Indemnity and insurance difference Idea

Home » Trend » Indemnity and insurance difference IdeaYour Indemnity and insurance difference images are available in this site. Indemnity and insurance difference are a topic that is being searched for and liked by netizens today. You can Download the Indemnity and insurance difference files here. Find and Download all royalty-free photos.

If you’re searching for indemnity and insurance difference images information linked to the indemnity and insurance difference topic, you have pay a visit to the right blog. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Indemnity And Insurance Difference. Hospital indemnity insurance is very similar to accident insurance. In the following article we’ll discuss the different types of indemnity, anti. There are two different types of indemnity plans: Indemnities and insurances are a means of managing risk and transferring financial losses.

Difference Between General Insurance And Life Insurance From thismybrightside.blogspot.com

Difference Between General Insurance And Life Insurance From thismybrightside.blogspot.com

Indemnity clause in their insurance policy protects them in the event of such claims by coughing up money to meet such claims. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. The existence of indemnity insurance contracts, which combine these two concepts, make understanding the difference even more difficult. It is also used to supplement any expenses incurred outside of your health coverage. Indemnity is best described as compensation for a loss or injury sustained, and all contracts of property or pecuniary insurance are referred to as contracts of indemnity. If their client files a lawsuit against them for suffering a financial loss from their underperformance, the insurance saves the professional.

Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings.

The two are very different and offer very different types of coverage. What is the difference between directors and officers insurance and professional indemnity insurance? Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. The purpose of having indemnity insurance is to protect yourself or your business professionally against liability claims associated with mistakes, misjudgments or. Indemnities and insurances are a means of managing risk and transferring financial losses. In insurance, indemnity insurance is the financial protection given to a business or professional from the financial losses incurred due to professional negligence, errors & omissions, or malpractice.

Source: indemnityinsurancedehadami.blogspot.com

Source: indemnityinsurancedehadami.blogspot.com

So is insurance, but the difference is insurance is a contract to provide you protection from bills by paying them for you for a fee. However, insurance can be seen as a periodic payment that is made to guard against any losses suffered, whilst indemnity is a contract between two parties for which the injured party will receive compensation for losses. In an insurance policy, the insurer receives a premium for the acceptance of risk. They will possibly reduce the amount you end up paying or losing to someone with limited legal resources. However, they differ in the manner that they shift the risk.

Source: lifeinsure.com

Source: lifeinsure.com

To indemnify means to provide protection against financial losses. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. The act of insuring, or assuring, against loss or damage by a contingent event; So is insurance, but the difference is insurance is a contract to provide you protection from bills by paying them for you for a fee. What is the difference between directors and officers insurance and professional indemnity insurance?

Source: unovest.co

Source: unovest.co

In an insurance policy, the insurer receives a premium for the acceptance of risk. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. The purpose of having indemnity insurance is to protect yourself or your business professionally against liability claims associated with mistakes, misjudgments or. The act of insuring, or assuring, against loss or damage by a contingent event; Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings.

Source: youtube.com

Source: youtube.com

What is the difference between directors and officers insurance and professional indemnity insurance? Indemnity insurance is a type of professional liability insurance coverage. The term indemnity insurance refers to an insurance policy that compensates an insured party for certain unexpected damages or losses up to a certain limit—usually the amount of the loss itself. Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. These plans come by different names like mediclaim, arogya sanjeevani, pradhan mantri medical insurance, comprehensive health plan, ayushman bharat.

Source: moneydigest.sg

Source: moneydigest.sg

Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. These plans come by different names like mediclaim, arogya sanjeevani, pradhan mantri medical insurance, comprehensive health plan, ayushman bharat. So is insurance, but the difference is insurance is a contract to provide you protection from bills by paying them for you for a fee. Indemnity is not always a contract. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money.

Source: quotesbae.com

Source: quotesbae.com

Both indemnity provisions and insurance agreements require one party to stand good for the loss of another. In a nutshell, directors and officers insurance protects the directors and their personal assets from claims of business mismanagement, whilst professional indemnity protects a business and its assets from claims of negligent service provision. What is the difference between directors and officers insurance and professional indemnity insurance? What is hospital indemnity insurance? An insurance policy that compensates a party for any accidental damages or losses up to a certain limit—usually the value of the loss of itself —is known as indemnity insurance.

