In a key employee life insurance policy the third Idea

Home » Trend » In a key employee life insurance policy the third IdeaYour In a key employee life insurance policy the third images are ready. In a key employee life insurance policy the third are a topic that is being searched for and liked by netizens today. You can Get the In a key employee life insurance policy the third files here. Download all royalty-free photos.

If you’re searching for in a key employee life insurance policy the third images information linked to the in a key employee life insurance policy the third keyword, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

In A Key Employee Life Insurance Policy The Third. Key person insurance is a life insurance policy that a company purchases on an owner, a top executive, or another individual critical to the business. The owner of a life insurance policy has control over the policy. Typically, the company pays premiums for the key person policy, and also owns it and is the beneficiary, says the iii. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured.

Key Person Protection Key Man Insurance Understanding From bpsuk.co.uk

Key Person Protection Key Man Insurance Understanding From bpsuk.co.uk

In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. Typically, the company pays premiums for the key person policy, and also owns it and is the beneficiary, says the iii. A life insurance policy owned by a third party. Unlike key person insurance, the employee owns the policy, names the beneficiaries, and has all the rights of the policy, including any cash. The policyowner and beneficiary can also be the same person, but the insured and beneficiary. Her salary is $50,000, which means a life insurance benefit of $100,000.

A life insurance policy owned by a third party.

The company purchases a life insurance policy on the key employee’s life that is sufficient to provide the future benefits outlined in the agreement. An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the. Employer can either surrender the policy and get the surrender value or absolutely assign the policy to the employee as a part of his terminal benefits. How your policy is structured may depend on your company�s legal structure. What is key employee disability income insurance? Further, if the key employee does leave, the policy can be sold off to a third party as a life settlement.

Source: pinnaclequote.com

Source: pinnaclequote.com

The death benefit has to be passed to the nominee of the employee unless it is specifically mentioned in the agreement. Her salary is $50,000, which means a life insurance benefit of $100,000. All of the following are correct regarding key employee life insurance, except: For example, an employee has a life insurance policy that is twice (or 200%) her salary. The owner of a life insurance policy has control over the policy.

Source: dbs.com.sg

Source: dbs.com.sg

Any employee named as the insured on a coli policy must receive written notification before purchase of the policy of the company�s intent to insure the employee and also the amount of coverage. Key employees are usually highly. All of the following are correct regarding key employee life insurance, except: The policyowner and beneficiary can also be the same person, but the insured and beneficiary. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance.

Source: ginahooverdesigns.blogspot.com

Source: ginahooverdesigns.blogspot.com

The key employee must provide consent, in writing, to your company owning the policy. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. The company pays the premiums, owns the policy and is the policy beneficiary. The death benefit has to be passed to the nominee of the employee unless it is specifically mentioned in the agreement. Each partner must own a policy on the other partners.

![Key Person Insurance The Scoop [Best Coverages + 2020 Rates] Key Person Insurance The Scoop [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2020/03/3f949db9-keypersoninsurance-1024x647.png) Source: effortlessinsurance.com

Source: effortlessinsurance.com

Unlike other types of life insurance, key person insurance is paid out to the business instead of an individual. Key employees are usually highly. The key employee must provide consent, in writing, to your company owning the policy. Should a key employee suffer permanent total disability, the loss to your business will. Unlike key person insurance, the employee owns the policy, names the beneficiaries, and has all the rights of the policy, including any cash.

Source: thebalancesmb.com

Source: thebalancesmb.com

Coverage is a set amount. The older the key man the better price the company can receive on the now no longer needed coverage through a viatical settlement. All of the following are correct regarding key employee life insurance, except: A life insurance policy owned by a third party. The insured and policyowner are often the same person, but not always.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

Life insurance policies with a cash value component, such as universal life and permanent life policies, can be. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. The older the key man the better price the company can receive on the now no longer needed coverage through a viatical settlement. Any employee named as the insured on a coli policy must receive written notification before purchase of the policy of the company�s intent to insure the employee and also the amount of coverage. A life insurance policy owned by a third party.

