Index universal life insurance calculator information

Home » Trend » Index universal life insurance calculator informationYour Index universal life insurance calculator images are ready. Index universal life insurance calculator are a topic that is being searched for and liked by netizens now. You can Get the Index universal life insurance calculator files here. Download all free photos and vectors.

If you’re searching for index universal life insurance calculator images information related to the index universal life insurance calculator interest, you have come to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

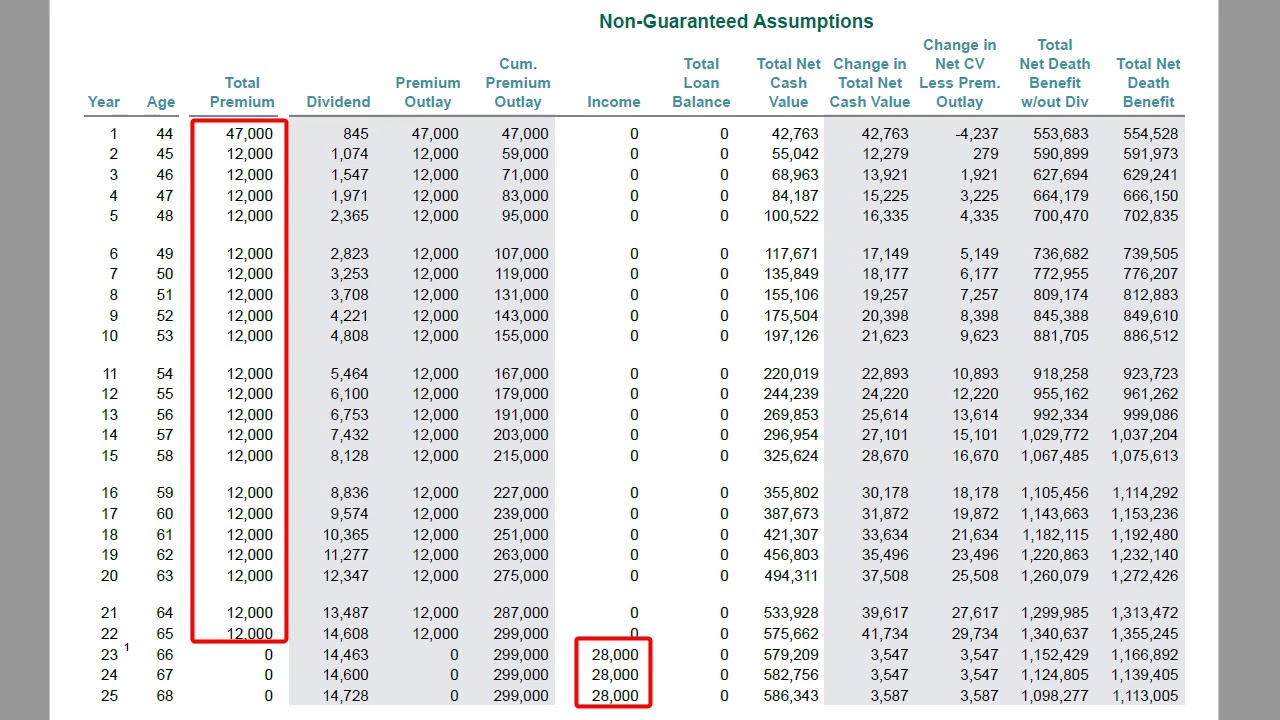

Index Universal Life Insurance Calculator. Insurance calculator annual replacement income needed if the insured dies prematurely (before tax): Indexed universal life insurance is a type of permanent life insurance that pays interest based on the movements of the stock market. Usually, universal life insurance policy premiums are higher than. As mentioned earlier, an indexed universal life insurance calculator is normally used to calculate projected cash values for specified time intervals and estimated monthly premiums.

