In a life insurance contract an insurance company s promise information

Home » Trend » In a life insurance contract an insurance company s promise informationYour In a life insurance contract an insurance company s promise images are ready. In a life insurance contract an insurance company s promise are a topic that is being searched for and liked by netizens today. You can Download the In a life insurance contract an insurance company s promise files here. Download all free vectors.

If you’re looking for in a life insurance contract an insurance company s promise pictures information connected with to the in a life insurance contract an insurance company s promise keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

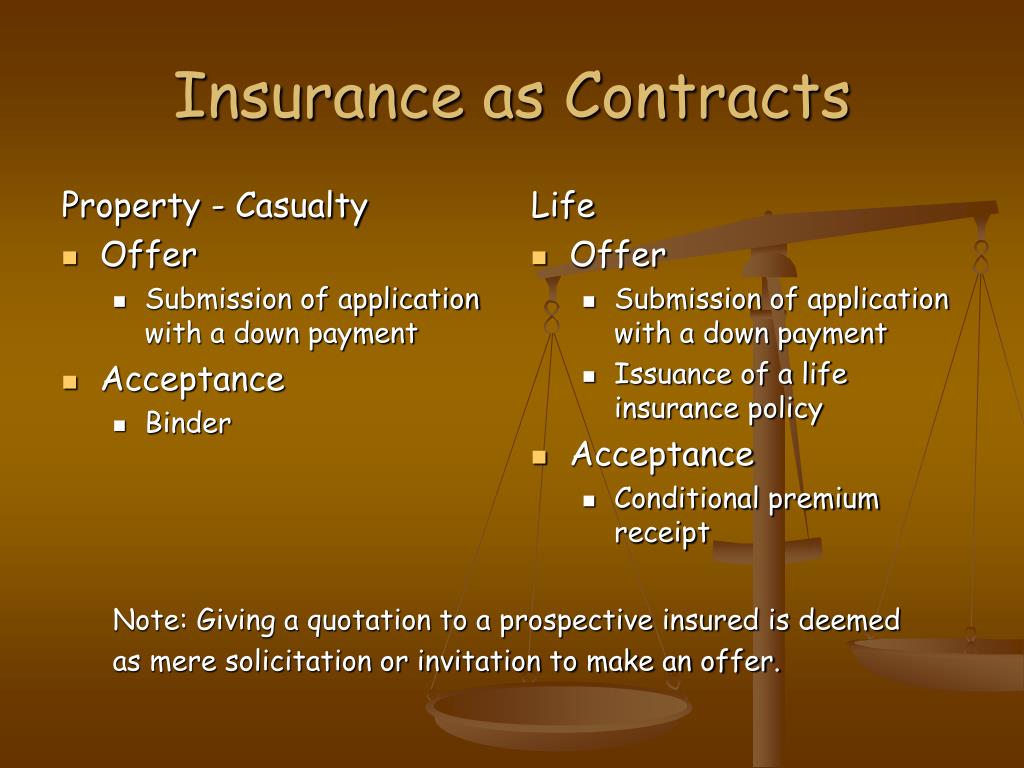

In A Life Insurance Contract An Insurance Company S Promise. Vagueness in a contract�s wording is resolved in favor of the policyowner. Introduction to insurance intro • insurance = contractual agreement where an insurance company promises to indemnify the insured or pay an agreed upon amount in exchange of a premium/payment (consideration) • enforceable by law • contracts fall under state law • each state has insurance code • revised statute 23 contract law and insurance 1) offer and. Similarly, many commercial contracts will include a promise by one party to indemnify the other against specified types of loss, damage or liability. (bar 2011) nb the minimum paid up capital requirement for a new insurance company is now p 1 billion a.

