Income replacement insurance Idea

Home » Trending » Income replacement insurance IdeaYour Income replacement insurance images are available. Income replacement insurance are a topic that is being searched for and liked by netizens now. You can Get the Income replacement insurance files here. Find and Download all free vectors.

If you’re looking for income replacement insurance images information connected with to the income replacement insurance interest, you have visit the right site. Our website always gives you hints for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

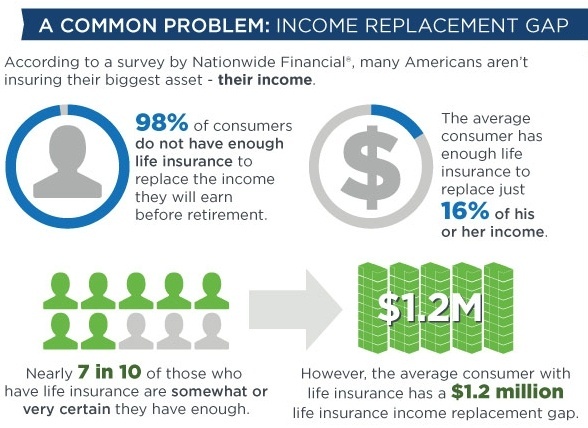

Income Replacement Insurance. Some people may not realize the immediate financial benefits that a life insurance policy can bring to a family when a loved one dies and a regular stream of income ends. If you are unable to work, your health insurance will only pay you a replacement income if you have contributed to the belgian social security system over the last 12 months (six in the event of pregnancy). Permanent health insurance will cover you for a percentage of your income if you have an accident or illness that leaves you unable to work. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn.

Elementum Money From elementummoney.com

Elementum Money From elementummoney.com

Income replacement refers to insurance policies designed to replace part or all of your income if you or your dependents couldn�t count on it anymore. Benefit starts at one hundred pesos per unit and up to a maximum benefit of two thousand pesos (php 2,000.00) per day. That’s where life insurance comes in. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn. Accident and sickness cover pays out until you can return to work, usually for one or two years. $10,000 $12,500 $15,000 $17,500 $20,000 $22,500.

Income replacement is one of the main reasons many people, especially those who have loved ones depending on them financially, have life insurance.

How much life insurance do you need? Some assured increases automatically as the time passes and it balances inflation successfully. If you are unable to work, your health insurance will only pay you a replacement income if you have contributed to the belgian social security system over the last 12 months (six in the event of pregnancy). That’s where life insurance comes in. Providing life insurance as an employee benefit helps alleviate the financial concerns related to premature death. The risks covered can include disability, illness, accidents, unemployment or involuntary redundancy.

Source: elementummoney.com

Source: elementummoney.com

Some of the riders available to an individual. Unemployment cover pays out a replacement income if you lose your job. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn. Your monthly benefit can be higher as income replacement plans can include more than just salary. Income replacement refers to insurance policies designed to replace part or all of your income if you or your dependents couldn�t count on it anymore.

Source: hopeinsurancebroker.ca

Source: hopeinsurancebroker.ca

The income replacement benefits plan will partially compensate you for any loss of income you suffer as a result of your injuries. In some cases, starting coverage can be as high as $1,800,000 ($5,000 per month for 30 years). Some of the riders available to an individual. There is no maturity benefit. An income replacement term insurance plan is a death benefit plan.

Source: blog.nationwide.com

Source: blog.nationwide.com

Income replacement policies help replace part of your regular working income while you are off work. Today, insurers are offering term insurance with an increasing cover at the rate of 5% to 10% annually. Whether or not you are entitled to a replacement income depends on your personal situation as certain conditions. When you are thinking of term insurance, specifically as an income replacement plan, opting for those that offer return of premium makes sense. Group ltd plans typically are payable after 120 days but an individual plan can be payable from day 1.

Source: burgessinsurance.ca

Source: burgessinsurance.ca

Providing life insurance as an employee benefit helps alleviate the financial concerns related to premature death. What is income protection insurance? $10,000 $12,500 $15,000 $17,500 $20,000 $22,500. Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. Some people may not realize the immediate financial benefits that a life insurance policy can bring to a family when a loved one dies and a regular stream of income ends.

![Are You Insuring Your Biggest Asset? [Infographic] Are You Insuring Your Biggest Asset? [Infographic]](https://blog.nationwide.com/wp-content/uploads/2013/09/LifeInsurance_850w-infographic-approved-2.png) Source: blog.nationwide.com

Source: blog.nationwide.com

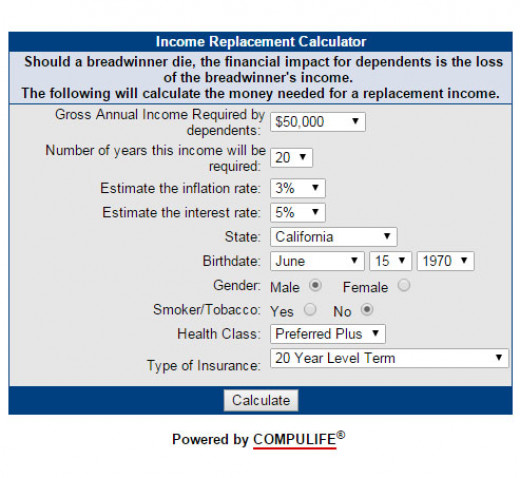

Income replacement assurance (ira) manila bankers life’s hospital daily income product is a yearly renewable policy that gives you protection by providing compensation of lost income in case of hospital confinement. Income replacement policies help replace part of your regular working income while you are off work. Income replacement is one of the main reasons many people, especially those who have loved ones depending on them financially, have life insurance. Gross annual income needed by dependents. The following will calculate the lump sum of money needed to provide a replacement income.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

The income replacement benefits plan will partially compensate you for any loss of income you suffer as a result of your injuries. Unemployment cover pays out a replacement income if you lose your job. The long term disability definition of “disability” a key question regarding income replacement policies is what constitutes a triggering event entitling the covered. The income replacement approach is a method of determining the amount of life insurance you should purchase. Gross annual income needed by dependents.

