Implied authority insurance Idea

Home » Trend » Implied authority insurance IdeaYour Implied authority insurance images are available. Implied authority insurance are a topic that is being searched for and liked by netizens today. You can Download the Implied authority insurance files here. Get all free photos.

If you’re looking for implied authority insurance images information related to the implied authority insurance keyword, you have visit the right blog. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

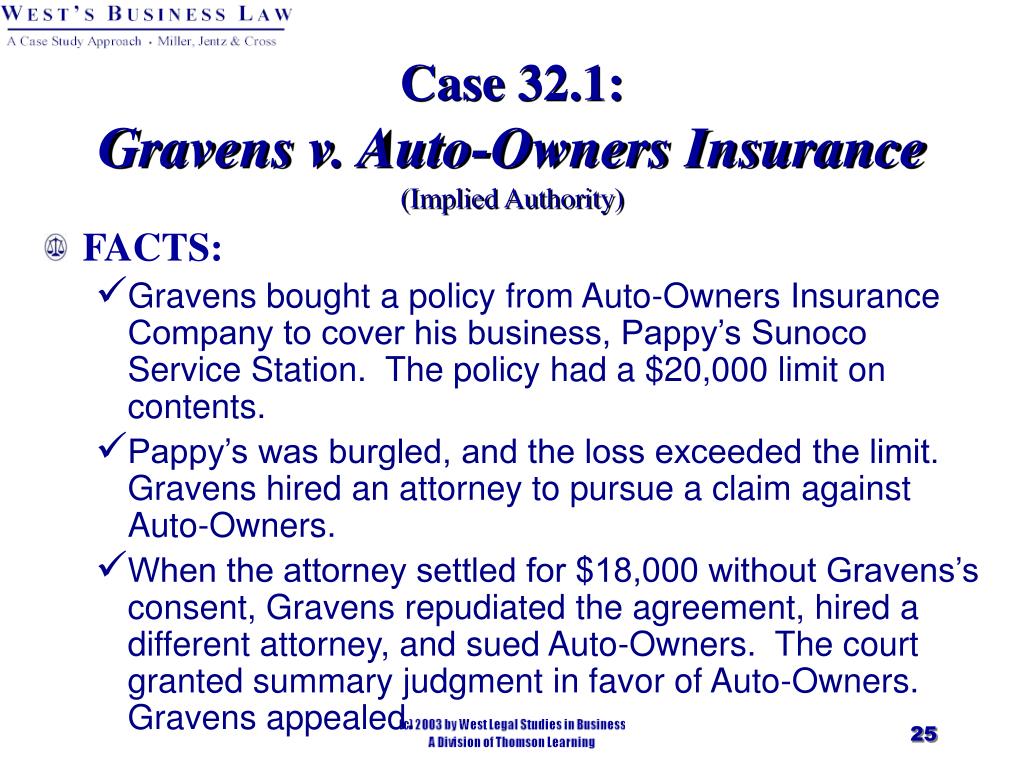

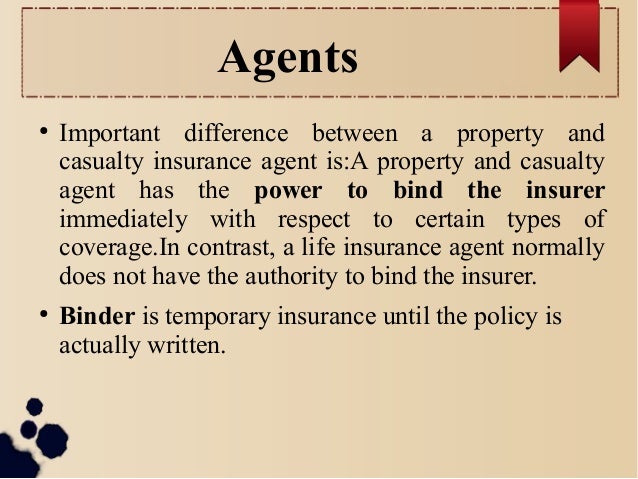

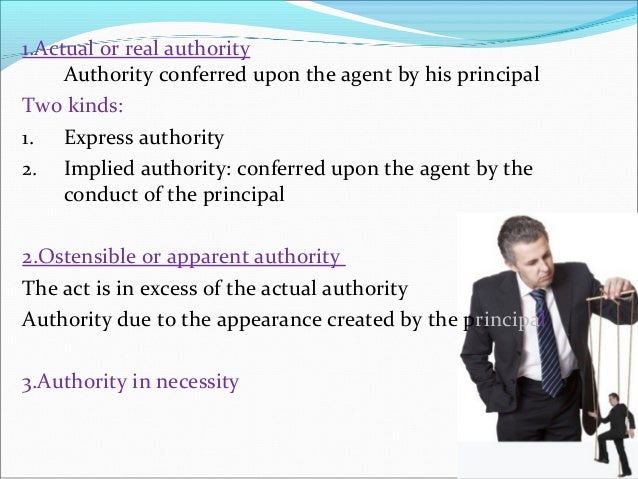

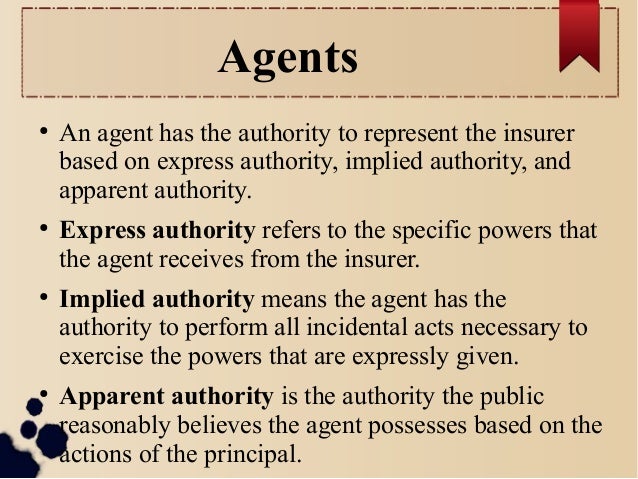

Implied Authority Insurance. (1) subject to the provisions of section 22, the act of a partner which is done to carry on, in the usual way, business of the kind carried on by the firm, binds the firm. Let’s take a look at each. Implied authority is granted to agents who work on behalf of a company. What are the implied authority of a partner?

