Increasing term life insurance information

Home » Trending » Increasing term life insurance informationYour Increasing term life insurance images are available in this site. Increasing term life insurance are a topic that is being searched for and liked by netizens today. You can Get the Increasing term life insurance files here. Get all royalty-free vectors.

If you’re searching for increasing term life insurance images information linked to the increasing term life insurance keyword, you have visit the right site. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Increasing Term Life Insurance. Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. Increasing term life insurance policy 👪 feb 2022. When you have your first child; But how does this type of policy work and will your premiums increase too?

How Does A Car’s Age Affect Its Insurance Premium? Wide Info From wideinfo.org

How Does A Car’s Age Affect Its Insurance Premium? Wide Info From wideinfo.org

Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. An increasing term insurance policy can be effectively used to achieve your and your family’s life goals based on various life stages. Can a policy holder have. What is increasing term insurance? It’s different from simply increasing your existing coverage amount by adding a policy or rider. Most term life policies are level, meaning your premiums are.

Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage.

Increasing term life insurance under an increasing term life insurance plan the overall death benefit of the policy increases over time. Term life insurance in which the death benefit increases periodically over the policy�s term, usually purchased as a cost of living rider to a whole life policy. Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount. However, the death benefit for increasing term policies get larger over time. A decreasing term life policy is very similar and may mirror the.

Source: locallifeagents.com

Source: locallifeagents.com

Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Unlike other forms of insurance whereby the premiums remain the same each month, increasing term cover premiums usually increase periodically. Most term life policies are level, meaning your premiums are. If you die during this time, your beneficiary receives a death benefit from the life insurance company.