Source: compare.com

Source: compare.com

To indemnify means to provide protection against financial losses. Let me set the scene. The short answer could be designed as follows: Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings. Indemnity plans do not have to pay the hospital or doctor.

Source: myfinancemd.com

Source: myfinancemd.com

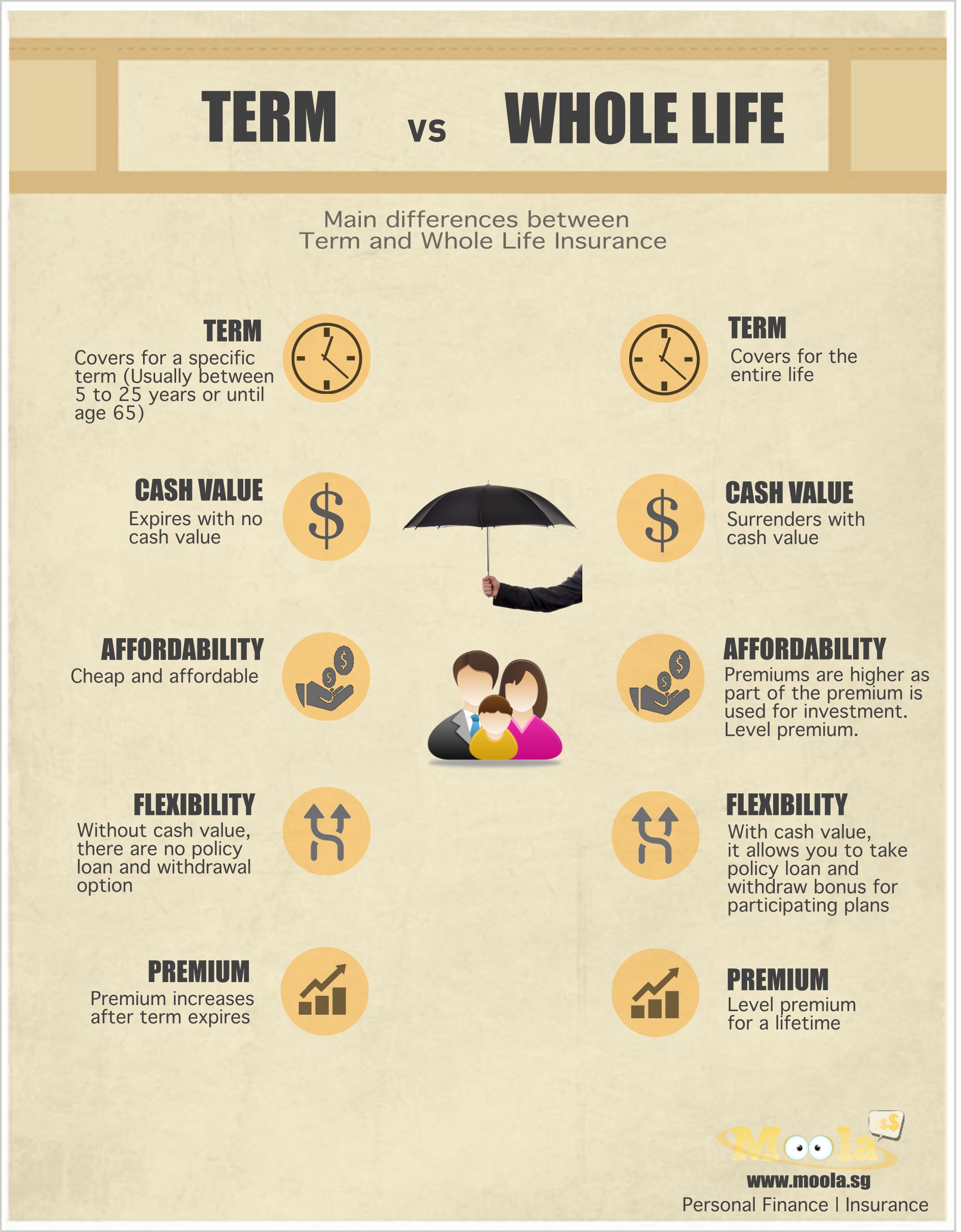

Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. The act of insuring, or assuring, against loss or damage by a contingent event; Indemnity plans are designed to indemnify either the insured or. In insurance, indemnity insurance is the financial protection given to a business or professional from the financial losses incurred due to professional negligence, errors & omissions, or malpractice. Both indemnity and life insurance policies present coverage for losses to an insured party in exchange for premiums up to a specific limit.