😀 Express actual authority. Life Insurance What is the From inzak.com

😀 Express actual authority. Life Insurance What is the From inzak.com

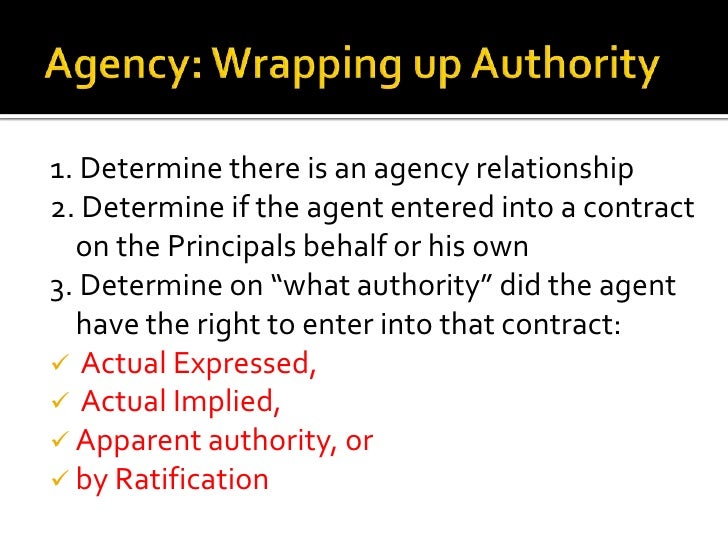

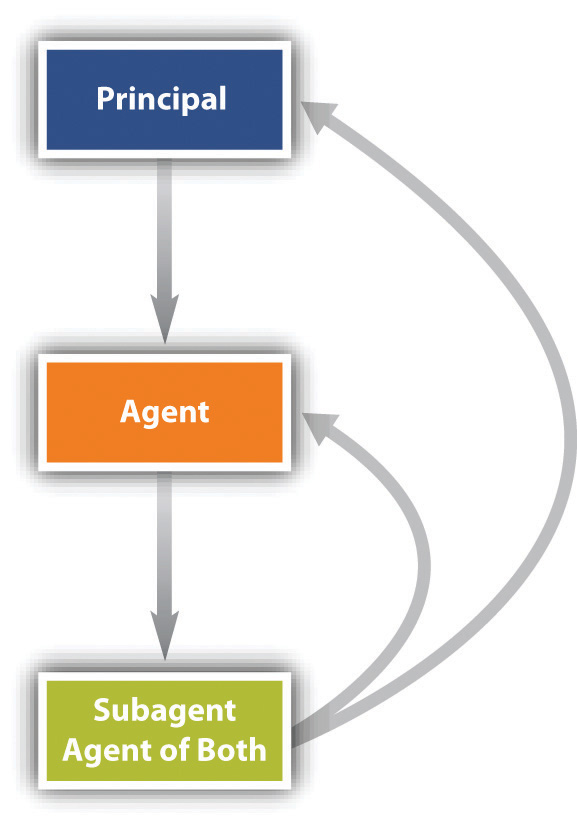

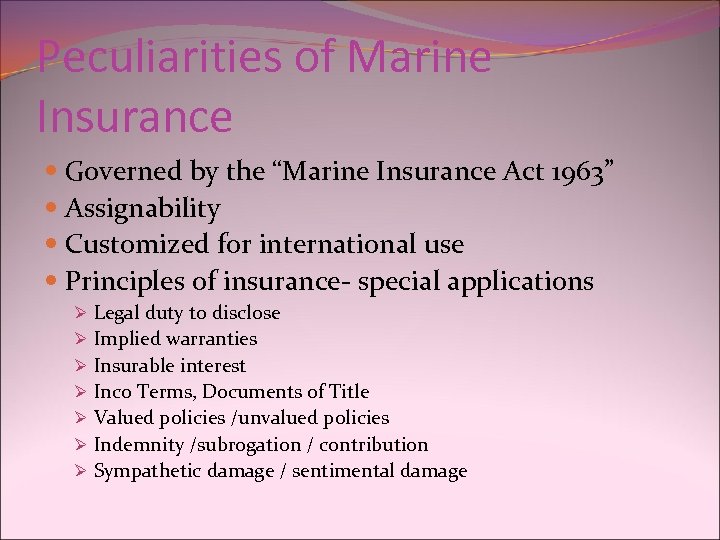

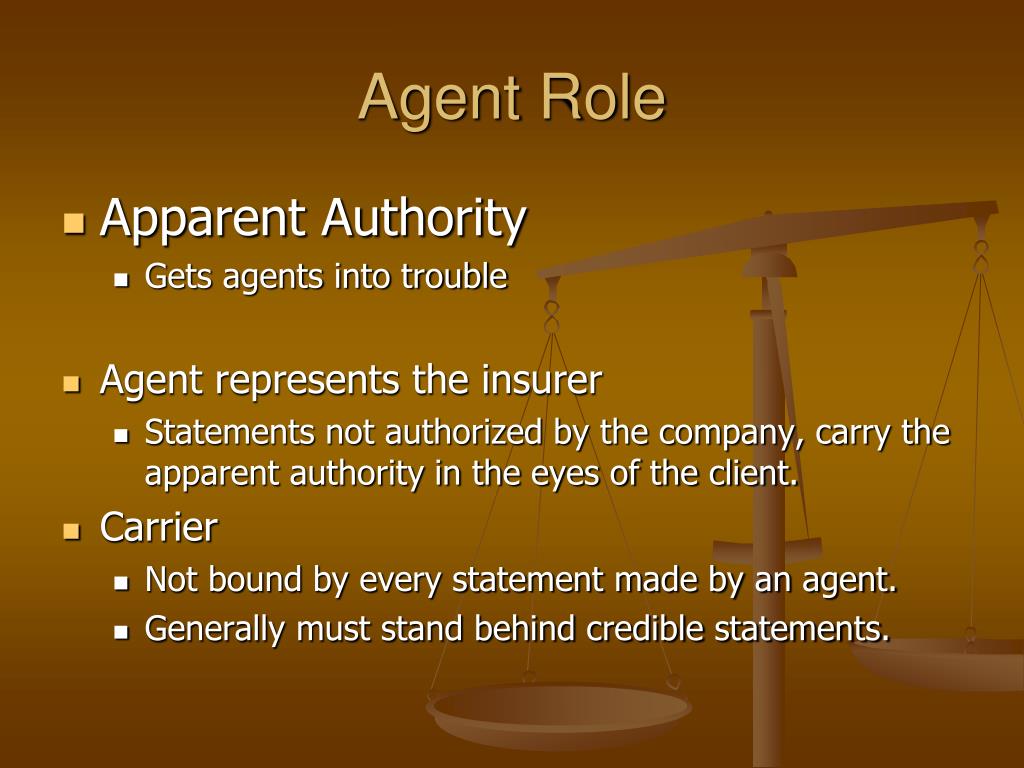

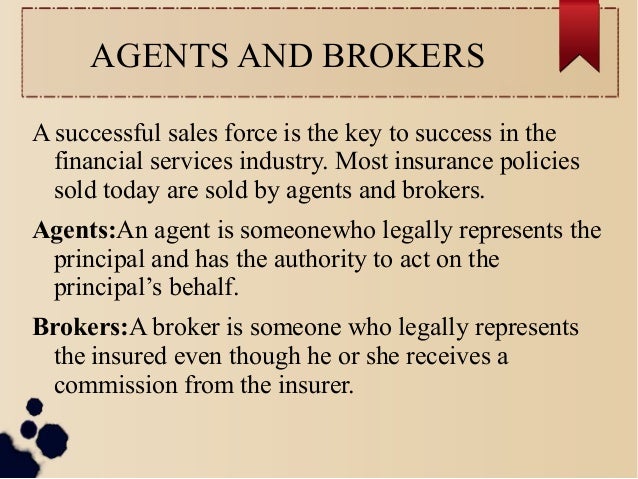

Implied authority applies to the insurance company agent that is given the authority to solicit applications for life insurance on behalf of. The authority of a partner to bind the firm conferred by this section is called his “implied authority”. The law of agency creates authority granted by the principal to the agent in a number of ways. Implied authority authority of the agent, which is not specifically expressed or communicated, but which is consistent with the agent fully exercising the express authority granted by the insurer. Let’s take a look at each. What are the limitations of implied authority of a partner?

This type of authority occurs when a principal permits an agent to act on its behalf without either expressed or implied authority.

Implied authority is granted to agents who work on behalf of a company. Implied authority is authority that is given not in writing but that is necessary for the agent to transact insurance. Contract whereby two or more persons bind themselves to contribute money, property, or industry to a common fund with the purpose of dividing profits among themselves. Implied authority is authority an. This situation can occur when someone (usually an employee) is wearing a company uniform or interacting with the public on. This type of authority occurs when a principal permits an agent to act on its behalf without either expressed or implied authority.

Source: slideserve.com

Source: slideserve.com

Terms in this set (32) partnership. Implied authority applies to the insurance company agent that is given the authority to solicit applications for life insurance on behalf of. Technically, only those actions for which an agent is actually authorized can bind a principal. The agent’s authority is implied as such ancillary and incidental duties are required to allow the principal to perform its responsibilities towards the principal effectively. Implied authority is authority that is not express or written into the contract, but which the agent is assumed to have in order to transact the business of insurance for the principal.

Source: mortgagesbycheryl.com

Source: mortgagesbycheryl.com

Implied authority is not expressly granted under an agency contract, but it is actual authority that the agent has to transact the principal�s business in accordance with general business practices. Contract whereby two or more persons bind themselves to contribute money, property, or industry to a common fund with the purpose of dividing profits among themselves. Actual authority refers to specific powers, expressly conferred by a principal (often an insurance company) to an agent to act on the principal’s behalf. Implied authority is incidental to express authority since not every single detail of an agent�s authority can be spelled out in the written contract. Implied authority is authority that is not express or written into the contract, but which the agent is assumed to have in order to transact the business of insurance for the principal.