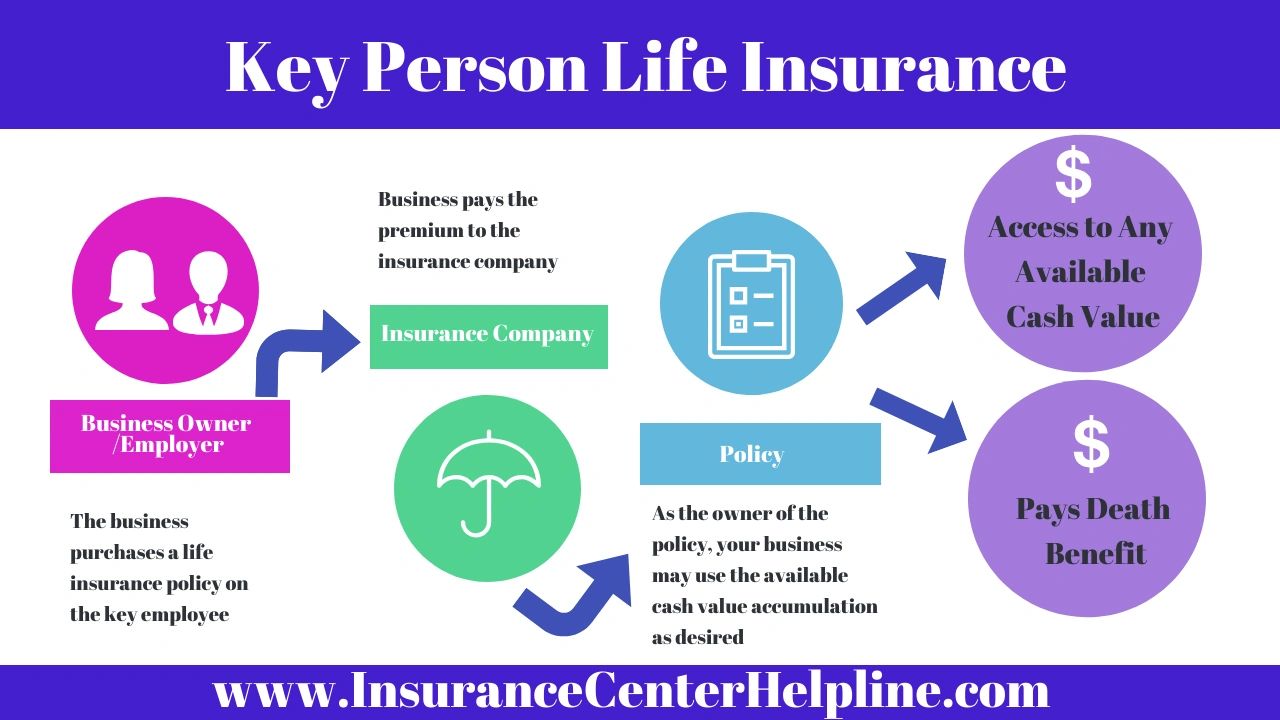

Source: insurancecenterhelpline.com

Source: insurancecenterhelpline.com

The key employee must provide consent, in writing, to your company owning the policy. How your policy is structured may depend on your company�s legal structure. Coverage is a percentage of the employee’s salary. Nevertheless, the risk of a key employee experiencing partial, total or permanent disability is actually much greater than the risk the person will die. Key person insurance is a life insurance policy that a company purchases on an owner, a top executive, or another individual critical to the business.

Source: pinterest.com

Source: pinterest.com

Under internal revenue code 162, employers can purchase life insurance on the lives of employees and deduct the premiums, subsequently or simultaneously transferring ownership of the policy to the employee. For example, a business might buy key person insurance on a crucial employee such as a ceo, or an insured might sell their own policy to a third party for cash in a life settlement. When an insured purchased a new home, the insured made an absolute assignment of a life insurance policy to the mortgage company b. The insured and policyowner are often the same person, but not always. The policyowner and beneficiary can also be the same person, but the insured and beneficiary.

Source: noclutter.cloud

Source: noclutter.cloud

Her salary is $50,000, which means a life insurance benefit of $100,000. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. For example, an employee has a life insurance policy that is twice (or 200%) her salary. An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the.

Source: theearthe.com

Source: theearthe.com

Key employee disability income insurance is less well known than key employee life insurance. The owner of a life insurance policy has control over the policy. How your policy is structured may depend on your company�s legal structure. Should a key employee suffer permanent total disability, the loss to your business will. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business.

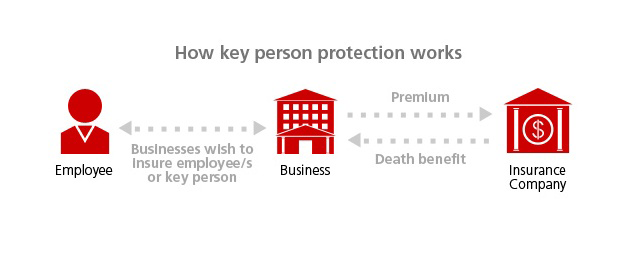

Source: bpsuk.co.uk

Source: bpsuk.co.uk

An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the. The key employee must provide consent, in writing, to your company owning the policy. Further, if the key employee does leave, the policy can be sold off to a third party as a life settlement. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. Unlike key person insurance, the employee owns the policy, names the beneficiaries, and has all the rights of the policy, including any cash.

