In a survivorship life insurance policy information

Home » Trend » In a survivorship life insurance policy informationYour In a survivorship life insurance policy images are available in this site. In a survivorship life insurance policy are a topic that is being searched for and liked by netizens now. You can Get the In a survivorship life insurance policy files here. Find and Download all free images.

If you’re looking for in a survivorship life insurance policy pictures information connected with to the in a survivorship life insurance policy interest, you have come to the right site. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

In A Survivorship Life Insurance Policy. The policy’s death benefit is only paid out after both people pass away. The life insurance benefit can be used to help pay estate taxes, estate settlement costs, or as a way to leave an inheritance to children and grandchildren. Survivorship life insurance policies defined. This makes it very different that other types of life insurance.

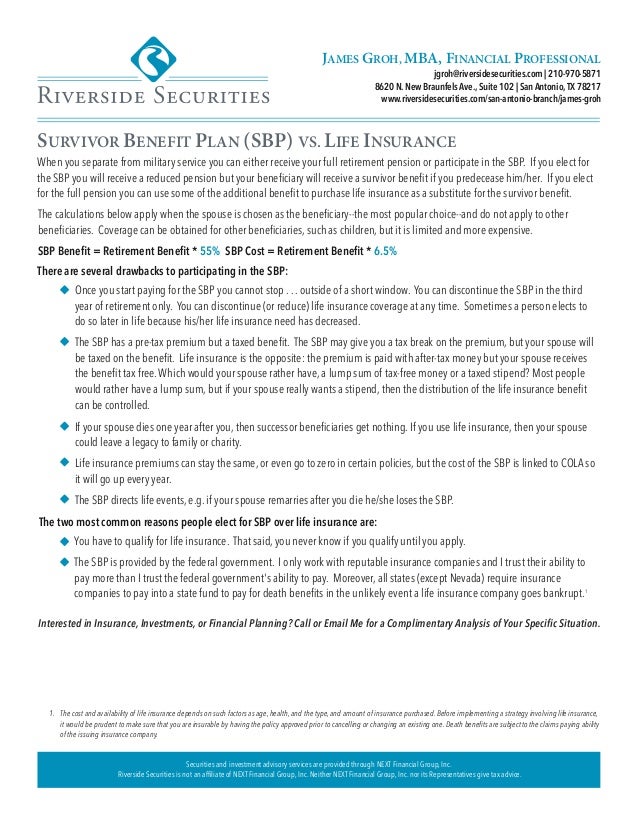

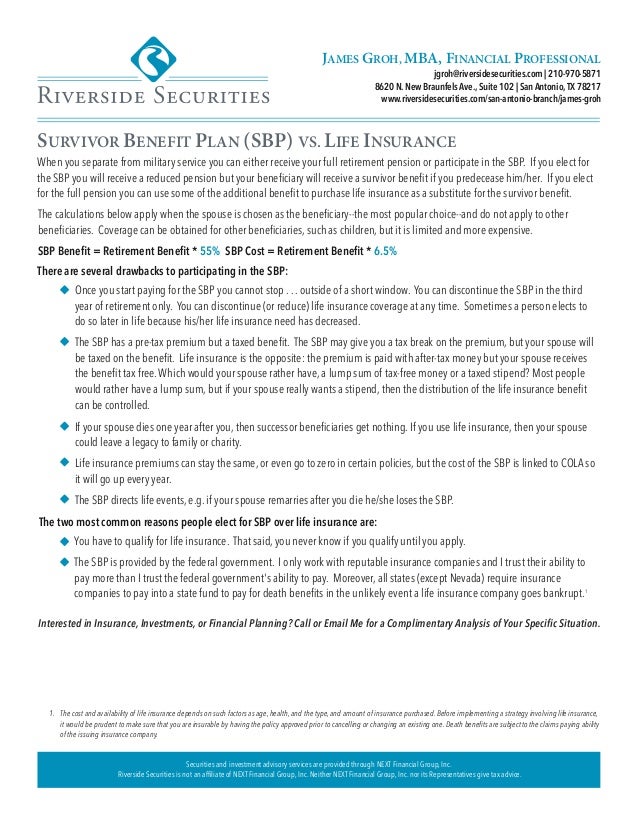

SURVIVOR BENEFIT PLAN (SBP) VS. LIFE INSURANCE From slideshare.net

SURVIVOR BENEFIT PLAN (SBP) VS. LIFE INSURANCE From slideshare.net

Survivorship life insurance is a unique type of policy. For example, a policyholder may specify that the beneficiary receives half of the benefit immediately after death and the other half a. Survivorship life insurance is a type of permanent life insurance that covers two people under one policy. It is generally sold as a whole life, universal life, or variable universal life insurance policy. This type of policy includes the death benefit and a cash value component. Survivorship life insurance is designed to cover two people on a single policy.

