Increasing term life insurance policy Idea

Home » Trend » Increasing term life insurance policy IdeaYour Increasing term life insurance policy images are available in this site. Increasing term life insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Increasing term life insurance policy files here. Get all royalty-free photos and vectors.

If you’re looking for increasing term life insurance policy pictures information linked to the increasing term life insurance policy topic, you have visit the right site. Our site always gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

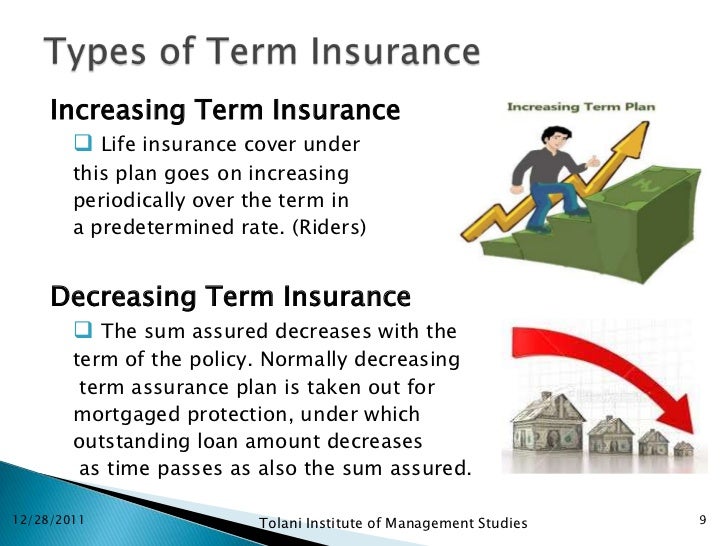

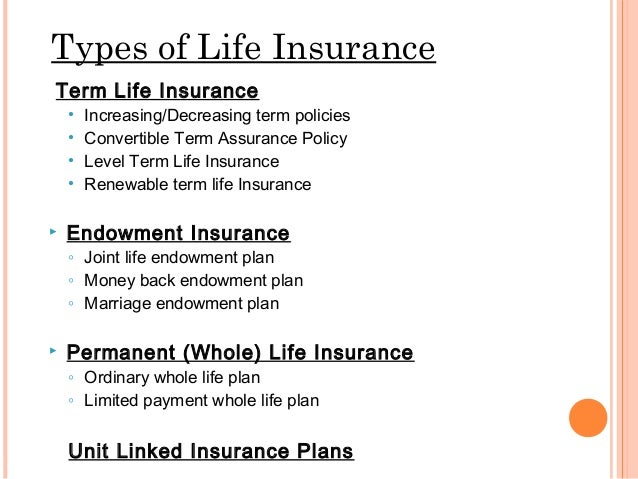

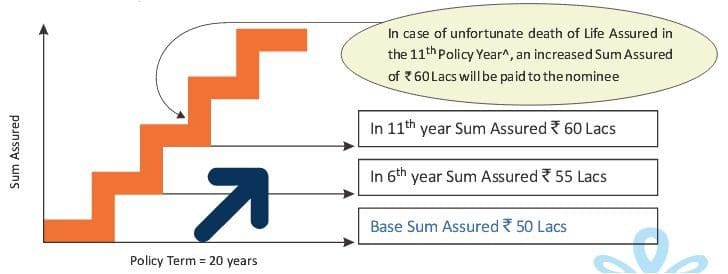

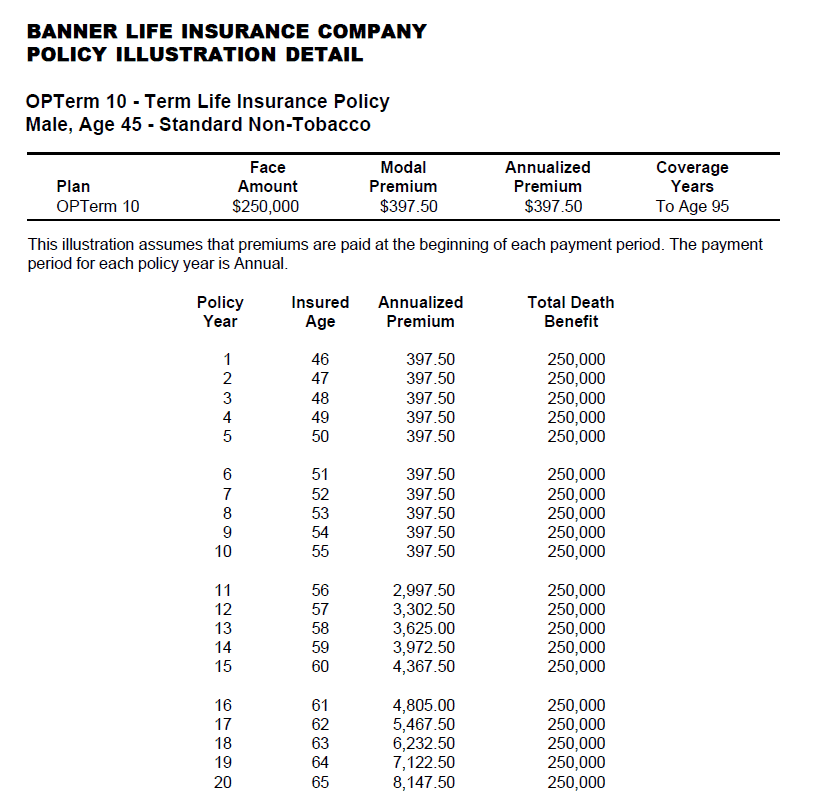

Increasing Term Life Insurance Policy. Along with the benefit of providing higher coverage to the family of. In total, you can double your policy’s death benefit amount over five years with no additional underwriting. Most term life insurance policies are level term, which means that the premiums and death benefit stay the same from beginning to end. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount.

Term Insurance Compare Best Online Term Plans in India From bankbazaar.com

Term Insurance Compare Best Online Term Plans in India From bankbazaar.com

Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. 40 years if bought with critical illness cover or critical illness extra. Increasing term has the benefit of premiums that do not change over the period of time that the contract is in force. Along with the benefit of providing higher coverage to the family of. By and large, all insurance policies have an alternative to broaden or renew the plan after the completion of its term. Increasing term life insurance policy 👪 feb 2022.

