Individual short term disability insurance with pre existing condition information

Home » Trending » Individual short term disability insurance with pre existing condition informationYour Individual short term disability insurance with pre existing condition images are ready. Individual short term disability insurance with pre existing condition are a topic that is being searched for and liked by netizens today. You can Get the Individual short term disability insurance with pre existing condition files here. Download all royalty-free images.

If you’re searching for individual short term disability insurance with pre existing condition pictures information linked to the individual short term disability insurance with pre existing condition interest, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Individual Short Term Disability Insurance With Pre Existing Condition. If you file too late, they can use this clause to deny your claim. This is the fairly standard practice among short term insurers. The insurance company will review the following factors when processing your claim: And those who can get a policy will have a longer waiting period to receive benefits, perhaps 12 months or more.

Short Term Medical Coverage Nevada Benefits Group From nevadabenefits.com

Short Term Medical Coverage Nevada Benefits Group From nevadabenefits.com

Yes, it can be cheap. If you file too late, they can use this clause to deny your claim. This is the fairly standard practice among short term insurers. In most cases, they would not even qualify for coverage. Yes, it can help in a pinch. You’ll pay a premium, either monthly or yearly, for coverage.

And those who can get a policy will have a longer waiting period to receive benefits, perhaps 12 months or more.

In most cases, they would not even qualify for coverage. It might even remove exclusions if you can demonstrate that a condition has gone away or significantly improved. Thus, it is in the insurer’s best interest to investigate all the facts. And those who can get a policy will have a longer waiting period to receive benefits, perhaps 12 months or more. If you file too late, they can use this clause to deny your claim. Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre.

Source: glgamerica.com

Source: glgamerica.com

Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. Thus, it is in the insurer’s best interest to investigate all the facts. It might even remove exclusions if you can demonstrate that a condition has gone away or significantly improved. You must be healthy enough to qualify for new coverage. In a group plan, the members of a particular group or organization are all offered the opportunity to receive disability insurance coverage.

Source: mysgmcbenefits.com

Source: mysgmcbenefits.com

Thus, it is in the insurer’s best interest to investigate all the facts. Read your disclosure statement carefully where you might find a similar legal language. It also depends on the severity of the condition and whether the condition is covered by the policy. Ltd policies often have “proof of claim” or clauses dictating when a claim must be filed. Individually purchased long term policies also have these exclusions however, a consumer can avail of.

Source: termlife2go.com

Source: termlife2go.com

The insurance company will review the following factors when processing your claim: Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. This is the fairly standard practice among short term insurers. If you file too late, they can use this clause to deny your claim. It might even remove exclusions if you can demonstrate that a condition has gone away or significantly improved.

Source: usave.co.uk

Source: usave.co.uk

You’ll pay a premium, either monthly or yearly, for coverage. This is the fairly standard practice among short term insurers. When they are, it’s usually only after 12 months or. And even if you can find one that fits that bill, you’ll likely pay for it in the long run. Ltd policies often have “proof of claim” or clauses dictating when a claim must be filed.

Source: classroom.synonym.com

Source: classroom.synonym.com

It is an obstacle that disabled employees should be prepared to deal with when applying for ltd benefits. And even if you can find one that fits that bill, you’ll likely pay for it in the long run. Ltd policies often have “proof of claim” or clauses dictating when a claim must be filed. If you file too late, they can use this clause to deny your claim. You must be healthy enough to qualify for new coverage.

Source: capricmw.ca

Source: capricmw.ca

Individually purchased long term policies also have these exclusions however, a consumer can avail of. Subsequently, question is, can you get short term disability with a pre existing condition? In most cases, they would not even qualify for coverage. The insurance company will review the following factors when processing your claim: Ltd policies often have “proof of claim” or clauses dictating when a claim must be filed.

Source: pinterest.com

Source: pinterest.com

The amount you pay depends on your general health and. It might even remove exclusions if you can demonstrate that a condition has gone away or significantly improved. Yes, it can help in a pinch. The amount you pay depends on your general health and. Thus, it is in the insurer’s best interest to investigate all the facts.

Source: houston-disability-attorneys.com

Source: houston-disability-attorneys.com

It also depends on the severity of the condition and whether the condition is covered by the policy. Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. Read your disclosure statement carefully where you might find a similar legal language. Thus, it is in the insurer’s best interest to investigate all the facts. The amount you pay depends on your general health and.

Source: groupplansaz.com

Source: groupplansaz.com

It is an obstacle that disabled employees should be prepared to deal with when applying for ltd benefits. This is the fairly standard practice among short term insurers. You’ll pay a premium, either monthly or yearly, for coverage. Yes, it can help in a pinch. You must be healthy enough to qualify for new coverage.

Source: revisi.net

Source: revisi.net

You must be healthy enough to qualify for new coverage. In a group plan, the members of a particular group or organization are all offered the opportunity to receive disability insurance coverage. You’ll pay a premium, either monthly or yearly, for coverage. It is an obstacle that disabled employees should be prepared to deal with when applying for ltd benefits. Thus, it is in the insurer’s best interest to investigate all the facts.

Source: nursa.org

Source: nursa.org

Yes, it can be cheap. And even if you can find one that fits that bill, you’ll likely pay for it in the long run. The amount you pay depends on your general health and. Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. This is the fairly standard practice among short term insurers.