This type of policy includes the death benefit and a cash value component.

It may pay out a benefit prior to the first policyholder’s death if the policy has a living benefit rider. Survivorship life insurance differs in that it is a policy that is written on two lives. Survivorship life insurance is often used by couples or spouses. What is a survivorship policy? It may pay out a benefit prior to the first policyholder’s death if the policy has a living benefit rider. Survivorship life policy is higher c.

Source: pinterest.com

Source: pinterest.com

It�s often used by couples whose families will be hit by large estate taxes, but there are other good uses for it. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. The two individuals are usually married. Survivorship life policy is higher c. Survivorship life insurance differs in that it is a policy that is written on two lives.

Source: termlifeadvice.com

Source: termlifeadvice.com

It is generally sold as a whole life, universal life, or variable universal life insurance policy. Depends on the investment performance of the underlying accounts d. Survivorship life insurance is often used by couples or spouses. A survivorship life insurance policy insures two people under one policy. What is survivorship life insurance?

Source: bsmg.net

Source: bsmg.net

When the first insured passes, nothing happens. Survivorship life insurance is designed to cover two people on a single policy. Survivorship policies insure two lives, typically a husband and wife, under one life insurance policy and pays a life insurance death benefit after the surviving insured has passed away. Survivorship policies were introduced in the early 1980s following a change in the tax law allowing a couple to defer all estate taxes until the last one dies. This type of policy includes the death benefit and a cash value component.

Source: youtube.com

Source: youtube.com

For example, a policyholder may specify that the beneficiary receives half of the benefit immediately after death and the other half a. Survivorship life insurance is a type of permanent life insurance that covers two people under one policy. Survivorship life insurance only pays the benefit to the beneficiary when all the policyholders or insured people on the policy have died. It will not pay the death benefit if. With survivorship policies, your family receives a cash payout called a death benefit after both you and your partner have died.

Source: insuranceandestates.com

Source: insuranceandestates.com

The policy pays out the death benefit after both the insured people die. Both have the same actuarial costs Depends on the investment performance of the underlying accounts d. What is a survivorship policy? What is survivorship life insurance?

Source: termlifeadvice.com

Source: termlifeadvice.com

Both have the same actuarial costs The two individuals are usually married. Survivorship life insurance only pays the benefit to the beneficiary when all the policyholders or insured people on the policy have died. When the first insured passes, nothing happens. For example, a policyholder may specify that the beneficiary receives half of the benefit immediately after death and the other half a.

Source: pinterest.com

Source: pinterest.com

Survivorship life insurance is a unique type of policy. The life insurance benefit can be used to help pay estate taxes, estate settlement costs, or as a way to leave an inheritance to children and grandchildren. Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. A survivorship life insurance policy insures two people under one policy. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die.

Source: termlifeadvice.com

Source: termlifeadvice.com

Survivorship life insurance policies defined. Survivorship life insurance differs in that it is a policy that is written on two lives. Variable survivorship life insurance is a type of variable life insurance policy that covers two individuals and pays a death benefit to a beneficiary only after both people have died. The policy pays out the death benefit after both the insured people die. Survivorship life insurance is often used by couples or spouses.

