Income protection insurance information

Home » Trend » Income protection insurance informationYour Income protection insurance images are ready. Income protection insurance are a topic that is being searched for and liked by netizens today. You can Get the Income protection insurance files here. Download all free photos and vectors.

If you’re searching for income protection insurance images information linked to the income protection insurance keyword, you have come to the right site. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

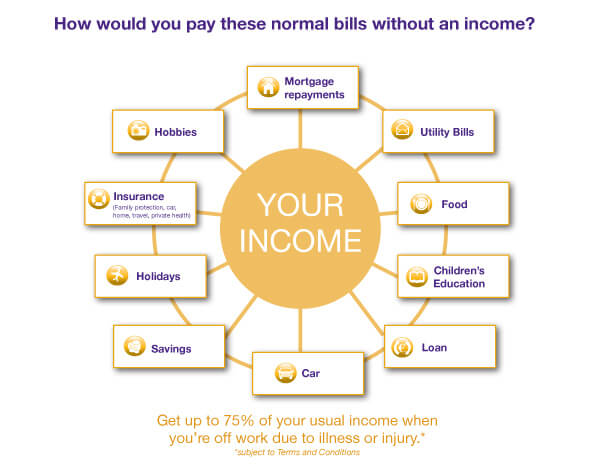

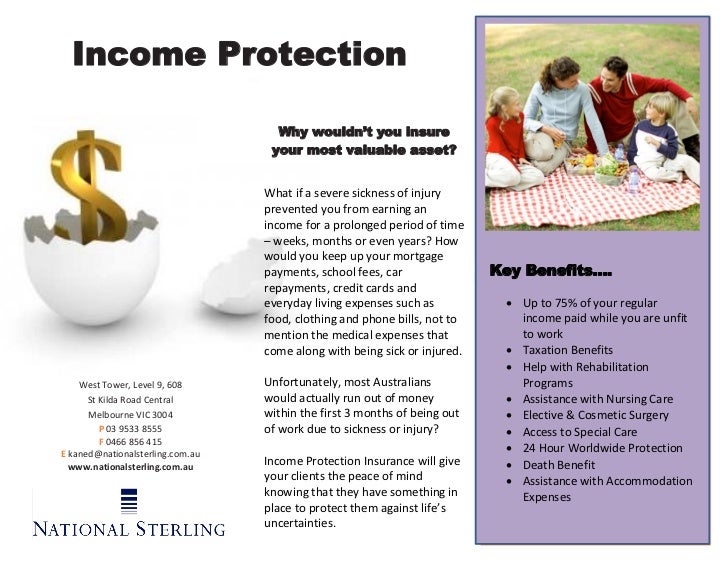

Income Protection Insurance. Only the premiums you pay to protect your income are deductible. This could help to make financial ends meet until you are well enough to return to work and start earning your regular income again. Income protection insurance can help replace up to 75% of your income and is payable from the insurance company your policy is with. You can claim a deduction for the cost of premiums you pay for insurance against the loss of your employment income.

Protection Insurance Why you need it? From expert-tax.com.au

Protection Insurance Why you need it? From expert-tax.com.au

When deciding if you need income protection insurance, you should consider your savings, how long your employer will continue to pay you, and what state benefits you may get after any employer payments stop. Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. Income protection insurance will provide you with financial support if you find yourself unable to work, due to accident or illness, or if you�re made redundant. There are, however, multiple kinds of income protection policies, so it helps to familiarize yourself with them so you can decide which ones are right for your situation. Income protection insurance provides you with regular monthly payments to assist with your financial commitments if you face an illness or injury that prevents you from working. These payments could assist with ongoing:

Income protection insurance can help replace up to 75% of your income and is payable from the insurance company your policy is with.

Once you’re well enough to return to your job, the payments stop. It pays a monthly cash benefit directly to you for up to 12 or 24 months during times when an accidental injury results in total disability leaving you unable to work. Income protection insurance offers a replacement income if you’re unable to work, usually due to illness or injury. Funding towards your monthly expenses, even if you cannot work 1 due to illness, accident or injury. Financial support for your loved ones and dependents, regardless of your ability to work 1 when you’re ill. Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work.

