Indemnification insurance information

Home » Trend » Indemnification insurance informationYour Indemnification insurance images are ready. Indemnification insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Indemnification insurance files here. Find and Download all royalty-free photos.

If you’re searching for indemnification insurance pictures information related to the indemnification insurance topic, you have come to the ideal blog. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Indemnification Insurance. Directors and officers (d&o) insurance (which in the fund industry, is often coupled with “errors and omissions” (e&o) insurance). Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. Indemnification is aimed at providing financial protection, especially against potential lawsuits. Indemnification obligations net of insurance proceeds and other amounts.

What is Professional Indemnity Insurance? Our Blog From firstireland.ie

What is Professional Indemnity Insurance? Our Blog From firstireland.ie

Managers and insurance professionals is that any duty to defend the client pursuant to an indemnification clause, or other provision of the contract, is uninsurable pursuant to the contractual liability provision of the contract. Technically, the insured must not only suffer a loss but must also pay the loss before being indemnified by the insurer. Contractor shall indemnify, defend, and hold harmless to the Indemnification obligations net of insurance proceeds and other amounts. Licenses, indemnification and insurance requirements. The contractor must demonstrate that they are duly licensed by whatever state, county or local regulatory body may so require.

Both indemnity provisions and insurance agreements require one party to stand good for the loss of another.

The main difference between indemnification and insurance is that the former represents the process of transferring loss responsibility within a contractual relationship, and can exist independent of a policy, while the latter represents the actual contract backed by an insurance company. Indemnification obligations net of insurance proceeds and other amounts. Learn about the directors’ indemnification provisions in the companies act of 2006 here. Indemnity is defined by black’s law dictionary as “a duty to make good any loss, damage, or liability incurred by another.”. The owner of a commercial property has been paying an insurance premium to an insurance company so that she can recover the costs for any loss or damage if a future bad event were to happen to the establishment. An insurance policy that indemnifies the policyholder for losses that are found during the policy period, regardless of when the loss actually occurred.

