In dwelling policies automatic increase in insurance is Idea

Home » Trending » In dwelling policies automatic increase in insurance is IdeaYour In dwelling policies automatic increase in insurance is images are ready in this website. In dwelling policies automatic increase in insurance is are a topic that is being searched for and liked by netizens now. You can Find and Download the In dwelling policies automatic increase in insurance is files here. Find and Download all free images.

If you’re searching for in dwelling policies automatic increase in insurance is pictures information linked to the in dwelling policies automatic increase in insurance is interest, you have visit the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

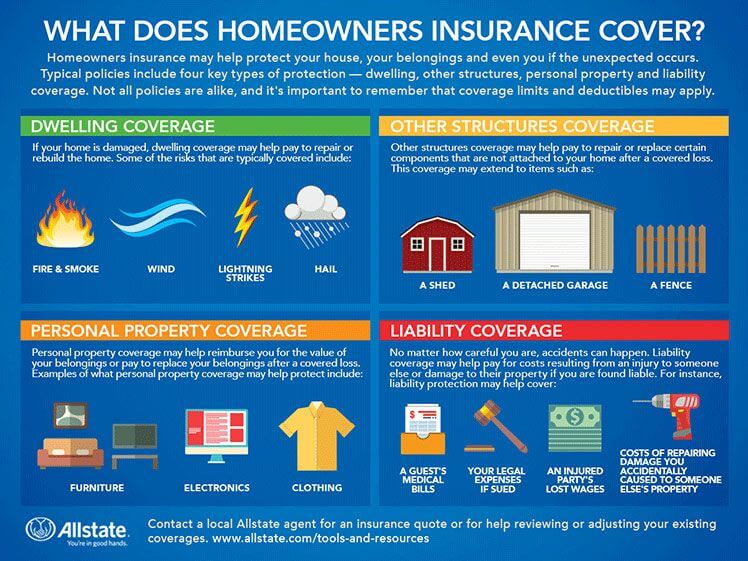

In Dwelling Policies Automatic Increase In Insurance Is. Your insurance is about guarding your assets, so if you feel something is off, call your agent to ask questions or ask for a review. A dwelling fire policy is designed to insure only your dwelling, which is the outer structure of your home. This is an important distinction that needs to be understood. If there is a fire in your home, this policy will cover any damages to its outer structure.

Did Your Home Insurance Premium Increase at Renewal Time From jackstoneinsurance.com

Did Your Home Insurance Premium Increase at Renewal Time From jackstoneinsurance.com

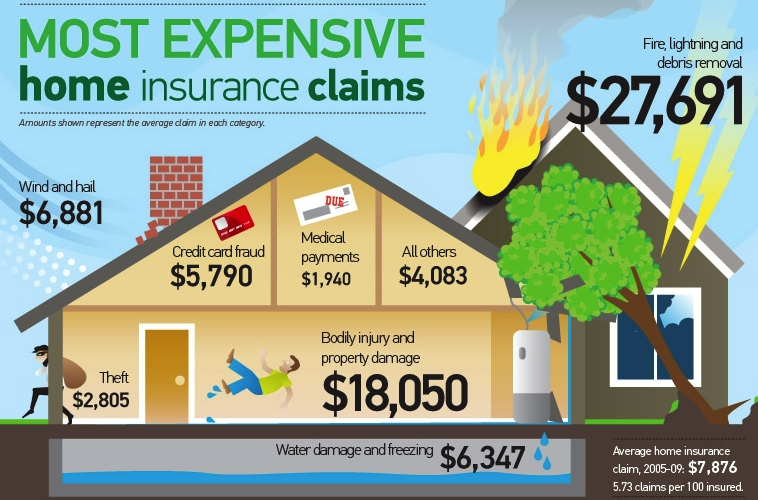

In dwelling policies, automatic increase in insurance is sinkhole collapse endorsement the endorsement that provides coverage for losses arising from sudden collapse of earth rising from underground limestone created by the action of water on the rock formations is a/an The older the dwelling gets, the less it is worth. When your insured dwelling value changes, review how it will impact the rest of the coverage on your policy, such as your personal belongings. Here�s a look at what dwelling insurance covers, what types of perils and structures are not covered, and how. An insured purchased a dwelling policy with $40,000 of coverage. Dwelling coverage, also known as dwelling insurance or coverage a, is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your house in the event it’s damaged by a covered peril, like a fire, windstorm, or a lightning strike.