With an increasing term life insurance policy, your cover amount will increase by a certain percentage each year, (in line with the retail prices index).

This type of insurance can provide extra protection as the years go by to cover growing expenses, like a new house or bigger family, or protect your death benefit from inflation. If you die after the term, your beneficiary receives nothing. What is an increasing term life insurance policy? If so, increasing term life insurance may be a good fit for you. Life auto home health business renter disability commercial auto long term care annuity. Typically, increasing term life policies are used to leave lump sum for loved ones that adjusts and protects against the rising cost of living by increasing by a fixed rate each year.

Source: locallifeagents.com

Source: locallifeagents.com

In order to attract people, insurance providers lowered their rates. 40 years if bought with critical illness cover or critical illness extra. However, a traditional term insurance plan does not offer any entitlement to the. If so, increasing term life insurance may be a good fit for you. In total, you can double your policy’s death benefit amount over five years with no additional underwriting.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

With increasing term life insurance, your death benefit increases over the life of the policy. You may find a decreasing term policy useful if you only need your life insurance policy to cover your debts, but a traditional level term policy likely offers more flexibility and a better value for your money. There are three basic types of term life insurance coverage that you can choose from. However, a traditional term insurance plan does not offer any entitlement to the. Increasing term life insurance policy 👪 feb 2022.

