Insurable interest examples information

Home » Trending » Insurable interest examples informationYour Insurable interest examples images are ready. Insurable interest examples are a topic that is being searched for and liked by netizens today. You can Get the Insurable interest examples files here. Find and Download all royalty-free photos.

If you’re searching for insurable interest examples pictures information connected with to the insurable interest examples keyword, you have pay a visit to the right site. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

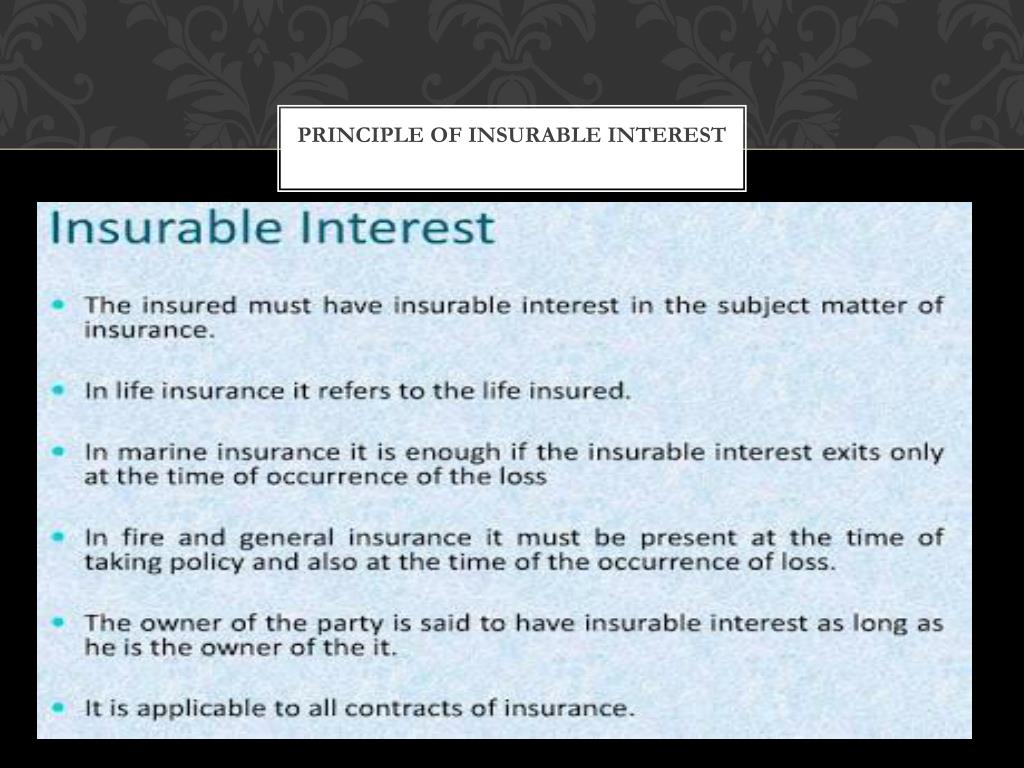

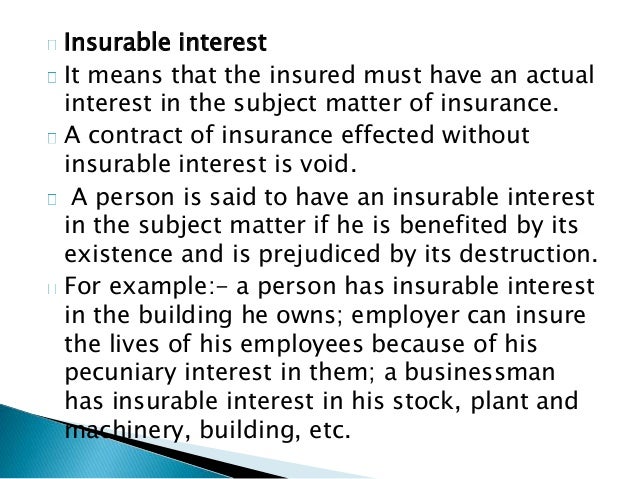

Insurable Interest Examples. Insurable interest is the basis of all insurance policies. There are three types of insurable interest: Insurable interest also applies to property insurance. Employee hereby grants to the company an insurable interest in employee�s life, and agrees and understands that the company may at any time or from time to time during the term of employment choose to purchase and maintain key man life insurance on employee.

