Imputed income life insurance calculator irs information

Home » Trend » Imputed income life insurance calculator irs informationYour Imputed income life insurance calculator irs images are ready in this website. Imputed income life insurance calculator irs are a topic that is being searched for and liked by netizens now. You can Find and Download the Imputed income life insurance calculator irs files here. Get all royalty-free photos and vectors.

If you’re searching for imputed income life insurance calculator irs images information linked to the imputed income life insurance calculator irs interest, you have pay a visit to the right blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Imputed Income Life Insurance Calculator Irs. Add the retirement system death benefit and the ncflex group term life insurance benefit together. Once we add the $150 to shannon’s previous taxable wage of $1,150. Cuenca & associates insurance agency, inc., dba lifehelp, is licensed to transact business in all 50 states and the district of. But when the benefits exceed $50,000, then it must be taxed.

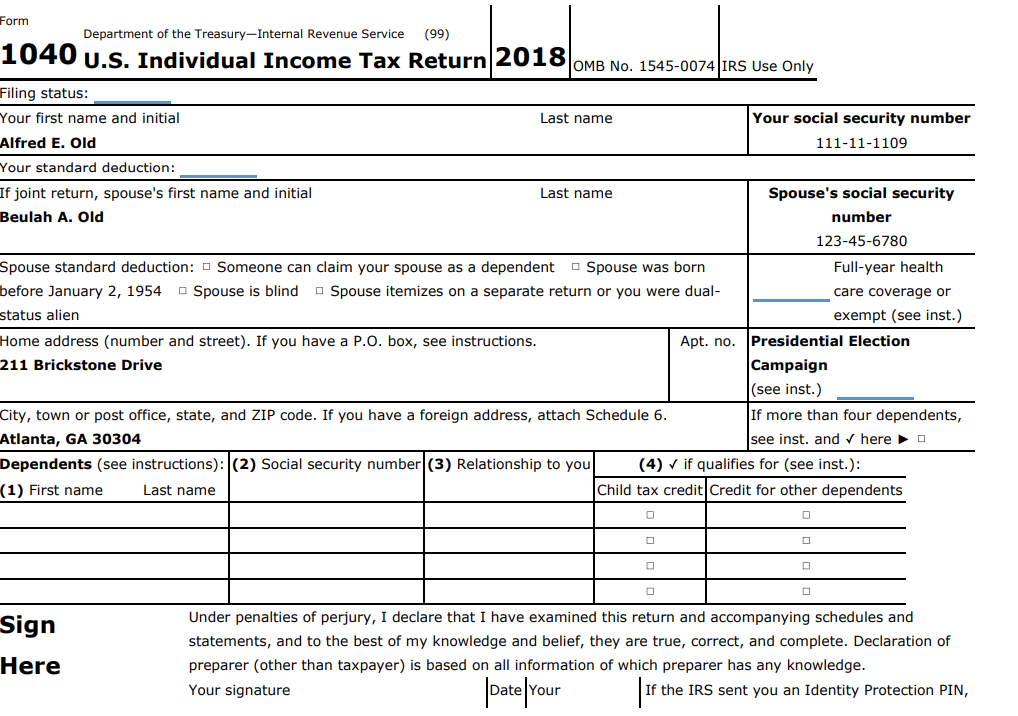

Irs Tax Table Group Term Life From brokeasshome.com

Irs Tax Table Group Term Life From brokeasshome.com

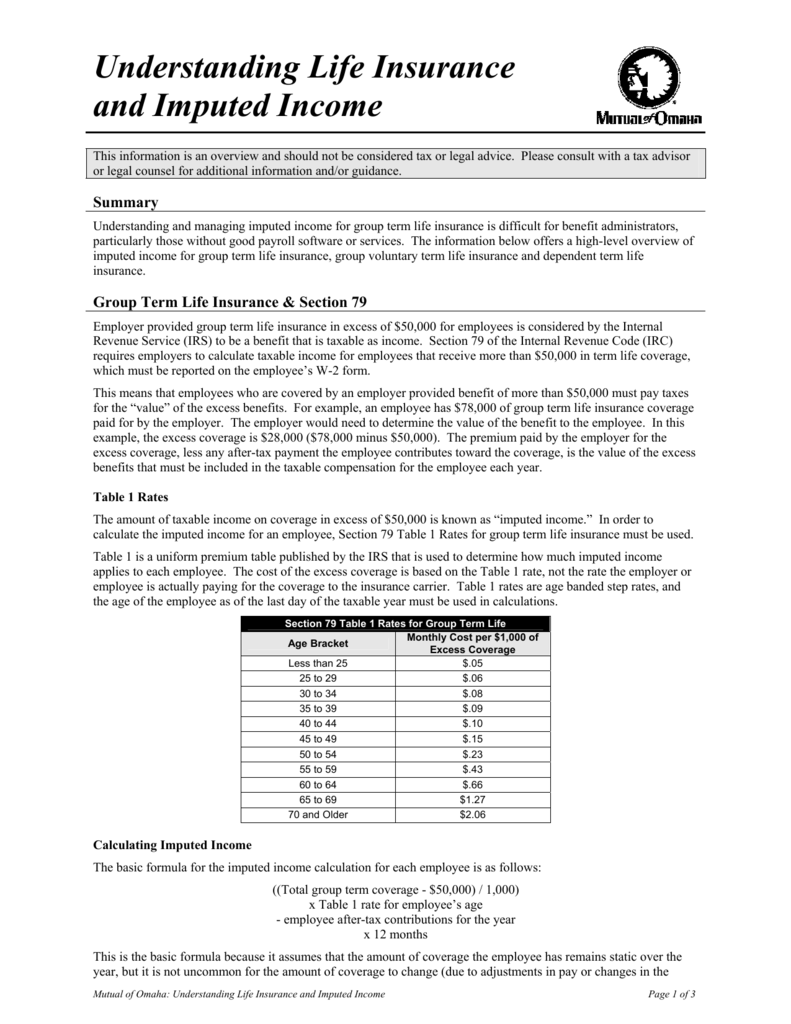

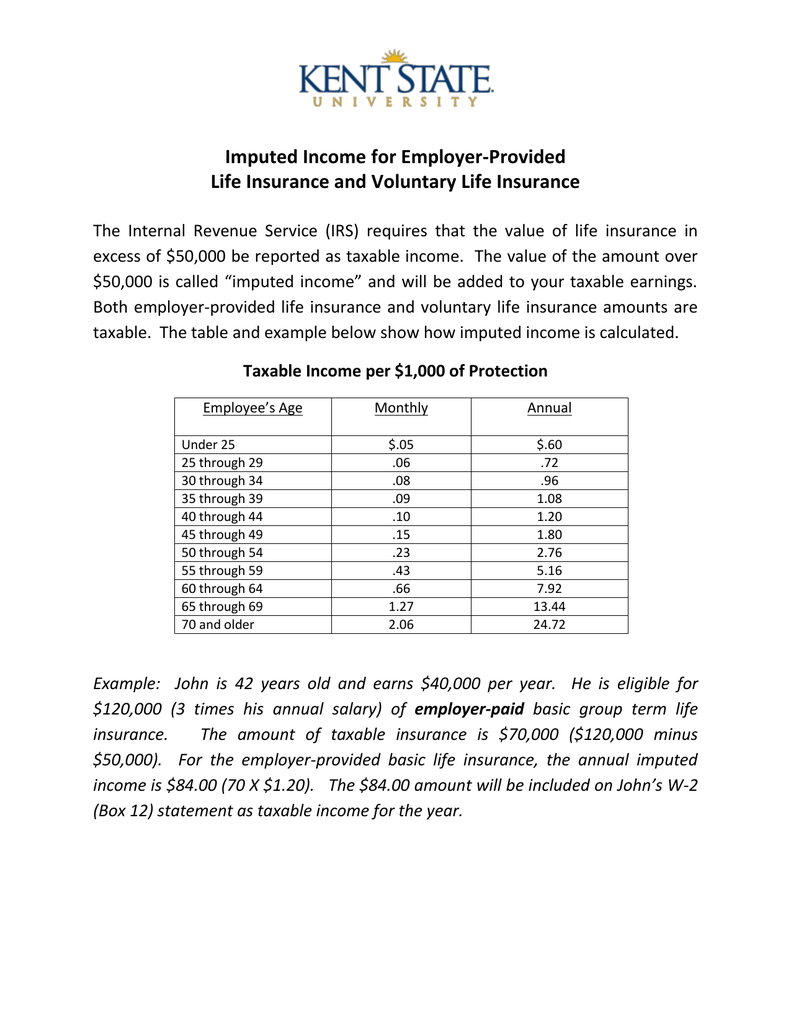

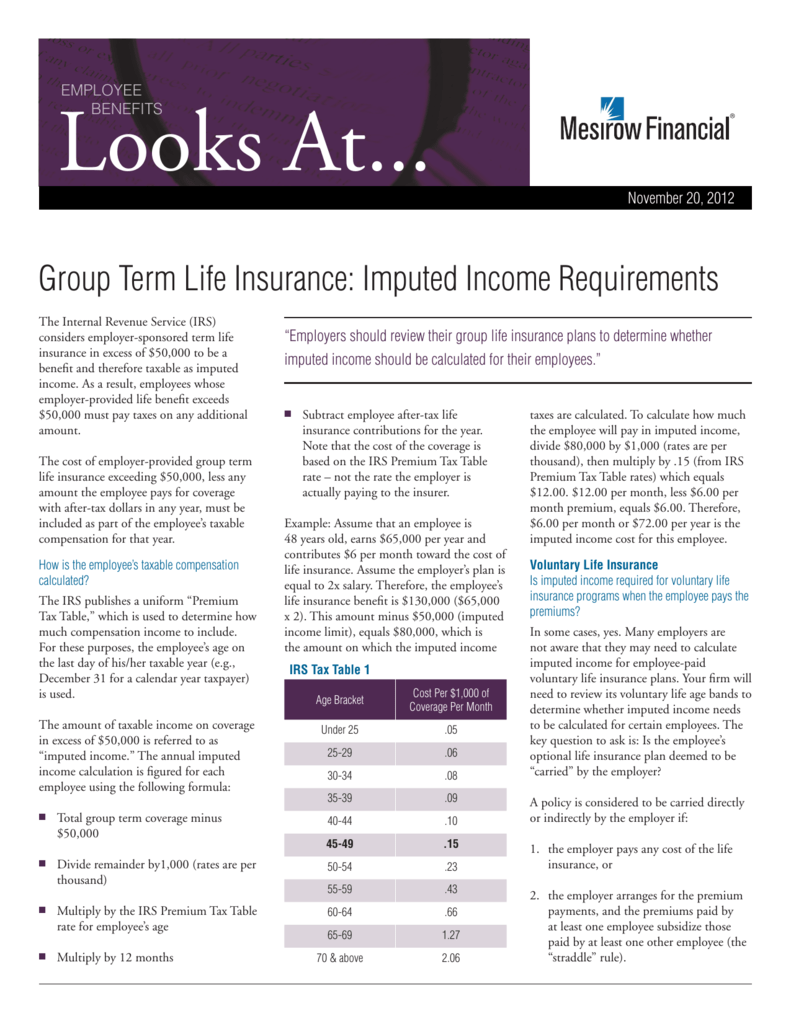

The irs requires that the “value” of employer provided group term life insurance in excess of $50,000 be reported as taxable income to covered employees. For instance, if a 50 years old employee receives coverage of about $200,000, the imputed income on the cover will be. When it comes to life insurance, imputed income occurs when a person receives coverage through his or her employer but does not pay for it. How to calculate imputed income will vary depending on if you have a basic or voluntary life insurance policy with your employer. Your imputed income is automatically calculated for you and added to each paycheck. Calculate your retirement system death benefit.

For example, age 45 is in age group 45 through 49. identify the monthly cost for the employee�s age group from the irs premium table.

The “value” is referred to as imputed income. To calculate the value of the excess benefit coverage: The irs requires that the “value” of employer provided group term life insurance in excess of $50,000 be reported as taxable income to covered employees. Life insurance in excess of $50,000 (50 *50 $1.80 = $90). Imputed income occurs when either your employer covers the entire cost of providing the life insurance coverage or the employer subsidizes the cost for some employees by charging other employees more for the coverage received versus what irs premium table i reports as the cost for that age group. The amount over $50,000 is added to your taxable salary or imputed income.