Source: slideshare.net

Source: slideshare.net

Existing aami customers get 5% discount on their policy. It doesn�t cover you if you�re unemployed or made redundant. Income protection insurance provides you with regular monthly payments to assist with your financial commitments if you face an illness or injury that prevents you from working. What is income protection insurance? The benefit starts after a waiting period which you choose and is payable for a maximum period which you choose.

Source: roban.ie

Source: roban.ie

If something happens to you then you’ll receive a monthly benefit to help with any expenses, including: What is income protection insurance? Why do you need income protection. Both policies are paid for in insurance premiums. Income protection insurance can help replace up to 75% of your income and is payable from the insurance company your policy is with.

Source: pinterest.com

Source: pinterest.com

It’s your money, your decision. What is income protection insurance? Income protection insurance is also known as permanent health insurance. This money can be used for anything you choose. Only the premiums you pay to protect your income are deductible.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

It doesn�t cover you if you�re unemployed or made redundant. Our income protection direct supplemental insurance plan is simple. Existing aami customers get 5% discount on their policy. Funding towards your monthly expenses, even if you cannot work 1 due to illness, accident or injury. Income protection insurance offers a replacement income if you’re unable to work, usually due to illness or injury.

Source: villageinsurancedirect.com

Source: villageinsurancedirect.com

Income protection will usually cover most illnesses and injuries that will render you unable to work for both short or long term periods. What is the deferred period? Income protection is designed to help you get back on your feet if you are unable to work due to an accident 1 or sickness 1. If you’re worried about what might happen if you become ill or lose your job, income protection insurance could offer you and your family security. What is income protection insurance?

Source: keyperson.com.au

Source: keyperson.com.au

This money can be used for anything you choose. Income protection is an insurance policy that offers financial support after a set term. What is income protection insurance? What is income protection insurance? What does income protection insurance cover?

Source: slideshare.net

Source: slideshare.net

Funding towards your monthly expenses, even if you cannot work 1 due to illness, accident or injury. What does income protection insurance cover? What is income protection insurance? There are, however, multiple kinds of income protection policies, so it helps to familiarize yourself with them so you can decide which ones are right for your situation. Existing aami customers get 5% discount on their policy.

Source: focusorm.co.uk

Source: focusorm.co.uk

It pays a monthly cash benefit directly to you for up to 12 or 24 months during times when an accidental injury results in total disability leaving you unable to work. Income protection will usually cover most illnesses and injuries that will render you unable to work for both short or long term periods. Only the premiums you pay to protect your income are deductible. It doesn�t cover you if you�re unemployed or made redundant. Income protection insurance is a policy that pays benefits to policyholders who are unable to work as the result of an illness or injury.

Source: spotwalls.com

Source: spotwalls.com

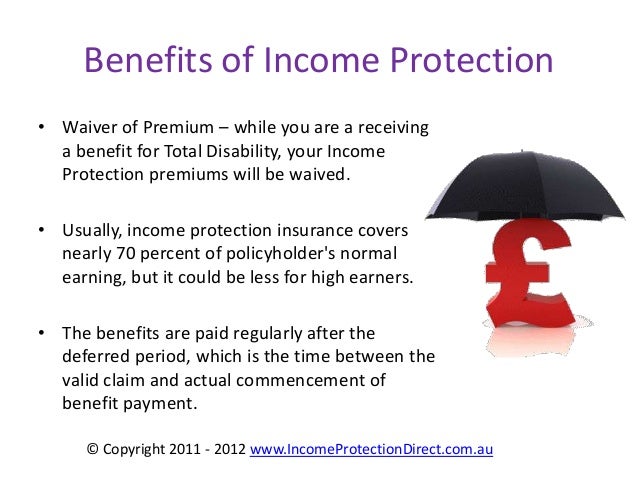

If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month. Income protection insurance gives you an income while you aren’t working. Existing aami customers get 5% discount on their policy. What is income protection insurance? The benefits of income protection:

It works by covering part of your salary when you’re unable to do your job through sickness or injury. There are, however, multiple kinds of income protection policies, so it helps to familiarize yourself with them so you can decide which ones are right for your situation. Financial support for your loved ones and dependents, regardless of your ability to work 1 when you’re ill. If you become sick or injured and unable to work, income protection cover can help cover most of your expenses and keep your life on track. Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work.