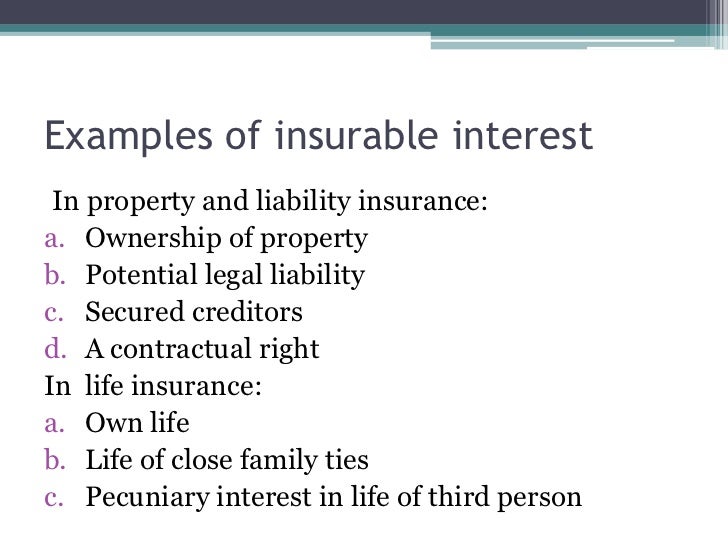

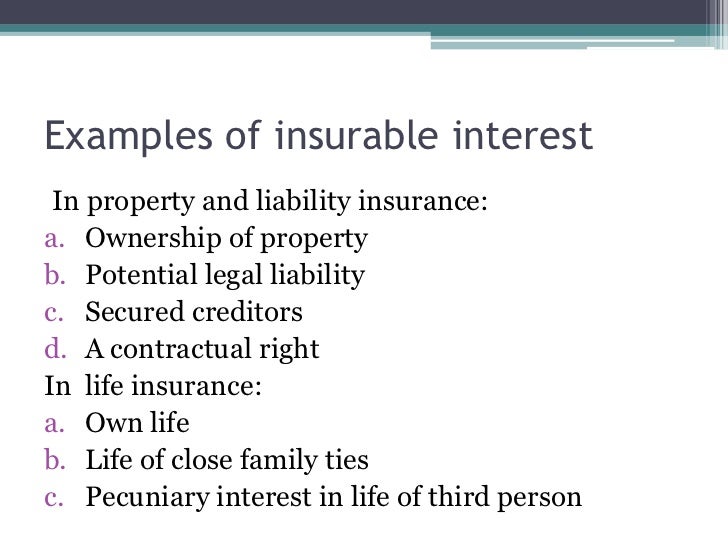

Insurance principles From slideshare.net

Insurance principles From slideshare.net

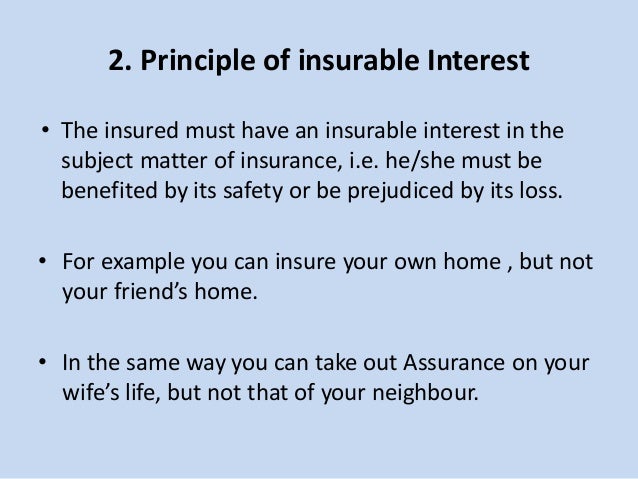

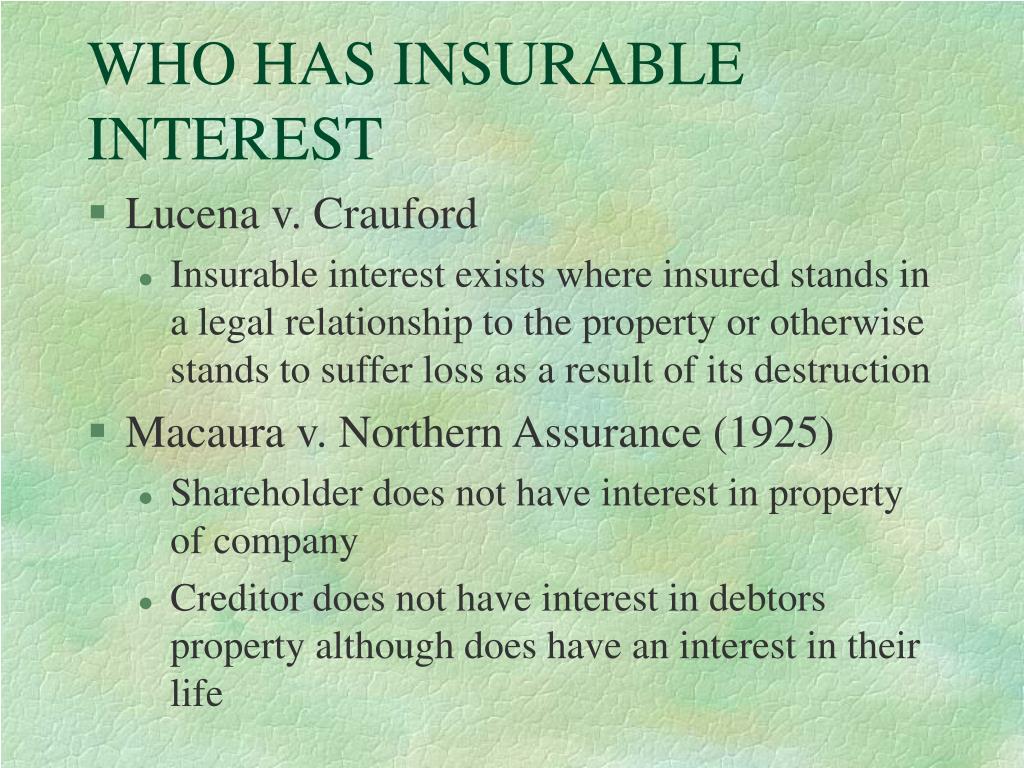

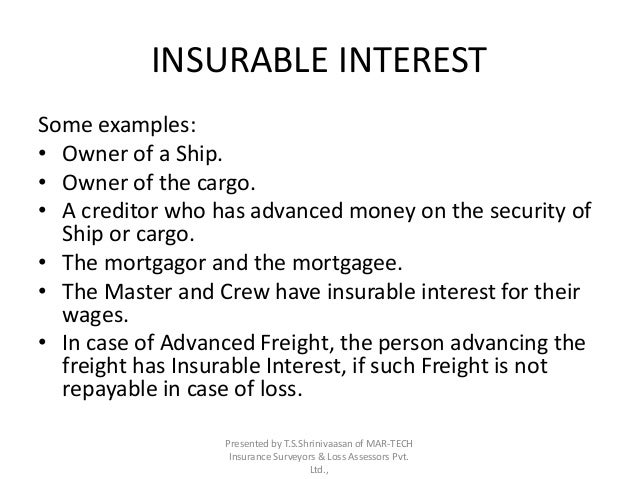

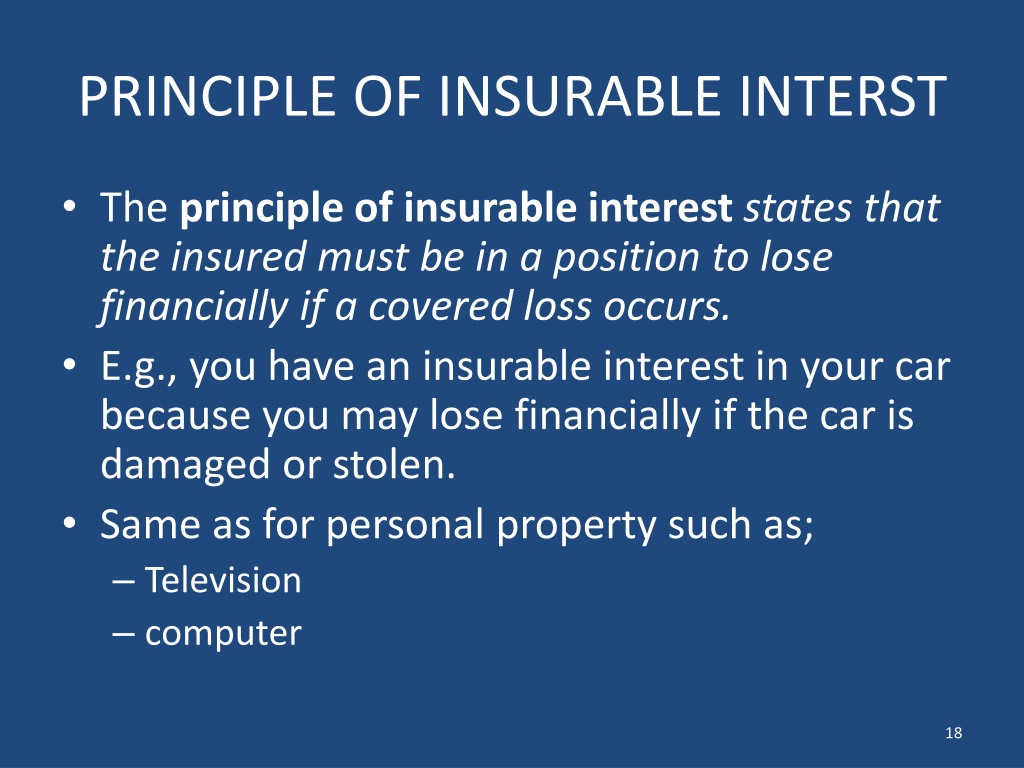

Insurable interest is almost a legal right to insure. This is true for any insurance policy, including homeowners, business, and life insurance. It can be understood from the following example, that any individual will have an insurable interest in his own home or family and not on some random home or family. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.it is not possible to affect an insurance policy on a subject. Besides these categories, there are other persons recognised by case law to have an insurable interest, such as captors and agents who might accrue a benefit from the preservation. In fact, before the promulgation of certain acts by english parliament, it was not.

Thus, the principle of insurable interest is based on no moral.

This is the most common example of someone you would be considered to have an insurable interest in. Examples of insurable interest in a sentence. The act recognises the shipowner, the mortgagee and the insurer as obvious examples of persons who have legal rights in the property and, thus, an insurable interest. Insurable interest is almost a legal right to insure. If the spouse were to die, that person would be without the spouse. See all ( 15) insurable interest.

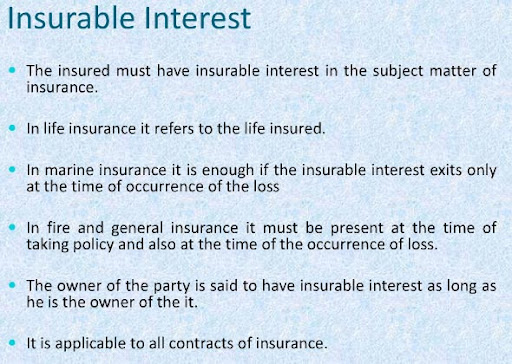

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

Besides these categories, there are other persons recognised by case law to have an insurable interest, such as captors and agents who might accrue a benefit from the preservation. An insurable interest is an object which, if damaged or destroyed, would result in financial hardship for the policyholder. The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss. For example, if you buy car insurance, your personal interest would be the damage or destruction of the car. Husband or wife (including former spouses) brothers/sisters;