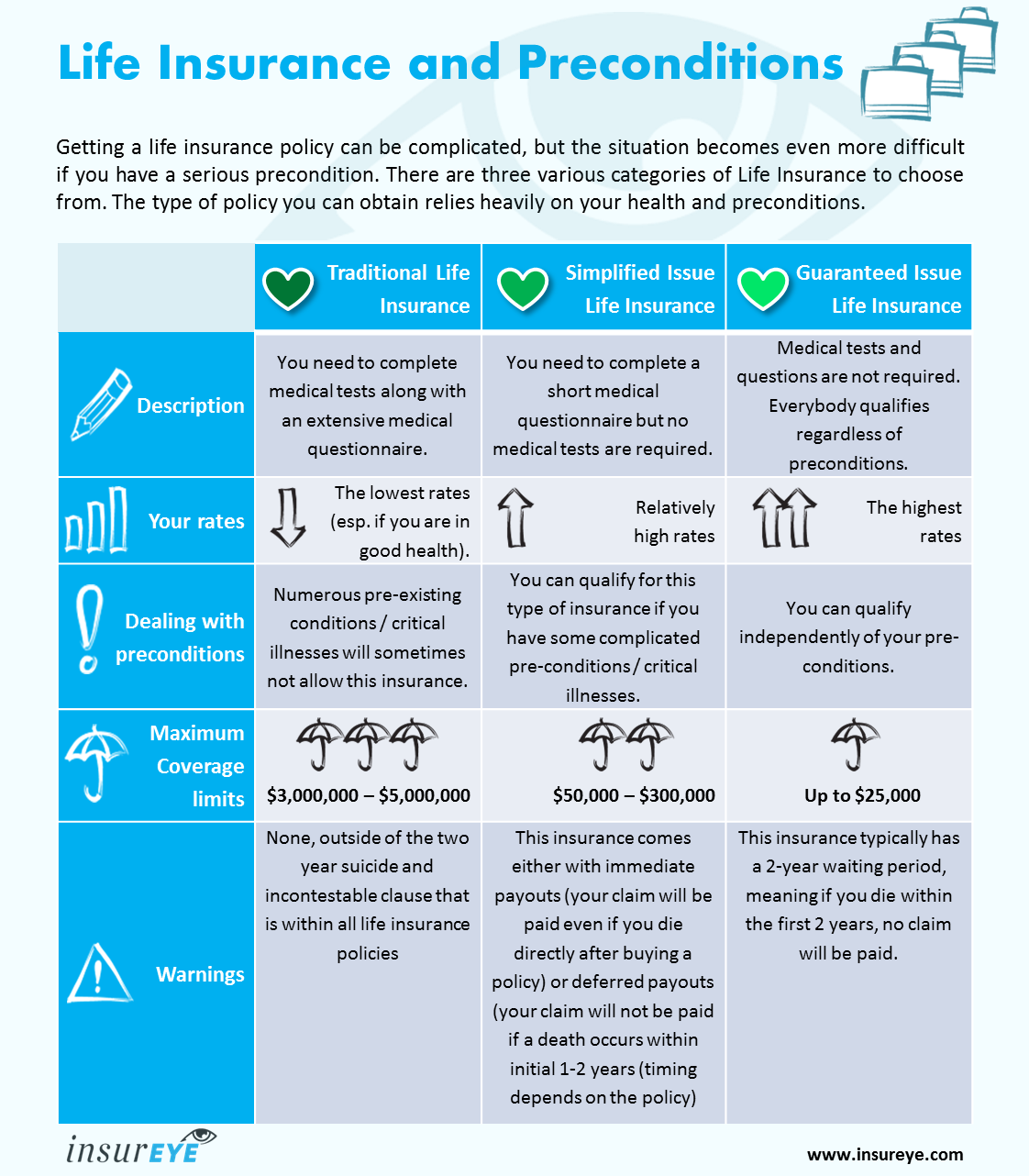

Source: insureye.com

Source: insureye.com

The policy pays out the death benefit after both the insured people die. This makes it very different that other types of life insurance. Survivorship policies were introduced in the early 1980s following a change in the tax law allowing a couple to defer all estate taxes until the last one dies. Survivorship life insurance policies defined. Survivorship life policy is higher c.

Source: youtube.com

Source: youtube.com

Depends on the investment performance of the underlying accounts d. It covers two lives instead of one. Survivorship life insurance only pays the benefit to the beneficiary when all the policyholders or insured people on the policy have died. In this type of policy, the insurance company pays out its death benefit when both policyholders pass away. Survivorship life insurance policies defined.

Source: termlifeadvice.com

Source: termlifeadvice.com

Also known as a second to die policy, survivorship life insurance a joint permanent life insurance policy that pays out upon the death of all insured parties. It covers two lives instead of one. Survivorship life insurance is a policy taken out on two lives instead of one. It is generally sold as a whole life, universal life, or variable universal life insurance policy. Variable survivorship life insurance is a type of variable life insurance policy that covers two individuals and pays a death benefit to a beneficiary only after both people have died.

