In insurance transactions fiduciary responsibility means Idea

Home » Trend » In insurance transactions fiduciary responsibility means IdeaYour In insurance transactions fiduciary responsibility means images are available. In insurance transactions fiduciary responsibility means are a topic that is being searched for and liked by netizens now. You can Get the In insurance transactions fiduciary responsibility means files here. Download all royalty-free photos.

If you’re looking for in insurance transactions fiduciary responsibility means pictures information linked to the in insurance transactions fiduciary responsibility means interest, you have visit the ideal site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

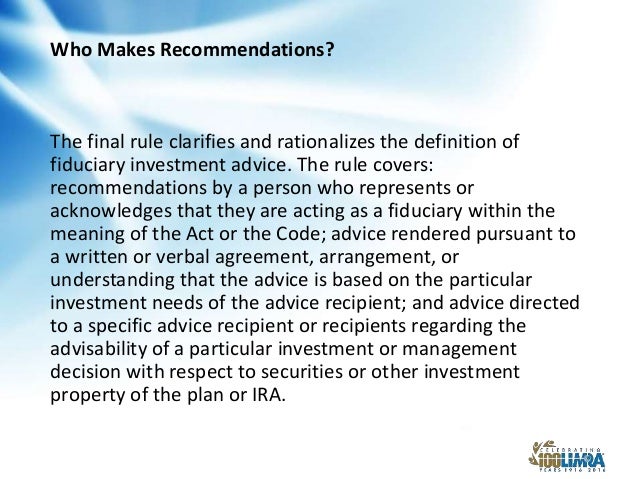

In Insurance Transactions Fiduciary Responsibility Means. These are obligations established by laws which have come about through our history of english common law or statutory enactments. Clients also have the option to donate an unwanted or unneeded life insurance policy. Act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the. Here is an outline of how board members can fulfill their role as fiduciaries.

BREACH OF CONTRACT Breached Meaning? What is a Breach of From dianalegal.com

BREACH OF CONTRACT Breached Meaning? What is a Breach of From dianalegal.com

A contract of agency establishes a fiduciary relationship between an insurer and an agent. Fiduciaries are responsible for overseeing the administration of the plan and should be familiar with the plan�s terms, loan policy, etc. Wrongful denial or improper change in benefits Act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the. A fiduciary is a person in a position of financial trust. Here is an outline of how board members can fulfill their role as fiduciaries.

What does fiduciary liability insurance cover?

A being liable with respect to payment of claims. Wrongful denial or improper change in benefits Attorneys, accountants, trust officers, pension plan trustees, stockbrokers and insurance agents are all considered fiduciaries. The most common is a trustee of a trust, but fiduciaries can include business. However, it will not protect your company from fraudulent cases of theft. A fiduciary of a plan if such person is specifically included as an insured person in a written endorsement issued by the insurer.

Source: slideshare.net

Source: slideshare.net

A fiduciary of a plan if such person is specifically included as an insured person in a written endorsement issued by the insurer. Minimum recordkeeping requirements (a) (1) this section is issued for the purpose of interpreting, and facilitating compliance with, insurance law section 2120(a) and (c). As long as an investment can be said to meet a client�s objectives. A contract of agency establishes a fiduciary relationship between an insurer and an agent. Insurance agents and brokers may owe a fiduciary duty to both to the companies they represent and to the insurance buying public.