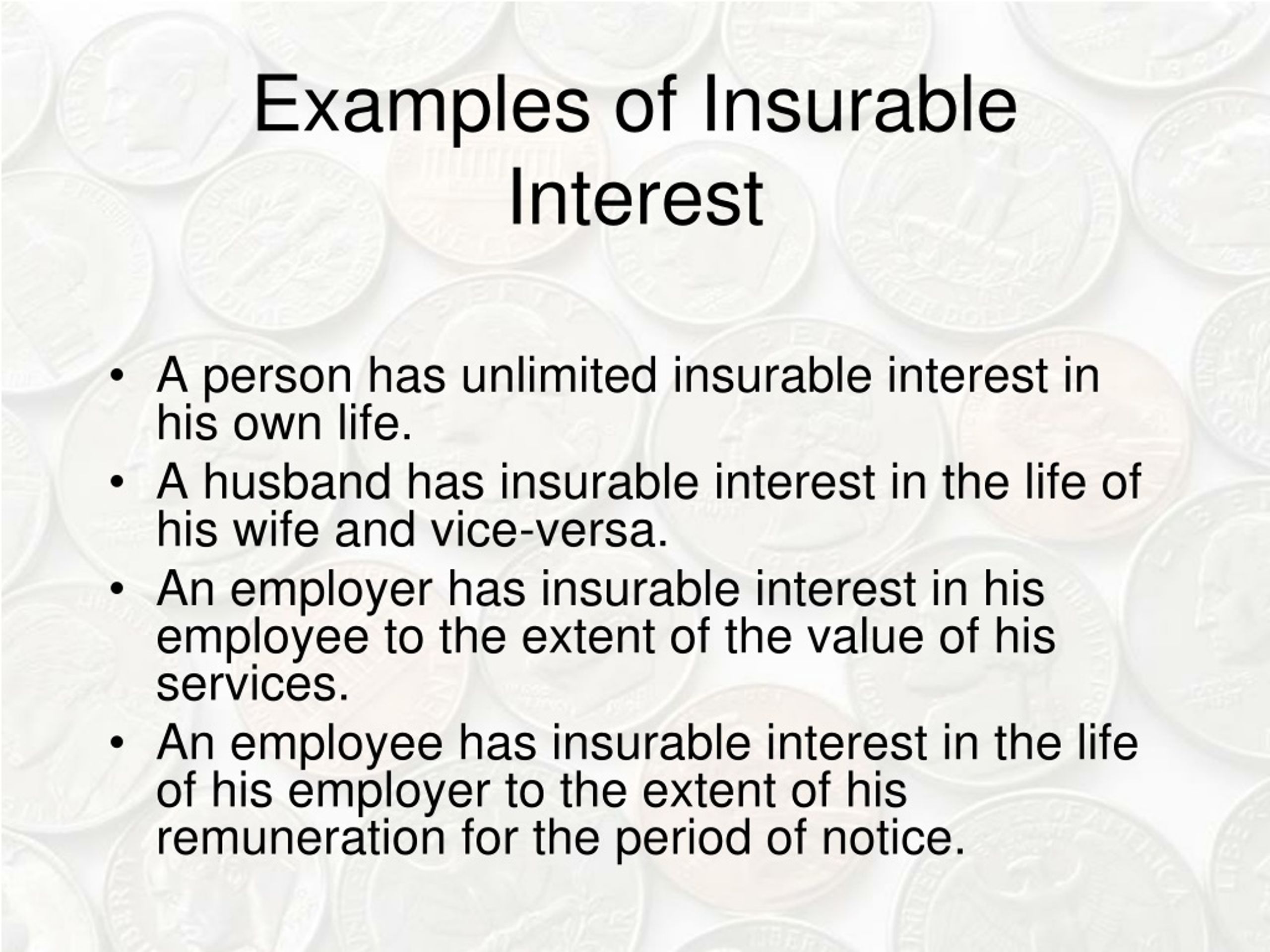

Source: slideserve.com

Source: slideserve.com

Insurable interest is the basis of all insurance policies. For example, if you buy car insurance, your personal interest would be the damage or destruction of the car. The act recognises the shipowner, the mortgagee and the insurer as obvious examples of persons who have legal rights in the property and, thus, an insurable interest. Examples of insurable interest in a sentence. Insurable interest also applies to property insurance.

Source: slideshare.net

Source: slideshare.net

Insurable interest is the basis of all insurance policies. This type of insurable interest applies when. For example, people can have an insurable interest in their homes, cars, spouse, and jobs. This is the most common example of someone you would be considered to have an insurable interest in. Read more, especially a financial tie with the covered item.

Source: slideshare.net

Source: slideshare.net

Thus, the principle of insurable interest is based on no moral. In fact, before the promulgation of certain acts by english parliament, it was not. Thus, the principle of insurable interest is based on no moral. Insurable interest also applies to property insurance. There are three types of insurable interest:

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

In fact, before the promulgation of certain acts by english parliament, it was not. This is true for any insurance policy, including homeowners, business, and life insurance. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.it is not possible to affect an insurance policy on a subject. The extent of the interest only stretches as far as the person’s or entity’s investment reaches. The act recognises the shipowner, the mortgagee and the insurer as obvious examples of persons who have legal rights in the property and, thus, an insurable interest.

Source: slideserve.com

Source: slideserve.com

For example, people can have an insurable interest in their homes, cars, spouse, and jobs. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. If the spouse were to die, that person would be without the spouse. For example, vested interest arises in retirement funds, contingent equity, property distribution, etc. See all ( 15) insurable interest.

Source: slideserve.com

Source: slideserve.com

The person does not have an insurable interest in any financial loss arising from damage to their neighbor’s house. This is true for any insurance policy, including homeowners, business, and life insurance. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. The policy was owned by a trust set up in bergman’s name, and her grandson was the trustee and beneficiary of that trust. This is the most common example of someone you would be considered to have an insurable interest in.

