Incidental limitations life insurance Idea

Home » Trending » Incidental limitations life insurance IdeaYour Incidental limitations life insurance images are available in this site. Incidental limitations life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Incidental limitations life insurance files here. Get all royalty-free images.

If you’re searching for incidental limitations life insurance pictures information linked to the incidental limitations life insurance interest, you have visit the ideal site. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

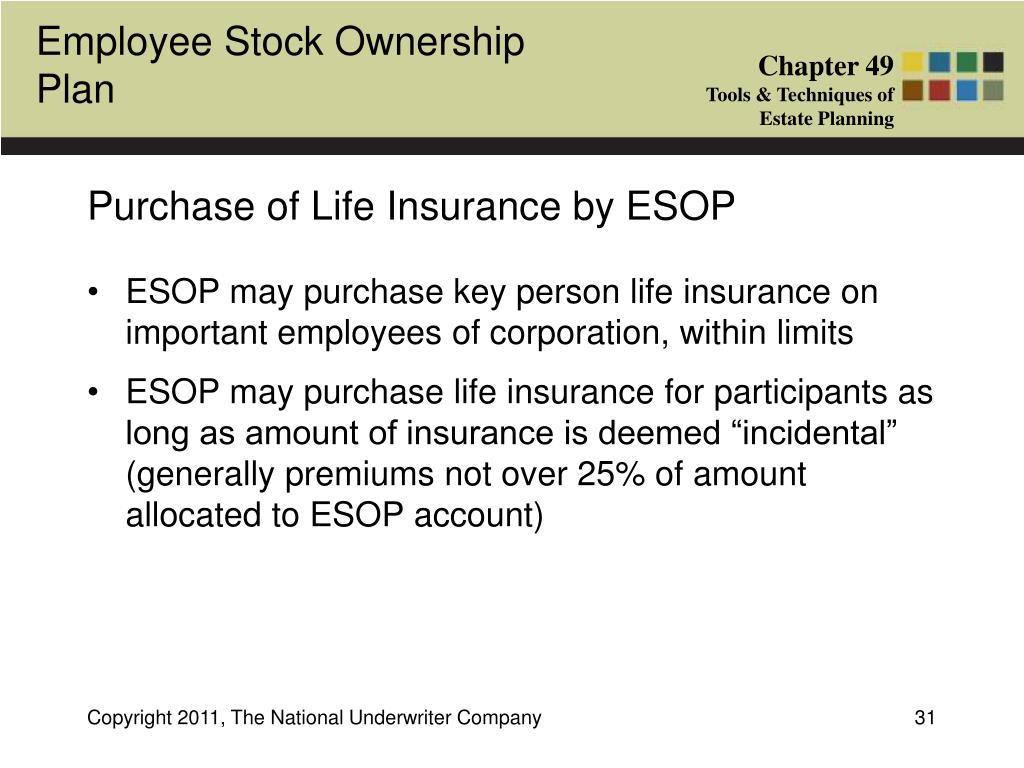

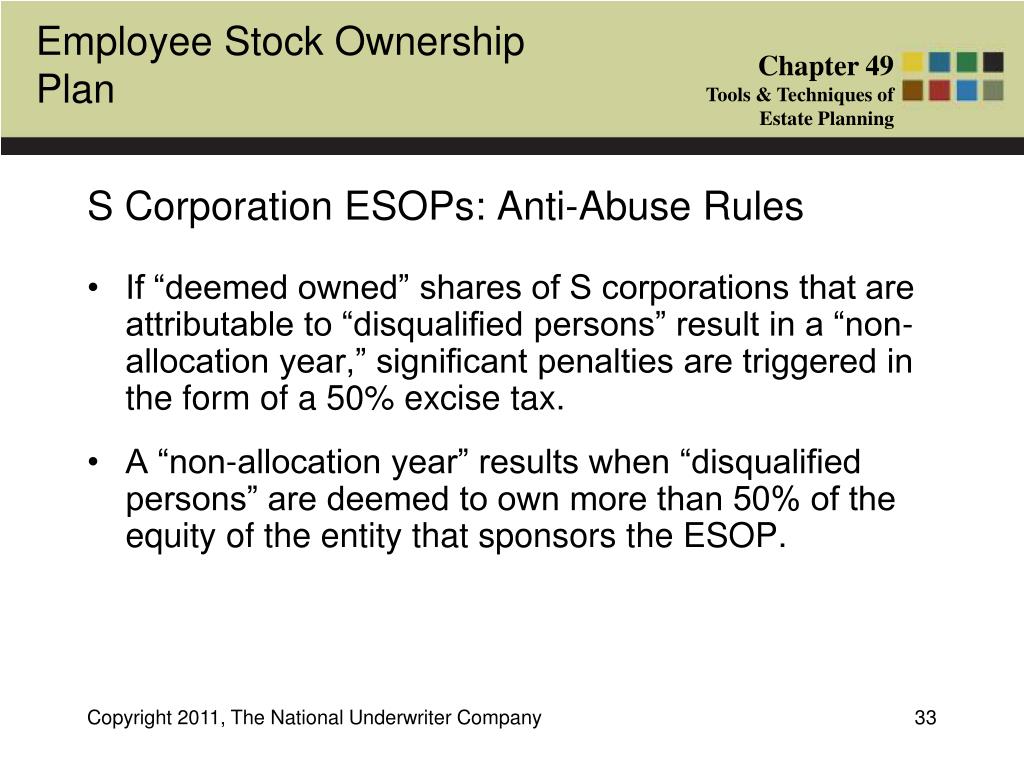

Incidental Limitations Life Insurance. Charitable uses of life insurance. Knowing the difference is crucial to. The aggregate of life insurance premiums paid for the benefit of a participant, at all times, may not exceed the following percentages of the aggregate of. The incidental death benefit requirement is satisfied by not having the death benefit exceed the incidental reserve.

How Much Personal Umbrella Insurance Do I Need? Daniels From danielsinsuranceinc.com

How Much Personal Umbrella Insurance Do I Need? Daniels From danielsinsuranceinc.com

The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement. The basic rule is the 100 to 1 rule, which would indicate that the participant could have a death benefit of 100 x the monthly pension benefit of $16,250, for a total insured death benefit of $1,625,000. Premiums may not exceed 33% of the theoretical contribution if you’re using term or universal life insurance. Knowing the difference is crucial to. Incidental coverage means any other type of liability insurance covering activities directly related 3259 to the continued and efficient delivery of health care that: For whole life insurance the threshold is 66%.