Medical Insurance Reimbursement Letter From treatsinc.org

Medical Insurance Reimbursement Letter From treatsinc.org

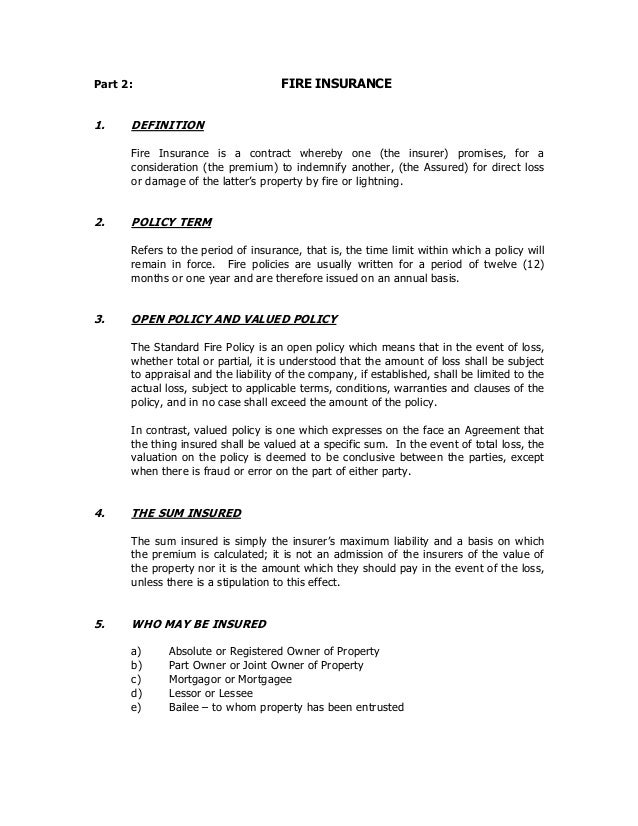

Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. Why do you need in a life insurance contract, an insurance companys promise to pay stated benefits is called the? Only one party makes any kind of enforceable promise. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). Insurance policies have unilateral contract characteristics. Similarly, many commercial contracts will include a promise by one party to indemnify the other against specified types of loss, damage or liability.

In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law.

In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. If an individual acquires a life insurance policy insuring her life for $500,000, that is the amount payable at death. Similarly, many commercial contracts will include a promise by one party to indemnify the other against specified types of loss, damage or liability. An insurance contract may be voided if a. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow.

Source: sec.gov

Source: sec.gov

What distinguishes a contract of insurance from. Something with monetary value, voluntarily exchanged for an act, benefit, forbearance, interest, promise, right, or goods or services. Practically every person has insurance policy today. Only one party makes any kind of enforceable promise. Similarly, many commercial contracts will include a promise by one party to indemnify the other against specified types of loss, damage or liability.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Called premium, is charged in consideration. Every insurance contract contains an unwritten, invisible, or implied term referred to as the covenant or promise of good faith and fair dealing. Why do you need in a life insurance contract, an insurance companys promise to pay stated benefits is called the? What distinguishes a contract of insurance from. The state insurance department checks and approves insurance contracts.

Source: pinterest.com

Source: pinterest.com

Insurance policies have unilateral contract characteristics. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. In the case of an insurance contract, the insurer promises to pay if certain acts occur under the terms of a contract’s coverage. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. An insurance contract is either a valued contract or an indemnity contract.

Source: pinterest.com

Source: pinterest.com

A valued contract pays a stated sum regardless of the actual loss incurred. In insurance, the insurance company�s offer to make a loss good is a consideration in exchange for payment of premium. A valued contract pays a stated sum regardless of the actual loss incurred. Legal elements of insurance elements of a contract as we’ve said, an insurance policy is a legally binding contract between two parties. (bar 2011) nb the minimum paid up capital requirement for a new insurance company is now p 1 billion a.

Source: emlqa.blogspot.com

Source: emlqa.blogspot.com

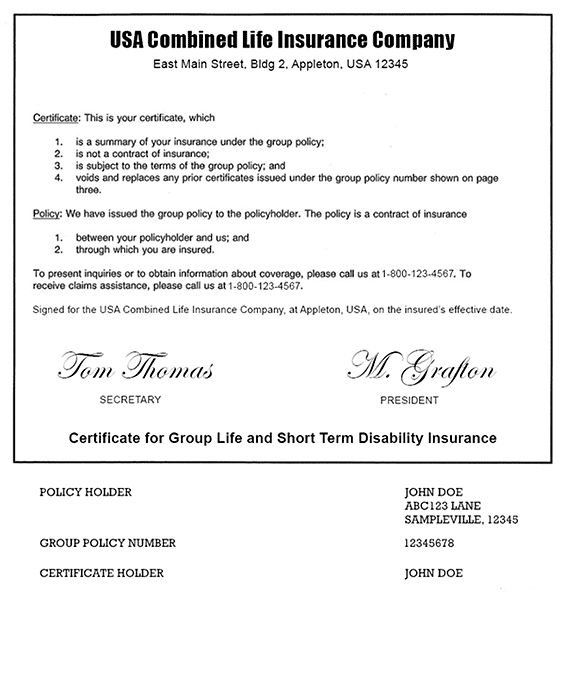

Involves the potential for the unequal exchange of value. Something with monetary value, voluntarily exchanged for an act, benefit, forbearance, interest, promise, right, or goods or services. An insurance policy describes the rights and obligations of. Life insurance is a contract between the policyholder and the insurance company where the beneficiary is designated to receive stated monetary benefits in case of death of the insured person. (bar 2011) nb the minimum paid up capital requirement for a new insurance company is now p 1 billion a.

Source: ministryofteamagic.com

Source: ministryofteamagic.com

Insurance contracts must comply with the local laws of your state. Introduction to insurance intro • insurance = contractual agreement where an insurance company promises to indemnify the insured or pay an agreed upon amount in exchange of a premium/payment (consideration) • enforceable by law • contracts fall under state law • each state has insurance code • revised statute 23 contract law and insurance 1) offer and. An insurance contract is either a valued contract or an indemnity contract. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). This is a promise imposed by law upon an insurance company to always act fairly towards its insureds in handling their claims.