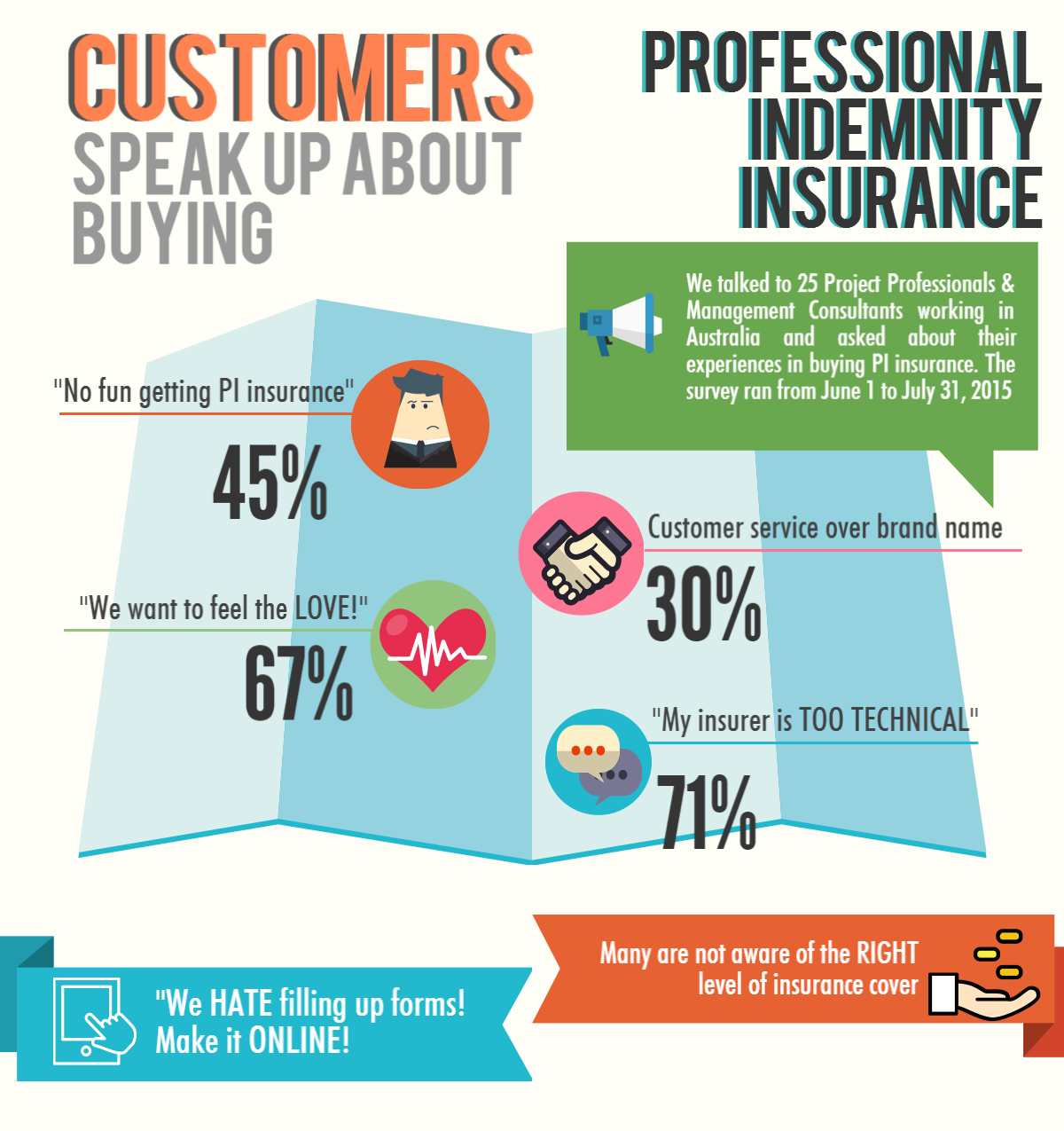

Source: sherpainsurance.com.au

Source: sherpainsurance.com.au

But there are significant differences, both practical and legal. Whether the indemnification clause is found in an acquisition agreement, corporate bylaws or some other company document, policyholders should resist insurer assertions that coverage obligations are relieved by the presence of the indemnification language. The terms of an indemnification clause can dictate how an insurance policy responds to hold an indemnitee harmless. Indemnification and insurance appendix d in professional services agreements agreement no: Learn about the directors’ indemnification provisions in the companies act of 2006 here.

Source: mglegal.co.uk

Source: mglegal.co.uk

Indemnity insurance is designed to protect. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. An indemnification provision is one of the most common and frequently used provisions when negotiating any type of contract, and yet the parties to a contract often don’t understand the meaning. Learn about the directors’ indemnification provisions in the companies act of 2006 here. Indemnification is an agreement that the hartford restores you to a previous financial standing after experiencing a loss.

Source: blackandwhiteinsurance.co.uk

Source: blackandwhiteinsurance.co.uk

An insurance policy that indemnifies the policyholder for losses that are found during the policy period, regardless of when the loss actually occurred. This insulation applies to financial and legal decisions while allowing the business to continue operations. Learn about the directors’ indemnification provisions in the companies act of 2006 here. 10/21/2021 contractor shall include the provisions of this form in all subcontracts which exceed $25,000 and shall ensure subcontractor�s compliance with such provisions. Both indemnity provisions and insurance agreements require one party to stand good for the loss of another.

Source: vistainsurance.co.uk

Source: vistainsurance.co.uk

Indemnification is an agreement that the hartford restores you to a previous financial standing after experiencing a loss. Indemnification obligations net of insurance proceeds and other amounts. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. Whether the indemnification clause is found in an acquisition agreement, corporate bylaws or some other company document, policyholders should resist insurer assertions that coverage obligations are relieved by the presence of the indemnification language. Indemnification is aimed at providing financial protection, especially against potential lawsuits.

Source: justquoteme.co.uk

Source: justquoteme.co.uk

If you�re having trouble understanding the language in the indemnification clause, or the contract as a whole, you should consult an. Technically, the insured must not only suffer a loss but must also pay the loss before being indemnified by the insurer. Indemnity insurance is a type of insurance policy where the insurance company guarantees compensation for losses or damages sustained by a policyholder. But there are significant differences, both practical and legal. Both indemnity provisions and insurance agreements require one party to stand good for the loss of another.

Source: primerhub.com

Source: primerhub.com

Therefore, it should be struck from the contract language accordingly. Managers and insurance professionals is that any duty to defend the client pursuant to an indemnification clause, or other provision of the contract, is uninsurable pursuant to the contractual liability provision of the contract. Example of indemnity in business. Learn more about what indemnification means in insurance and how it. This type of contract allows businesses to carry out their services and/or provide products without.

Source: firstireland.ie

Source: firstireland.ie

An indemnification agreement, also called an indemnity agreement, hold harmless agreement, waiver of liability, or release of liability, is a contract that provides a business or a company with protection against damages, loss, or other burdens. The owner of a commercial property has been paying an insurance premium to an insurance company so that she can recover the costs for any loss or damage if a future bad event were to happen to the establishment. Learn about the directors’ indemnification provisions in the companies act of 2006 here. (a) during the employment period and for a period of six (6) years thereafter, the company shall cause the executive to be covered by and named as an insured under any policy or contract of insurance obtained by it to insure its directors and officers against personal. Therefore, it should be struck from the contract language accordingly.