Source: insurancerepublic.ie

Source: insurancerepublic.ie

A loss of earnings could have a real financial impact on any family’s lifestyle, and income protection insurance is designed to meet the needs of people who want to protect against this, by payng out a regular monthly amount. There are, however, multiple kinds of income protection policies, so it helps to familiarize yourself with them so you can decide which ones are right for your situation. Income protection insurance is a policy which pays a monthly benefit if you are disabled due to illness or injury and, as a result, you are unable to work in your own occupation. Income protection insurance, also known as ip insurance, supports you financially if you’re unable to work because of injury or illness. Income protection insurance gives you an income while you aren’t working.

Source: visual.ly

Source: visual.ly

What is income protection insurance? The benefit starts after a waiting period which you choose and is payable for a maximum period which you choose. Only the premiums you pay to protect your income are deductible. Income protection insurance (ipi) is an insurance policy, available principally in australia, ireland, new zealand, south africa, and the united kingdom, paying benefits to policyholders who are incapacitated and hence unable to work due to illness or accident. There are, however, multiple kinds of income protection policies, so it helps to familiarize yourself with them so you can decide which ones are right for your situation.

Source: visual.ly

Source: visual.ly

Only the premiums you pay to protect your income are deductible. What does income protection insurance cover? What is income protection insurance? Our income protection direct supplemental insurance plan is simple. What is income protection insurance?

Source: expert-tax.com.au

Source: expert-tax.com.au

Income protection insurance is a policy which pays a monthly benefit if you are disabled due to illness or injury and, as a result, you are unable to work in your own occupation. Workers compensation is typically administered by the state and territory governments and is designed to cover employees for. Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. What does income protection insurance cover? This is known as income protection of continuing salary cover.

Source: pascoepartnersaccountants.com.au

Source: pascoepartnersaccountants.com.au

Our income protection direct supplemental insurance plan is simple. Existing aami customers get 5% discount on their policy. If something happens to you then you’ll receive a monthly benefit to help with any expenses, including: Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. Our income protection insurance supports you financially if you’re unable to work because of injury or illness.

Source: slideshare.net

Source: slideshare.net

These payments could assist with ongoing: Only the premiums you pay to protect your income are deductible. If you’re worried about what might happen if you become ill or lose your job, income protection insurance could offer you and your family security. Income protection insurance pays you a regular income if you can�t work because of sickness or disability and continues until you return to paid work or you retire. Income protection insurance is a policy that pays benefits to policyholders who are unable to work as the result of an illness or injury.

Source: financegab.com

Source: financegab.com

The benefits of income protection: Income protection insurance pays you a regular income if you can�t work because of sickness or disability and continues until you return to paid work or you retire. This could help to make financial ends meet until you are well enough to return to work and start earning your regular income again. Income protection insurance can help replace up to 75% of your income and is payable from the insurance company your policy is with. Both policies are paid for in insurance premiums.

Source: slideshare.net

Source: slideshare.net

It pays a monthly cash benefit directly to you for up to 12 or 24 months during times when an accidental injury results in total disability leaving you unable to work. If you become sick or injured and unable to work, income protection cover can help cover most of your expenses and keep your life on track. Income protection insurance will provide you with financial support if you find yourself unable to work, due to accident or illness, or if you�re made redundant. Income protection insurance can give you the peace of mind you deserve. Income protection will usually cover most illnesses and injuries that will render you unable to work for both short or long term periods.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title income protection insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.