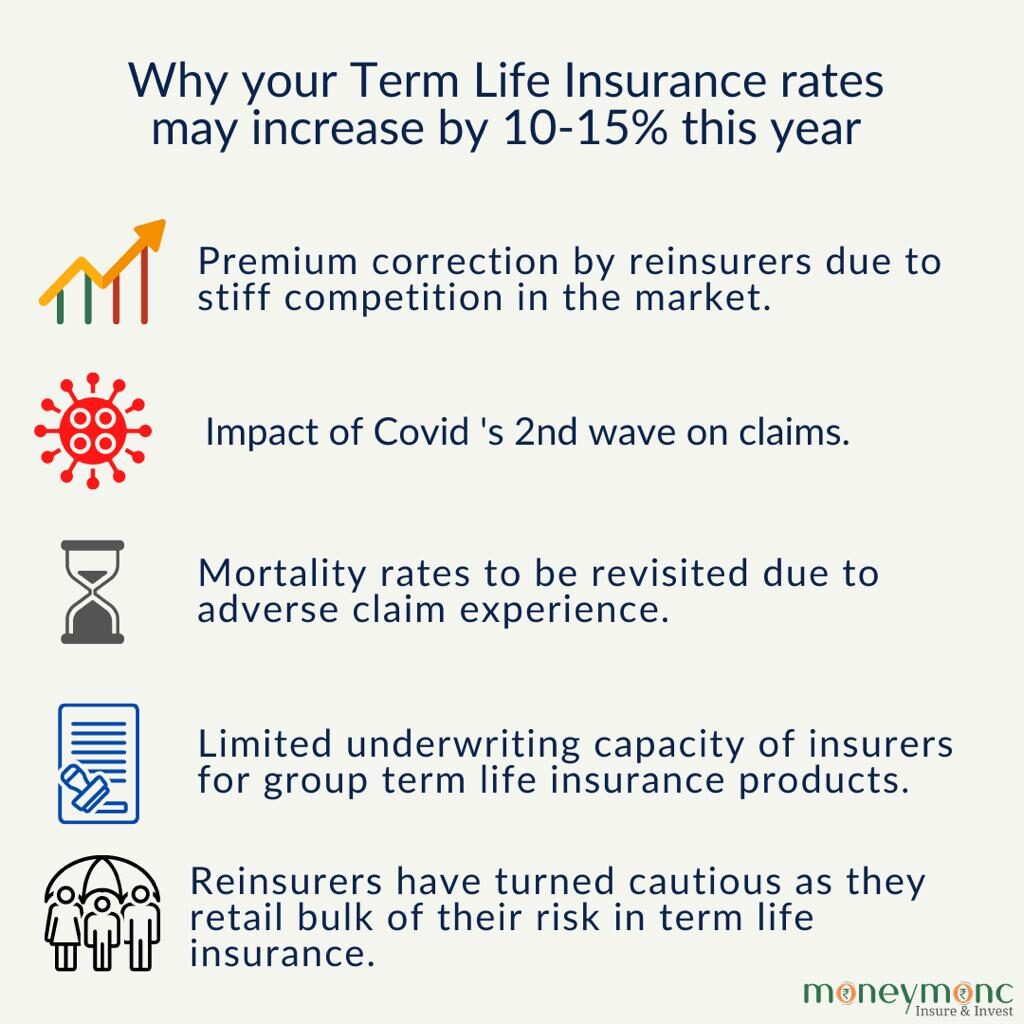

Source: moneymonc.com

Source: moneymonc.com

It’s different from simply increasing your existing coverage amount by adding a policy or rider. This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. Is affordable the best part about increasing term insurance plans is that the premiums are low and affordable. A decreasing term life policy is very similar and may mirror the. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

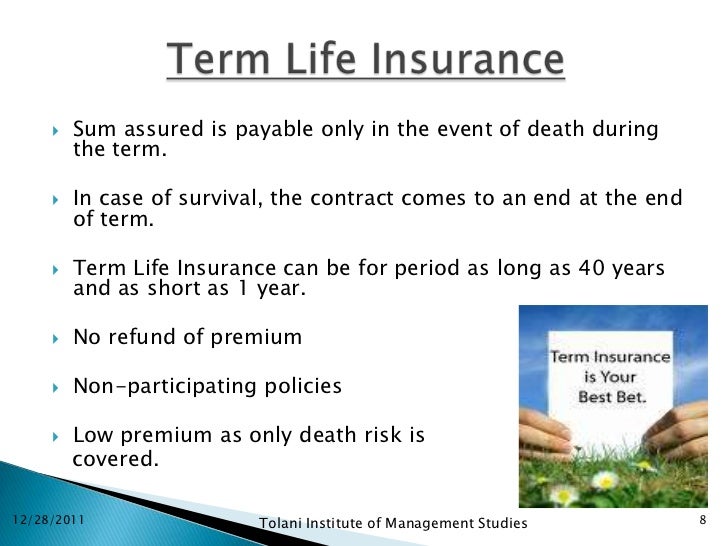

Source: youtube.com

Source: youtube.com

Term life insurance in which the death benefit increases periodically over the policy�s term, usually purchased as a cost of living rider to a whole life policy. With increasing term life insurance, your death benefit increases over the life of the policy. In case of an increasing term insurance plan, the premiums may increase according to the increased death benefit. However, the death benefit for increasing term policies get larger over time. Along with the benefit of providing higher coverage to the family of the insured, there are many other features of increasing term insurance plan, which includes the following.

Source: in.pinterest.com

Source: in.pinterest.com

A decreasing term life policy is very similar and may mirror the. This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. An increasing term insurance policy can be effectively used to achieve your and your family’s life goals based on various life stages. However, the death benefit for increasing term policies get larger over time. Most term life policies are level, meaning your premiums are stable and the death benefit does not change.

