Income protection insurance unemployment cover information

Home » Trend » Income protection insurance unemployment cover informationYour Income protection insurance unemployment cover images are ready. Income protection insurance unemployment cover are a topic that is being searched for and liked by netizens today. You can Find and Download the Income protection insurance unemployment cover files here. Find and Download all royalty-free vectors.

If you’re searching for income protection insurance unemployment cover images information connected with to the income protection insurance unemployment cover topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Income Protection Insurance Unemployment Cover. Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. The benefits ceiling for ordinary unemployment insurance covers monthly incomes of up to sek 33 000 only. Unemployment cover acts as insurance for unemployed periods, so if you lose your job, your insurer would pay you a monthly income. When comparing income protection policies, you’ll be asked to choose between accident and sickness protection only, unemployment protection only or comprehensive income protection, which covers both.

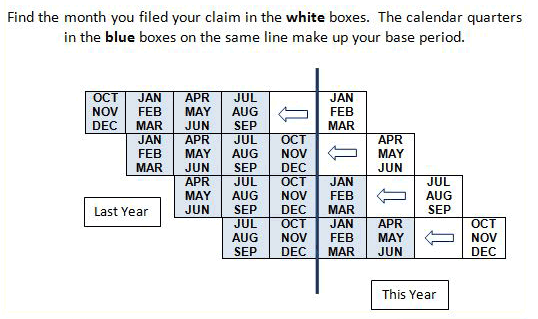

Temporarily waiving some unemployment insurance benefit From reddit.com

Temporarily waiving some unemployment insurance benefit From reddit.com

If your income is less than sek 33 000 but more than sek 27 500 per. Income protection refers to a range of insurance policies designed to ensure you’ll continue to receive an income if you’re unable to work due to illness or disability. Virgin income protection and virgin life insurance are promoted by virgin money (australia) pty limited abn 75 103 478 897, authorised representative no 280884 of virgin money financial. We stopped offering new income protection insurance policies from 1 april 2021. It can be used to protect things like your income, mortgage payments or loan and credit card repayments. For example, if you break your leg or are made redundant.

This gives you the reassurance that you’ll be able to continue to make these payments if you were unable to work.

If you’ve returned to work for at least 16 hours a week for at least six months in a row, you can make another claim if you�re unable to work due to illness or injury. What does unemployment insurance cover? Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. Although income protection does not typically include unemployment cover automatically, it can be added at additional cost with most providers, and can offer peace of mind for those worried about. Is unemployment covered by income protection? If you’ve returned to work for at least 16 hours a week for at least six months in a row, you can make another claim if you�re unable to work due to illness or injury.

Source: des.az.gov

Source: des.az.gov

If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month. It provides cover for your income, for up to 12 months, if you�re unable to work due to involuntary redundancy. It will often provide up to 12 months of cover which should allow you to keep up with all your essential expenditure such as mortgage payments, grocery shopping and bills while you. Note that, in the event of a successful claim, there might be a deferred or ‘wait’ period before the initial payment is made. Is unemployment covered by income protection?

Source: finovate.com

Source: finovate.com

When comparing income protection policies, you’ll be asked to choose between accident and sickness protection only, unemployment protection only or comprehensive income protection, which covers both. Is unemployment covered by income protection? This gives you the reassurance that you’ll be able to continue to make these payments if you were unable to work. Unemployment insurance which is also known as redundancy insurance, will protect a proportion of your monthly income if you’re made forcibly redundant through no fault of your own. If you’ve returned to work for at least 16 hours a week for at least six months in a row, you can make another claim if you�re unable to work due to illness or injury.

Source: pinterest.com

Source: pinterest.com

Instead, certain plans offer redundancy cover as an option, which will provide you. It can be used to protect things like your income, mortgage payments or loan and credit card repayments. Unemployment insurance, or employment protection insurance, is a type of income protection insurance policy. Income protection refers to a range of insurance policies designed to ensure you’ll continue to receive an income if you’re unable to work due to illness or disability. And many employees opt to pay for various types of income protection cover, such as ‘redundancy insurance’ and ‘unemployment cover’.

