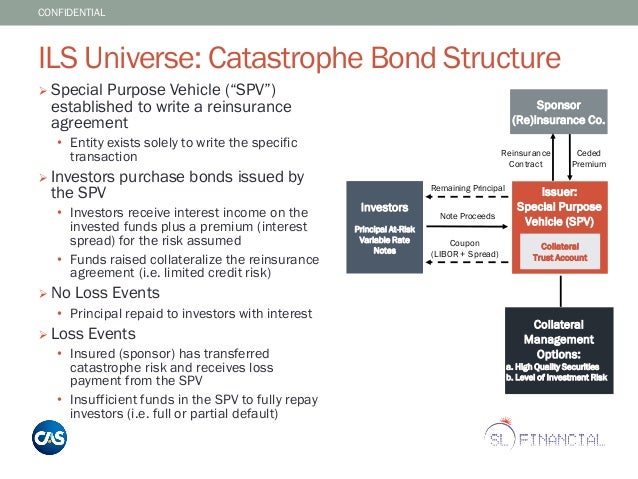

Source: slideshare.net

Source: slideshare.net

In comparison to last year, the amount of new issuance during 2020 has far surpassed the total of 2019 (about usd 5.5bn). Ledger investing is a technology marketplace that matches insurance risk to capital markets. These companies are therefore often referred to as “protection buyers”. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. The scope of the pcc�s approval is different to any approval previously issued by the pra and reflects the unique nature of the lloyd�s market in that it permits the pcc to reinsure any class.

Source: artemis.bm

Source: artemis.bm

In comparison to last year, the amount of new issuance during 2020 has far surpassed the total of 2019 (about usd 5.5bn). Essentially, ils is a way for companies to buy protection against the risk of incurring a loss as a result of an event. Hannover re has said it expects volume in excess of $100bn for the ils market this year, compared with around $95bn in 2021, with the carrier anticipating increased volume for catastrophe bonds. Ils value is influenced by an insured loss event underlying the security. The combination of a large volume of maturing structures along with lower average new issuance deal sizes were key attributes, which led to this lower outstanding amount at the end of 2019.

![]() Source: businessinsurance.com

Source: businessinsurance.com

As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. Ils, both from the life and property/casualty (p/c). In comparison to last year, the amount of new issuance during 2020 has far surpassed the total of 2019 (about usd 5.5bn). The scope of the pcc�s approval is different to any approval previously issued by the pra and reflects the unique nature of the lloyd�s market in that it permits the pcc to reinsure any class. Ils value is influenced by an insured loss event underlying the security.

Source: insuranceasianews.com

Source: insuranceasianews.com

The combination of a large volume of maturing structures along with lower average new issuance deal sizes were key attributes, which led to this lower outstanding amount at the end of 2019. What it needs now to take it to the next level is a liquid secondary market. Nonetheless, even with a healthy amount of issuance, the ils market (measured by notional outstanding) has shrunk by 1.35% since the end of 2019, which can be seen in figure 2. Ils is able to offer agents proven, successful sales solutions across the united states. Ils, both from the life and property/casualty (p/c).

Source: clearpathanalysis.com

Source: clearpathanalysis.com

What it needs now to take it to the next level is a liquid secondary market. The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. Ils, both from the life and property/casualty (p/c). These companies are therefore often referred to as “protection buyers”.

Source: artemis.bm

Source: artemis.bm

The chinese insurance market has a 13% compound annual growth rate; Ledger investing is a technology marketplace that matches insurance risk to capital markets. The lloyd�s ils platform, london bridge risk pcc limited, has the potential to attract investors away from the more established regimes and into the uk. The combination of a large volume of maturing structures along with lower average new issuance deal sizes were key attributes, which led to this lower outstanding amount at the end of 2019. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital.

Source: schroders.com

Source: schroders.com

In comparison to last year, the amount of new issuance during 2020 has far surpassed the total of 2019 (about usd 5.5bn). Ils is able to offer agents proven, successful sales solutions across the united states. Nonetheless, even with a healthy amount of issuance, the ils market (measured by notional outstanding) has shrunk by 1.35% since the end of 2019, which can be seen in figure 2. The combination of a large volume of maturing structures along with lower average new issuance deal sizes were key attributes, which led to this lower outstanding amount at the end of 2019. The ils funds have in the last ten years changed the face of reinsurance market to become an integral part of client’s reinsurance asset base, we have been at the heart of this change by delivering high value collateralised reinsurance products to satisfy our clients’ needs.

![]() Source: businessinsurance.com

Source: businessinsurance.com

- an investment in insurance linked securities involves potentially significant risks for an investor. Recent market developments have reiterated the need of stable investment returns uncorrelated to traditional asset classes also in asia. The ils funds have in the last ten years changed the face of reinsurance market to become an integral part of client’s reinsurance asset base, we have been at the heart of this change by delivering high value collateralised reinsurance products to satisfy our clients’ needs. Nonetheless, even with a healthy amount of issuance, the ils market (measured by notional outstanding) has shrunk by 1.35% since the end of 2019, which can be seen in figure 2. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital.

![]() Source: revisi.net

Source: revisi.net

•investors may lose all or a portion of their investment in insurance linked securities if a natural catastrophe or other event triggers a payment Ils is able to offer agents proven, successful sales solutions across the united states. Nonetheless, even with a healthy amount of issuance, the ils market (measured by notional outstanding) has shrunk by 1.35% since the end of 2019, which can be seen in figure 2. Ils, both from the life and property/casualty (p/c). The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding.

Source: ilsbermuda.com

Source: ilsbermuda.com

Recent market developments have reiterated the need of stable investment returns uncorrelated to traditional asset classes also in asia. The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. These companies are therefore often referred to as “protection buyers”. Ledger investing is a technology marketplace that matches insurance risk to capital markets. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital.

Source: revisi.net

Source: revisi.net

Ils advisers is the first asia based investment consultant focusing exclusively on insurance linked investment. Ils value is influenced by an insured loss event underlying the security. Ils is able to offer agents proven, successful sales solutions across the united states. The protection buyers of ils are generally insurance or reinsurance companies (and also corporations or public entities) looking to reduce or remove the risk of paying out on an insured. The scope of the pcc�s approval is different to any approval previously issued by the pra and reflects the unique nature of the lloyd�s market in that it permits the pcc to reinsure any class.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ils insurance market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.