Source: kerrywoodrow.blogspot.com

Source: kerrywoodrow.blogspot.com

Calculate your retirement system death benefit. If the total value of your retiree life insurance exceeds $50,000, the amount exceeding $50,000 is considered “imputed income” (taxable income) by the (27). Ncflex group term life imputed income calculator. $5 x 12 months = $60 imputed income; Add the retirement system death benefit and the ncflex group term life insurance benefit together.

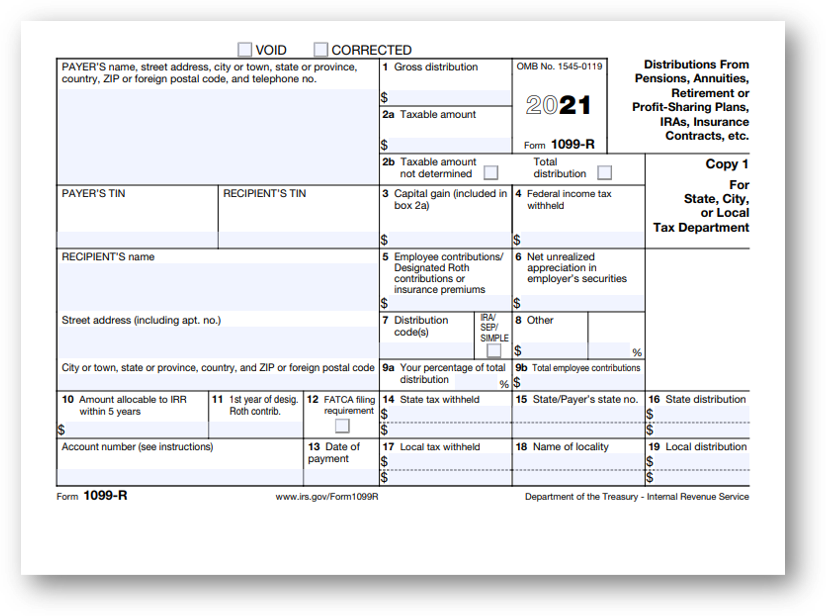

Source: studylib.net

Source: studylib.net

$5 x 12 months = $60 imputed income; The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e. The irs taxes the value on the employer sponsored group benefit term life insurance exceeding $50,000. Life insurance in excess of $50,000 (50 *50 $1.80 = $90). A taxable fringe benefit arises if coverage exceeds $50,000 and the policy is considered carried directly or indirectly by the employer.

Source: brokeasshome.com

Source: brokeasshome.com

The “value” is referred to as imputed income. For instance, if a 50 years old employee receives coverage of about $200,000, the imputed income on the cover will be. Imputed income occurs when either your employer covers the entire cost of providing the life insurance coverage or the employer subsidizes the cost for some employees by charging other employees more for the coverage received versus what irs premium table i reports as the cost for that age group. Imputed income is the recognition of a benefit received but not paid for by the recipient. The taxable portion is the imputed income.

Source: blog.nisbenefits.com

Simply put, imputed income is a term constructed by the internal revenue service to describe the taxable value of a group life insurance policy that a taxpayer holds. Determine the employee�s age group from the irs premium table. The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e. For instance, if a 50 years old employee receives coverage of about $200,000, the imputed income on the cover will be. Imputed income for your spouse’s life insurance benefit will be reported as income on each paycheck, (28).

Determine the employee�s age group from the irs premium table. Imputed income is the recognition of a benefit received but not paid for by the recipient. The majority of the rules for imputed income are outlined in internal revenue code 61. $5 x 12 months = $60 imputed income; The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e.

Source: askinglawyer.blogspot.com

The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e. Determine the employee�s age group from the irs premium table. Life insurance imputed income calculation: The amount over $50,000 is added to your taxable salary or imputed income. Total group term life insurance provided:

But when the benefits exceed $50,000, then it must be taxed. The irs requires that the “value” of employer provided group term life insurance in excess of $50,000 be reported as taxable income to covered employees. Imputed income occurs when either your employer covers the entire cost of providing the life insurance coverage or the employer subsidizes the cost for some employees by charging other employees more for the coverage received versus what irs premium table i reports as the cost for that age group. How to calculate imputed income will vary depending on if you have a basic or voluntary life insurance policy with your employer. There is a simple formula that is available which will help you calculate the amount of imputed income for life insurance so that you’ll know what is needed to be paid.