Source: globaldata.com

Source: globaldata.com

If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month. Most permanent employees receive sick pay from their employer when they can’t work through illness. While you can’t receive 100% of your salary, you can typically get 70% of your income before tax. If you become unemployed whilst you have the policy you can still claim, if you become ill or injured, so long as you’ve continued to pay. Note that, in the event of a successful claim, there might be a deferred or ‘wait’ period before the initial payment is made.

Source: pinterest.com

Source: pinterest.com

Existing policies and claims will continue to be administered under agreement with the insurers, tal life and for involuntary unemployment cover, st andrew�s. To help cover some of your lost earnings for up to 12 months following the deferred period. Our income protection insurance provides you with cover for income up to sek 80 000 per month and you receive approximately 80% of your monthly salary for up to 150 days. Although income protection does not typically include unemployment cover automatically, it can be added at additional cost with most providers, and can offer peace of mind for those worried about. If you already have an income protection insurance policy, there’s no change to your cover.

Source: insurancelovers.com

Source: insurancelovers.com

We stopped offering new income protection insurance policies from 1 april 2021. Income protection refers to a range of insurance policies designed to ensure you’ll continue to receive an income if you’re unable to work due to illness or disability. While it may not be as possible to buy income protection insurance that includes unemployment cover in the middle of an economic crisis, one likely outcome of. There is a similar type of insurance out there known as accident, sickness and unemployment cover. If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month.

Source: bobatoo.co.uk

Source: bobatoo.co.uk

What our income protection insurance includes. It can be used to protect things like your income, mortgage payments or loan and credit card repayments. Read more about income protection insurance. To help cover some of your lost earnings for up to 12 months following the deferred period. You�ll hear it called unemployment protection insurance too.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

For example, if you break your leg or are made redundant. How much of my income will it cover? Income protection benefit is not unemployment cover so it won’t pay out due to being made unemployed. You won�t be covered by a standard income protection policy. For example, if you break your leg or are made redundant.

Source: thommy-aguilas.blogspot.com

Source: thommy-aguilas.blogspot.com

Income protection refers to a family of insurance products which ensure you can continue to meet your financial commitments if you are forced to take an extended break from work. Instead, certain plans offer redundancy cover as an option, which will provide you. It can be used to protect things like your income, mortgage payments or loan and credit card repayments. Most permanent employees receive sick pay from their employer when they can’t work through illness. If you already have an income protection insurance policy, there’s no change to your cover.

Source: slideshare.net

Source: slideshare.net

If you’ve returned to work for at least 16 hours a week for at least six months in a row, you can make another claim if you�re unable to work due to illness or injury. Although income protection does not typically include unemployment cover automatically, it can be added at additional cost with most providers, and can offer peace of mind for those worried about. Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. There is a similar type of insurance out there known as accident, sickness and unemployment cover. Unemployment cover acts as insurance for unemployed periods, so if you lose your job, your insurer would pay you a monthly income.

Source: oncomie.blogspot.com

Source: oncomie.blogspot.com

Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. It will often provide up to 12 months of cover which should allow you to keep up with all your essential expenditure such as mortgage payments, grocery shopping and bills while you. If you already have an income protection insurance policy, there’s no change to your cover. How much of my income will it cover? If you’ve returned to work for at least 16 hours a week for at least six months in a row, you can make another claim if you�re unable to work due to illness or injury.

Source: ixivixi.com

Source: ixivixi.com

This gives you the reassurance that you’ll be able to continue to make these payments if you were unable to work. There is a similar type of insurance out there known as accident, sickness and unemployment cover. We don’t offer new income protection insurance anymore. This is because income protection insurance is primarily intended to cover you against sickness or accident affecting your ability to earn an income. Although income protection does not typically include unemployment cover automatically, it can be added at additional cost with most providers, and can offer peace of mind for those worried about.

