Individual stop loss insurance Idea

Home » Trend » Individual stop loss insurance IdeaYour Individual stop loss insurance images are available in this site. Individual stop loss insurance are a topic that is being searched for and liked by netizens today. You can Get the Individual stop loss insurance files here. Download all royalty-free images.

If you’re searching for individual stop loss insurance images information related to the individual stop loss insurance topic, you have visit the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

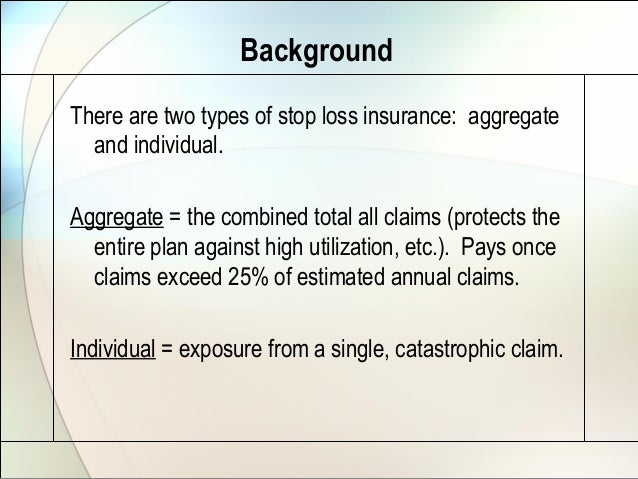

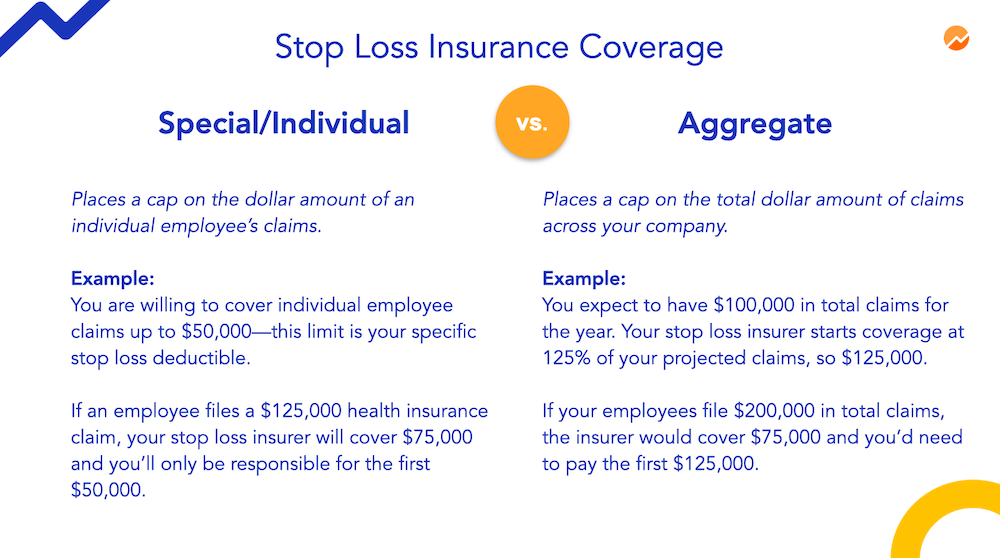

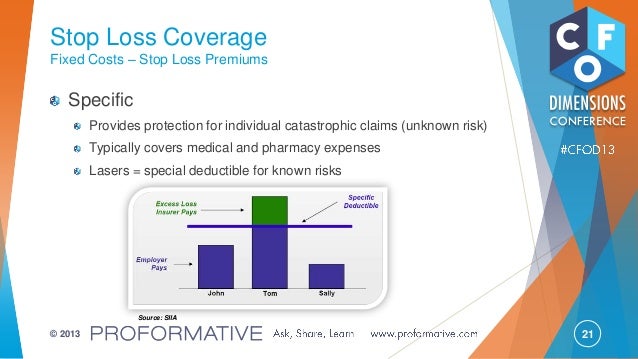

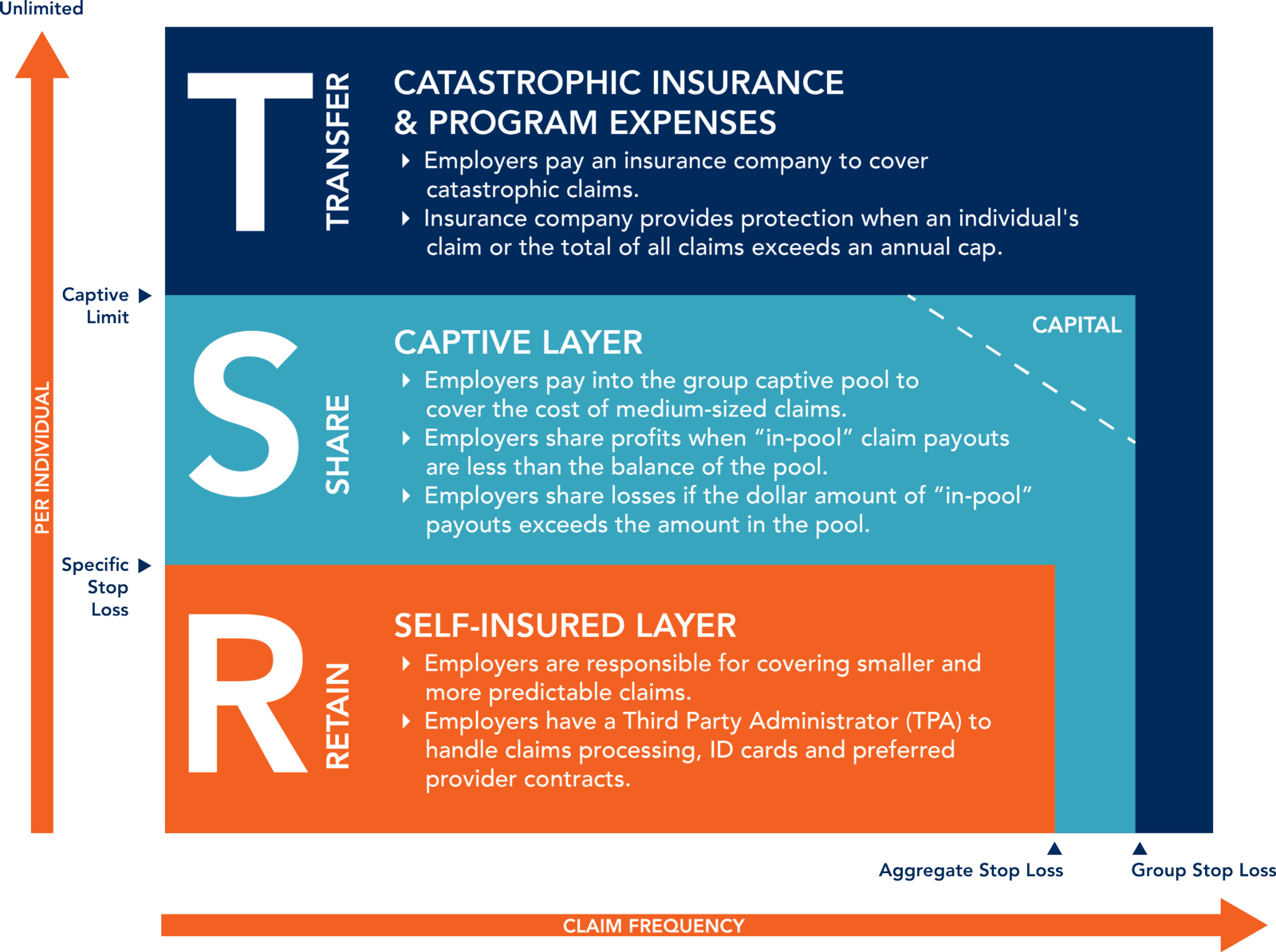

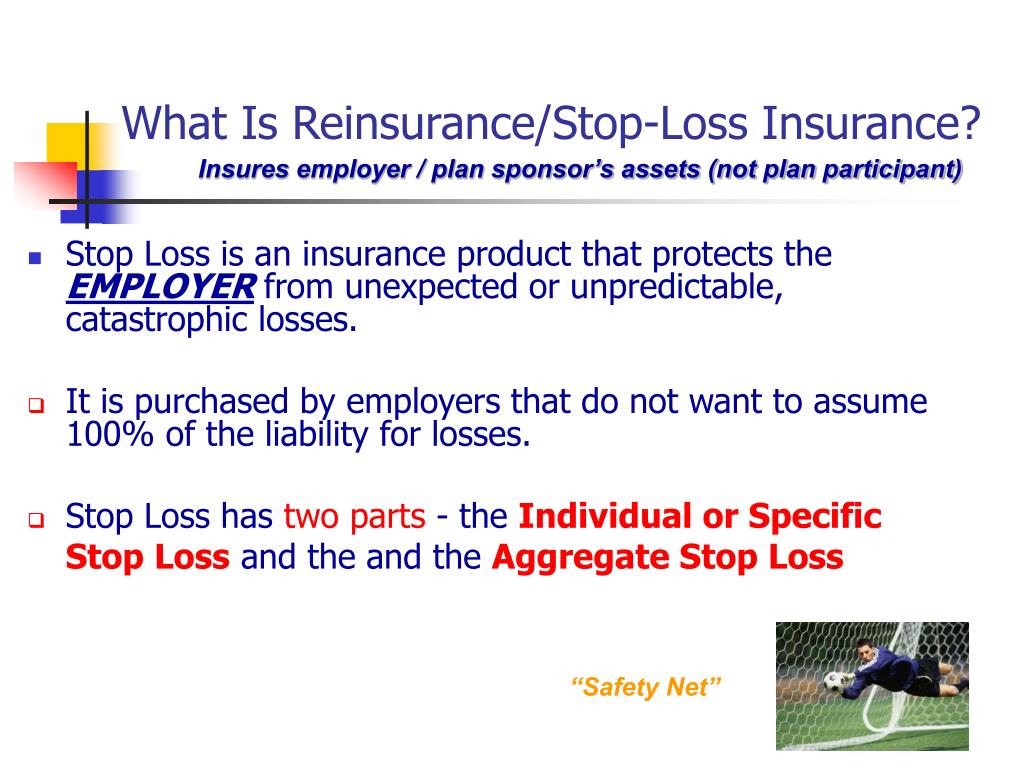

Individual Stop Loss Insurance. (1) an insurer shall not issue a stop loss insurance policy that : Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). Individual, or specific, coverage protects your company against large, catastrophic claims. Provides coverage that limits the annual amount paid out for all covered employees;

