Increasing term insurance information

Home » Trend » Increasing term insurance informationYour Increasing term insurance images are available. Increasing term insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Increasing term insurance files here. Download all free images.

If you’re searching for increasing term insurance pictures information related to the increasing term insurance keyword, you have pay a visit to the ideal blog. Our site always provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Increasing Term Insurance. Most term life policies are level, meaning your premiums are. Along with the benefit of providing higher coverage to the family of the insured, there are many other features of increasing term insurance plan, which includes the following. As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. Increasing term life insurance policy 👪 feb 2022.

Term Insurance Articles Information, Tips, Reviews From policybazaar.com

Term Insurance Articles Information, Tips, Reviews From policybazaar.com

The increasing term insurance plans are specifically designed keeping in mind the changing circumstances of individual life and the increasing inflation rate. Provides beneficiaries with a means to settle debt obligations. With increasing term, your coverage amount will rise by increments throughout the policy term, sometimes along with your premium rates. For example, if you choose a $250,000 policy with a 5% increasing term, your policy face amount will be $312,500 in five years. In an increasing term insurance plan, the sum assured increases by a predefined amount every year until completing the policy term. Most term life policies are level, meaning your premiums are stable and the death benefit does not change.

What is an increasing term insurance plan?

Unlike a regular term insurance plan, an increasing term plan allows the policyholder to increase the sum assured during the policy period. In an increasing term insurance plan, the sum assured increases by a predefined amount every year until completing the policy term. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. The premium rate might or might not remain same throughout the plan tenure. Foremost, an increasing term insurance plan is your cover again, increasing inflation.

Source: abiewtt.blogspot.com

Source: abiewtt.blogspot.com

Increasing term insurance plan with its gradual but steady approach to increment maintain that balance effectively and help your family take care. Indian insurers raised term insurance premiums by roughly 3% at the start of the financial year 2021. In an increasing term insurance plan, the sum assured increases by a predefined amount every year until completing the policy term. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Decreasing term insurance is ideal for individuals who wish to cover their financial obligations, debt, or loans.

Source: policybazaar.com

Source: policybazaar.com

Tax benefits raise your savings besides saving your dear ones against the ill effects of inflation, increasing term insurance cover raises your savings by offering tax benefits on the premiums you pay to the insurance company. Provides beneficiaries with a means to settle debt obligations. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. As the name suggests, an increasing term insurance plan is a term insurance plan wherein the sum assured chosen on plan commencement increases every year by a specified amount.

Source: in.pinterest.com

Source: in.pinterest.com

What is an increasing term insurance plan? In an increasing term insurance plan, the sum assured increases every year by a predefined amount to adjust against inflation or other financial goals. This option ensures that the value of the policy doesn�t erode over time due to the effects of inflation and maintains its buying power. How does increasing term insurance work? Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

Source: hoken.rakuten.co.jp

Source: hoken.rakuten.co.jp

With increasing term, your coverage amount will rise by increments throughout the policy term, sometimes along with your premium rates. How does increasing term insurance work? As an added bonus, several optional riders are available for increasing term life insurance. In an increasing term insurance plan, the sum assured increases by a predefined amount every year until completing the policy term. Even though the coverage of the.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

With increasing term, your coverage amount will rise by increments throughout the policy term, sometimes along with your premium rates. The instrument is ideal because it complements the size decrease of the debts and financial obligations over a fixed period of time. If you die during this time, your beneficiary receives a death benefit from the life insurance company. With increasing term, your coverage amount will rise by increments throughout the policy term, sometimes along with your premium rates. In addition, depending on your insurer, the policy rates may or may not change.

Source: clever-mortgages.co.uk

Source: clever-mortgages.co.uk

As an added bonus, several optional riders are available for increasing term life insurance. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. Indian insurers raised term insurance premiums by roughly 3% at the start of the financial year 2021. Provides beneficiaries with a means to settle debt obligations.

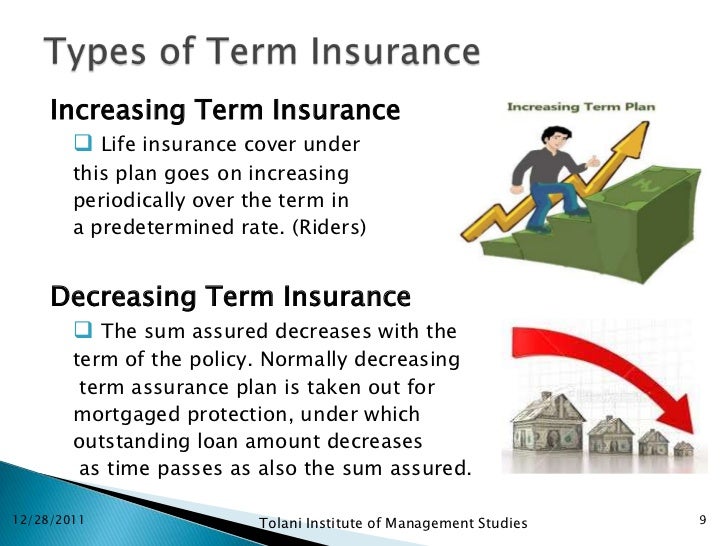

Source: slideshare.net

Source: slideshare.net

As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. Indian insurers raised term insurance premiums by roughly 3% at the start of the financial year 2021. If you die after the term, your beneficiary receives nothing. The major drawback to an increasing term life insurance plan is the fact that the premium will generally increase. In an increasing term insurance plan, the sum assured increases every year by a predefined amount to adjust against inflation or other financial goals.