Source: aspectuw.com.au

Source: aspectuw.com.au

Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. Is unemployment covered by income protection? Virgin income protection and virgin life insurance are promoted by virgin money (australia) pty limited abn 75 103 478 897, authorised representative no 280884 of virgin money financial. Up to 70%, but closer to 50% is more typical. The benefits ceiling for ordinary unemployment insurance covers monthly incomes of up to sek 33 000 only.

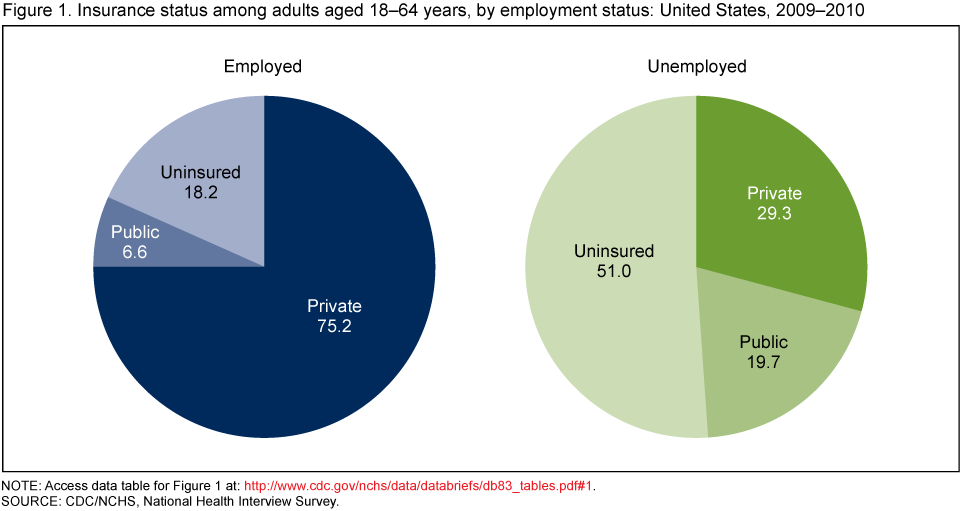

Source: cdc.gov

Source: cdc.gov

Although income protection does not typically include unemployment cover automatically, it can be added at additional cost with most providers, and can offer peace of mind for those worried about. And many employees opt to pay for various types of income protection cover, such as ‘redundancy insurance’ and ‘unemployment cover’. It can be used to protect things like your income, mortgage payments or loan and credit card repayments. Income protection insurance is completely different. This gives you the reassurance that you’ll be able to continue to make these payments if you were unable to work.

Source: themortgageconsultancy.co.uk

Source: themortgageconsultancy.co.uk

We stopped offering new income protection insurance policies from 1 april 2021. Up to 70%, but closer to 50% is more typical. Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month. We don’t offer new income protection insurance anymore.

Source: reddit.com

Source: reddit.com

Read more about income protection insurance. How much of my income will it cover? For example, if you break your leg or are made redundant. Income protection insurance is completely different. You won�t be covered by a standard income protection policy.

Source: hchra.shrm.org

To help cover some of your lost earnings for up to 12 months following the deferred period. Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. Virgin income protection and virgin life insurance are promoted by virgin money (australia) pty limited abn 75 103 478 897, authorised representative no 280884 of virgin money financial. Income protection benefit is not unemployment cover so it won’t pay out due to being made unemployed. If you already have an income protection insurance policy, there’s no change to your cover.

Source: pinterest.com

Source: pinterest.com

Until recently, onepath onecare income secure and comminsure income care policies offered payment of anz or cba minimum loan repayments for up to 3 months in the event of involuntary unemployment. And many employees opt to pay for various types of income protection cover, such as ‘redundancy insurance’ and ‘unemployment cover’. Up to 70%, but closer to 50% is more typical. If you can’t work because you’ve had an accident, fallen sick, or lost your job through no fault of your own, income protection insurance pays you an agreed portion of your salary each month. What our income protection insurance includes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title income protection insurance unemployment cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.