Indemnity insurance vs liability insurance information

Home » Trending » Indemnity insurance vs liability insurance informationYour Indemnity insurance vs liability insurance images are ready in this website. Indemnity insurance vs liability insurance are a topic that is being searched for and liked by netizens now. You can Download the Indemnity insurance vs liability insurance files here. Find and Download all free images.

If you’re searching for indemnity insurance vs liability insurance images information related to the indemnity insurance vs liability insurance interest, you have come to the right blog. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Indemnity Insurance Vs Liability Insurance. It covers the legal liability to compensate a third party who has sustained injury, loss or damage created by the existence of a duty of care owed to third parties as a result of. Indemnity clause in their insurance policy protects them in the event of such claims by coughing up money to meet such claims. Indemnity is a contractual obligation of one party (indemnifier) to compensate the loss incurred to the other party (indemnity holder) due to the acts of the indemnitor or any other party. If you are responsible for negligence and you are likely to face the claims, public liability insurance will protect you against that risk.

What is Collision Insurance? From everquote.com

What is Collision Insurance? From everquote.com

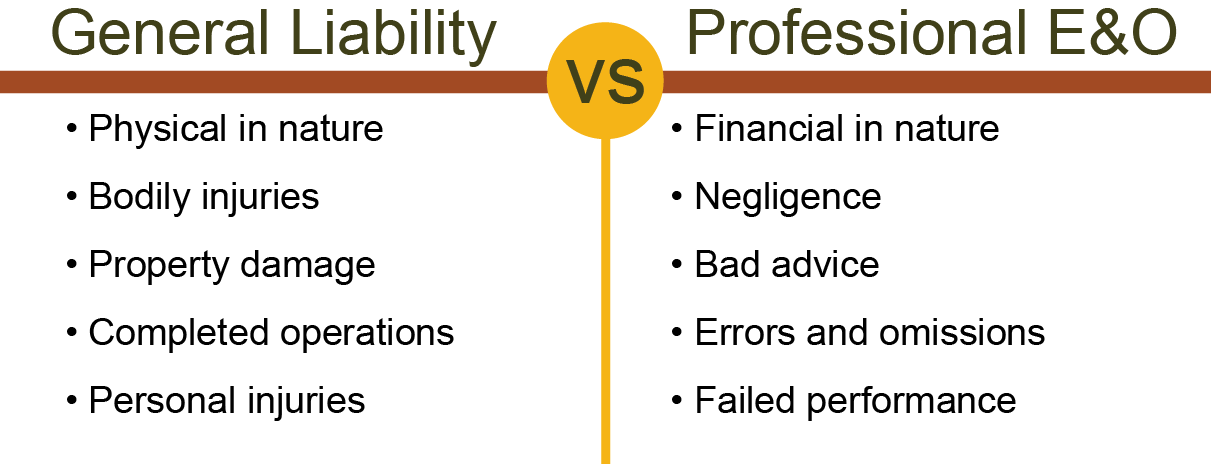

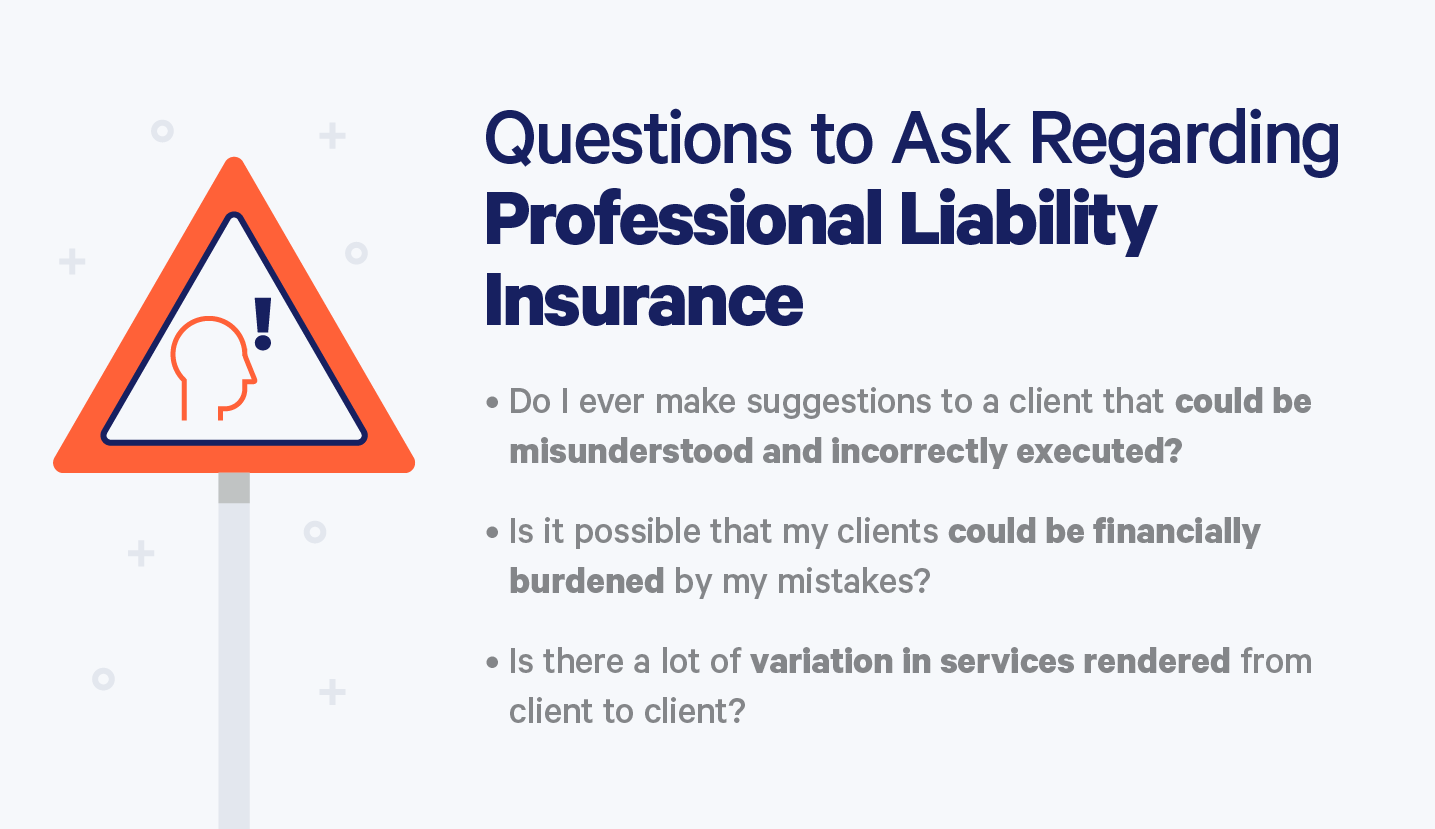

This form of cover protects you and your business financially against claims which result from allegations of negligence or breach of duty which have occurred as the result of an. It can also cover against liability for breach of professional duty when providing a service. Professional indemnity insurance can be confused with public liability cover, but what it insures against is different: Two of the primary mechanisms for construction risk transfer are indemnity provisions and insurance agreements. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. Liability policies insure against claims for personal injury or property damage resulting from the negligence of the insured.

This is where public liability and professional indemnity cover come in.

Professional indemnity insurance can be confused with public liability cover, but what it insures against is different: The professional indemnity insurance will help cover any damage or legal fee needed for compensation. While running a business, a company will need a variety of insurances. It can also cover against liability for breach of professional duty when providing a service. It generally cover a variety of costs. You can receive a free quote for an insurance lawyer here.