Source: pinterest.com

Source: pinterest.com

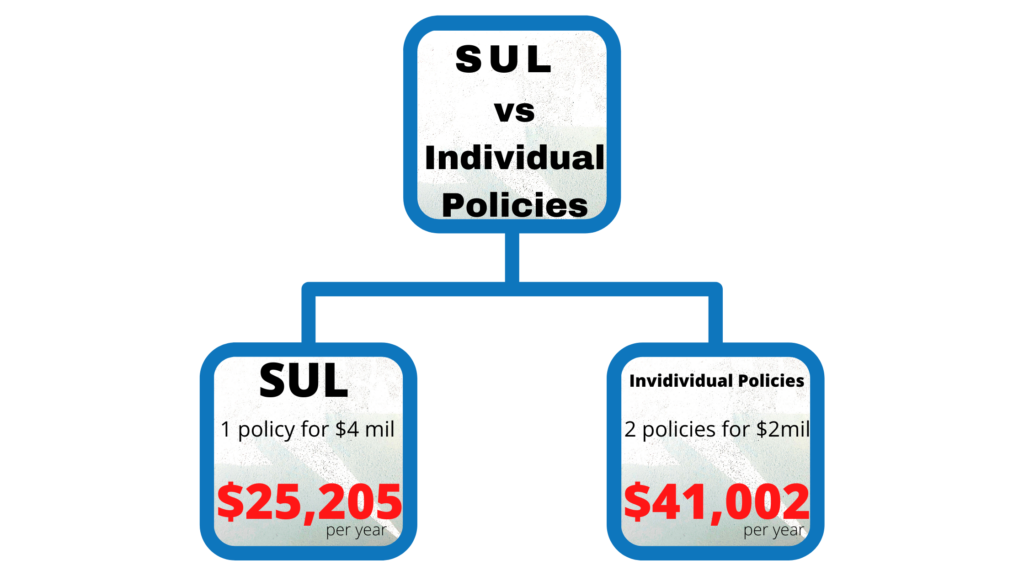

The policy’s death benefit is only paid out after both people pass away. Survivorship life insurance is typically less expensive than two separate permanent policies. It�s often used by couples whose families will be hit by large estate taxes, but there are other good uses for it. The policy’s death benefit is only paid out after both people pass away. What is survivorship life insurance?

Source: survivaldaily.com

Source: survivaldaily.com

It may pay out a benefit prior to the first policyholder’s death if the policy has a living benefit rider. Depends on the investment performance of the underlying accounts d. When the first insured passes, nothing happens. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. A survivorship life insurance policy insures two people under one policy.

Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

It�s often used by couples whose families will be hit by large estate taxes, but there are other good uses for it. In this type of policy, the insurance company pays out its death benefit when both policyholders pass away. Survivorship life insurance only pays the benefit to the beneficiary when all the policyholders or insured people on the policy have died. Survivorship life policy is higher c. Survivorship life insurance is often used by couples or spouses.

Source: issuu.com

Source: issuu.com

This type of policy includes the death benefit and a cash value component. A survivorship life insurance policy insures two people under one policy. It may pay out a benefit prior to the first policyholder’s death if the policy has a living benefit rider. What is survivorship life insurance? Survivorship life insurance is a unique type of policy.

Source: slideshare.net

Source: slideshare.net

Although they can be term life insurance policies, most joint life policies are permanent life insurance policies, which last your entire lifetime and often have a savings component known as “cash value.” Survivorship life policy is lower b. Survivorship life insurance is a type of permanent life insurance that covers two people under one policy. It�s often used by couples whose families will be hit by large estate taxes, but there are other good uses for it. In this type of policy, the insurance company pays out its death benefit when both policyholders pass away.

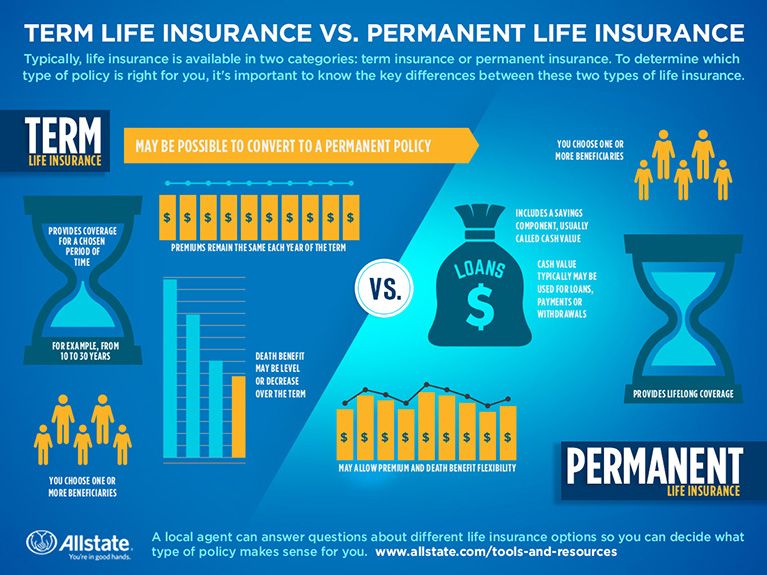

Source: allstate.com

Source: allstate.com

The policy’s death benefit is only paid out after both people pass away. Variable survivorship life insurance, also known as survivorship life insurance, is a type of joint life insurance policy that insures two people. Typically this type of joint insurance is on a husband and wife, and the policy death benefit is paid only after both die. Survivorship life insurance is often used by couples or spouses. In this type of policy, the insurance company pays out its death benefit when both policyholders pass away.