Accidental death insurance can help with benefits that range from $37,500 to $200,000 in the event of a covered accident.

We have looked at all contributions (and forfeitures) allocated to the participant�s account, and all premiums paid from the participants account, going back to the participant�s original date of. No percentage limit applies if the participant purchases life insurance with company contributions held in a profit sharing plan for two years or longer. And (ii) cannot be 3261 obtained through other involuntary market mechanisms. This is a theoretical contribution. The aggregate of life insurance premiums paid for the benefit of a participant, at all times, may not exceed the following percentages of the aggregate of. For whole life insurance the threshold is 66%.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

We have a client with a profit sharing plan with term life insurance. And (ii) cannot be 3261 obtained through other involuntary market mechanisms. This is a theoretical contribution. Qualified employer plans can provide “incidental” life insurance benefits, meaning that the amount of insurance is subject to restrictions. The aggregate of life insurance premiums paid for the benefit of a participant, at all times, may not exceed the following percentages of the aggregate of.

Source: slideserve.com

Source: slideserve.com

And (ii) cannot be 3261 obtained through other involuntary market mechanisms. And (ii) cannot be 3261 obtained through other involuntary market mechanisms. The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement. The incidental death benefit requirement is satisfied by not having the death benefit exceed the incidental reserve. The number of questions on the exam and the amount of time allowed to complete the exam varies depending on the state and.