Dwelling insurance policies are not homeowners’ insurance policies.

This is done on an annual basis when your homeowner policy comes up for renewal. The older the dwelling gets, the less it is worth. Higher coverage limits may also be added via a coverage endorsement. In dwelling policies, automatic increase in insurance is (choose from the following options) 1. Coverage for newly acquired property. It takes into account the changes to the cost of construction so that there is an automatic change in the insured property�s coverage whenever there is a change in the costs.

Source: npuckettdesign.blogspot.com

Source: npuckettdesign.blogspot.com

Adding the extended dwelling coverage by endorsement is an additional premium investment. This is an important distinction that needs to be understood. Adding the extended dwelling coverage by endorsement is an additional premium investment. This is done on an annual basis when your homeowner policy comes up for renewal. At the end of the day, this endorsement is a.

Source: allstate.com

Source: allstate.com

Standard homeowners insurance, however, does not cover damage from floods or earthquakes. This type of coverage reimburses you for damage to things such as your: The north carolina department of insurance and the north carolina rate bureau (ncrb) have reached a settlement for an average 4% increase on a proposal to increase dwelling insurance rates. Dwelling insurance is a highly significant portion of your homeowners insurance policy that protects the physical structure of your home. Coverage for newly acquired property.

Source: eadesignerterry.blogspot.com

Source: eadesignerterry.blogspot.com

It’s vital that you review your policy with an insurance professional that can provide guidance on your policy. Your insurance is about guarding your assets, so if you feel something is off, call your agent to ask questions or ask for a review. It’s vital that you review your policy with an insurance professional that can provide guidance on your policy. Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire. Adding the extended dwelling coverage by endorsement is an additional premium investment.

Source: jackstoneinsurance.com

Source: jackstoneinsurance.com

The north carolina department of insurance and the north carolina rate bureau (ncrb) have reached a settlement for an average 4% increase on a proposal to increase dwelling insurance rates. Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire. An insured purchased a dwelling policy with $40,000 of coverage. At the end of the day, this endorsement is a. Dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical structure of your home if it�s damaged by a covered hazard.

Source: pawson.com

Source: pawson.com

Dwelling insurance policies are not homeowners’ insurance policies. If your home is damaged by a covered peril, your policy’s dwelling coverage may pay to repair, rebuild, or replace your home’s physical structure. This coverage doesn’t come standard in any dwelling policy, but can be. An automatic increase in insurance endorsement is an addition to a property insurance policy that renders coverage limits on buildings flexible to inflation rate. Your insurance is about guarding your assets, so if you feel something is off, call your agent to ask questions or ask for a review.

Source: freepricecompare.com

Source: freepricecompare.com

Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Higher coverage limits may also be added via a coverage endorsement. When your insured dwelling value changes, review how it will impact the rest of the coverage on your policy, such as your personal belongings. It takes into account the changes to the cost of construction so that there is an automatic change in the insured property�s coverage whenever there is a change in the costs. Here�s a look at what dwelling insurance covers, what types of perils and structures are not covered, and how.

Source: ciainsurance.com

Source: ciainsurance.com

This is done on an annual basis when your homeowner policy comes up for renewal. Dwelling insurance policies are not homeowners’ insurance policies. If you are a landlord and your rental property is insured with actual In dwelling policies, automatic increase in insurance is sinkhole collapse endorsement the endorsement that provides coverage for losses arising from sudden collapse of earth rising from underground limestone created by the action of water on the rock formations is a/an This type of coverage reimburses you for damage to things such as your:

Source: clovered.com

Source: clovered.com

Coverage for newly acquired property. This means if your home is insured for $350,000, you’d have up to $35,000 in building ordinance or law coverage. If your home is damaged by a covered peril, your policy’s dwelling coverage may pay to repair, rebuild, or replace your home’s physical structure. This type of coverage reimburses you for damage to things such as your: An insured purchased a dwelling policy with $40,000 of coverage.

Source: bcnpha.ca

Source: bcnpha.ca

An insured purchased a dwelling policy with $40,000 of coverage. Dwelling insurance policies are not homeowners’ insurance policies. It’s vital that you review your policy with an insurance professional that can provide guidance on your policy. This is an important distinction that needs to be understood. Most dp1 insurance policies are actual cash value (acv) insurance policies.