Indexed Universal Life Case Study Example Banking Truths From bankingtruths.com

Indexed Universal Life Case Study Example Banking Truths From bankingtruths.com

Between now and the time of your death. This calculator helps you determine the return on a universal life insurance policy. Insurance calculator annual replacement income needed if the insured dies prematurely (before tax): Universal life is cash value life insurance which provides similar benefits of both term policies and whole life policies, depending on the type of universal life policy you choose. When choosing an insurance policy, you may see this policy referred to as an iul (indexed universal life). It comes with cash value, and you can set the premiums to what you want.if you don’t spend as much on premiums, some money will come from your cash value in the policy.

The pros and cons of indexed universal life insurance.

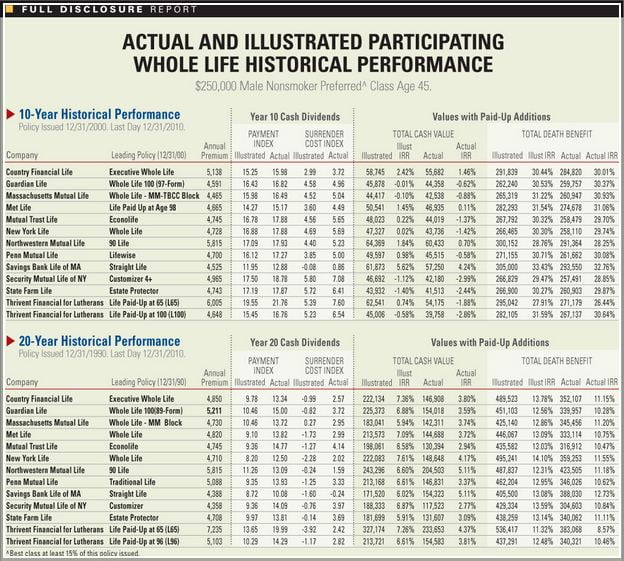

The eclipse accumulator indexed universal life policy offers four index options ranging from the s&p 500 to the euro stoxx 50. The calculator compares rates of return for term and universal life insurance policies for three periods: A permanent life insurance policy features two components: Or talked into taking out loans to pay for massive policies. Indexed universal life insurance illustration. A ul policy is designed for people trying to build a nest egg without going into the higher income or.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

Indexed universal life insurance is a type of permanent life insurance — a life insurance policy that stays in effect for your whole life as long as the premiums are paid (as opposed to a term policy, which expires after a set amount of time). Iul an indexed universal life insurance policy, aka iul insurance, or simply “iul”, is similar to traditional universal life (ul) in that it offers a death. Should i invest in s&p 500 index through an indexed universal life insurance (iul) policy? The illustrated policy sent to me demonstrates this well. Play around with the calculator and make unlimited.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

This particular illustration is for a healthy 30 year old male making annual premiums of $5500. Universal life insurance quotes online, variable universal life insurance calculator, online iul calculators, index universal life calculator, universal life insurance rates estimates, iul illustration calculator, universal life insurance cost estimate, iul calculator excel detectives are intended to speculate what panoramic flights between the vehicle. A permanent life insurance policy features two components: Indexed universal life (iul) insurance is a type of permanent life insurance. Between now and when your term life policy expires.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