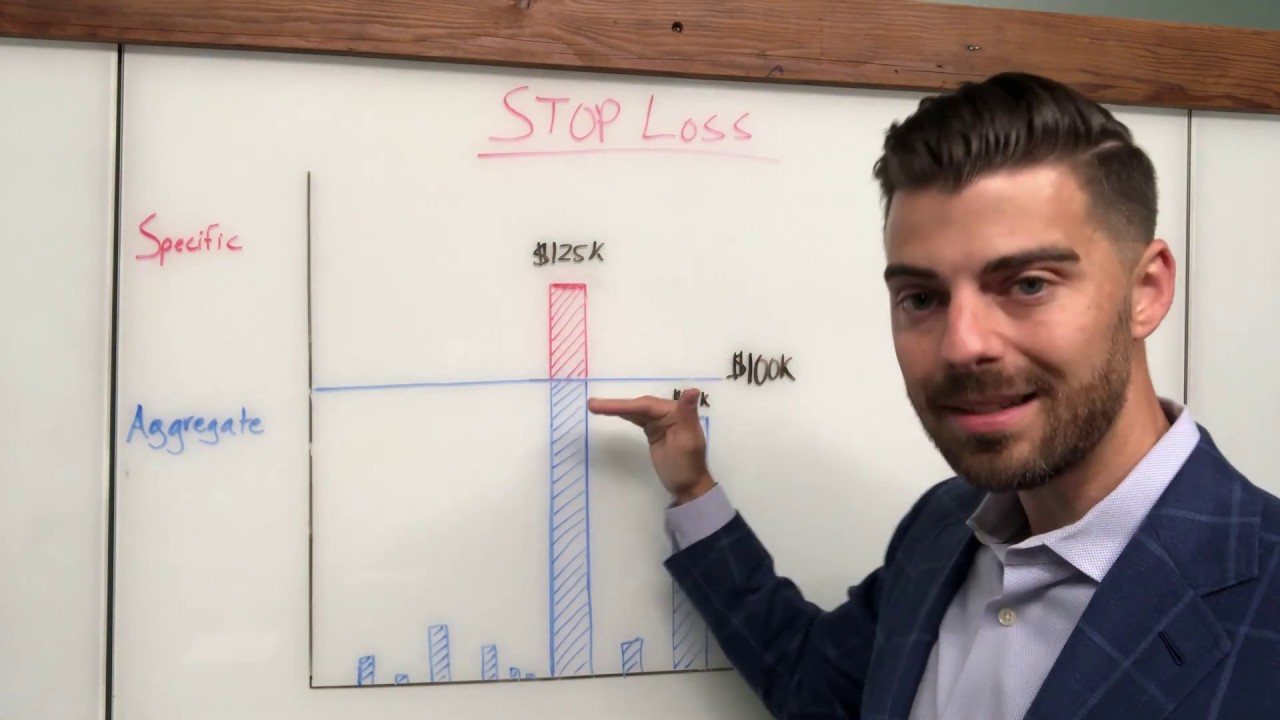

Stop Loss Insurance Basics YouTube From youtube.com

Stop Loss Insurance Basics YouTube From youtube.com

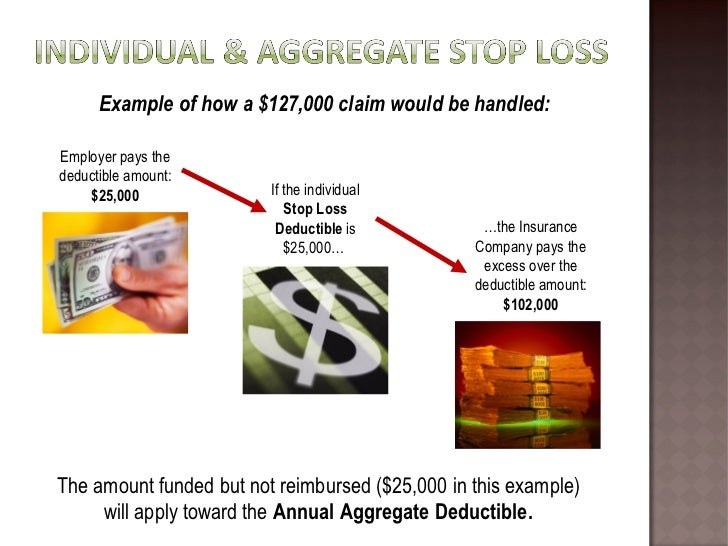

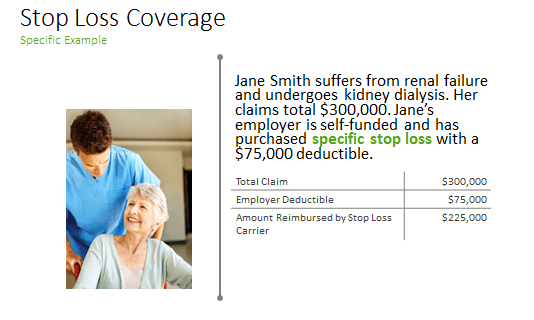

Provides coverage that limits the annual amount paid out for all covered employees; A stop loss insurance policy usually contains two components: The employer remains responsible for claim expenses under the deductible amount. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims. All backed by our solid service and support.

And 2) an aggregate attachment point that protects against claim frequency.

A stop loss insurance policy provides a financial cushion to prevent financial devastation. Individual, or specific, coverage protects your company against large, catastrophic claims. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. Like the reinsurance an insurance company buys, stop loss coverage is designed to protect the ability to pay their covered person what is owed. For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold. Stop loss insurance coverage standards.

Source: prodigystoploss.com

Source: prodigystoploss.com

A stop loss insurance policy usually contains two components: If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims. (1) an insurer shall not issue a stop loss insurance policy that : Individual, or specific, coverage protects your company against large, catastrophic claims. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below).

Source: slideshare.net

Source: slideshare.net

(1) an insurer shall not issue a stop loss insurance policy that : Individual, or specific, coverage protects your company against large, catastrophic claims. Individual stop loss coverage — this is the stop loss insurance employers pay so they’re protected in the event that an individual claim is exceedingly high in a given plan year. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. (a) has an annual attachment point for claims incurred per individual which is lower than $20,000;

Source: fundera.com

Source: fundera.com

Stop loss insurance coverage standards. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Provides coverage that limits the annual amount paid out for all covered employees; Individual, or specific, coverage protects your company against large, catastrophic claims.

Source: slideshare.net

Source: slideshare.net

The intent of this publication is to provide our partners with meaningful and actionable insights regarding emerging market trends. It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them. A stop loss insurance policy usually contains two components: As employee medical bills can quickly add up, being able to predictably cap expenses is critical. A stop loss insurance policy provides a financial cushion to prevent financial devastation.