Source: insurancequotespro.blogspot.co.id

Source: insurancequotespro.blogspot.co.id

What is the difference between directors and officers insurance and professional indemnity insurance? They are of little use when someone with unlimited legal funds has got really upset and is gunning for you or becomes insolvent and runs from you. If their client files a lawsuit against them for suffering a financial loss from their underperformance, the insurance saves the professional. Exemption from loss or damage, past or to. Indemnity plans do not have to pay the hospital or doctor.

Source: differencebetween.net

Source: differencebetween.net

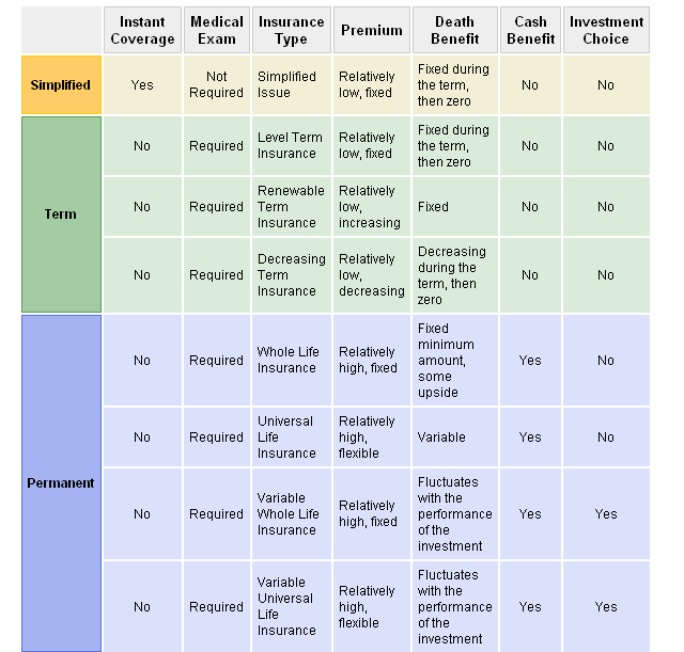

Professional indemnity insurance cover claims made by clients for professional negligence or mistakes, whereas public liability insurance covers claims made by members of the public for injury or damage. Traditional indemnity health insurance plans are available for hospital and surgery coverage, major medical coverage, and a combination of the two, including. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. The difference between indemnity and traditional health insurance plan? Public liability insurance covers your business for claims against injury or illness caused to clients and members of the public, or damage to their property.