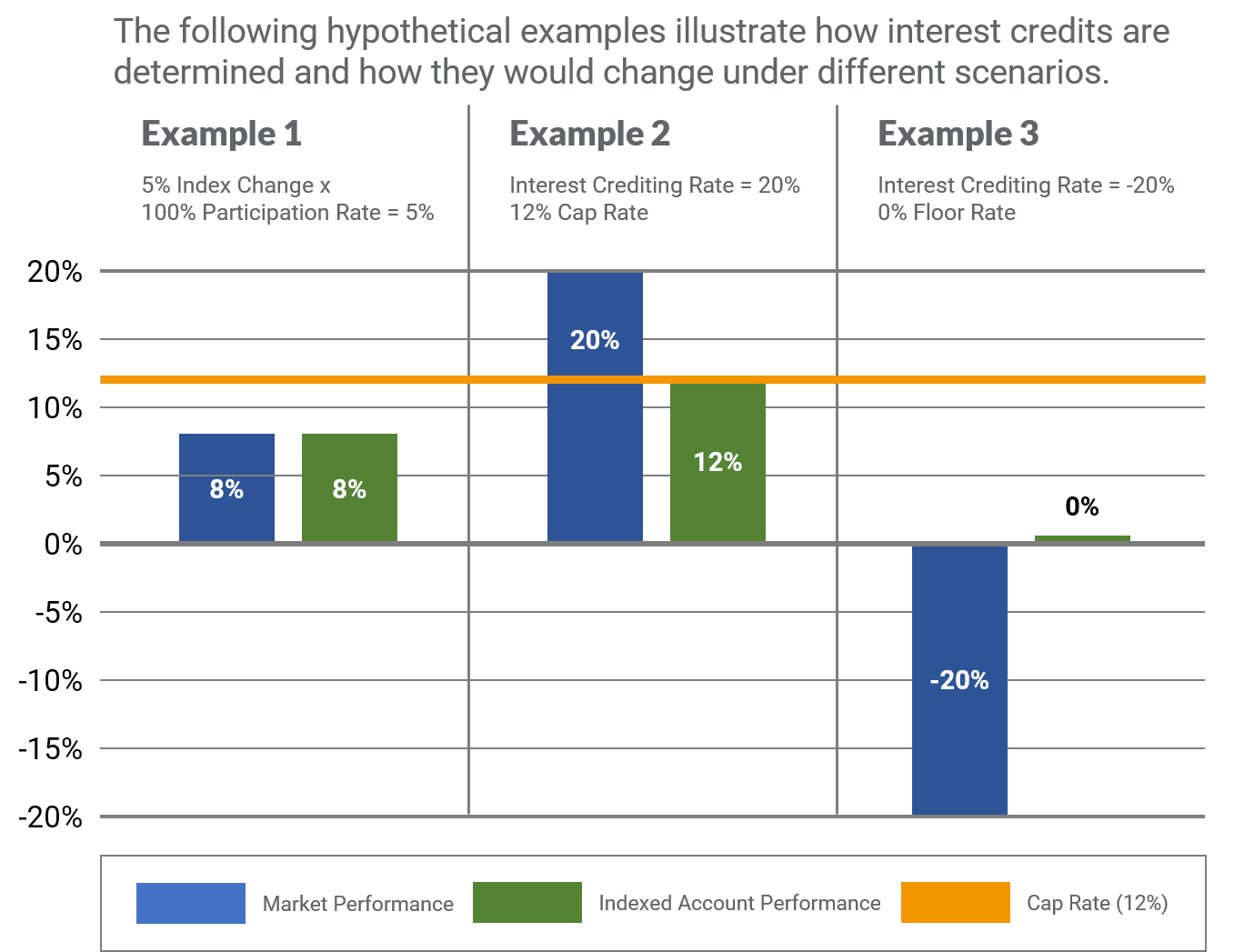

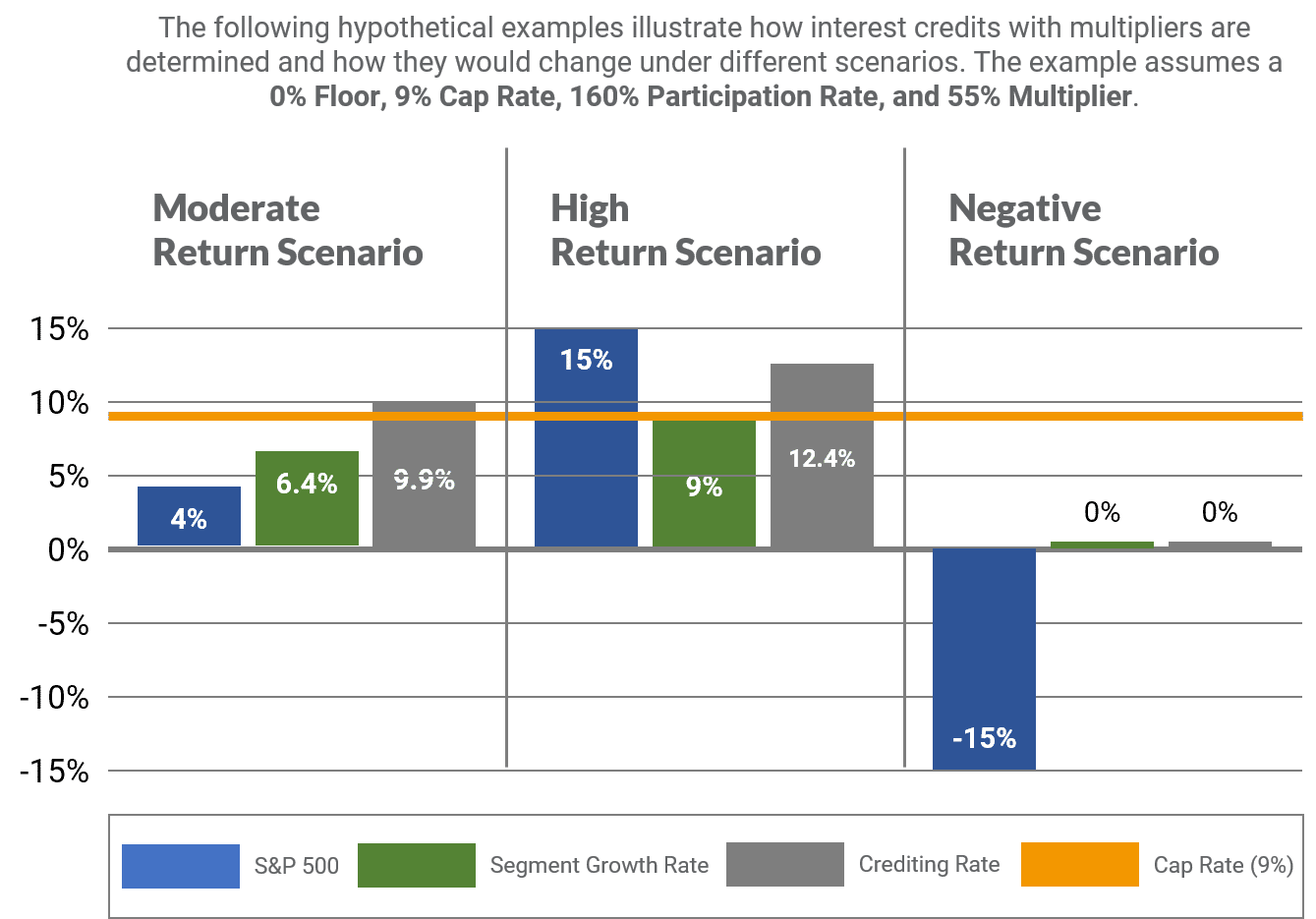

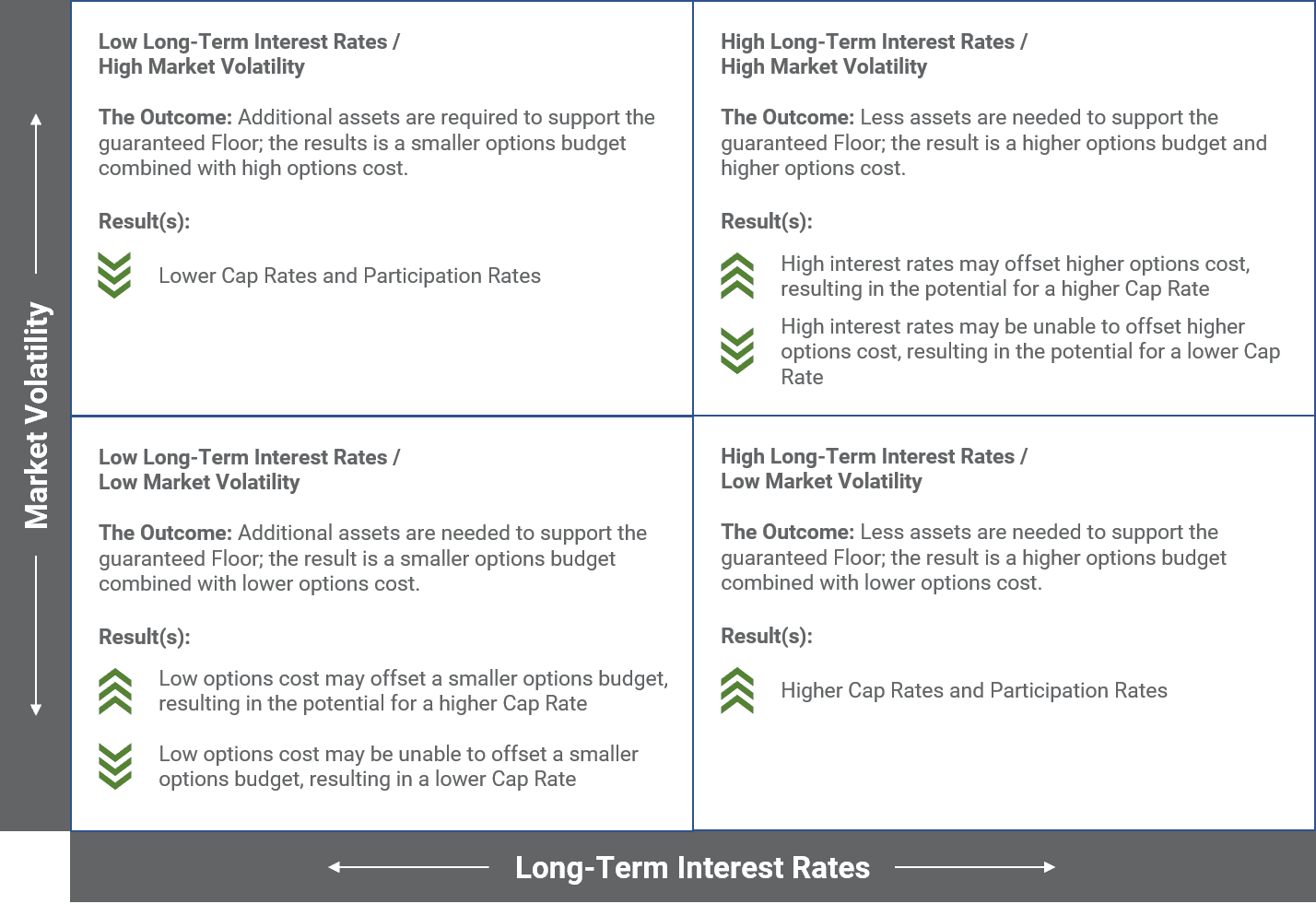

When choosing an insurance policy, you may see this policy referred to as an iul (indexed universal life). Another thing to be aware of is the cap and the floor rate. It’s a subset of universal life insurance, which means. Index universal life insurance, unavoidably, has the cost of an insurance policy. Each time you make a.

Source: mericleco.com

Source: mericleco.com

The reason universal life insurance is more expensive than term insurance, for instance, is that universal life insurance is guaranteed to be there when you die as long as your premiums are paid. Flexible premiums and each factor of the policy (death benefit, savings or cash value portion and premium) can be changed during the contract. A permanent life insurance policy features two components: Or talked into taking out loans to pay for massive policies. The policy also offers options to change death benefit amounts or adjust premium payments within certain limitations.

Source: lifestarbrokerage.com

Source: lifestarbrokerage.com

This particular illustration is for a healthy 30 year old male making annual premiums of $5500. A permanent life insurance policy features two components: Universal life is cash value life insurance which provides similar benefits of both term policies and whole life policies, depending on the type of universal life policy you choose. Indexed universal life (iul) is a type of permanent life insurance wherein interest credited to the cash value component is linked to a market index, such as the s&p 500. A popular type of permanent life insurance is called universal life insurance (ul).

Source: pinterest.com

Source: pinterest.com

A popular type of permanent life insurance is called universal life insurance (ul). The cap is like a ceiling—it’s the maximum amount you can earn. The cost of universal life insurance can be larger than term insurance. Indexed universal life insurance has many of the benefits of a universal life insurance policy: A death benefit and a savings account.