Source: aiastl.com

Source: aiastl.com

It can also cover against liability for breach of professional duty when providing a service. It covers the legal liability to compensate a third party who has sustained injury, loss or damage created by the existence of a duty of care owed to third parties as a result of. • professionals such as doctors when they are at a fault to have caused injury to their clients, are often sued, and face claims from patients. In the following article we’ll discuss the different types of indemnity, anti. Designed to cover claims that occur out of failing to meet general duties of care e.g.

Source: everquote.com

Source: everquote.com

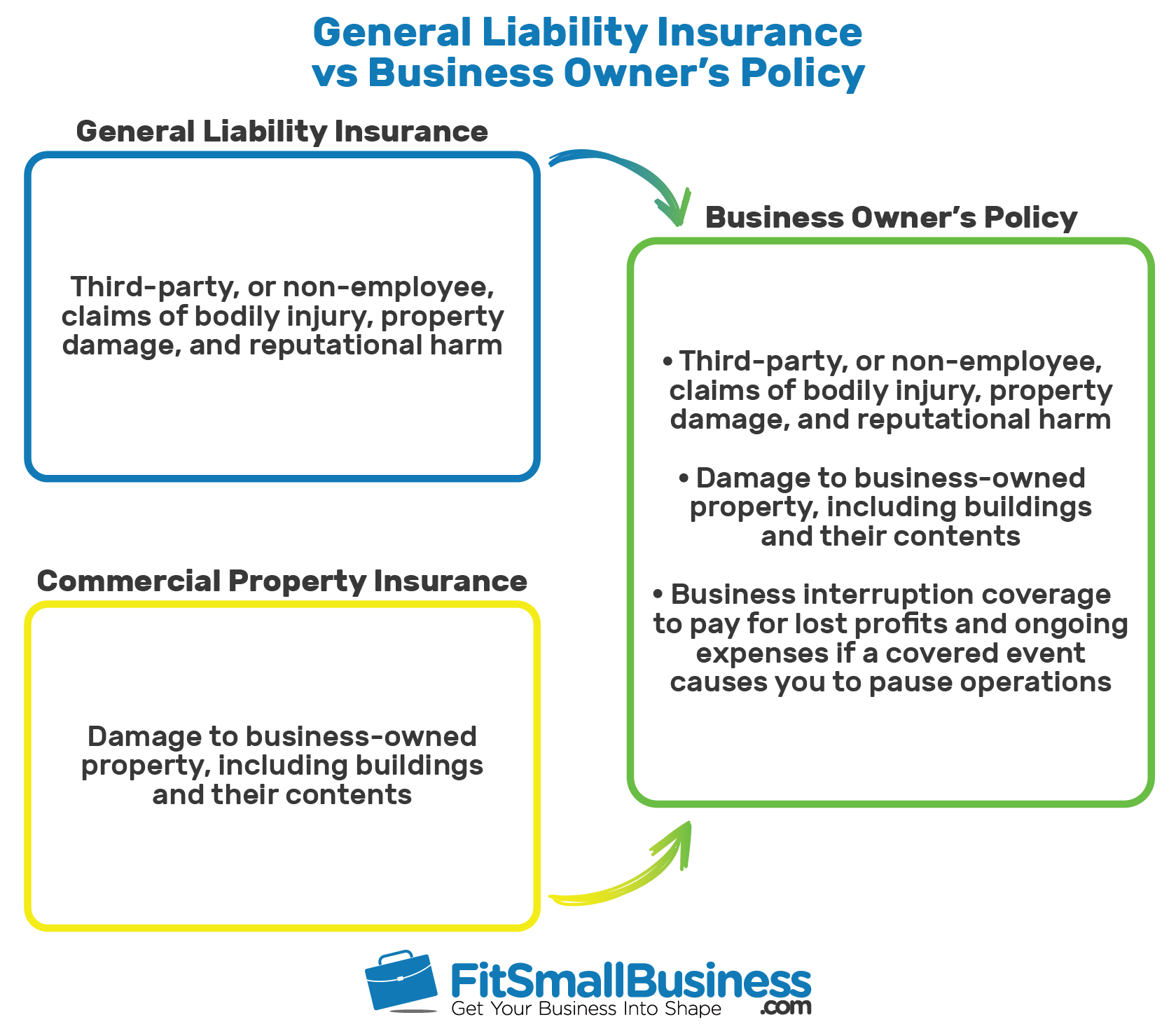

What is the difference between liability and indemnity? It covers the legal liability to compensate a third party who has sustained injury, loss or damage created by the existence of a duty of care owed to third parties as a result of. Professional indemnity insurance, also called professional liability insurance, covers your business for claims against professional mistakes or negligence that end up. The professional indemnity insurance will help cover any damage or legal fee needed for compensation. Companies are liable for the cost of compensation for employees who are injured at work.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Insurance policies are contracts of indemnity. Insurance policies are contracts of indemnity. The duty to indemnify is usually, but not always, coextensive with the contractual duty to or. If you are responsible for negligence and you are likely to face the claims, public liability insurance will protect you against that risk. Professional indemnity insurance can be confused with public liability cover, but what it insures against is different:

Source: everquote.com

Source: everquote.com

Professional indemnity insurance can be confused with public liability cover, but what it insures against is different: You can receive a free quote for an insurance lawyer here. This form of cover protects you and your business financially against claims which result from allegations of negligence or breach of duty which have occurred as the result of an. The short answer could be designed as follows: What is professional indemnity insurance?

Source: tenaxtransport.com

Source: tenaxtransport.com

The only real way to assess whether a liability cover should be preferred to an indemnity is by thinking about who is likely to take action against an entity and why would they even think about. Professional indemnity vs public liability insurance. It can also cover against liability for breach of professional duty when providing a service. Indemnity is a contractual obligation of one party (indemnifier) to compensate the loss incurred to the other party (indemnity holder) due to the acts of the indemnitor or any other party. A liability, in layman’s terms, is more of a legal responsibility rather than a professional one.