Source: clever-mortgages.co.uk

Source: clever-mortgages.co.uk

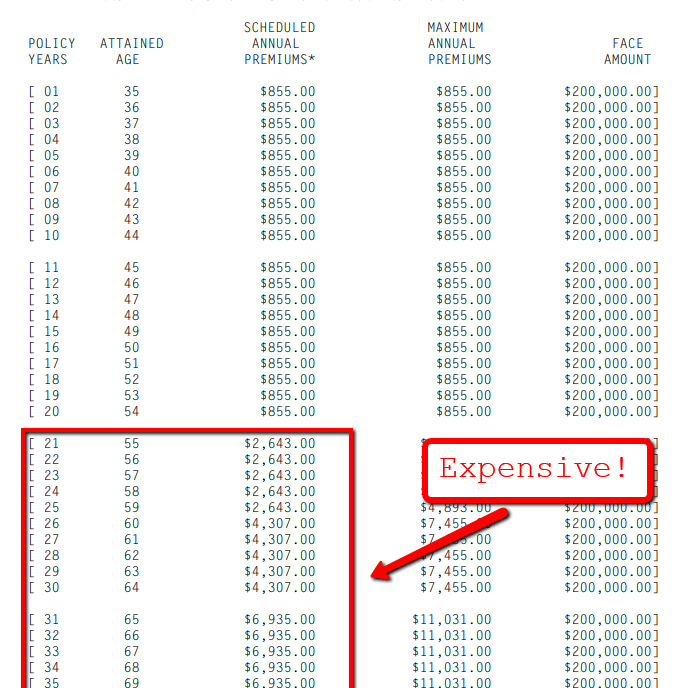

Loan a loan is a sum of money. Loan a loan is a sum of money. If you die after the term, your beneficiary receives nothing. In case of death of the insured during the policy period, the beneficiary receives a death benefit as defined under the chosen. Not only will the cost go up, but it’s likely to increase dramatically.

Source: slideshare.net

Source: slideshare.net

Critical illness insurance will cover you against falling seriously ill, offering a tax. A traditional life insurance policy entitles the policy holder�s nominee(s) to receive the main plan benefit i.e. It is possible for a life of another policy to be taken on a 17 year old by an adult with insurable interest. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. In this article, i will address the subject and definition of increasing term life policies.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This type of policy gives policyholders a quote for the year the coverage is bought. Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. Thanks to the internet, the competition between insurance companies increased. Most term life insurance policies are level term, which means that the premiums and death benefit stay the same from beginning to end. This option ensures that the value of the policy doesn�t erode over time due to the effects of inflation and maintains its buying power.

Source: slideshare.net

Source: slideshare.net

By and large, all insurance policies have an alternative to broaden or renew the plan after the completion of its term. Most term life policies are level, meaning your premiums are. You may find a decreasing term policy useful if you only need your life insurance policy to cover your debts, but a traditional level term policy likely offers more flexibility and a better value for your money. The increasing term insurance plans are specifically designed keeping in mind the changing circumstances of individual life and the increasing inflation rate. Term insurance is the most affordable form of insurance that provides high life cover for a specific period of time.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

There are three basic types of term life insurance coverage that you can choose from. If so, increasing term life insurance may be a good fit for you. It allows you to purchase a lesser amount of coverage now — for a lower premium — and then increase coverage at set increments over the first five years of the policy. What is an increasing term life insurance policy? Along with the benefit of providing higher coverage to the family of.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

If so, increasing term life insurance may be a good fit for you. The premium rate might or might not remain same throughout the plan tenure. Along with the benefit of providing higher coverage to the family of. Decreasing term life insurance offers a set premium, but the death benefit decreases over the life of the policy. For example, with legal & general increasing cover your sum assured can have a maximum increase of 15% each year [1].

Since the payout declines, decreasing term insurance often has lower rates than other types of term life insurance. It is possible for a life of another policy to be taken on a 17 year old by an adult with insurable interest. Most term life insurance policies are level term, which means that the premiums and death benefit stay the same from beginning to end. As the name suggests, an increasing term insurance plan is a term insurance plan wherein the sum assured chosen on plan commencement increases every year by a specified amount. With increasing term life insurance, your death benefit increases over the life of the policy.