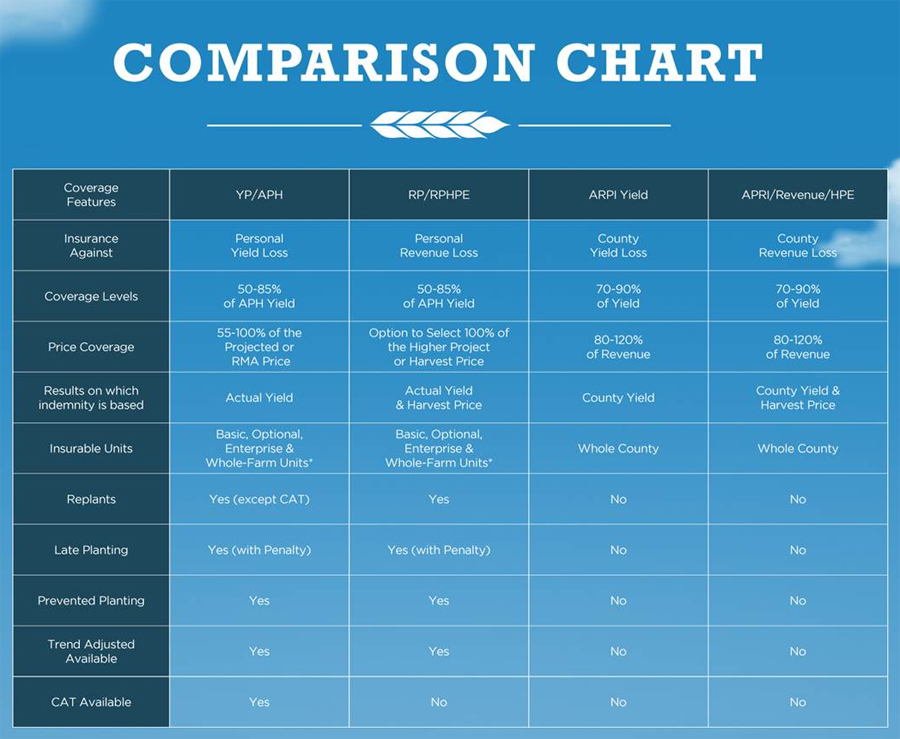

Source: andersonsgrain.com

Source: andersonsgrain.com

It is also used to supplement any expenses incurred outside of your health coverage. In a nutshell, directors and officers insurance protects the directors and their personal assets from claims of business mismanagement, whilst professional indemnity protects a business and its assets from claims of negligent service provision. Both indemnity and life insurance policies present coverage for losses to an insured party in exchange for premiums up to a specific limit. For indemnities, the indemnifier voluntary accepts the transfer of risk. In an insurance policy, the insurer receives a premium for the acceptance of risk.

Source: jaiinsurance.com

Source: jaiinsurance.com

Hospital indemnity insurance provides a set cash payment to use for. In an insurance policy, the insurer receives a premium for the acceptance of risk. For indemnities, the indemnifier voluntary accepts the transfer of risk. The insurance company’s job now is to fix or replace everything so that everyone is back in the same position they were before. Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings.

