Incurred claim ratio car insurance Idea

Home » Trending » Incurred claim ratio car insurance IdeaYour Incurred claim ratio car insurance images are available. Incurred claim ratio car insurance are a topic that is being searched for and liked by netizens now. You can Get the Incurred claim ratio car insurance files here. Find and Download all free vectors.

If you’re looking for incurred claim ratio car insurance pictures information related to the incurred claim ratio car insurance topic, you have pay a visit to the right site. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Incurred Claim Ratio Car Insurance. What is incurred claims ratio (icr)? Incurred claim ratio refers to the net claims paid by an insurance company as against the net premiums earned. The incurred claim ratio is equal to the value of all the claims the company has paid divided by the total premium collected during the same period. Then the icr of the company will be 90%.

Latest Health Insurance Incurred Claims Ratio 201718 From pinterest.com

Latest Health Insurance Incurred Claims Ratio 201718 From pinterest.com

Incurred claim ratio of less than 50% highlights that the cost of the policy is on the higher side and it has a lot of exceptions because of which the policyholders’ claims are being rejected. Bajaj allianz general insurance co. Claim settlement ratio (csr) indicates how many claims a company has settled against the number of claims received. The incurred claim ratio (icr) is the ratio of net claims settled by the insurer to the net premiums collected by the company during any given financial year. The insurance regulatory and development authority of india (irdai) issues the details regarding the icr of various insurance companies every year. Incurred claim ratio is commonly mistaken for claim settlement ratio, but they are not the same.

Bharti axa general insurance co.

What is incurred claim ratio (icr)? Cholamandalam ms general insurance co. Higher the csr, the greater are the chances of settlement of a claim. Among life insurers, lic has the highest claim settlement ratio of 98.33%. For instance, if an insurance company received inr 1 crore as premium and paid out inr 80 lakhs against claims, the icr of the insurance company is 80%. Icr indicates the ability of the company to pay claims raised by the insured.