Source: insurefloridians.com

Source: insurefloridians.com

Public liability insurance can cover compensation claims if you’re sued by a member of the public for injury or damage, while professional indemnity insurance can cover compensation claims if you’re sued by a client for a mistake that you make in your work. Professional indemnity insurance can provide cover in the event of a breach of contract, or a mistake from professional services provided, such as a mistake made in the course of providing professional services or advice, or recommendations to a client. It covers the legal liability to compensate a third party who has sustained injury, loss or damage created by the existence of a duty of care owed to third parties as a result of. Professional indemnity deals with intangibles. This form of cover protects you and your business financially against claims which result from allegations of negligence or breach of duty which have occurred as the result of an.

Source: automoblog.net

Source: automoblog.net

What is professional indemnity insurance? What is the difference between liability and indemnity? Indemnity clause in their insurance policy protects them in the event of such claims by coughing up money to meet such claims. In liability policies, an insured’s cause of action against an insurer accrues when the insured’s liability attaches. On top of that, it’ll also cover any legal fees that you might pick up as a result of any claims you have to defend.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

In liability policies, an insured’s cause of action against an insurer accrues when the insured’s liability attaches. If you give advice or services as part of your business (and there are very few businesses who don’t!) then you probably need professional indemnity insurance. Liability policies insure against claims for personal injury or property damage resulting from the negligence of the insured. The only real way to assess whether a liability cover should be preferred to an indemnity is by thinking about who is likely to take action against an entity and why would they even think about. It generally cover a variety of costs.

In the following article we’ll discuss the different types of indemnity, anti. Professional indemnity deals with intangibles. What is the difference between liability and indemnity? Do you need public liability insurance? On top of that, it’ll also cover any legal fees that you might pick up as a result of any claims you have to defend.