Source: insurancefortexans.com

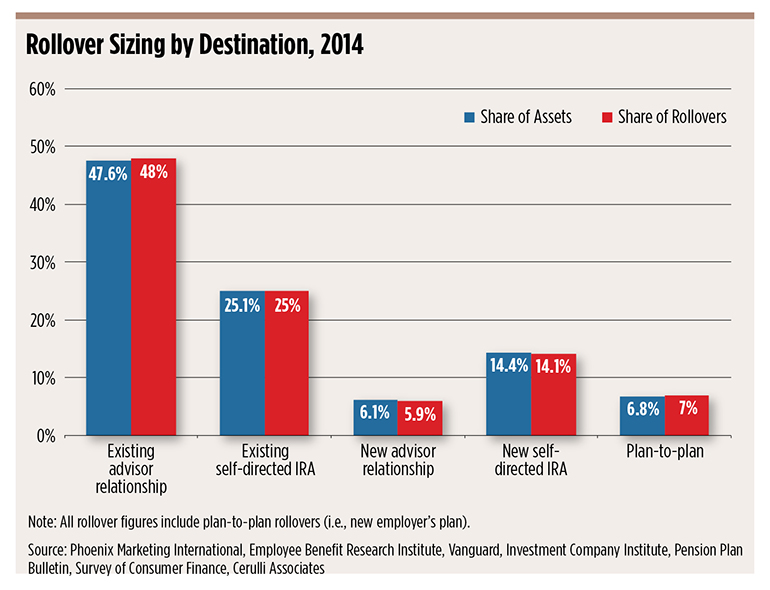

As long as an investment can be said to meet a client�s objectives. As stated in earlier postings, an insurance company owes their insured a duty to act in good faith. Donating life insurance complicates the value. In insurance transactions, fiduciary responsibility means handling insurer funds in a trust capacity which authority is not stated in an agents contract but is. A being liable with respect to payment of claims.

Source: garybuyshouses.com

Source: garybuyshouses.com

The fiduciary duty applies to registered investment advisors and it means they’re held to a different legal and ethical standard in managing client relationships. It’s important to be aware that not every advisor is a fiduciary and that not every fiduciary will act in the best interests of their clients, despite the rules they’re required to follow. There are many aspects to plan administration including: The most common is a trustee of a trust, but fiduciaries can include business. As stated in earlier postings, an insurance company owes their insured a duty to act in good faith.

Wrongful denial or improper change in benefits There are many aspects to plan administration including: A fiduciary of a plan if such person is specifically included as an insured person in a written endorsement issued by the insurer. However, it will not protect your company from fraudulent cases of theft. Donating life insurance complicates the value.

Source: larsenfinancial.us

Source: larsenfinancial.us

Fiduciaries are responsible for overseeing the administration of the plan and should be familiar with the plan�s terms, loan policy, etc. However, it will not protect your company from fraudulent cases of theft. Fiduciary responsibility to the client. In legal matters, a person with a fiduciary duty must act in ways that will be beneficial to someone else. Clients also have the option to donate an unwanted or unneeded life insurance policy.

Source: bradshawweil.com

Source: bradshawweil.com

Attorneys, accountants, trust officers, pension plan trustees, stockbrokers and insurance agents are all considered fiduciaries. Clients also have the option to donate an unwanted or unneeded life insurance policy. Minimum recordkeeping requirements (a) (1) this section is issued for the purpose of interpreting, and facilitating compliance with, insurance law section 2120(a) and (c). However, it will not protect your company from fraudulent cases of theft. There are many aspects to plan administration including:

Source: usbenefits.law

Source: usbenefits.law

Clients also have the option to donate an unwanted or unneeded life insurance policy. Most often, this responsibility refers to financial decisions that are. A child�s legal guardian), but often the task involves finances;. A fiduciary is an individual or entity that acts on behalf of another person or group. Interrelated wrongful acts means wrongful acts that have as a common

Source: ropesgray.com

Source: ropesgray.com

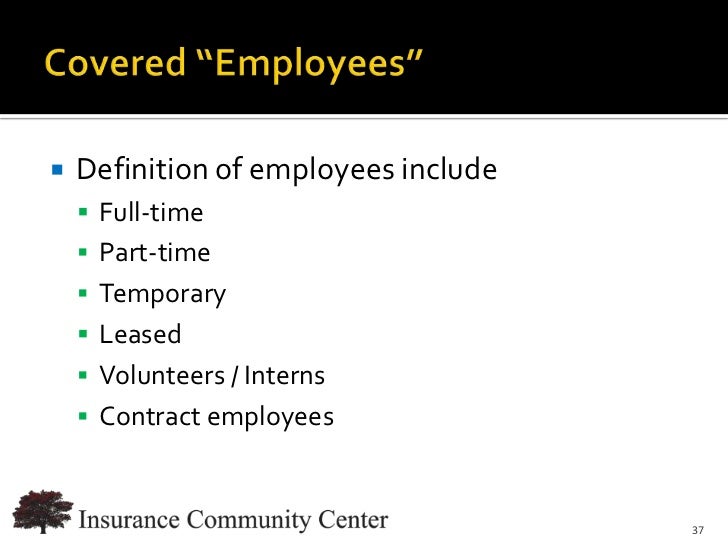

As long as an investment can be said to meet a client�s objectives. Enrolling and covering the right employees; This duty extends through all actions the agent takes in which the insurer�s interest is at stake, especially proper handling of. The fiduciary standard is a whole other set of rules that requires much stricter conduct than the suitability standard, (the current rule brokers, insurance agents, and most other financial advisors follow). Enrolling and covering the right employees;

