In an insurance contract the insurer is the only party Idea

Home » Trending » In an insurance contract the insurer is the only party IdeaYour In an insurance contract the insurer is the only party images are ready in this website. In an insurance contract the insurer is the only party are a topic that is being searched for and liked by netizens today. You can Find and Download the In an insurance contract the insurer is the only party files here. Download all free images.

If you’re searching for in an insurance contract the insurer is the only party pictures information related to the in an insurance contract the insurer is the only party topic, you have come to the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

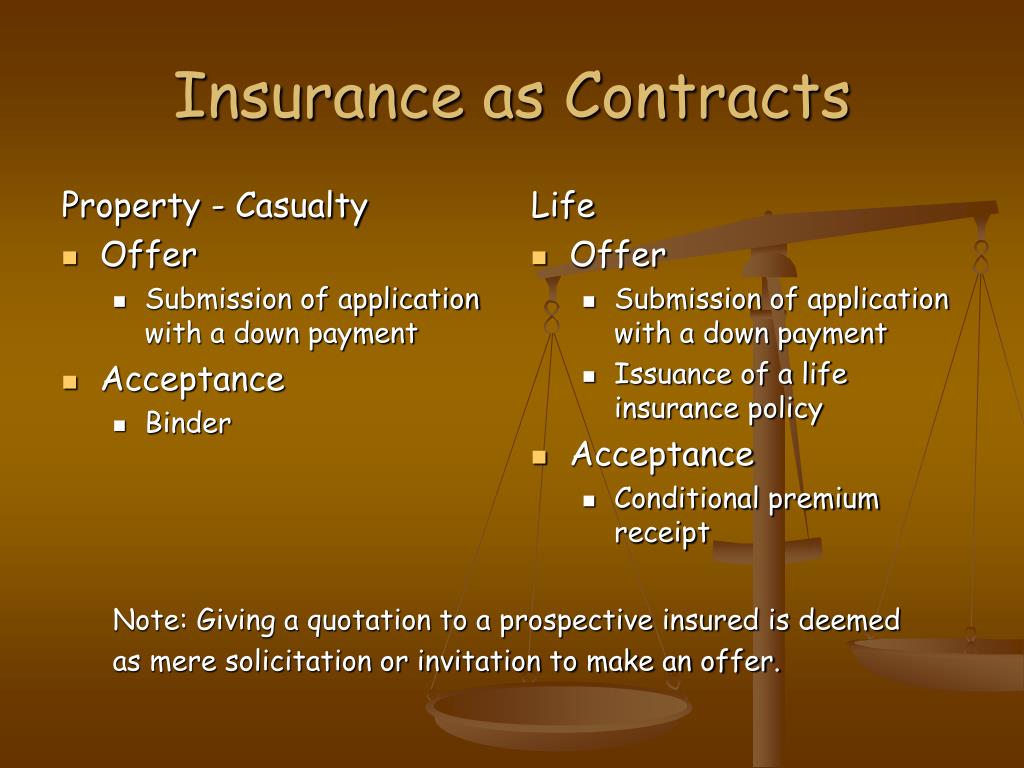

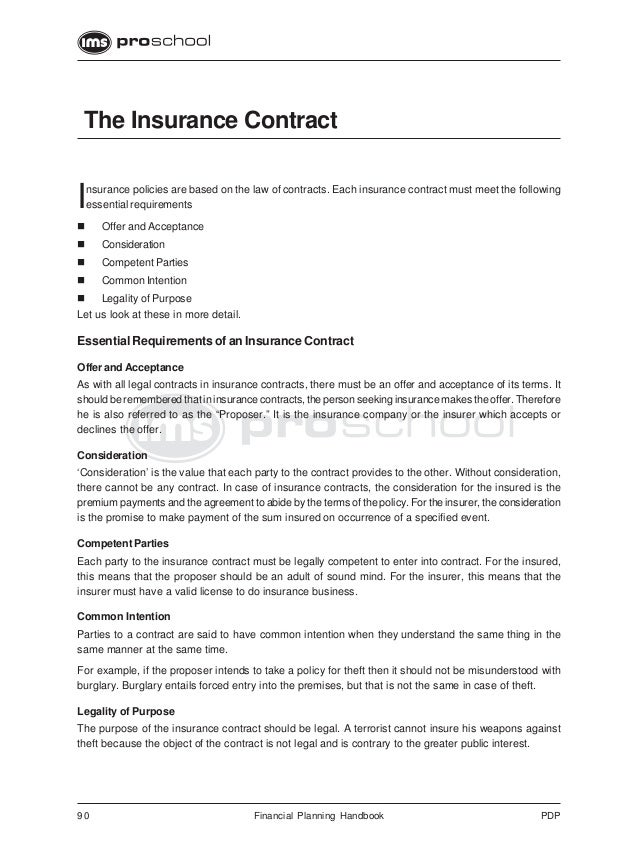

In An Insurance Contract The Insurer Is The Only Party. In an insurance contract no principles of contact are applicable. A) there is an element of chance and potential for unequal exchange of value or consideration for both parties b) only one party (the insurer) makes any kind of legally enforceable promise c) the contract has been prepared by one party (the insurance company) with no negotiation between the applicant and the insurer In an insurance contract a prospect makes an offer and an insurer accepts it. Both parties consent to the contract.

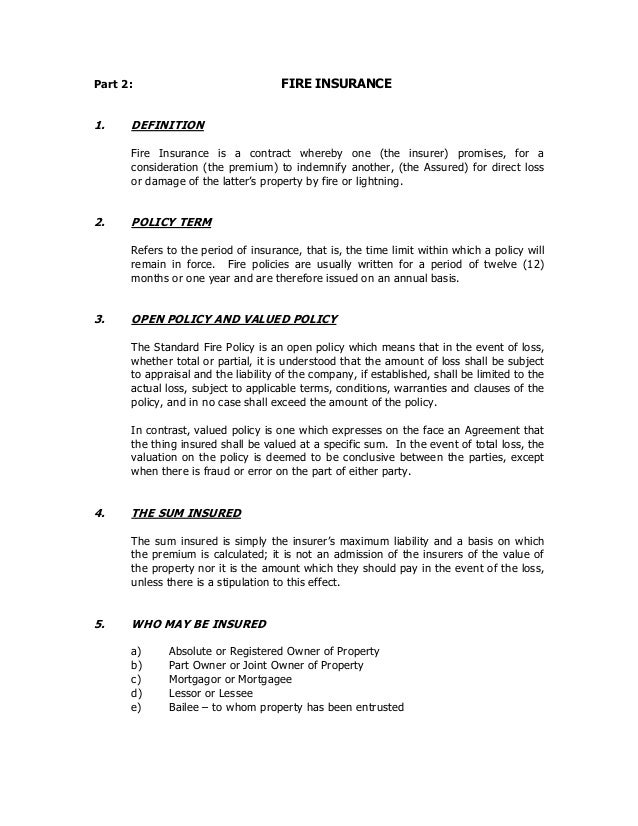

Introduction to non life insurance short course From slideshare.net

Introduction to non life insurance short course From slideshare.net

In a unilateral contract, the offeror is the only party with a contractual obligation. Called premium, is charged in consideration. Apparent authority is the appearance or assumption of authority based on the actions, words, or deeds of the producer. In an insurance contract an offer and acceptance is not a requirement. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language.

Adhesion insurance policies are contracts of adhesion, which means that one party has greater power over the other party in drafting the contract.

When it comes to insurance, the notion of a beneficiary plays an important role. The business of insurance may be carried on by individuals just as much as by corporations and associations. The insurance, thus, is a contract whereby. Insured is the person, whose property, life or health is the subject of the insurance. In an insurance contract, the insurer is the only party legally obligated to perform. By contrast, the insured makes few,.