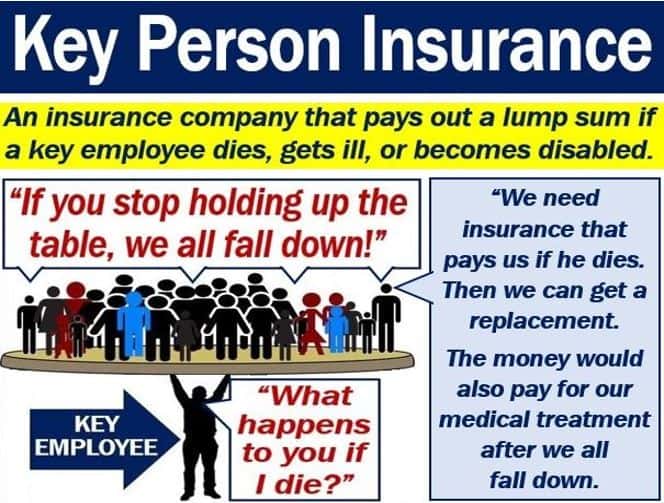

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The company purchases a life insurance policy on the key employee’s life that is sufficient to provide the future benefits outlined in the agreement. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. The older the key man the better price the company can receive on the now no longer needed coverage through a viatical settlement. Under internal revenue code 162, employers can purchase life insurance on the lives of employees and deduct the premiums, subsequently or simultaneously transferring ownership of the policy to the employee. An insured borrow money from the bank and makes a collateral assignment of a part of the death benefit to secure the.

Source: ristrettz-hiw.blogspot.com

Source: ristrettz-hiw.blogspot.com

A premiums are deducted from the employee�s salary b the employer is the owner/applicant of the policy c the beneficiary (the employer) typically receives the death benefit free of federal income tax d the employer has an insurable interest in the key employee It is usually paid in a lump sum, but in some cases may be paid out monthly to support ongoing loss of revenue. Vul has no floor, so. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. Unlike other types of life insurance, key person insurance is paid out to the business instead of an individual.

Source: w3ins.com

Source: w3ins.com

Nevertheless, the risk of a key employee experiencing partial, total or permanent disability is actually much greater than the risk the person will die. The company pays the premiums, owns the policy and is the policy beneficiary. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. A premiums are deducted from the employee�s salary b the employer is the owner/applicant of the policy c the beneficiary (the employer) typically receives the death benefit free of federal income tax d the employer has an insurable interest in the key employee Under internal revenue code 162, employers can purchase life insurance on the lives of employees and deduct the premiums, subsequently or simultaneously transferring ownership of the policy to the employee.

Source: deandraper.com

Should a key employee suffer permanent total disability, the loss to your business will. The policyowner and beneficiary can also be the same person, but the insured and beneficiary. A premiums are deducted from the employee�s salary b the employer is the owner/applicant of the policy c the beneficiary (the employer) typically receives the death benefit free of federal income tax d the employer has an insurable interest in the key employee A life insurance policy owned by a third party. Unlike other types of life insurance, key person insurance is paid out to the business instead of an individual.

Source: ginahooverdesigns.blogspot.com

Source: ginahooverdesigns.blogspot.com

All of the following are correct regarding key employee life insurance, except: For example, an employee has a life insurance policy that is twice (or 200%) her salary. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. Under internal revenue code 162, employers can purchase life insurance on the lives of employees and deduct the premiums, subsequently or simultaneously transferring ownership of the policy to the employee. How your policy is structured may depend on your company�s legal structure.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Key employees are usually highly. Vul has no floor, so. The death benefit has to be passed to the nominee of the employee unless it is specifically mentioned in the agreement. Unlike key person insurance, the employee owns the policy, names the beneficiaries, and has all the rights of the policy, including any cash. The owner of a life insurance policy has control over the policy.

Source: 1investing.in

Source: 1investing.in

Key employees are usually highly. It is usually paid in a lump sum, but in some cases may be paid out monthly to support ongoing loss of revenue. The company pays the premiums, owns the policy and is the policy beneficiary. In this article, quotacy focuses on the role of the owner of the policy and what it means to get life insurance. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title in a key employee life insurance policy the third by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.