Source: slideshare.net

Source: slideshare.net

There are actually two types of stop loss insurance that help limit employer liability: And 2) an aggregate attachment point that protects against claim frequency. Like the reinsurance an insurance company buys, stop loss coverage is designed to protect the ability to pay their covered person what is owed. All backed by our solid service and support. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below).

Source: associationhealthplans.com

Source: associationhealthplans.com

Individual stop loss coverage — this is the stop loss insurance employers pay so they’re protected in the event that an individual claim is exceedingly high in a given plan year. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. (1) an insurer shall not issue a stop loss insurance policy that : Provides coverage that limits the annual amount paid out for all covered employees;

Source: guardiananytime.com

Source: guardiananytime.com

As employee medical bills can quickly add up, being able to predictably cap expenses is critical. And 2) an aggregate attachment point that protects against claim frequency. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. A stop loss insurance policy provides a financial cushion to prevent financial devastation. The employer remains responsible for claim expenses under the deductible amount.

Source: connerstrong.com

Source: connerstrong.com

Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Individual, or specific, coverage protects your company against large, catastrophic claims. The employer remains responsible for claim expenses under the deductible amount. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below).

Source: slideserve.com

Source: slideserve.com

The employer remains responsible for claim expenses under the deductible amount. Home and business owners often buy umbrella coverage. Like the reinsurance an insurance company buys, stop loss coverage is designed to protect the ability to pay their covered person what is owed. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. 1) a specific “attachment point” (or retention level”)“ that protects against claim severity;

Source: guardiananytime.com

Source: guardiananytime.com

Individual stop loss coverage — this is the stop loss insurance employers pay so they’re protected in the event that an individual claim is exceedingly high in a given plan year. For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Stop loss insurance coverage standards. (b) has an annual aggregate attachment point, for groups of fifty (50) or fewer, that is lower than the greater of:

Source: youtube.com

Source: youtube.com

There are actually two types of stop loss insurance that help limit employer liability: Home and business owners often buy umbrella coverage. There are actually two types of stop loss insurance that help limit employer liability: If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims. Stop loss insurance coverage standards.

Source: cutcompcosts.com

Source: cutcompcosts.com

For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). A stop loss insurance policy usually contains two components: Individual stop loss coverage — this is the stop loss insurance employers pay so they’re protected in the event that an individual claim is exceedingly high in a given plan year. (a) has an annual attachment point for claims incurred per individual which is lower than $20,000;

Source: guardiananytime.com

Source: guardiananytime.com

As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Specific claims may be reimbursed as soon as the individual’s deductible has been met. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. A stop loss insurance policy usually contains two components: For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold.

Source: springgroup.com

Source: springgroup.com

As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Individual, or specific, coverage protects your company against large, catastrophic claims. For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). It is able to do that by letting the insurance cover for the medical expenses of the employees after the employer spends a specific amount on them.

Source: slideshare.net

Source: slideshare.net

- a specific “attachment point” (or retention level”)“ that protects against claim severity; If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims. Provides coverage that limits the annual amount paid out for all covered employees; Stop loss insurance coverage standards. As employee medical bills can quickly add up, being able to predictably cap expenses is critical.

Source: medcost.com

Source: medcost.com

Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). A stop loss insurance policy provides a financial cushion to prevent financial devastation. (b) has an annual aggregate attachment point, for groups of fifty (50) or fewer, that is lower than the greater of: If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer.

Source: slideshare.net

Source: slideshare.net

Like the reinsurance an insurance company buys, stop loss coverage is designed to protect the ability to pay their covered person what is owed. Like the reinsurance an insurance company buys, stop loss coverage is designed to protect the ability to pay their covered person what is owed. For claims above the deductible, the employer pays upfront and the stop loss carrier reimburses any portion exceeding that threshold. The intent of this publication is to provide our partners with meaningful and actionable insights regarding emerging market trends. If this individual claim reaches the stop loss deductible, the reinsurance kicks in and reimburses the employer for claims.

Source: medcost.com

Source: medcost.com

The intent of this publication is to provide our partners with meaningful and actionable insights regarding emerging market trends. Provides coverage that limits the annual amount paid out for all covered employees; A stop loss insurance policy provides a financial cushion to prevent financial devastation. As employee medical bills can quickly add up, being able to predictably cap expenses is critical. Individual, or specific, coverage protects your company against large, catastrophic claims.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title individual stop loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.