Source: getchancegetchange.blogspot.com

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Utmost good faith.actingin fairness and equity with a sincere belief that the act is not unlawful or. Unilateral 17 when must insurable interest exist for a life insurance contract to be valid? Apparent authority is the appearance or assumption of authority based on the actions, words, or deeds of the producer. The carrying amount of related deferred acquisition costs or related intangible assets decreased),

Source: youtube.com

Source: youtube.com

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. A contract in which only the insurer would be legally obligated to perform is. In an insurance contract, the insurer has greater power An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. Apparent authority is the appearance or assumption of authority based on the actions, words, or deeds of the producer.

Source: slideserve.com

Source: slideserve.com

In an insurance contract, the insurer is the only party who makes a legally enforceable promise. As per the insurance act, 1938. The insured does not make a promise but pays a premium, which constitutes the insured�s part of the consideration. An insurance contract shall bind an insurer to undertake certain risks in return for the payment of premium, and upon occurrence of an insured event to pay the insured or a third beneficiary party an insurance indemnity or an amount in cash. The carrying amount of related deferred acquisition costs or related intangible assets decreased),

Source: slideshare.net

Source: slideshare.net

In the case of an insurance contract, the insurer promises to. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Third parties, or persons who are not party to a contract, have no cause of action in respect of the contract. An insurance contract shall bind an insurer to undertake certain risks in return for the payment of premium, and upon occurrence of an insured event to pay the insured or a third beneficiary party an insurance indemnity or an amount in cash. Called premium, is charged in consideration.