Source: youtube.com

Source: youtube.com

The policy was owned by a trust set up in bergman’s name, and her grandson was the trustee and beneficiary of that trust. Read more, especially a financial tie with the covered item. Insurable interest notwithstanding any other law relating to insurance, a strata company shall, for the purpose of effecting any insurance entered into pursuant to this division, be deemed to have an. Examples of insurable interest before discussing the examples of insurable interest, i want to explain the basics regarding this doctrine. Some commonly accepted examples are:

Source: slideserve.com

Source: slideserve.com

Insurable interest must exist for a policy to be underwritten. An example of insurable interest is a policyholder buying property insurance for their own house but not for their neighbor’s house. Employee hereby grants to the company an insurable interest in employee�s life, and agrees and understands that the company may at any time or from time to time during the term of employment choose to purchase and maintain key man life insurance on employee. Husband or wife (including former spouses) brothers/sisters; Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual.

Source: slideshare.net

Source: slideshare.net

Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. This is the most common type of insurable interest and applies when you have a financial stake in the policy. Some commonly accepted examples are: An example of insurable interest is a policyholder buying property insurance for their own house but not for their neighbor’s house. For example, if you buy car insurance, your personal interest would be the damage or destruction of the car.

Source: slideserve.com

Source: slideserve.com

This type of insurable interest applies when. In 2019, sun life assurance won a lawsuit against wells fargo over a $5 million life insurance policy taken out on a woman named nancy bergman. To exercise insurable interest, the policyholder would buy insurance on the person or. Insurable interest is almost a legal right to insure. Insurable interest also applies to property insurance.

Source: youtube.com

Source: youtube.com

The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss. To exercise insurable interest, the policyholder would buy insurance on the person or. Principle of insurable interest denotes that only the person who has insurable interest on a subject matter of insurance can insure that particular subject matter.it is not possible to affect an insurance policy on a subject. Thus, the principle of insurable interest is based on no moral. For example, people can have an insurable interest in their homes, cars, spouse, and jobs.

Source: slideserve.com

Source: slideserve.com

Insurable interest is a type of investment that protects anything subject to a financial loss. It can be understood from the following example, that any individual will have an insurable interest in his own home or family and not on some random home or family. The person does not have an insurable interest in any financial loss arising from damage to their neighbor’s house. Definition types, example (explained) insurable interest is a part of an entity’s value for which an insurance policy is purchased to cover the risk of loss. When it comes to life insurance, family members (by blood relation or marriage) are usually considered to constitute interest (considered they are immediate).

Source: wptechh.com

Source: wptechh.com

This type of insurable interest applies when. A person or entity has an insurable interest in an item, event or action when the damage or loss of. Besides these categories, there are other persons recognised by case law to have an insurable interest, such as captors and agents who might accrue a benefit from the preservation. The act recognises the shipowner, the mortgagee and the insurer as obvious examples of persons who have legal rights in the property and, thus, an insurable interest. See all ( 15) insurable interest.

Source: slideserve.com

Source: slideserve.com

For example, if you buy car insurance, your personal interest would be the damage or destruction of the car. Examples of insurable interest in a sentence. Examples of insurable interest before discussing the examples of insurable interest, i want to explain the basics regarding this doctrine. Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual. An example of insurable interest is a policyholder buying property insurance for their own house but not for their neighbor’s house.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Insurable interest also applies to property insurance. The extent of the interest only stretches as far as the person’s or entity’s investment reaches. An insurable interest is an object which, if damaged or destroyed, would result in financial hardship for the policyholder. Insurable interest must exist for a policy to be underwritten. Thus, the principle of insurable interest is based on no moral.

Source: iedunote.com

Source: iedunote.com

Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual. The policy was owned by a trust set up in bergman’s name, and her grandson was the trustee and beneficiary of that trust. Examples of insurable interest before discussing the examples of insurable interest, i want to explain the basics regarding this doctrine. The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss. If the spouse were to die, that person would be without the spouse.

Source: slideshare.net

Source: slideshare.net

To exercise insurable interest, the policyholder would buy insurance on the person or. In 2019, sun life assurance won a lawsuit against wells fargo over a $5 million life insurance policy taken out on a woman named nancy bergman. Insurable interest must exist for a policy to be underwritten. When it comes to life insurance, family members (by blood relation or marriage) are usually considered to constitute interest (considered they are immediate). The act recognises the shipowner, the mortgagee and the insurer as obvious examples of persons who have legal rights in the property and, thus, an insurable interest.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurable interest examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.