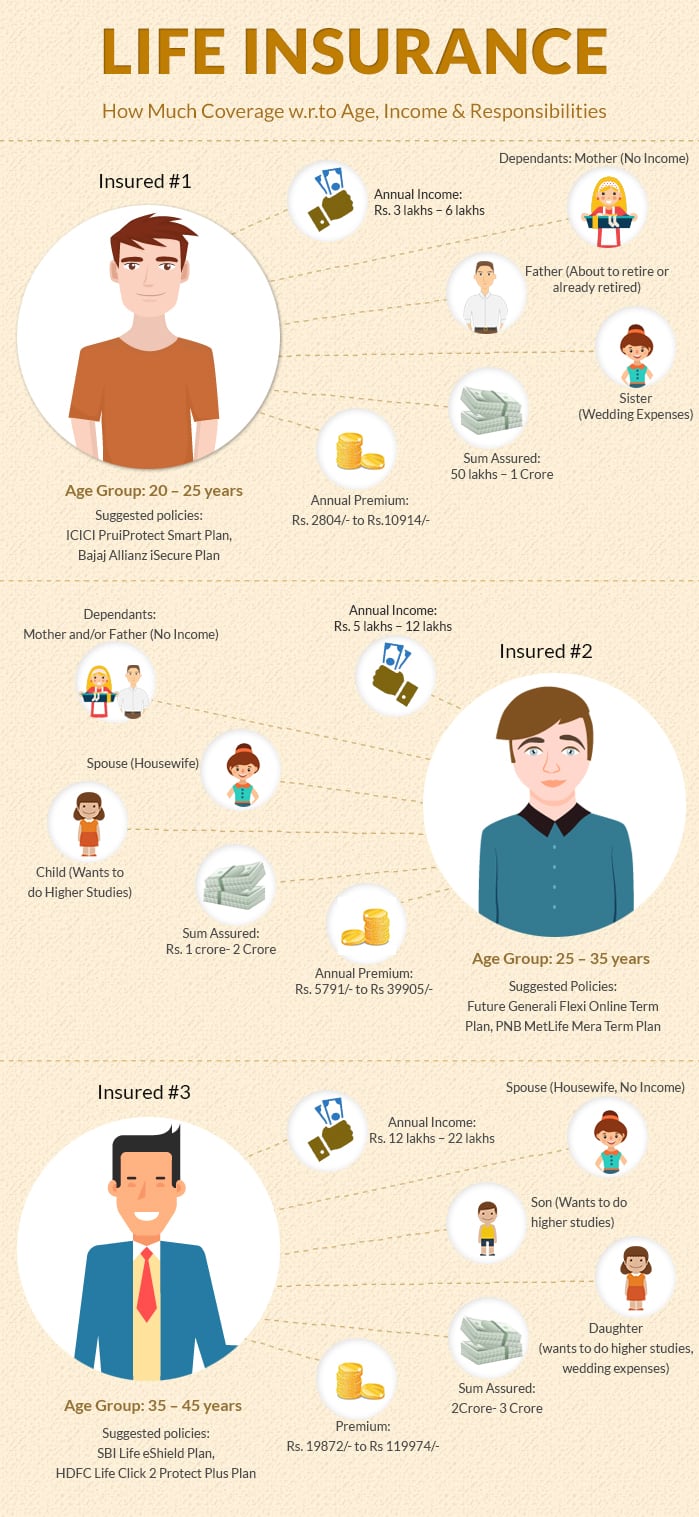

Source: policybazaar.com

Source: policybazaar.com

What is survivorship life insurance? Survivorship life insurance is a policy taken out on two lives instead of one. It may pay out a benefit prior to the first policyholder’s death if the policy has a living benefit rider. How does the cost for a survivorship life policy compare to the cost of combining two separate life insurance policies? A survivorship life insurance policy insures two people under one policy.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title in a survivorship life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.