Source: worthview.com

Source: worthview.com

Indemnity insurance is designed to protect. The contractor must demonstrate that they are duly licensed by whatever state, county or local regulatory body may so require. Managers and insurance professionals is that any duty to defend the client pursuant to an indemnification clause, or other provision of the contract, is uninsurable pursuant to the contractual liability provision of the contract. Indemnification — (1) in policies written on an indemnification basis, the insurer reimburses the insured for claims and claim costs already paid by the insured. Indemnity insurance is designed to protect.

Source: modernlifeblogs.com

Source: modernlifeblogs.com

But there are significant differences, both practical and legal. Indemnification clauses in partnerships prevent the personal actions of one partner from affecting the other. Therefore, it should be struck from the contract language accordingly. Insurance policies are a common example of one party indemnifying another. The contractor must demonstrate that they are duly licensed by whatever state, county or local regulatory body may so require.

Source: in.pinterest.com

Source: in.pinterest.com

This type of contract allows businesses to carry out their services and/or provide products without. It is important to note that a liability covered under an. Fund independent directors generally have two potential protections against liabilities to which they may be subject by reason of their service as directors: Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. 10/21/2021 contractor shall include the provisions of this form in all subcontracts which exceed $25,000 and shall ensure subcontractor�s compliance with such provisions.

Source: iselect.com.au

Source: iselect.com.au

If you�re having trouble understanding the language in the indemnification clause, or the contract as a whole, you should consult an. Whether the indemnification clause is found in an acquisition agreement, corporate bylaws or some other company document, policyholders should resist insurer assertions that coverage obligations are relieved by the presence of the indemnification language. Therefore, it should be struck from the contract language accordingly. This type of contract allows businesses to carry out their services and/or provide products without. 10/21/2021 contractor shall include the provisions of this form in all subcontracts which exceed $25,000 and shall ensure subcontractor�s compliance with such provisions.

Source: iselect.com.au

Source: iselect.com.au

Whether the indemnification clause is found in an acquisition agreement, corporate bylaws or some other company document, policyholders should resist insurer assertions that coverage obligations are relieved by the presence of the indemnification language. Indemnification obligations net of insurance proceeds and other amounts. Licenses, indemnification and insurance requirements. Therefore, it should be struck from the contract language accordingly. Learn about the directors’ indemnification provisions in the companies act of 2006 here.