Source: brossfrankel.com

Source: brossfrankel.com

This is the fairly standard practice among short term insurers. As always, in group insurance, every plan may. Individual disability insurance policies may also Yes, it can be cheap. In a group plan, the members of a particular group or organization are all offered the opportunity to receive disability insurance coverage.

Source: wellingtonassetprotection.com

Source: wellingtonassetprotection.com

Individual disability insurance policies may also Read your disclosure statement carefully where you might find a similar legal language. It is an obstacle that disabled employees should be prepared to deal with when applying for ltd benefits. And those who can get a policy will have a longer waiting period to receive benefits, perhaps 12 months or more. It also depends on the severity of the condition and whether the condition is covered by the policy.

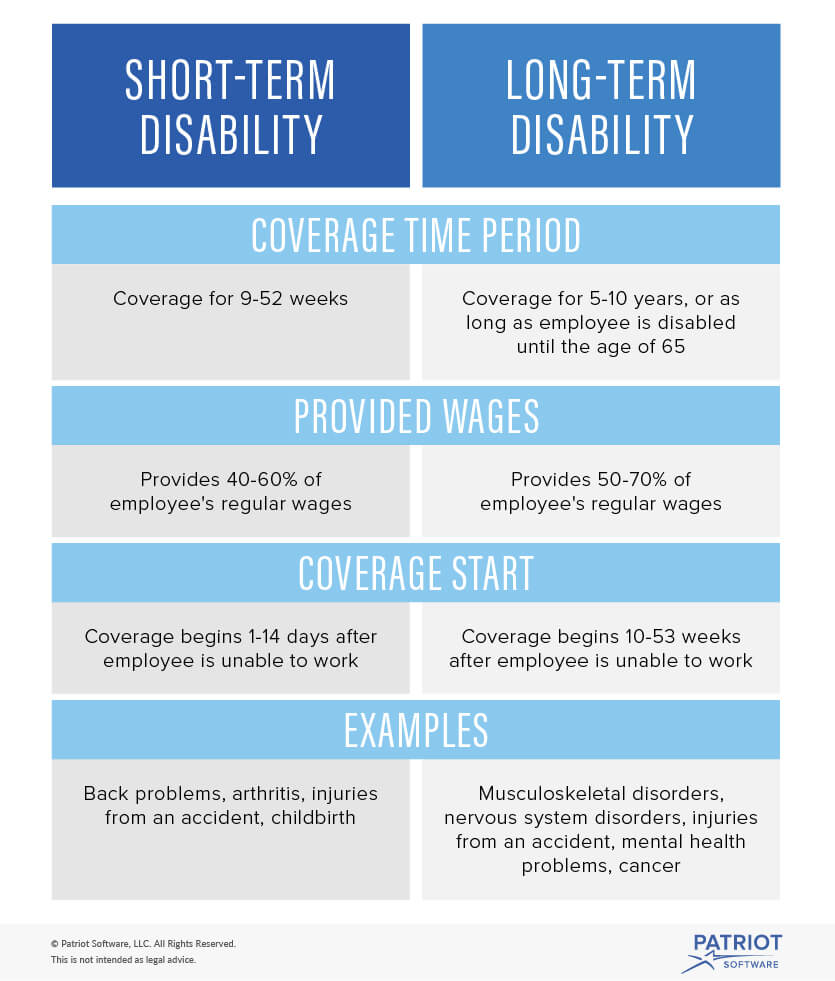

Source: patriotsoftware.com

Source: patriotsoftware.com

And even if you can find one that fits that bill, you’ll likely pay for it in the long run. If you file too late, they can use this clause to deny your claim. Yes, it can help in a pinch. It might even remove exclusions if you can demonstrate that a condition has gone away or significantly improved. Subsequently, question is, can you get short term disability with a pre existing condition?

Source: revisi.net

Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. Subsequently, question is, can you get short term disability with a pre existing condition? If you file too late, they can use this clause to deny your claim. Individual disability insurance policies may also Individually purchased long term policies also have these exclusions however, a consumer can avail of.

Source: revisi.net

Source: revisi.net

If you file too late, they can use this clause to deny your claim. Under the affordable care act ( obamacare ), health insurance companies cannot refuse to cover you because of any pre. The insurance company will review the following factors when processing your claim: As always, in group insurance, every plan may. Thus, it is in the insurer’s best interest to investigate all the facts.

Source: topclassactions.com

Source: topclassactions.com

Yes, it can help in a pinch. In a group plan, the members of a particular group or organization are all offered the opportunity to receive disability insurance coverage. It also depends on the severity of the condition and whether the condition is covered by the policy. Individual disability insurance policies may also This is the fairly standard practice among short term insurers.

Source: phillipsinsurancega.com

Source: phillipsinsurancega.com

In a group plan, the members of a particular group or organization are all offered the opportunity to receive disability insurance coverage. Read your disclosure statement carefully where you might find a similar legal language. When they are, it’s usually only after 12 months or. If you file too late, they can use this clause to deny your claim. As always, in group insurance, every plan may.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title individual short term disability insurance with pre existing condition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.