Source: es.slideshare.net

Source: es.slideshare.net

We work with the best fiduciary liability carriers to protect against these claims and more: However, it will not protect your company from fraudulent cases of theft. Fiduciary responsibility to the client. One central tenet of this contract is the agent�s duty to act in the best interests of the insurer. Clients also have the option to donate an unwanted or unneeded life insurance policy.

Source: shreveportlawyer.com

Source: shreveportlawyer.com

A fiduciary of a plan if such person is specifically included as an insured person in a written endorsement issued by the insurer. As stated in earlier postings, an insurance company owes their insured a duty to act in good faith. This duty extends through all actions the agent takes in which the insurer�s interest is at stake, especially proper handling of. Act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the. There are many aspects to plan administration including:

Source: insurancemagazine.net

Source: insurancemagazine.net

Fiduciaries are responsible for overseeing the administration of the plan and should be familiar with the plan�s terms, loan policy, etc. The most common is a trustee of a trust, but fiduciaries can include business. Here is an outline of how board members can fulfill their role as fiduciaries. Most often, this responsibility refers to financial decisions that are. Interrelated wrongful acts means wrongful acts that have as a common

Source: rcsplanning.com

From the latin fiducia, meaning trust, a person (or a business like a bank or stock brokerage) who has the power and obligation to act for another (often called the beneficiary) under circumstances which require total trust, good faith and honesty. A being liable with respect to payment of claims. Your physician has a fiduciary responsibility to give you medical care. The fiduciary standard is a whole other set of rules that requires much stricter conduct than the suitability standard, (the current rule brokers, insurance agents, and most other financial advisors follow). Minimum recordkeeping requirements (a) (1) this section is issued for the purpose of interpreting, and facilitating compliance with, insurance law section 2120(a) and (c).

Source: benefitnews.com

Source: benefitnews.com

Act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the. There are many aspects to plan administration including: In legal matters, a person with a fiduciary duty must act in ways that will be beneficial to someone else. We work with the best fiduciary liability carriers to protect against these claims and more: As stated in earlier postings, an insurance company owes their insured a duty to act in good faith.

Source: dianalegal.com

Source: dianalegal.com

What does a fiduciary relationship mean in the insurance contract setting? Duty to monitor other fiduciaries. B commingling premiums with agent’s personal funds. In legal matters, a person with a fiduciary duty must act in ways that will be beneficial to someone else. A fiduciary is a person in a position of financial trust.

Source: wealthmanagement.com

Source: wealthmanagement.com

The fiduciary duty applies to registered investment advisors and it means they’re held to a different legal and ethical standard in managing client relationships. Enrolling and covering the right employees; The most common is a trustee of a trust, but fiduciaries can include business. There are many aspects to plan administration including: Most often, this responsibility refers to financial decisions that are.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Fiduciaries are responsible for overseeing the administration of the plan and should be familiar with the plan�s terms, loan policy, etc. Insurance agents and brokers may owe a fiduciary duty to both to the companies they represent and to the insurance buying public. Clients also have the option to donate an unwanted or unneeded life insurance policy. Enrolling and covering the right employees; Fiduciaries are responsible for overseeing the administration of the plan and should be familiar with the plan�s terms, loan policy, etc.

Source: slideserve.com

Source: slideserve.com

Insurance agents and brokers may owe a fiduciary duty to both to the companies they represent and to the insurance buying public. Donating life insurance complicates the value. A fiduciary is a person in a position of financial trust. In insurance transactions, fiduciary responsibility means handling insurer funds in a trust capacity which authority is not stated in an agents contract but is. Act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the.

Source: dianalegal.com

Source: dianalegal.com

However, it will not protect your company from fraudulent cases of theft. B commingling premiums with agent’s personal funds. Wrongful denial or improper change in benefits A being liable with respect to payment of claims. There are many aspects to plan administration including:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title in insurance transactions fiduciary responsibility means by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.