Source: researchgate.net

Source: researchgate.net

If you die after the term, your beneficiary receives nothing. Unlike other forms of insurance whereby the premiums remain the same each month, increasing term cover premiums usually increase periodically. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. With increasing term, your coverage amount will rise by increments throughout the policy term, sometimes along with your premium rates. How does increasing term insurance work?

Source: abiewtt.blogspot.com

Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. As an added bonus, several optional riders are available for increasing term life insurance. Unlike other forms of insurance whereby the premiums remain the same each month, increasing term cover premiums usually increase periodically. Foremost, an increasing term insurance plan is your cover again, increasing inflation. Most term life policies are level, meaning your premiums are stable and the death benefit does not change.

Source: beshak.org

Source: beshak.org

With an increasing term insurance plan, the policyholder can increase the sum assured amount at any time during the policy term. The major drawback to an increasing term life insurance plan is the fact that the premium will generally increase. It is just opposite to the decreasing term insurance plan. The increasing term insurance plans are specifically designed keeping in mind the changing circumstances of individual life and the increasing inflation rate. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount.

Source: instantbazinga.com

Source: instantbazinga.com

If you die during this time, your beneficiary receives a death benefit from the life insurance company. Generally, all insurance policies have an option to extend or renew a policy after the completion of its term. Ideally, increasing term insurance plans are helpful when achieving financial goals for you and your family at various periods of life. With an increasing term insurance plan, the policyholder can increase the sum assured amount at any time during the policy term. In an increasing term insurance plan, the sum assured increases by a predefined amount every year until completing the policy term.

Source: youtube.com

Source: youtube.com

Increasing term life insurance plans are designed to provide a solution to the problem of inflation, and ensure that the death benefit (which can be substantial at the time of purchase) remains substantial when it is finally paid. The major drawback to an increasing term life insurance plan is the fact that the premium will generally increase. If you die after the term, your beneficiary receives nothing. Life auto home health business renter disability commercial auto long term care annuity. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount.

Source: canarahsbclife.com

Source: canarahsbclife.com

An increasing term insurance cover will help you achieve that number easily. An increasing term insurance cover will help you achieve that number easily. Along with the benefit of providing higher coverage to the family of the insured, there are many other features of increasing term insurance plan, which includes the following. How does increasing term insurance work? Ideally, increasing term insurance plans are helpful when achieving financial goals for you and your family at various periods of life.

Source: choozi.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. In an increasing term insurance plan, the sum assured increases every year by a predefined amount to adjust against inflation or other financial goals. Increasing term life insurance policy 👪 feb 2022. Premiums are usually constant throughout the contract, and.

Source: wishpolicy.com

Source: wishpolicy.com

Unlike a regular term insurance plan, an increasing term plan allows the policyholder to increase the sum assured during the policy period. Indian insurers raised term insurance premiums by roughly 3% at the start of the financial year 2021. The instrument is ideal because it complements the size decrease of the debts and financial obligations over a fixed period of time. Most term life policies are level, meaning your premiums are stable and the death benefit does not change. Premiums are usually constant throughout the contract, and.

Source: workwithseangrant.com

Source: workwithseangrant.com

It’s different from simply increasing your existing coverage amount by adding a policy or rider. What is increasing term insurance? Most term life policies are level, meaning your premiums are stable and the death benefit does not change. What is an increasing term insurance plan? This option ensures that the value of the policy doesn�t erode over time due to the effects of inflation and maintains its buying power.

Source: aaronpeacock.com

Source: aaronpeacock.com

Most term life policies are level, meaning your premiums are stable and the death benefit does not change. Adding a rider to your increasing term policy can help you tailor your coverage to your specific needs. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount. Increasing term life insurance plans are designed to provide a solution to the problem of inflation, and ensure that the death benefit (which can be substantial at the time of purchase) remains substantial when it is finally paid. Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage.

Source: policyadvice.net

Source: policyadvice.net

Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. Increasing term insurance plan with its gradual but steady approach to increment maintain that balance effectively and help your family take care. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. It is anticipated to increase even higher, reaching 15% to 20%. Unlike other forms of insurance whereby the premiums remain the same each month, increasing term cover premiums usually increase periodically.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title increasing term insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.