Source: slideshare.net

Source: slideshare.net

The insurer is the party who assumes or accepts the risk of loss and undertakes for a consideration to indemnify the insured or to pay him a certain sum on the happening of a specified contingency or event. In an insurance contract, the insurer is the only party who makes a legally enforceable promise. An insurance contract shall bind an insurer to undertake certain risks in return for the payment of premium, and upon occurrence of an insured event to pay the insured or a third beneficiary party an insurance indemnity or an amount in cash. In the case of an insurance contract, the insurer promises to. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay.

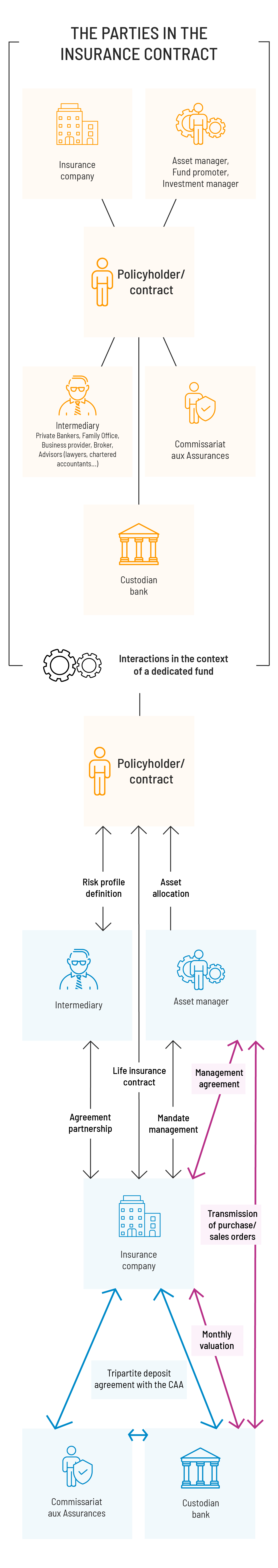

Source: life-insurance360.com

Source: life-insurance360.com

Utmost good faith.actingin fairness and equity with a sincere belief that the act is not unlawful or. An assessment of whether the carrying amount of an insurance liability needs to be increased (or: Applicant adheres on a take it or leave it basis 15. Insured is the person, whose property, life or health is the subject of the insurance. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language.

Source: sophia.org

Source: sophia.org

A) there is an element of chance and potential for unequal exchange of value or consideration for both parties b) only one party (the insurer) makes any kind of legally enforceable promise c) the contract has been prepared by one party (the insurance company) with no negotiation between the applicant and the insurer Both parties consent to the contract. In an insurance contract a prospect makes an offer and an insurer accepts it. The carrying amount of related deferred acquisition costs or related intangible assets decreased), In an insurance contract no principles of contact are applicable.

Source: youtube.com

Source: youtube.com

As per the insurance act, 1938. In a unilateral contract, the offeror is the only party with a contractual obligation. An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. Insured is the person, whose property, life or health is the subject of the insurance. A fundamental contract law principle, which has long haunted those not party to an insurance contract, is the doctrine of privity, which essentially states that only parties to a contract may enforce the contract.