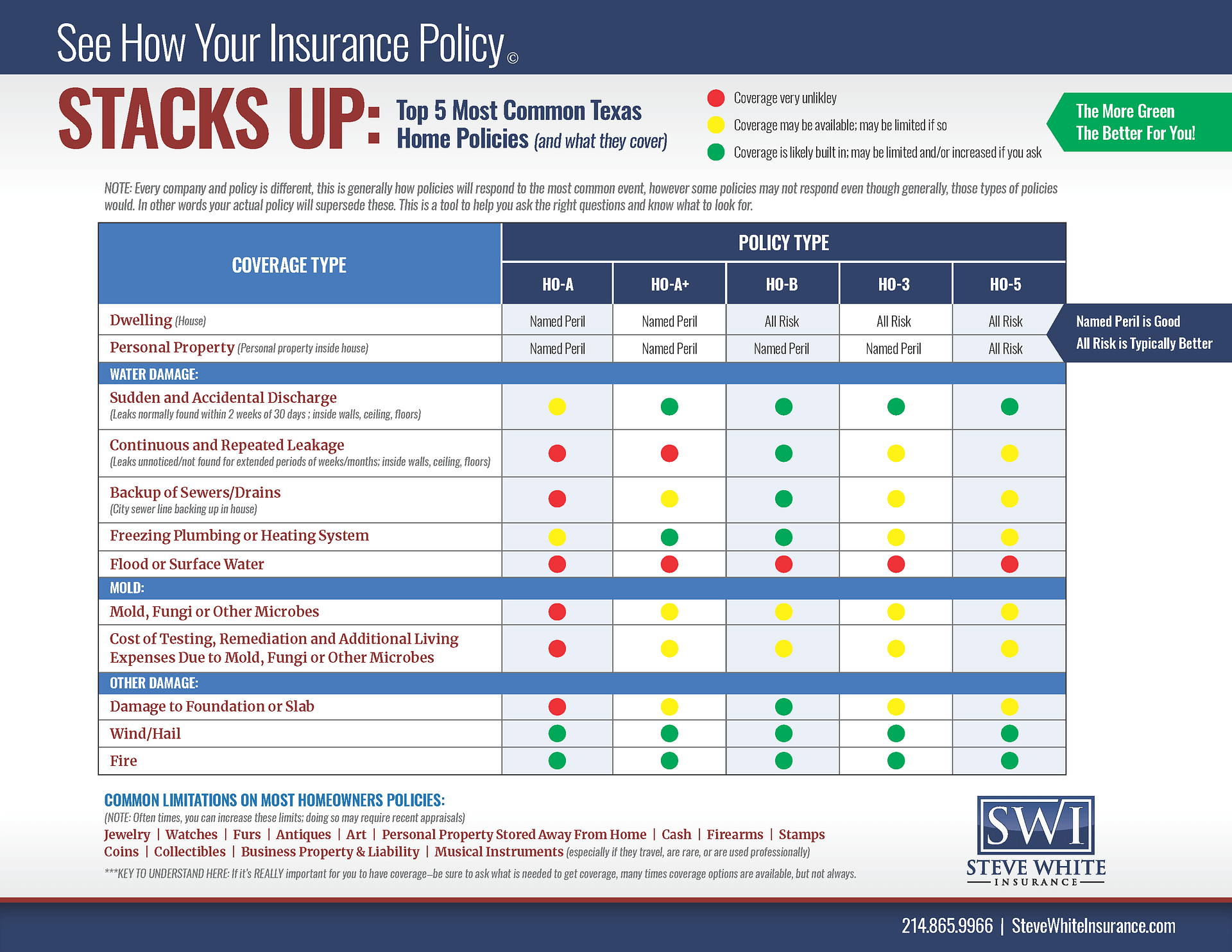

Source: stevewhiteinsurance.com

Source: stevewhiteinsurance.com

The purpose of having indemnity insurance is to protect yourself or your business professionally against liability claims associated with mistakes, misjudgments or. Indemnities and insurances are a means of managing risk and transferring financial losses. For indemnities, the indemnifier voluntary accepts the transfer of risk. The car skids on the ice and crashes into a garage door which needs replacing. Both indemnity provisions and insurance agreements require one party to stand good for the loss of another.

Source: clips-60z.blogspot.com

Source: clips-60z.blogspot.com

What is the difference between directors and officers insurance and professional indemnity insurance? The insurance company’s job now is to fix or replace everything so that everyone is back in the same position they were before. To help understand the difference better, below are some pointers which highlight their differences. Professional indemnity insurance cover claims made by clients for professional negligence or mistakes, whereas public liability insurance covers claims made by members of the public for injury or damage. Both indemnity and life insurance policies present coverage for losses to an insured party in exchange for premiums up to a specific limit.

Source: everquote.com

Source: everquote.com

Let me set the scene. How do you know the difference between the two until you have compared them? The term indemnity insurance refers to an insurance policy that compensates an insured party for certain unexpected damages or losses up to a certain limit—usually the amount of the loss itself. Indemnity is best described as compensation for a loss or injury sustained, and all contracts of property or pecuniary insurance are referred to as contracts of indemnity. To indemnify means to provide protection against financial losses.

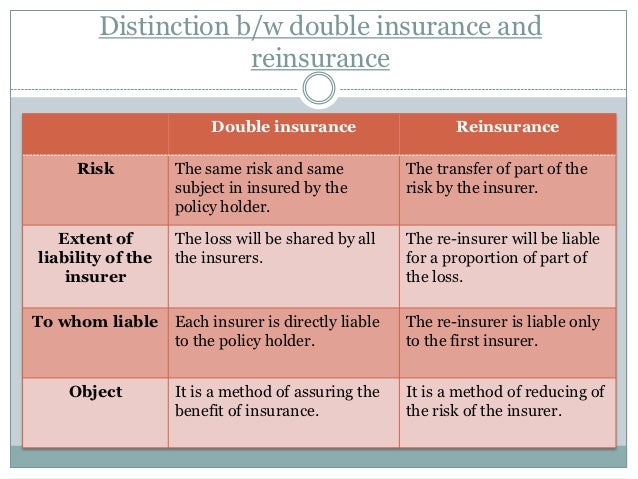

Source: slideshare.net

Source: slideshare.net

In the following article we’ll discuss the different types of indemnity, anti. What is hospital indemnity insurance? Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. The existence of indemnity insurance contracts, which combine these two concepts, make understanding the difference even more difficult. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Indemnities and insurances are a means of managing risk and transferring financial losses. A contract whereby, for a stipulated consideration, called premium, one party undertakes to indemnify or guarantee another against loss by certain specified risks. Legislative and judicial enactments of contract of indemnity under english law The difference between indemnity and traditional health insurance plan? Both indemnity provisions and insurance agreements require one party to stand good for the loss of another.

Source: personalcapital.com

Source: personalcapital.com

But there are significant differences, both practical and legal. The difference between indemnity and traditional health insurance plan? Indemnities and insurances are a means of managing risk and transferring financial losses. Legislative and judicial enactments of contract of indemnity under english law How do you know the difference between the two until you have compared them?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title indemnity and insurance difference by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.