Source: wideinfo.org

Source: wideinfo.org

In increasing the term insurance plan, the coverage allowed under the policy depends on the policy buyer�s health at the time of purchasing the policy. If so, increasing term life insurance may be a good fit for you. Most term life policies are level, meaning your premiums are. Policyholders may choose whether they want their nominees to avail the sum assured in a lump sum or as a regular monthly income. In case the policy holder survives the term, she/he is entitled to receive the maturity benefits as well.

Source: easyquotes4you.com

Source: easyquotes4you.com

In an increasing term insurance plan coverage, the sum insured increases by a predefined sum each year until reaching the end term. It allows you to purchase a lesser amount of coverage now — for a lower premium — and then increase coverage at set increments over the first five years of the policy. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Critical illness insurance will cover you against falling seriously ill, offering a tax. You may find a decreasing term policy useful if you only need your life insurance policy to cover your debts, but a traditional level term policy likely offers more flexibility and a better value for your money.

Source: slideshare.net

Source: slideshare.net

Along with the benefit of providing higher coverage to the family of. Life auto home health business renter disability commercial auto long term care annuity. In total, you can double your policy’s death benefit amount over five years with no additional underwriting. If you die after the term, your beneficiary receives nothing. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

Source: lifeant.com

Source: lifeant.com

In this article, i will address the subject and definition of increasing term life policies. In an increasing term insurance plan coverage, the sum insured increases by a predefined sum each year until reaching the end term. Loan a loan is a sum of money. In case of death of the insured during the policy period, the beneficiary receives a death benefit as defined under the chosen. However, a decreasing term life policy has a payout that lessens over time.

Source: relakhs.com

Source: relakhs.com

In total, you can double your policy’s death benefit amount over five years with no additional underwriting. In order to attract people, insurance providers lowered their rates. If you die during this time, your beneficiary receives a death benefit from the life insurance company. With increasing term life insurance, your death benefit increases over the life of the policy. Not only will the cost go up, but it’s likely to increase dramatically.

Source: bankbazaar.com

Source: bankbazaar.com

Increasing term has the benefit of premiums that do not change over the period of time that the contract is in force. What is an increasing term life insurance policy? It allows you to purchase a lesser amount of coverage now — for a lower premium — and then increase coverage at set increments over the first five years of the policy. In increasing the term insurance plan, the coverage allowed under the policy depends on the policy buyer�s health at the time of purchasing the policy. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount.

Source: mutualtrust.com

Source: mutualtrust.com

Thanks to the internet, the competition between insurance companies increased. Increasing term life insurance is a type of term life insurance plan in which the face value of the policy (the death benefit) increases each year by a certain amount. In total, you can double your policy’s death benefit amount over five years with no additional underwriting. Term insurance is a pure life insurance product, which provides financial protection to the policyholder. The premium rate might or might not remain same throughout the plan tenure.

Source: in.pinterest.com

Source: in.pinterest.com

Term insurance is the most affordable form of insurance that provides high life cover for a specific period of time. This type of policy gives policyholders a quote for the year the coverage is bought. If you die during this time, your beneficiary receives a death benefit from the life insurance company. Along with the benefit of providing higher coverage to the family of. For example, with legal & general increasing cover your sum assured can have a maximum increase of 15% each year [1].

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

A traditional life insurance policy entitles the policy holder�s nominee(s) to receive the main plan benefit i.e. In total, you can double your policy’s death benefit amount over five years with no additional underwriting. It is possible for a life of another policy to be taken on a 17 year old by an adult with insurable interest. Critical illness insurance will cover you against falling seriously ill, offering a tax. Most term life policies are level, meaning your premiums are.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title increasing term life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.