Source: superclubpenguinbr.blogspot.com

Source: superclubpenguinbr.blogspot.com

Let’s take a look at each. Nothing in her contract mentions handling of initial premiums. Implied authority (sometimes described as usual authority) is the authority of an agent to do acts which are reasonably incidental to and necessary for the effective performance of his duties. Albert�s life insurance premium is. This type of authority occurs when a principal permits an agent to act on its behalf without either expressed or implied authority.

Source: inzak.com

Source: inzak.com

The acts undertaken surrounding the use of implied authority depend on the circumstances and the case. On the other hand, implied authority (also referred to as usual authority) is the authority to handle incidental matters related to the performance of the agent’s duties. Implied authority applies to the insurance company agent that is given the authority to solicit applications for life insurance on behalf of. This type of authority occurs when a principal permits an agent to act on its behalf without either expressed or implied authority. The acts undertaken surrounding the use of implied authority depend on the circumstances and the case.

Source: inzak.com

Source: inzak.com

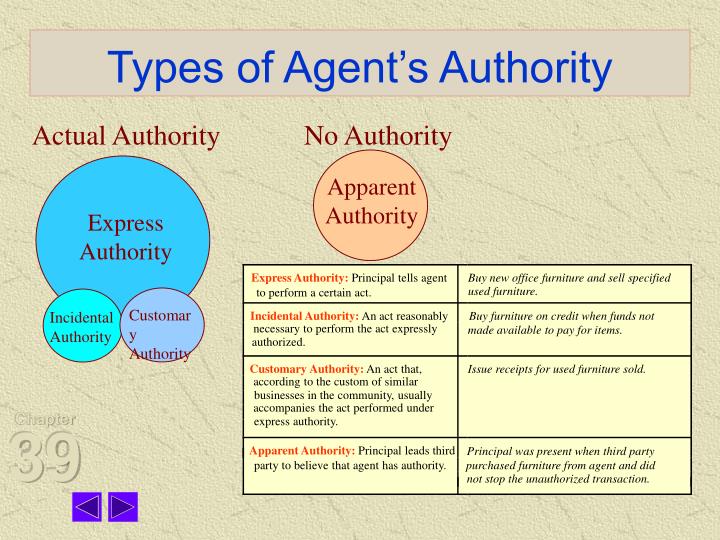

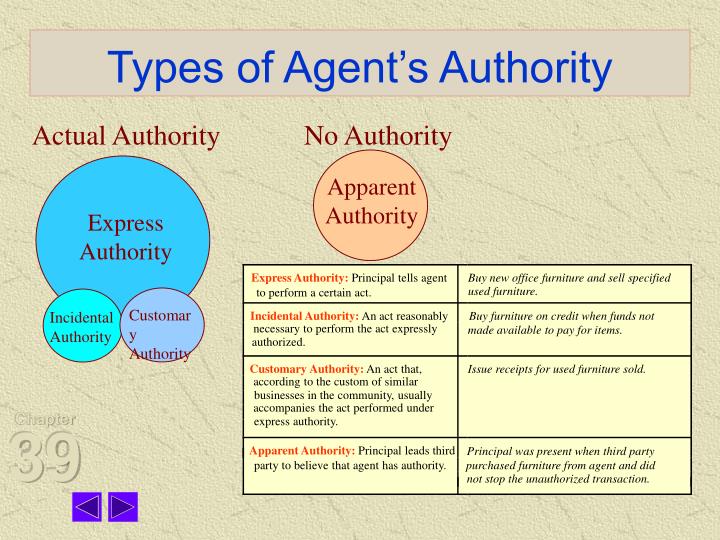

What does authority mean in insurance? Authority is what’s given by an insurer to a licensee to transact insurance on their behalf. The person acting with implied authority does what is reasonably necessary in order to effectively perform his duties. There are three types of agent authority: Fair market value implied authority general partner limited partner partnership agreement.

Source: slideshare.net

Source: slideshare.net

What does authority mean in insurance? Nothing in her contract mentions handling of initial premiums. The law of agency creates authority granted by the principal to the agent in a number of ways. Fair market value implied authority general partner limited partner partnership agreement. Legal concepts of the insurance contract.