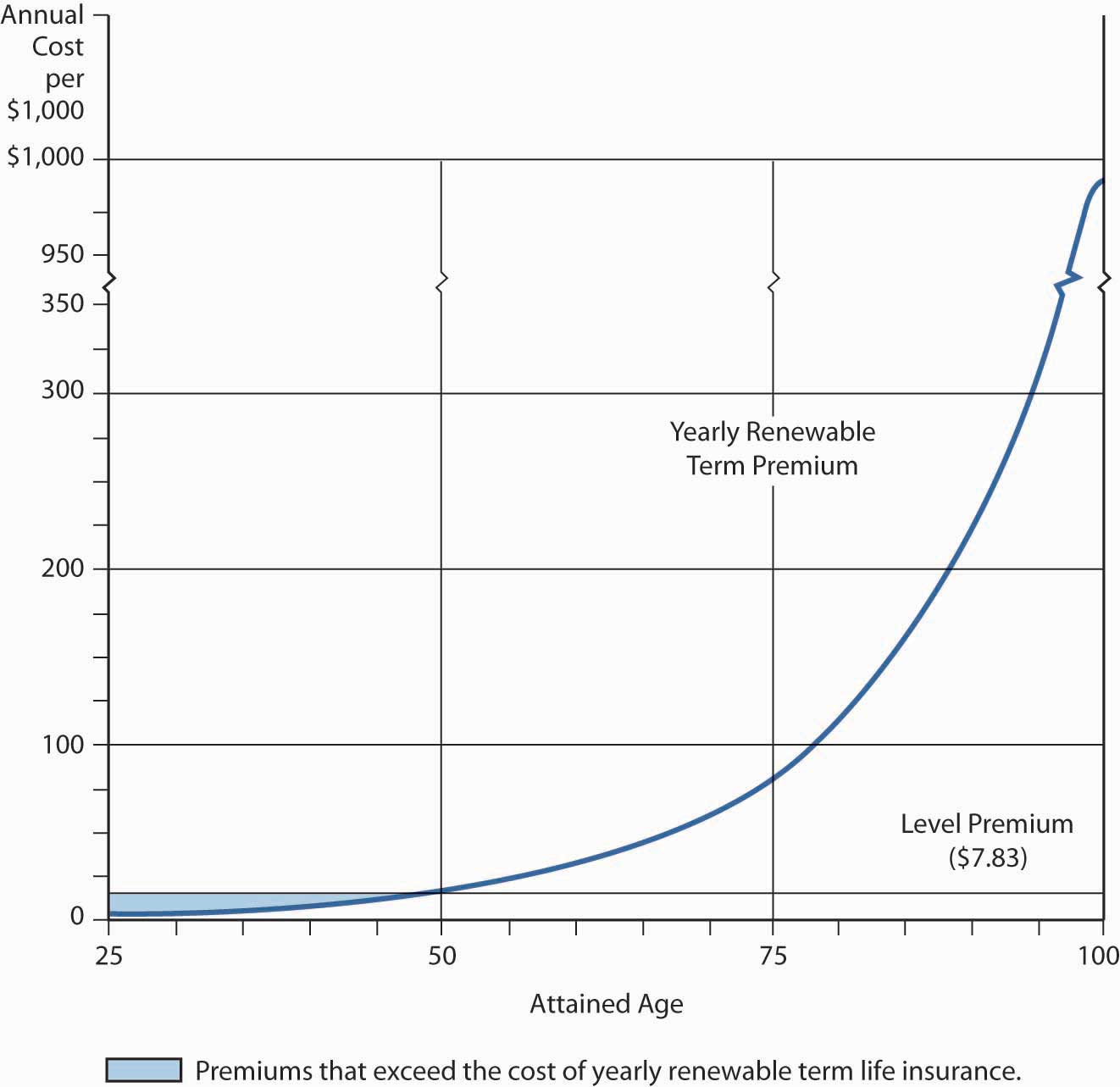

Source: saylordotorg.github.io

Source: saylordotorg.github.io

This policy can then be placed in an absolute trust with the 17 year old as the beneficiary. This policy can then be placed in an absolute trust with the 17 year old as the beneficiary. But how does this type of policy work and will your premiums increase too? This is normally in line with an agreed index, such as the consumer price index, or at a previously determined fixed percentage. Can a policy holder have.