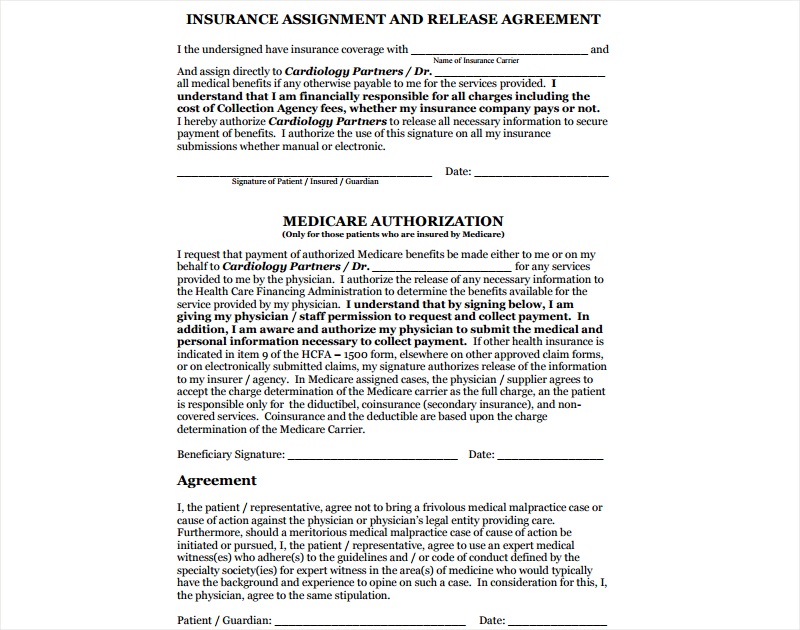

Source: sampletemplates.com

Source: sampletemplates.com

An insurance contract shall bind an insurer to undertake certain risks in return for the payment of premium, and upon occurrence of an insured event to pay the insured or a third beneficiary party an insurance indemnity or an amount in cash. The insured does not make a promise but pays a premium, which constitutes the insured�s part of the consideration. An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. What kind of contract is this? The term which describes the fact that both parties of a contract may not receive the same value is referred to as

Source: issuu.com

Source: issuu.com

The carrying amount of related deferred acquisition costs or related intangible assets decreased), Utmost good faith.actingin fairness and equity with a sincere belief that the act is not unlawful or. Apparent authority is the appearance or assumption of authority based on the actions, words, or deeds of the producer. In an insurance contract, the insurer has greater power The business of insurance may be carried on by individuals just as much as by corporations and associations.

Source: slideshare.net

Source: slideshare.net

By contrast, the insured makes few,. Because of this, an insurance contract is considered. As per the insurance act, 1938. In an insurance contract an offer and acceptance is not a requirement. Insured is the person, whose property, life or health is the subject of the insurance.

Source: yan-kenyon.com

Source: yan-kenyon.com

The insurer which is the insurance company undertakes, in exchange of fixed premium to pay the insured fixed amount of money on the happening of a certain event. Adhesion insurance policies are contracts of adhesion, which means that one party has greater power over the other party in drafting the contract. In a unilateral contract, the offeror is the only party with a contractual obligation. Applicant adheres on a take it or leave it basis 15. An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured.