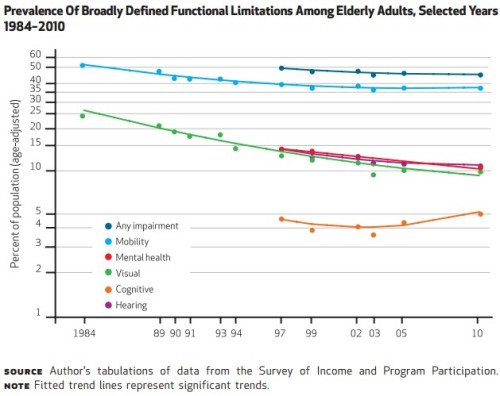

Source: theincidentaleconomist.com

Source: theincidentaleconomist.com

The number of questions on the exam and the amount of time allowed to complete the exam varies depending on the state and. One of the many advantages of life insurance is that it provides many tax benefits. We have looked at all contributions (and forfeitures) allocated to the participant�s account, and all premiums paid from the participants account, going back to the participant�s original date of. Regarding the contribution limits, life insurance coverage in a defined contribution plan is considered incidental if the amount of employer contributions and forfeitures used to purchase whole or term life insurance benefits are limited to 50 percent for whole life, and 25 percent for term policies. Incidental coverage means any other type of liability insurance covering activities directly related 3259 to the continued and efficient delivery of health care that:

Source: sec.gov

Source: sec.gov

Accidental death and dismemberment insurance is very different from other life insurance policies like term life. In checking the incidental benefit limitation, there are 2 participants whose premiums exceed the 25% limit. Qualified employer plans can provide “incidental” life insurance benefits, meaning that the amount of insurance is subject to restrictions. Currently, under this section, you can get a maximum tax deduction of rs. The incidental death benefit requirement is satisfied by not having the death benefit exceed the incidental reserve.

Source: slideserve.com

Source: slideserve.com

Under treasury regulations, this incidental benefit results in limits being placed on the amount of premiums paid as follows: Qualified employer plans can provide “incidental” life insurance benefits, meaning that the amount of insurance is subject to restrictions. As health insurance is one of the most important purchases in life, one should thoroughly understand the good and the bad before making a purchase. We have a client with a profit sharing plan with term life insurance. Check with your state’s license exam administrator for details.

Source: istorya.net

Source: istorya.net

(i) cannot be obtained in the voluntary market 3260 because medical malpractice insurance is being provided pursuant to this chapter; We have looked at all contributions (and forfeitures) allocated to the participant�s account, and all premiums paid from the participants account, going back to the participant�s original date of. Check with your state’s license exam administrator for details. The basic rule is the 100 to 1 rule, which would indicate that the participant could have a death benefit of 100 x the monthly pension benefit of $16,250, for a total insured death benefit of $1,625,000. Accidental death and dismemberment insurance is very different from other life insurance policies like term life.

Source: solexam.com

Source: solexam.com

The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan. For defined contribution plans, life insurance coverage is considered incidental if the amount of employer contributions and forfeitures used to purchase whole or term life insurance benefits under a plan are limited to 50 percent for whole life, and 25 percent for term policies. Under treasury regulations, this incidental benefit results in limits being placed on the amount of premiums paid as follows: Currently, under this section, you can get a maximum tax deduction of rs. We have a client with a profit sharing plan with term life insurance.

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

As health insurance is one of the most important purchases in life, one should thoroughly understand the good and the bad before making a purchase. Check with your state’s license exam administrator for details. This is a theoretical contribution. For whole life insurance the threshold is 66%. Though life insurance may be purchased with qualified plan assets, strict limitations imposed by the irs require that the life insurance protection be only “incidental” to the retirement.

Source: neamb.com

Source: neamb.com

The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan. The aggregate of life insurance premiums paid for the benefit of a participant, at all times, may not exceed the following percentages of the aggregate of. As health insurance is one of the most important purchases in life, one should thoroughly understand the good and the bad before making a purchase. The number of questions on the exam and the amount of time allowed to complete the exam varies depending on the state and. The basic rule is the 100 to 1 rule, which would indicate that the participant could have a death benefit of 100 x the monthly pension benefit of $16,250, for a total insured death benefit of $1,625,000.