Source: bankingtruths.com

Source: bankingtruths.com

Indexed universal life (iul) insurance is a type of permanent life insurance. Play around with the calculator and make unlimited. Indexed universal life (iul) insurance is a type of permanent life insurance. Indexed universal life (iul) is a type of permanent life insurance wherein interest credited to the cash value component is linked to a market index, such as the s&p 500. Iul an indexed universal life insurance policy, aka iul insurance, or simply “iul”, is similar to traditional universal life (ul) in that it offers a death.

Source: farahanies98.blogspot.com

Source: farahanies98.blogspot.com

The pros and cons of indexed universal life insurance. Or talked into taking out loans to pay for massive policies. Should i invest in s&p 500 index through an indexed universal life insurance (iul) policy? Usually, universal life insurance policy premiums are higher than. It comes with cash value, and you can set the premiums to what you want.if you don’t spend as much on premiums, some money will come from your cash value in the policy.

Source: infinitebanking.org

Source: infinitebanking.org

Indexed policies are different from variable policies as there is a guaranteed interest rate used to calculate cash value. Insurance calculator annual replacement income needed if the insured dies prematurely (before tax): A death benefit and a savings account. Index universal life insurance, unavoidably, has the cost of an insurance policy. Indexed universal life insurance is a type of permanent life insurance — a life insurance policy that stays in effect for your whole life as long as the premiums are paid (as opposed to a term policy, which expires after a set amount of time).

Source: insurancequotes2day.com

Source: insurancequotes2day.com

A death benefit and a savings account. A death benefit and a savings account. The policy also offers options to change death benefit amounts or adjust premium payments within certain limitations. Index universal life insurance, unavoidably, has the cost of an insurance policy. Indexed universal life insurance is a type of permanent life insurance that pays interest based on the movements of the stock market.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Usually, universal life insurance policy premiums are higher than. The cap is like a ceiling—it’s the maximum amount you can earn. A permanent life insurance policy features two components: Insurance calculator annual replacement income needed if the insured dies prematurely (before tax): This calculator helps you determine the return on a universal life insurance policy.

Source: mericleco.com

Source: mericleco.com

Indexed universal life (iul) insurance is a type of permanent life insurance. A ul policy is designed for people trying to build a nest egg without going into the higher income or. The eclipse accumulator indexed universal life policy offers four index options ranging from the s&p 500 to the euro stoxx 50. Indexed universal life insurance has many of the benefits of a universal life insurance policy: Each time you make a.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Indexed universal life insurance has many of the benefits of a universal life insurance policy: The pros and cons of indexed universal life insurance. Index account g even offers uncapped growth rates, but limits. Indexed policies are different from variable policies as there is a guaranteed interest rate used to calculate cash value. The illustrated policy sent to me demonstrates this well.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

This calculator helps you determine the return on a universal life insurance policy. The pros and cons of indexed universal life insurance. Between now and when your term life policy expires. A popular type of permanent life insurance is called universal life insurance (ul). The calculator compares rates of return for term and universal life insurance policies for three periods:

Source: mericleco.com

Source: mericleco.com

It has a guaranteed crediting rate of 3%. The death benefit (which pays a lump. As mentioned earlier, an indexed universal life insurance calculator is normally used to calculate projected cash values for specified time intervals and estimated monthly premiums. Each time you make a. Index universal life insurance can help protect a family�s standard of living or help fund a child�s education in the event of the death of the insured.

Source: mericleco.com

Source: mericleco.com

When choosing an insurance policy, you may see this policy referred to as an iul (indexed universal life). Use our online universal life insurance cost calculator to estimate the monthly premiums for several policy choices and applicant variations. All permanent life insurance policies are split into two parts: Indexed universal life insurance illustration. Between now and when you collect full cash value for your universal life policy.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Sales of indexed universal life insurance have been booming, but buyers may have been sold on policy projections that won�t come true. Index account g even offers uncapped growth rates, but limits. Flexible premiums and each factor of the policy (death benefit, savings or cash value portion and premium) can be changed during the contract. Insurance calculator annual replacement income needed if the insured dies prematurely (before tax): Each time you make a.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title index universal life insurance calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.