Source: inzak.com

Source: inzak.com

Actual authority refers to specific powers, expressly conferred by a principal (often an insurance company) to an agent to act on the principal’s behalf. If these actions result in no response from the insurer, authority is extended as if these fall within the agency contract. Let’s take a look at each. The agent’s authority is implied as such ancillary and incidental duties are required to allow the principal to perform its responsibilities towards the principal effectively. Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract.

Source: cityraven.com

Source: cityraven.com

This power may be broad, general power. If these actions result in no response from the insurer, authority is extended as if these fall within the agency contract. Implied authority is incidental to express authority since not every single detail of an agent�s authority can be spelled out in the written contract. As a result, the insurance agent will have the implied authority to use the insurance company�s car, use the logo, wear the. Implied authority is conjecture that even though certain functions are not spelled out in contract form, the agent still retains the authority;

Source: xithemes.com

Source: xithemes.com

The principal is still bound by the agent’s actions. The person acting with implied authority does what is reasonably necessary in order to effectively perform his duties. The authority of a partner to bind the firm conferred by this section is called his “implied authority”. What are the limitations of implied authority of a partner? This is an example of.

Source: xithemes.com

Source: xithemes.com

Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract. Let’s take a look at each. Only express and implied are actual authority, because the agent is truly authorized. Insurance agents are implied authorities because they have been granted permission to represent insurance companies and sell policies on their behalf. There are three types of authority:

Source: slideshare.net

Source: slideshare.net

Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract. Terms in this set (32) partnership. In reality, an agent’s authority can be quite broad. (1) subject to the provisions of section 22, the act of a partner which is done to carry on, in the usual way, business of the kind carried on by the firm, binds the firm. Implied authority is a type of authority that is implied or assumed when someone is acting on behalf of someone else.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract. The law of agency creates authority granted by the principal to the agent in a number of ways. Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract. There are three types of agent authority: What does authority mean in insurance?

Source: present5.com

Source: present5.com

Actual authority refers to specific powers, expressly conferred by a principal (often an insurance company) to an agent to act on the principal’s behalf. The acts undertaken surrounding the use of implied authority depend on the circumstances and the case. There are three types of agent authority: For instance, using the company stationery or logo for business purposes. Only express and implied are actual authority, because the agent is truly authorized.

Source: slideserve.com

Source: slideserve.com

Implied authority applies to the insurance company agent that is given the authority to solicit applications for life insurance on behalf of. Implied authority — actions of an agent that may extend beyond the rights and powers explicitly provided in the agency contract. Companies can be held legally liable for things that are expressed under apparent authority. The law of agency creates authority granted by the principal to the agent in a number of ways. What are the limitations of implied authority of a partner?

Source: slideserve.com

Source: slideserve.com

The principal is still bound by the agent’s actions. Implied authority is authority that is given not in writing but that is necessary for the agent to transact insurance. What are the limitations of implied authority of a partner? This type of authority occurs when a principal permits an agent to act on its behalf without either expressed or implied authority. The authority of a partner to bind the firm conferred by this section is called his “implied authority”.

Source: coursehero.com

Source: coursehero.com

Let’s take a look at each. The authority of a partner to bind the firm conferred by this section is called his “implied authority”. On the other hand, implied authority (also referred to as usual authority) is the authority to handle incidental matters related to the performance of the agent’s duties. Let’s take a look at each. The agent’s authority is implied as such ancillary and incidental duties are required to allow the principal to perform its responsibilities towards the principal effectively.

Source: slideserve.com

Source: slideserve.com

There are three types of agent authority: Implied authority authority of the agent, which is not specifically expressed or communicated, but which is consistent with the agent fully exercising the express authority granted by the insurer. If these actions result in no response from the insurer, authority is extended as if these fall within the agency contract. The person acting with implied authority does what is reasonably necessary in order to effectively perform his duties. In reality, an agent’s authority can be quite broad.

Source: slideshare.net

Source: slideshare.net

Implied authority is not expressly granted under an agency contract, but it is actual authority that the agent has to transact the principal�s business in accordance with general business practices. What are the implied authority of a partner? Albert�s life insurance premium is. Implied authority is a type of authority that is implied or assumed when someone is acting on behalf of someone else. Implied authority is authority an.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title implied authority insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.