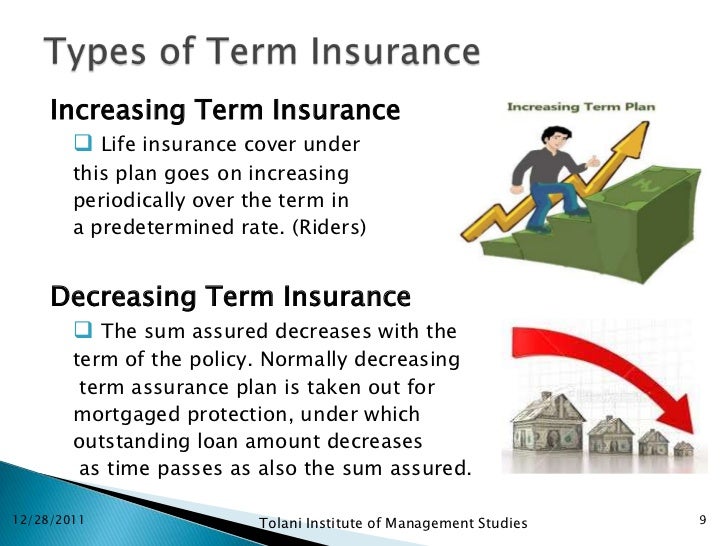

Source: slideshare.net

Source: slideshare.net

When you have your first child; Decreasing term life insurance is less expensive than term or whole life policies. The benefit of the increasing. An increasing term life insurance plan helps in meeting the increased financial responsibilities by increasing your coverage steadily over time. With increasing term life insurance, your death benefit increases over the life of the policy.

Source: lifeant.com

Source: lifeant.com

Is affordable the best part about increasing term insurance plans is that the premiums are low and affordable. When you have your first child; Decreasing term life insurance is less expensive than term or whole life policies. An increasing term insurance policy can be effectively used to achieve your and your family’s life goals based on various life stages. The benefit of the increasing.

Source: vitality.co.uk

Source: vitality.co.uk

Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. Life auto home health business renter disability commercial auto long term care annuity. Since the rate of inflation is going to increase annually, thus coverage that can beat the negative implications of inflation is necessary. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: slideshare.net

Source: slideshare.net

Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. Increasing term life insurance allows your sum assured (cover amount) to increase each year to protect your pay out amount from inflation. As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. In case of an increasing term insurance plan, the premiums may increase according to the increased death benefit. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

Source: youtube.com

Source: youtube.com

As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. The premium in a term insurance plan generally remains constant. Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. Life auto home health business renter disability commercial auto long term care annuity.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Increasing term insurance plan with its gradual but steady approach to increment maintain that balance effectively and help your family take care. In case of an increasing term insurance plan, the premiums may increase according to the increased death benefit. Even though the coverage of the. Decreasing term life insurance is less expensive than term or whole life policies. However, the death benefit for increasing term policies get larger over time.

Source: monegenix.com

Source: monegenix.com

Is affordable the best part about increasing term insurance plans is that the premiums are low and affordable. If you die during this time, your beneficiary receives a death benefit from the life insurance company. A decreasing term life policy is very similar and may mirror the. The premium in a term insurance plan generally remains constant. Most term life policies are level, meaning your premiums are stable and the death benefit does not change.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Increasing term life insurance under an increasing term life insurance plan the overall death benefit of the policy increases over time. Unlike level term insurance plans in which the sum assured remains fixed throughout the entire policy period, increasing term insurance policies are different in the sense that policyholders can opt for an increase in the sum assured each year by a specific percentage. But this gives the policyholder the advantage of paying a lower premium early on in life to adjust to their financial conditions. For instance, with an increasing term life insurance plan, you can increase the sum assured during important milestones in your life, such as when you get married; Minimum age at the end of the policy is 29.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What is increasing and decreasing term life insurance? If you die after the term, your beneficiary receives nothing. However, the death benefit for increasing term policies get larger over time. Most term life policies are level, meaning your premiums are. Is affordable the best part about increasing term insurance plans is that the premiums are low and affordable.

Source: workwithseangrant.com

Source: workwithseangrant.com

Decreasing term life insurance is less expensive than term or whole life policies. But this gives the policyholder the advantage of paying a lower premium early on in life to adjust to their financial conditions. The benefit of the increasing. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Life auto home health business renter disability commercial auto long term care annuity.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If you die after the term, your beneficiary receives nothing. The benefit of the increasing. If you die during this time, your beneficiary receives a death benefit from the life insurance company. Can a policy holder have. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

Source: aaronpeacock.com

Source: aaronpeacock.com

Increasing term life insurance allows your sum assured (cover amount) to increase each year to protect your pay out amount from inflation. As increasing term life insurance potentially offers the largest payout of term policies, it is probable that your monthly premiums will be higher than for decreasing and level term insurance. What is increasing and decreasing term life insurance? This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. What is increasing term insurance?

Source: moneytothemasses.com

Source: moneytothemasses.com

The benefit of the increasing. The benefit of the increasing. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount. When you have your first child; And when your child starts going to.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title increasing term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.