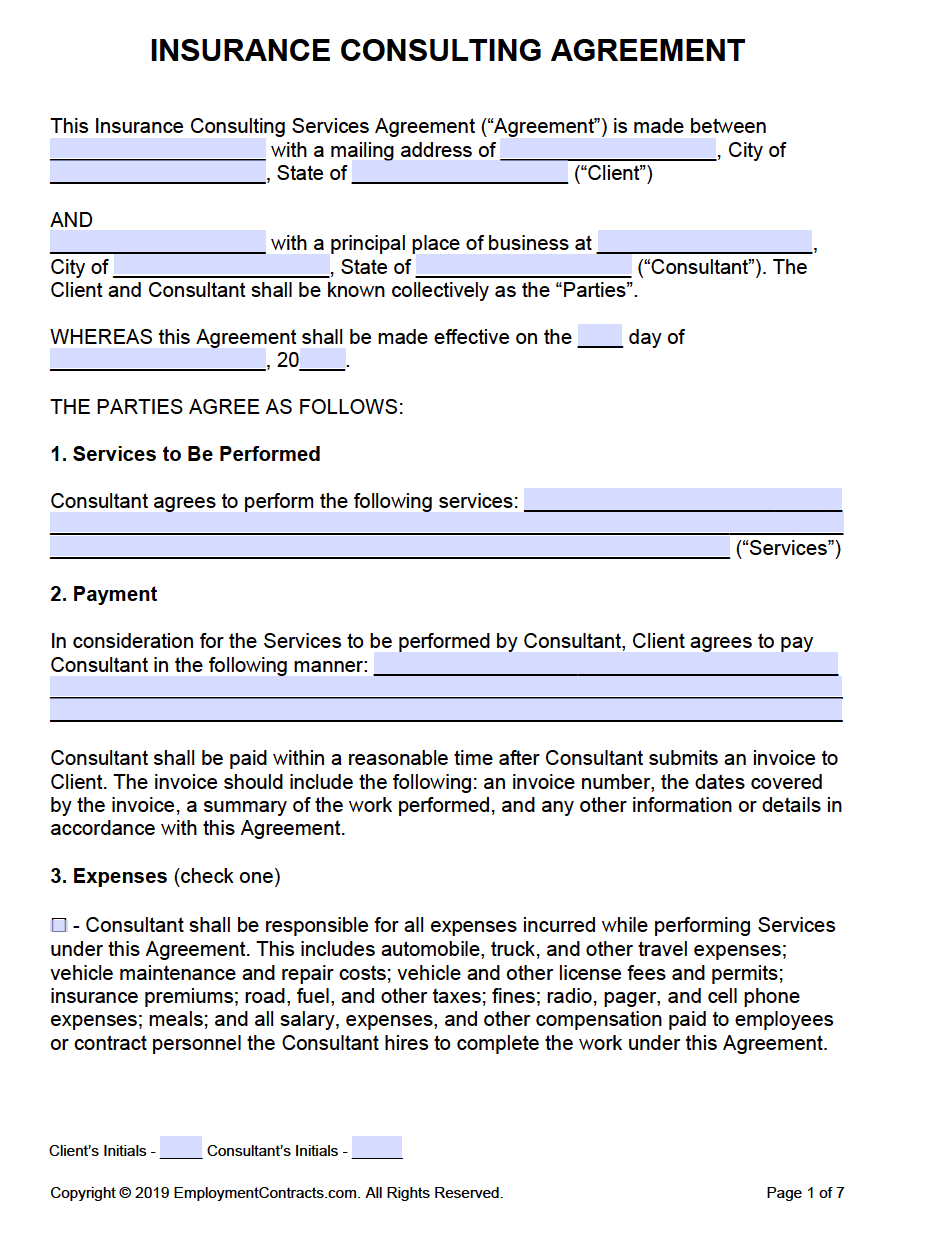

Source: template.net

Source: template.net

Because of this, an insurance contract is considered. In an insurance contract, the insurer has greater power Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. In a unilateral contract, the offeror is the only party with a contractual obligation. Third parties, or persons who are not party to a contract, have no cause of action in respect of the contract.

Source: life-insurance360.com

Source: life-insurance360.com

Insured is the person, whose property, life or health is the subject of the insurance. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. A fundamental contract law principle, which has long haunted those not party to an insurance contract, is the doctrine of privity, which essentially states that only parties to a contract may enforce the contract. What kind of contract is this?

Source: getchancegetchange.blogspot.com

Source: getchancegetchange.blogspot.com

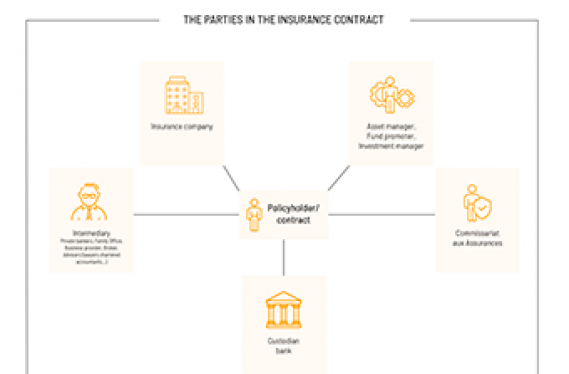

A contract in which only the insurer would be legally obligated to perform is. Unilateral contract — a contract in which only one party makes an enforceable promise. A) there is an element of chance and potential for unequal exchange of value or consideration for both parties b) only one party (the insurer) makes any kind of legally enforceable promise c) the contract has been prepared by one party (the insurance company) with no negotiation between the applicant and the insurer Parties to the contract of insurance. Third parties, or persons who are not party to a contract, have no cause of action in respect of the contract.

Source: whatisinsurancepdf.blogspot.com

Source: whatisinsurancepdf.blogspot.com

Unilateral 17 when must insurable interest exist for a life insurance contract to be valid? Adhesion insurance policies are contracts of adhesion, which means that one party has greater power over the other party in drafting the contract. The business of insurance may be carried on by individuals just as much as by corporations and associations. The term which describes the fact that both parties of a contract may not receive the same value is referred to as Applicant adheres on a take it or leave it basis 15.

In an insurance contract no principles of contact are applicable. Apparent authority is the appearance or assumption of authority based on the actions, words, or deeds of the producer. Parties to the contract of insurance. Insured is the person, whose property, life or health is the subject of the insurance. An insurance contract shall bind an insurer to undertake certain risks in return for the payment of premium, and upon occurrence of an insured event to pay the insured or a third beneficiary party an insurance indemnity or an amount in cash.

Source: examples.com

Source: examples.com

An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. The term which describes the fact that both parties of a contract may not receive the same value is referred to as In an insurance contract, the insurer is the only party who makes a legally enforceable promise. Both parties consent to the contract. Because of this, an insurance contract is considered.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title in an insurance contract the insurer is the only party by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.