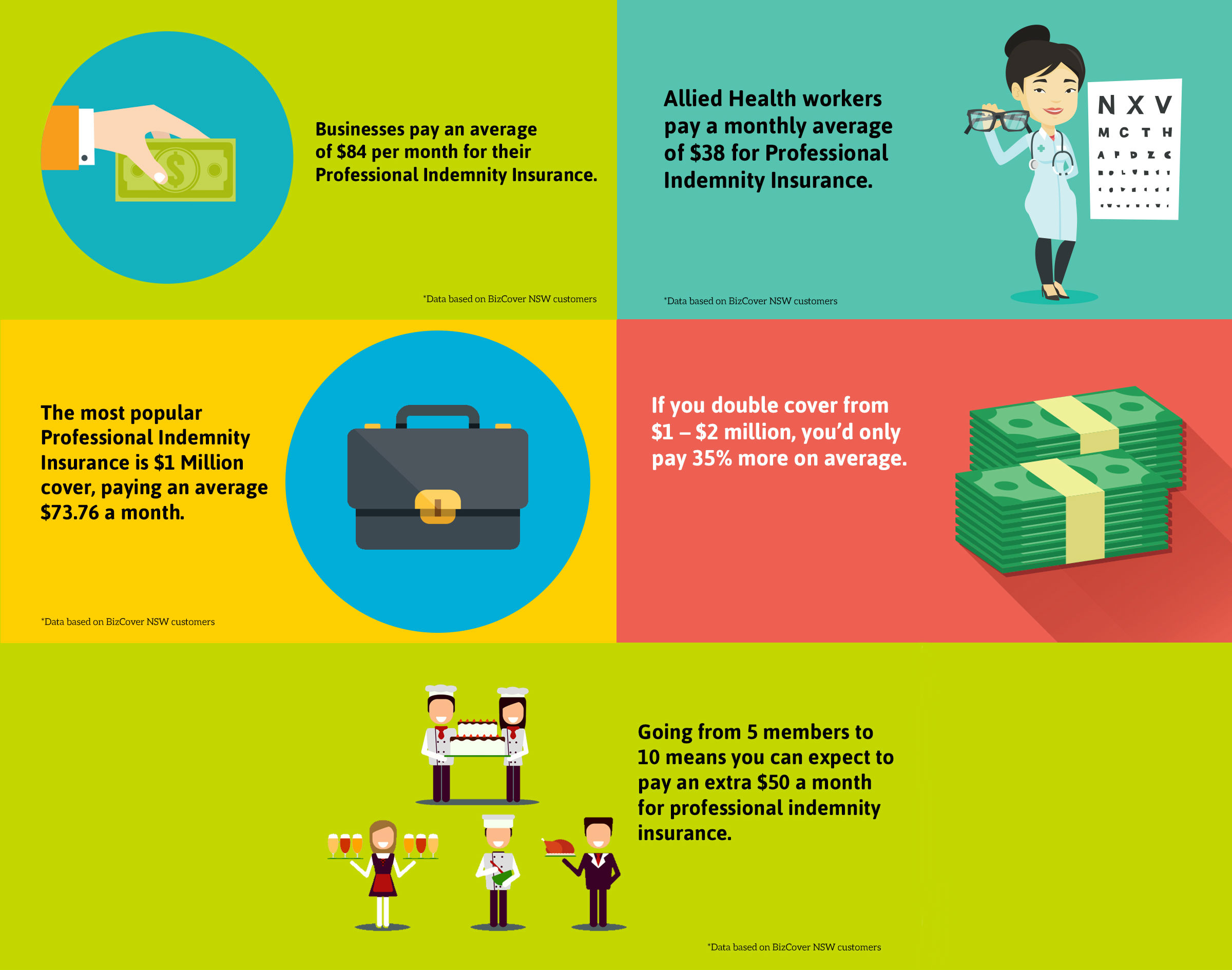

Source: bizcover.com.au

Source: bizcover.com.au

This insulation applies to financial and legal decisions while allowing the business to continue operations. 10/21/2021 contractor shall include the provisions of this form in all subcontracts which exceed $25,000 and shall ensure subcontractor�s compliance with such provisions. Insurance transfers risk from one party to another in exchange for payment. Indemnity is defined by black’s law dictionary as “a duty to make good any loss, damage, or liability incurred by another.”. Directors and officers (d&o) insurance (which in the fund industry, is often coupled with “errors and omissions” (e&o) insurance).

Source: dslaccounting.com

Source: dslaccounting.com

Indemnification — (1) in policies written on an indemnification basis, the insurer reimburses the insured for claims and claim costs already paid by the insured. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. The terms of an indemnification clause can dictate how an insurance policy responds to hold an indemnitee harmless. Indemnity is defined by black’s law dictionary as “a duty to make good any loss, damage, or liability incurred by another.”. Its focus is primarily on preventing financial loss.

Source: sherpainsurance.com.au

Source: sherpainsurance.com.au

The contractor must demonstrate that they are duly licensed by whatever state, county or local regulatory body may so require. But there are significant differences, both practical and legal. Indemnification obligations net of insurance proceeds and other amounts. (a) during the employment period and for a period of six (6) years thereafter, the company shall cause the executive to be covered by and named as an insured under any policy or contract of insurance obtained by it to insure its directors and officers against personal. If the corporation’s charter has a 102(b)(7) waiver, as most do, the risk of.

Source: irishtimes.com

Source: irishtimes.com

An insurance policy that indemnifies the policyholder for losses that are found during the policy period, regardless of when the loss actually occurred. Learn about the directors’ indemnification provisions in the companies act of 2006 here. Indemnification — (1) in policies written on an indemnification basis, the insurer reimburses the insured for claims and claim costs already paid by the insured. Example of indemnity in business. Indemnity insurance is a type of insurance policy where the insurance company guarantees compensation for losses or damages sustained by a policyholder.

Source: bruceburke.co.uk

Source: bruceburke.co.uk

Learn about the directors’ indemnification provisions in the companies act of 2006 here. Indemnification clauses in partnerships prevent the personal actions of one partner from affecting the other. (2) the agreement of one party to assume financial. The contractor must demonstrate that they are duly licensed by whatever state, county or local regulatory body may so require. Disney and stone made it quite clear that the risk of liability for unconflicted directors is now modest at best even under the default rules:

Source: tomorrowmakers.com

Source: tomorrowmakers.com

Published may 19, 2020 • 2 minute read. (2) the agreement of one party to assume financial. Fund independent directors generally have two potential protections against liabilities to which they may be subject by reason of their service as directors: Indemnification clauses in partnerships prevent the personal actions of one partner from affecting the other. Its focus is primarily on preventing financial loss.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title indemnification insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.