Source: golocalprov.com

Source: golocalprov.com

Life insurance imputed income calculation: The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e. Simply put, imputed income is a term constructed by the internal revenue service to describe the taxable value of a group life insurance policy that a taxpayer holds. Total group term life insurance provided: For example, if you are 50 years old and the life.

Source: crystalco.com

Source: crystalco.com

Once we add the $150 to shannon’s previous taxable wage of $1,150. The majority of the rules for imputed income are outlined in internal revenue code 61. The taxable portion is the imputed income. To calculate the value of the excess benefit coverage: Life insurance in excess of $50,000 (50 *50 $1.80 = $90).

Source: money.com

Source: money.com

The “value” is referred to as imputed income. Divide the excess amount by 1,000. Imputed income occurs when either your employer covers the entire cost of providing the life insurance coverage or the employer subsidizes the cost for some employees by charging other employees more for the coverage received versus what irs premium table i reports as the cost for that age group. There is a simple formula that is available which will help you calculate the amount of imputed income for life insurance so that you’ll know what is needed to be paid. For example, age 45 is in age group 45 through 49. identify the monthly cost for the employee�s age group from the irs premium table.

Source: saphcmpayroll.wordpress.com

Taxable income to covered employees. Determine the employee�s age group from the irs premium table. These taxable amounts are called imputed income. Taxable income to covered employees. Use your age as of the last day of the tax year.

Source: taxp.blogspot.com

Source: taxp.blogspot.com

The amount of the imputed income associated with. For instance, if a 50 years old employee receives coverage of about $200,000, the imputed income on the cover will be. Use your age as of the last day of the tax year. Life insurance in excess50 of $50,000 (50 * $1.80 = $90). The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e.

Source: studylib.net

Source: studylib.net

But when the benefits exceed $50,000, then it must be taxed. The monthly premium for employer sponsored group benefit term life insurance is payroll deducted, i.e. But when the benefits exceed $50,000, then it must be taxed. For instance, if a 50 years old employee receives coverage of about $200,000, the imputed income on the cover will be. Imputed income occurs when either your employer covers the entire cost of providing the life insurance coverage or the employer subsidizes the cost for some employees by charging other employees more for the coverage received versus what irs premium table i reports as the cost for that age group.

Source: studyingworksheets.com

Source: studyingworksheets.com

Add the retirement system death benefit and the ncflex group term life insurance benefit together. Retirement system death benefit format: You can determine the “value“ by multiplying the number of $1,000 units of insurance coverage over $50,000 (rounded to the nearest $100) by the. The irs taxes the value on the employer sponsored group benefit term life insurance exceeding $50,000. Ncflex group term life imputed income calculator.

Source: studylib.net

Source: studylib.net

You will need access to the age table provided by the irs as part of your calculation to pay the excess taxes. The “value” is referred to as imputed income. If the total value of your retiree life insurance exceeds $50,000, the amount exceeding $50,000 is considered “imputed income” (taxable income) by the (27). A taxable fringe benefit arises if coverage exceeds $50,000 and the policy is considered carried directly or indirectly by the employer. A policy is considered carried directly or indirectly by the employer if:

Source: slideserve.com

Source: slideserve.com

The amount of the imputed income associated with. The amount of the imputed income associated with. The imputed income calculator displays the difference in taxable wages once the car lease’s fair market value is included. You will need access to the age table provided by the irs as part of your calculation to pay the excess taxes. Ncflex group term life imputed income calculator.

Source: nisbenefits.com

Source: nisbenefits.com

Life insurance in excess of $50,000 (50 *50 $1.80 = $90). The irs requires that the “value” of employer provided group term life insurance in excess of $50,000 be reported as taxable income to covered employees. However, you may estimate your own imputed income by following these steps: You can determine the “value“ by multiplying the number of $1,000 units of insurance coverage over $50,000 (rounded to the nearest $100) by the. But when the benefits exceed $50,000, then it must be taxed.

Source: bizfluent.com

Source: bizfluent.com

The irs taxes the value on the employer sponsored group benefit term life insurance exceeding $50,000. Life insurance imputed income calculation: When it comes to life insurance, imputed income occurs when a person receives coverage through his or her employer but does not pay for it. Cuenca & associates insurance agency, inc., dba lifehelp, is licensed to transact business in all 50 states and the district of. Calculate your retirement system death benefit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title imputed income life insurance calculator irs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.