Source: iselect.com.au

Source: iselect.com.au

Public liability insurance (which is often, incorrectly, searched for under the name ‘public liability and indemnity insurance’) exists to provide cover for damage or injury to third party property or persons. • professionals such as doctors when they are at a fault to have caused injury to their clients, are often sued, and face claims from patients. Insurance policies are contracts of indemnity. Insurance lawyers can help you guide through the process of claiming on insurance. Designed to cover claims that occur out of failing to meet general duties of care e.g.

Source: lpmriskmanagement.com

Source: lpmriskmanagement.com

The professional indemnity insurance will help cover any damage or legal fee needed for compensation. But there are significant differences, both practical and legal. It generally cover a variety of costs. Public liability insurance can cover compensation claims if you’re sued by a member of the public for injury or damage, while professional indemnity insurance can cover compensation claims if you’re sued by a client for a mistake that you make in your work. Indemnity insurance is a supplemental form of liability insurance specific to certain professionals or service providers.

Source: embroker.com

Source: embroker.com

Indemnity clause in their insurance policy protects them in the event of such claims by coughing up money to meet such claims. If you give advice or services as part of your business (and there are very few businesses who don’t!) then you probably need professional indemnity insurance. Professional indemnity insurance can provide cover in the event of a breach of contract, or a mistake from professional services provided, such as a mistake made in the course of providing professional services or advice, or recommendations to a client. Naturally, people that undertake construction projects (or other outdoor work) are liable to members of the public if they cause damage, an injury or an illness. What is the difference between liability and indemnity?

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Liability policies insure against claims for personal injury or property damage resulting from the negligence of the insured. While running a business, a company will need a variety of insurances. Professional indemnity insurance offers protections for individuals or companies that provide any design, advice or expertise as part of their service. What is professional indemnity insurance? In simple terms, public liability insurance covers your business for claims against injury or illness caused to clients and members of the public, or damage to their property.

Source: houstonagencies.com

Source: houstonagencies.com

What is the difference between liability and indemnity? Insurance professionals provide counsel, expertise, or specialized services. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. It covers the legal liability to compensate a third party who has sustained injury, loss or damage created by the existence of a duty of care owed to third parties as a result of. While running a business, a company will need a variety of insurances.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

But there are significant differences, both practical and legal. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. Public liability insurance can cover compensation claims if you’re sued by a member of the public for injury or damage, while professional indemnity insurance can cover compensation claims if you’re sued by a client for a mistake that you make in your work. In liability policies, an insured’s cause of action against an insurer accrues when the insured’s liability attaches. Indemnity is a contractual obligation of one party (indemnifier) to compensate the loss incurred to the other party (indemnity holder) due to the acts of the indemnitor or any other party.

Source: iammrfoster.com

Source: iammrfoster.com

Indemnity clause in their insurance policy protects them in the event of such claims by coughing up money to meet such claims. The only real way to assess whether a liability cover should be preferred to an indemnity is by thinking about who is likely to take action against an entity and why would they even think about. Insurance policies are contracts of indemnity. This form of cover protects you and your business financially against claims which result from allegations of negligence or breach of duty which have occurred as the result of an. The insurer agrees to take responsibility for certain losses that may be sustained by the insured.

Source: embroker.com

Source: embroker.com

Insurance professionals provide counsel, expertise, or specialized services. What is professional indemnity insurance? Professional indemnity deals with intangibles. Insurance lawyers can help you guide through the process of claiming on insurance. Professional indemnity vs public liability insurance.

Source: plusonesolutions.net

Source: plusonesolutions.net

In simple terms, public liability insurance covers your business for claims against injury or illness caused to clients and members of the public, or damage to their property. Public liability insurance covers your business for claims against injury or illness caused to clients and members of the public, or damage to their property. While running a business, a company will need a variety of insurances. If you are responsible for negligence and you are likely to face the claims, public liability insurance will protect you against that risk. Professional indemnity deals with intangibles.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title indemnity insurance vs liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.