Source: lifewealthwin.com

Source: lifewealthwin.com

Providing life insurance as an employee benefit helps alleviate the financial concerns related to premature death. A disability can result from a number of causes, including an injury, a serious illness or a mental health issue. If the life assured passes away during the policy period, the nominee would receive a percentage of sum assured every month as. Disability income replacement insurance (or income insurance) is designed to compensate an employee for the loss of income due to an absence from work, a solution for income replacement. Income replacement is one of the main reasons many people, especially those who have loved ones depending on them financially, have life insurance.

Source: expatriatehealthcare.com

Source: expatriatehealthcare.com

Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. In some cases, starting coverage can be as high as $1,800,000 ($5,000 per month for 30 years). It takes less than 60 seconds to see if you qualify. They’re helpful, but often insufficient. The risks covered can include disability, illness, accidents, unemployment or involuntary redundancy.

Source: expatriatehealthcare.com

Source: expatriatehealthcare.com

A disability can result from a number of causes, including an injury, a serious illness or a mental health issue. Group ltd plans typically are payable after 120 days but an individual plan can be payable from day 1. $10,000 $12,500 $15,000 $17,500 $20,000 $22,500. Gross annual income needed by dependents. The income replacement ratio is used by pensions and other entities who deal with retirement.

Source: hubpages.com

Source: hubpages.com

Gross annual income needed by dependents. Providing life insurance as an employee benefit helps alleviate the financial concerns related to premature death. Annual coverage (12 monthly payments) is capped at a percentage of your gross income, as follows: Some assured increases automatically as the time passes and it balances inflation successfully. An income replacement term insurance plan is a death benefit plan.

Source: blog.insurethelake.com

Source: blog.insurethelake.com

Instead, once you successfully made your claim, you will receive monthly instalments of an agreed sum. Some of the riders available to an individual. Whether or not you are entitled to a replacement income depends on your personal situation as certain conditions. The income replacement benefits plan will partially compensate you for any loss of income you suffer as a result of your injuries. Your monthly benefit can be higher as income replacement plans can include more than just salary.

Source: uhyhn.co.nz

Source: uhyhn.co.nz

There is no maturity benefit. The following will calculate the lump sum of money needed to provide a replacement income. The risks covered can include disability, illness, accidents, unemployment or involuntary redundancy. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn. Disability income replacement insurance (or income insurance) is designed to compensate an employee for the loss of income due to an absence from work, a solution for income replacement.

Source: termlifeadvice.com

Source: termlifeadvice.com

There is no maturity benefit. Additionally, coverage duration is capped by your age as shown in the table below. The importance of income replacement. The income protection insurance offered by moneysupermarket is not agreed between your insurer and your mortgage or loan lender. The benefit is paid after all income replacement sources — e.g., employer group benefits, employment insurance (ei).

Source: longevityhealthfitness.blogspot.com

Source: longevityhealthfitness.blogspot.com

The long term disability definition of “disability” a key question regarding income replacement policies is what constitutes a triggering event entitling the covered. Annual coverage (12 monthly payments) is capped at a percentage of your gross income, as follows: Group ltd plans typically are payable after 120 days but an individual plan can be payable from day 1. To qualify, you must initiate the claims. They’re helpful, but often insufficient.

Source: unovest.co

Source: unovest.co

There is no maturity benefit. Income replacement policies help replace part of your regular working income while you are off work. It takes less than 60 seconds to see if you qualify. They’re helpful, but often insufficient. If you are unable to work, your health insurance will only pay you a replacement income if you have contributed to the belgian social security system over the last 12 months (six in the event of pregnancy).

Source: reduanhanif.blogspot.com

Source: reduanhanif.blogspot.com

Permanent health insurance will cover you for a percentage of your income if you have an accident or illness that leaves you unable to work. Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. They’re helpful, but often insufficient. When you are thinking of term insurance, specifically as an income replacement plan, opting for those that offer return of premium makes sense. Any amount you are eligible for or receive from other income replacement.

Source: youtube.com

Source: youtube.com

The income replacement benefits plan will partially compensate you for any loss of income you suffer as a result of your injuries. The importance of income replacement. U.s citizens are now eligible to receive income replacement with this new unknown life insurance policy. Benefit starts at one hundred pesos per unit and up to a maximum benefit of two thousand pesos (php 2,000.00) per day. To qualify, you must initiate the claims.

Source: expatriatehealthcare.com

Source: expatriatehealthcare.com

You then make your repayments to your creditors in a separate transaction. Under this approach, the insurance purchased is based on the value of the income the insured breadwinner can expect to earn. It takes less than 60 seconds to see if you qualify. Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. Your monthly benefit can be higher as income replacement plans can include more than just salary.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title income replacement insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.