Source: slideshare.net

Source: slideshare.net

Insurance contracts must comply with the local laws of your state. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Introduction to insurance intro • insurance = contractual agreement where an insurance company promises to indemnify the insured or pay an agreed upon amount in exchange of a premium/payment (consideration) • enforceable by law • contracts fall under state law • each state has insurance code • revised statute 23 contract law and insurance 1) offer and. Contract is prepared by only one party. This is a promise imposed by law upon an insurance company to always act fairly towards its insureds in handling their claims.

Source: agreements.org

Source: agreements.org

The essentials of any insurance contract are discussed as under with reference to the life insurance only. An insurance contract may be voided if a. Introduction to insurance intro • insurance = contractual agreement where an insurance company promises to indemnify the insured or pay an agreed upon amount in exchange of a premium/payment (consideration) • enforceable by law • contracts fall under state law • each state has insurance code • revised statute 23 contract law and insurance 1) offer and. An insurance contract is either a valued contract or an indemnity contract. (life insurance and some maritime insurance policies are notable exceptions to this standard.) as an illustration, if the owner of a car sells.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Whether or not such a clause is included in the policy, judges will read. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. What distinguishes a contract of insurance from. The state law may require specific forms to be used for — or specific provisions to be included in — different types of policies.

Source: treatsinc.org

Source: treatsinc.org

Life insurance contracts are valued contracts. Practically every person has insurance policy today. In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. In this agreement, the insurer promises to help with the losses of the insured on the happening contingency. The state insurance department checks and approves insurance contracts.

Source: emlqa.blogspot.com

Source: emlqa.blogspot.com

No, since an insurance company should be 100% owned by filipinos. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). The state law may require specific forms to be used for — or specific provisions to be included in — different types of policies. No, since an insurance company must have at least p74 m paid up capital. In insurance, the insurance company�s offer to make a loss good is a consideration in exchange for payment of premium.

Source: template.net

Source: template.net

(bar 2011) nb the minimum paid up capital requirement for a new insurance company is now p 1 billion a. What distinguishes a contract of insurance from. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). A valued contract pays a stated sum regardless of the actual loss incurred. In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer.

Source: myphotosofdogs.blogspot.com

Source: myphotosofdogs.blogspot.com

Whether or not such a clause is included in the policy, judges will read. If an individual acquires a life insurance policy insuring her life for $500,000, that is the amount payable at death. Called premium, is charged in consideration. Whether or not such a clause is included in the policy, judges will read. Something with monetary value, voluntarily exchanged for an act, benefit, forbearance, interest, promise, right, or goods or services.

Source: slideshare.net

Source: slideshare.net

In insurance, the insurance company�s offer to make a loss good is a consideration in exchange for payment of premium. In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. Why do you need in a life insurance contract, an insurance companys promise to pay stated benefits is called the? The essentials of any insurance contract are discussed as under with reference to the life insurance only. Practically every person has insurance policy today.

Source: dexform.com

Source: dexform.com

The state law may require specific forms to be used for — or specific provisions to be included in — different types of policies. Similarly, many commercial contracts will include a promise by one party to indemnify the other against specified types of loss, damage or liability. Only one party makes any kind of enforceable promise. Introduction to insurance intro • insurance = contractual agreement where an insurance company promises to indemnify the insured or pay an agreed upon amount in exchange of a premium/payment (consideration) • enforceable by law • contracts fall under state law • each state has insurance code • revised statute 23 contract law and insurance 1) offer and. Many contracts of insurance are, in essence, promises by the insurer to indemnify the insured against specified types of loss, damage or liability.

Source: slideserve.com

Source: slideserve.com

An insurance contract is either a valued contract or an indemnity contract. Contract is prepared by only one party. An insurance contract is either a valued contract or an indemnity contract. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. Involves the potential for the unequal exchange of value.

Source: bankrate.com

Source: bankrate.com

In the case of an insurance contract, the insurer promises to pay if certain acts occur under the terms of a contract’s coverage. In the case of an insurance contract, the insurer promises to pay if certain acts occur under the terms of a contract’s coverage. The state insurance department checks and approves insurance contracts. The insurance, thus, is a contract whereby. Many contracts of insurance are, in essence, promises by the insurer to indemnify the insured against specified types of loss, damage or liability.

Source: pinterest.com

Source: pinterest.com

Contract is prepared by only one party. (life insurance and some maritime insurance policies are notable exceptions to this standard.) as an illustration, if the owner of a car sells. What distinguishes a contract of insurance from. Life insurance is a contract between the policyholder and the insurance company where the beneficiary is designated to receive stated monetary benefits in case of death of the insured person. Practically every person has insurance policy today.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title in a life insurance contract an insurance company s promise by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.