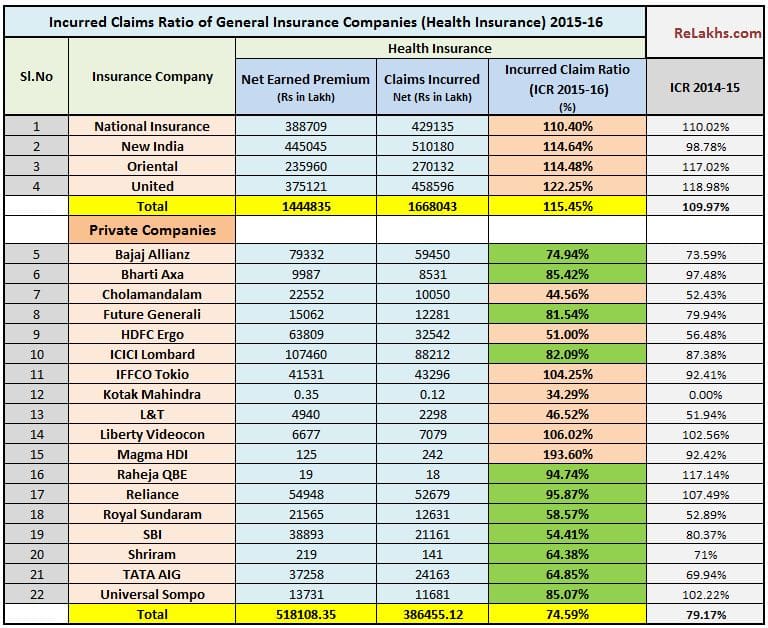

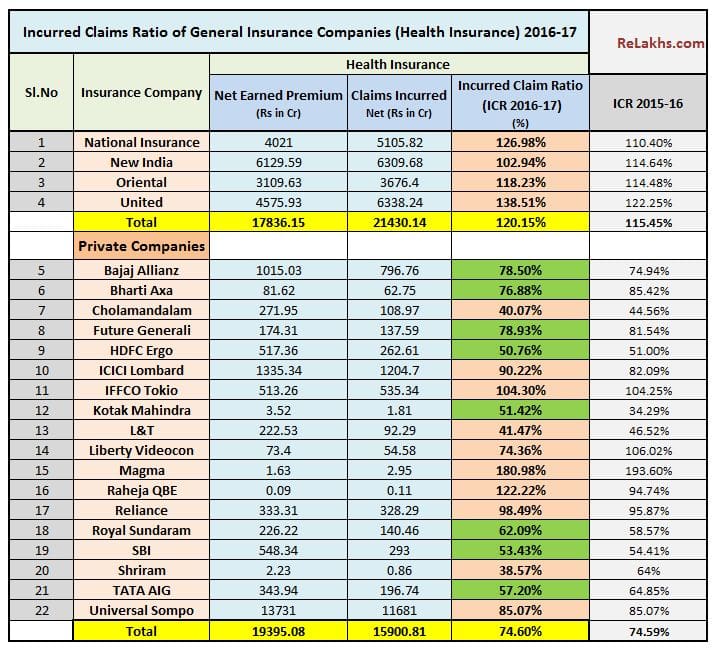

Source: relakhs.com

Source: relakhs.com

Icr determines the company’s ability to pay the claims raised by the insured people. When the incurred claims ratio is between 50% and 100%, it means that the insurer can manage the insurance claim settlements through the total premiums received in the year. Hence, if the claim settlement ratio of a company peaks at 90%, this is indicative of the fact that 90 claims out of the 100 have been successfully settled. Then the icr of the company will be 90%. What is incurred claims ratio (icr)?

Source: abiteofculture.com

Source: abiteofculture.com

What is incurred claim ratio? Higher the csr, the greater are the chances of settlement of a claim. Bajaj allianz general insurance co. Incurred claim ratio is the net claims paid out by a health insurance company against the total premium received. Why is this metric important?

Source: basunivesh.com

Source: basunivesh.com

Icr determines the company’s ability to pay the claims raised by the insured people. You can check the claim settlement ratio (csr) and incurred claim ratio (icr) of the insurance providers as a higher percentage of these ratios reduces the possibility of your car insurance claims getting rejected by the insurer. A good claim settlement ratio will improve your chances of getting your insurance policy claims accepted and settled by the insurance company when the situation comes. The percentage of total claims settled by an insurance company to the total number of premium value that the insured person pays to the policy provider is known as the incurred claim ratio. Bajaj allianz general insurance co.

Source: pinterest.com

Source: pinterest.com

The irda, or insurance regulatory and development authority of india publishes the incurred claims ratio for health insurance companies in india. Claim incurred claim ratio in (%) acko general insurance ltd. This is an indicator of how well an insurance company is doing. Among life insurers, lic has the highest claim settlement ratio of 98.33%. This ratio reflects if companies are collecting premiums higher than the amount paid in claims or if it is not collecting enough.

Source: mintwise.com

Source: mintwise.com

What is incurred claims ratio (icr)? The incurred claim ratio represents the total claims paid from the net premiums collected during the year. Claim settlement ratio (csr) indicates how many claims a company has settled against the number of claims received. Claim incurred claim ratio in (%) acko general insurance ltd. It is the ratio of claims settled to the premium received.

Source: pinterest.com

Source: pinterest.com

For instance, if the incurred claim ratio of a health insurance provider is 88%, then it means that the insurer pays rs 88 towards claim payment for every rs 100 of premium collected. Incurred claim ratio refers to the net claims paid by an insurance company as against the net premiums earned. The high icr is due to the old pending claims. A good claim settlement ratio will improve your chances of getting your insurance policy claims accepted and settled by the insurance company when the situation comes. Choosing an insurer with icr between 50% and 100%.

Source: relakhs.com

Source: relakhs.com

Insurers with the percentage of and above 95% are considered secure as the insurer is good at paying the claim amount to most customers. Moreover, incurred claim ratios are often confused with claim settlement ratios. According to the national association of insurance commissioners, the average losses incurred across all lines of insurance is 55.2%. Bharti axa general insurance co. Insurers with the percentage of and above 95% are considered secure as the insurer is good at paying the claim amount to most customers.

Source: relakhs.com

Source: relakhs.com

Why is this metric important? The higher the ratio, the more claims are settled. According to the national association of insurance commissioners, the average losses incurred across all lines of insurance is 55.2%. Icr determines the company’s ability to pay the claims raised by the insured people. In other words, the insurer is financially stable and sound of settling your claims and selling adequate health insurance.

Source: vipinkhandelwal.com

Source: vipinkhandelwal.com

Among life insurers, lic has the highest claim settlement ratio of 98.33%. The incurred claim ratio represents the total claims paid from the net premiums collected during the year. It is also a measure of the insurer’s reputation. Bajaj allianz general insurance co. The higher the ratio, the more claims are settled.