Source: morning-update213111.blogspot.com

Source: morning-update213111.blogspot.com

The basic rule is the 100 to 1 rule, which would indicate that the participant could have a death benefit of 100 x the monthly pension benefit of $16,250, for a total insured death benefit of $1,625,000. The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement. Accidental death insurance can help with benefits that range from $37,500 to $200,000 in the event of a covered accident. Though life insurance may be purchased with qualified plan assets, strict limitations imposed by the irs require that the life insurance protection be only “incidental” to the retirement. The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan.

Source: edcatu.blogspot.com

Source: edcatu.blogspot.com

Accidental death and dismemberment insurance is very different from other life insurance policies like term life. No percentage limit applies if the participant purchases life insurance with company contributions held in a profit sharing plan for two years or longer. The number of questions on the exam and the amount of time allowed to complete the exam varies depending on the state and. One of the many advantages of life insurance is that it provides many tax benefits. We have a client with a profit sharing plan with term life insurance.

Source: summitgreensboro.com

Source: summitgreensboro.com

Currently, under this section, you can get a maximum tax deduction of rs. Currently, under this section, you can get a maximum tax deduction of rs. The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement. No percentage limit applies if the participant purchases life insurance with company contributions held in a profit sharing plan for two years or longer. Specified amount of money (life insurance guarantees to the beneficiary a specified sum of money in the event of the insured�s death.)

Source: morning-update213111.blogspot.com

Source: morning-update213111.blogspot.com

And (ii) cannot be 3261 obtained through other involuntary market mechanisms. In checking the incidental benefit limitation, there are 2 participants whose premiums exceed the 25% limit. The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan. Accidental death and dismemberment insurance is very different from other life insurance policies like term life. To make contract of insurance valid in the eye of law, some essential elements must be considered in its process of validity.

Source: premierclimatecontrol.com

Source: premierclimatecontrol.com

The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan. Under treasury regulations, this incidental benefit results in limits being placed on the amount of premiums paid as follows: (i) cannot be obtained in the voluntary market 3260 because medical malpractice insurance is being provided pursuant to this chapter; Premiums may not exceed 33% of the theoretical contribution if you’re using term or universal life insurance. Knowing the difference is crucial to.

Source: slideserve.com

Source: slideserve.com

The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement. Under treasury regulations, this incidental benefit results in limits being placed on the amount of premiums paid as follows: Knowing the difference is crucial to. Accidental death and dismemberment insurance is very different from other life insurance policies like term life. As health insurance is one of the most important purchases in life, one should thoroughly understand the good and the bad before making a purchase.

Source: morning-update213111.blogspot.com

This is a theoretical contribution. Check with your state’s license exam administrator for details. The worse outcome is that exceeding the incidental limits is a qualification issue, and the irs could disqualify the entire plan. Qualified employer plans can provide “incidental” life insurance benefits, meaning that the amount of insurance is subject to restrictions. We have a client with a profit sharing plan with term life insurance.

Source: danielsinsuranceinc.com

Source: danielsinsuranceinc.com

Charitable uses of life insurance. Regarding the contribution limits, life insurance coverage in a defined contribution plan is considered incidental if the amount of employer contributions and forfeitures used to purchase whole or term life insurance benefits are limited to 50 percent for whole life, and 25 percent for term policies. To make contract of insurance valid in the eye of law, some essential elements must be considered in its process of validity. Though life insurance may be purchased with qualified plan assets, strict limitations imposed by the irs require that the life insurance protection be only “incidental” to the retirement. If you are a salaried employee and have purchased a life insurance policy, you can claim deduction under section 80c.

Source: loveyoutomorrow.com

Source: loveyoutomorrow.com

We have a client with a profit sharing plan with term life insurance. For whole life insurance the threshold is 66%. Accidental death insurance can help with benefits that range from $37,500 to $200,000 in the event of a covered accident. Currently, under this section, you can get a maximum tax deduction of rs. The incidental benefit rules that apply to holding life insurance in a qualified retirement plan prevent the plan from retaining the policy past a participant’s retirement.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title incidental limitations life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.