Source: qualityquote.co.za

Source: qualityquote.co.za

The north carolina department of insurance and the north carolina rate bureau (ncrb) have reached a settlement for an average 4% increase on a proposal to increase dwelling insurance rates. If you are a landlord and your rental property is insured with actual It takes into account the changes to the cost of construction so that there is an automatic change in the insured property�s coverage whenever there is a change in the costs. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. In dwelling policies, automatic increase in insurance is sinkhole collapse endorsement the endorsement that provides coverage for losses arising from sudden collapse of earth rising from underground limestone created by the action of water on the rock formations is a/an

Source: doyle-ogden.com

Source: doyle-ogden.com

Dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical structure of your home if it�s damaged by a covered hazard. Dwelling insurance policies are not homeowners’ insurance policies. This is an important distinction that needs to be understood. If you are a landlord and your rental property is insured with actual This is done on an annual basis when your homeowner policy comes up for renewal.

Source: algomainsurancebrokers.com

Source: algomainsurancebrokers.com

This endorsement allows you to guard against inflation by increasing the amount of insurance coverage in annual increments. Dwelling coverage, also known as dwelling insurance or coverage a, is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your house in the event it’s damaged by a covered peril, like a fire, windstorm, or a lightning strike. The older the dwelling gets, the less it is worth. An actual cash value dwelling insurance policy is much like a car insurance policy; In dwelling policies, automatic increase in insurance is (choose from the following options) 1.

Source: tgsinsurance.com

Source: tgsinsurance.com

This coverage doesn’t come standard in any dwelling policy, but can be. An actual cash value dwelling insurance policy is much like a car insurance policy; Typically, this coverage is well under 10% of the total policy premium, but each case is unique. This endorsement allows you to guard against inflation by increasing the amount of insurance coverage in annual increments. Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

This endorsement allows you to guard against inflation by increasing the amount of insurance coverage in annual increments. Dp 0411 automatic increase in insurance view dp 0411 wdp 00 01 basic form view wdp 00 01 wdp 00 02 broad form view wdp 00 02 dp 0472 broad theft coverage off premises view dp 0472 dp 0472 broad theft coverage on premises dp 0470 central station fire or smoke alarm view dp 0470 wdp0403 collision or upset coverage view wdp0403 Typically, this coverage is well under 10% of the total policy premium, but each case is unique. Dwelling coverage (sometimes called coverage a) is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind, hail, lightning, or fire. This is an important distinction that needs to be understood.

Source: insurezero.wordpress.com

Source: insurezero.wordpress.com

Adding the extended dwelling coverage by endorsement is an additional premium investment. This is done on an annual basis when your homeowner policy comes up for renewal. Dwelling insurance policies are not homeowners’ insurance policies. Your insurance is about guarding your assets, so if you feel something is off, call your agent to ask questions or ask for a review. A dwelling fire policy is designed to insure only your dwelling, which is the outer structure of your home.

Source: townleykenton.com

Source: townleykenton.com

This is done on an annual basis when your homeowner policy comes up for renewal. When your insured dwelling value changes, review how it will impact the rest of the coverage on your policy, such as your personal belongings. This means if your home is insured for $350,000, you’d have up to $35,000 in building ordinance or law coverage. The older the dwelling gets, the less it is worth. This endorsement allows you to guard against inflation by increasing the amount of insurance coverage in annual increments.

Source: indianexpress.com

Source: indianexpress.com

In dwelling policies, automatic increase in insurance is (choose from the following options) 1. An actual cash value dwelling insurance policy is much like a car insurance policy; This is done on an annual basis when your homeowner policy comes up for renewal. It bumps up the coverage amount specified in your policy declarations to cover your home.by a certain percentage. If there is a fire in your home, this policy will cover any damages to its outer structure.

Source: cheepinsurance.ca

Source: cheepinsurance.ca

Extended replacement cost coverage is an optional endorsement that may be available to add coverage of 10 percent, 25 percent or 50 percent of the estimated reconstruction cost, depending on the type of home insurance policy, in the event there are unexpected or unplanned increased costs to rebuild your home. Ordinance or law coverage is typically included in homeowners insurance policies up to a limited amount — generally 10% of your home’s dwelling coverage limit. Dwelling insurance policies are not homeowners’ insurance policies. The north carolina department of insurance and the north carolina rate bureau (ncrb) have reached a settlement for an average 4% increase on a proposal to increase dwelling insurance rates. This endorsement allows you to guard against inflation by increasing the amount of insurance coverage in annual increments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title in dwelling policies automatic increase in insurance is by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.