Source: basunivesh.com

Source: basunivesh.com

Hence, if the claim settlement ratio of a company peaks at 90%, this is indicative of the fact that 90 claims out of the 100 have been successfully settled. Among life insurers, lic has the highest claim settlement ratio of 98.33%. Hence, if the claim settlement ratio of a company peaks at 90%, this is indicative of the fact that 90 claims out of the 100 have been successfully settled. Moreover, incurred claim ratios are often confused with claim settlement ratios. Then the icr of the company will be 90%.

Source: relakhs.com

Source: relakhs.com

Between the total claims settled and the total number of them that have been made. The incurred claim ratio represents the total claims paid from the net premiums collected during the year. What is incurred claim ratio (icr)? The more the ratio, the more chances of the claim being settled. In other words, the insurer is financially stable and sound of settling your claims and selling adequate health insurance.

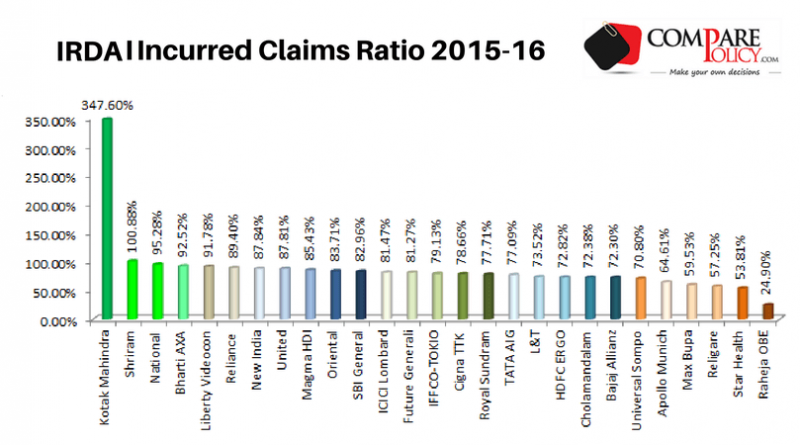

Source: comparepolicy.com

Source: comparepolicy.com

This is an indicator of how well an insurance company is doing. This is an indicator of how well an insurance company is doing. Incurred claim ratio = net claims settled/net premium collected. Choosing an insurer with icr between 50% and 100%. Cholamandalam ms general insurance co.

Source: relakhs.com

Source: relakhs.com

The high icr is due to the old pending claims. Incurred claim ratio is the net claims paid out by a health insurance company against the total premium received. Icr indicates the ability of the company to pay claims raised by the insured. The incurred claim ratio represents the total claims paid from the net premiums collected during the year. Between the total claims paid out to the total premium amount incurred.

Source: relakhs.com

Source: relakhs.com

Incurred claim ratio is commonly mistaken for claim settlement ratio, but they are not the same. Bharti axa general insurance co. The irdai publishes information about the incurred claim ratio of all companies every year. Between the total claims paid out to the total premium amount incurred. Incurred claim ratio = net claims settled/net premium collected.

Source: pinterest.com

Source: pinterest.com

Incurred claim ratio is commonly mistaken for claim settlement ratio, but they are not the same. Between the total claims settled and the total number of them that have been made. Cholamandalam ms general insurance co. Icr indicates the ability of the company to pay claims raised by the insured. Higher the csr, the greater are the chances of settlement of a claim.

Source: relakhs.com

Source: relakhs.com

Bharti axa general insurance co. Incurred claim ratio is the ratio between the total paid claims and the total premium earned by the insurer in a year. The higher the ratio, the more claims are settled. This is an indicator of how well an insurance company is doing. What is incurred claim ratio (icr)?

Source: relakhs.com

Source: relakhs.com

For instance, if the incurred claim ratio of a health insurance provider is 88%, then it means that the insurer pays rs 88 towards claim payment for every rs 100 of premium collected. Incurred claim ratio or icr refers to the total claim amount paid by the insurance company in ratio to the total premium amount collected in a financial year. You can check the claim settlement ratio (csr) and incurred claim ratio (icr) of the insurance providers as a higher percentage of these ratios reduces the possibility of your car insurance claims getting rejected by the insurer. A good claim settlement ratio will improve your chances of getting your insurance policy claims accepted and settled by the insurance company when the situation comes. The higher the ratio, the more claims are settled.

Source: researchgate.net

Source: researchgate.net

Claim settlement ratio (csr) indicates how many claims a company has settled against the number of claims received. Then the icr of the company will be 90%. The irdai publishes information about the incurred claim ratio of all companies every year. The high icr is due to the old pending claims. Claim incurred claim ratio in (%) acko general insurance ltd.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title incurred claim ratio car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.