Insurable risk Idea

Home » Trending » Insurable risk IdeaYour Insurable risk images are ready in this website. Insurable risk are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurable risk files here. Download all free photos and vectors.

If you’re looking for insurable risk pictures information connected with to the insurable risk topic, you have come to the right site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

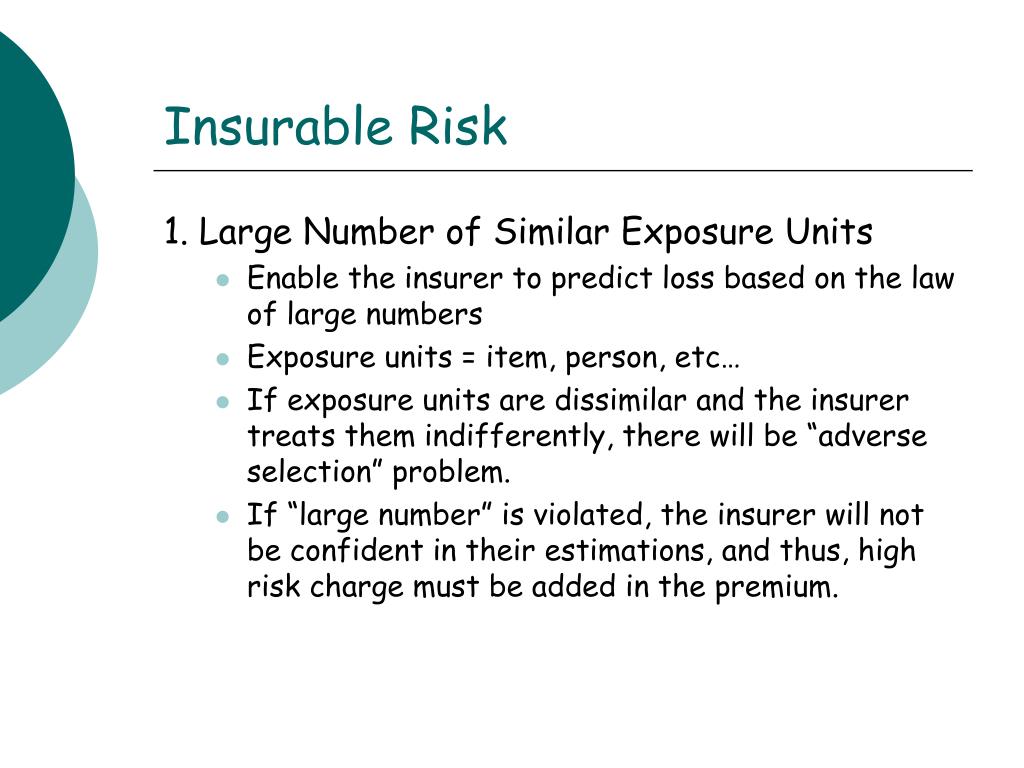

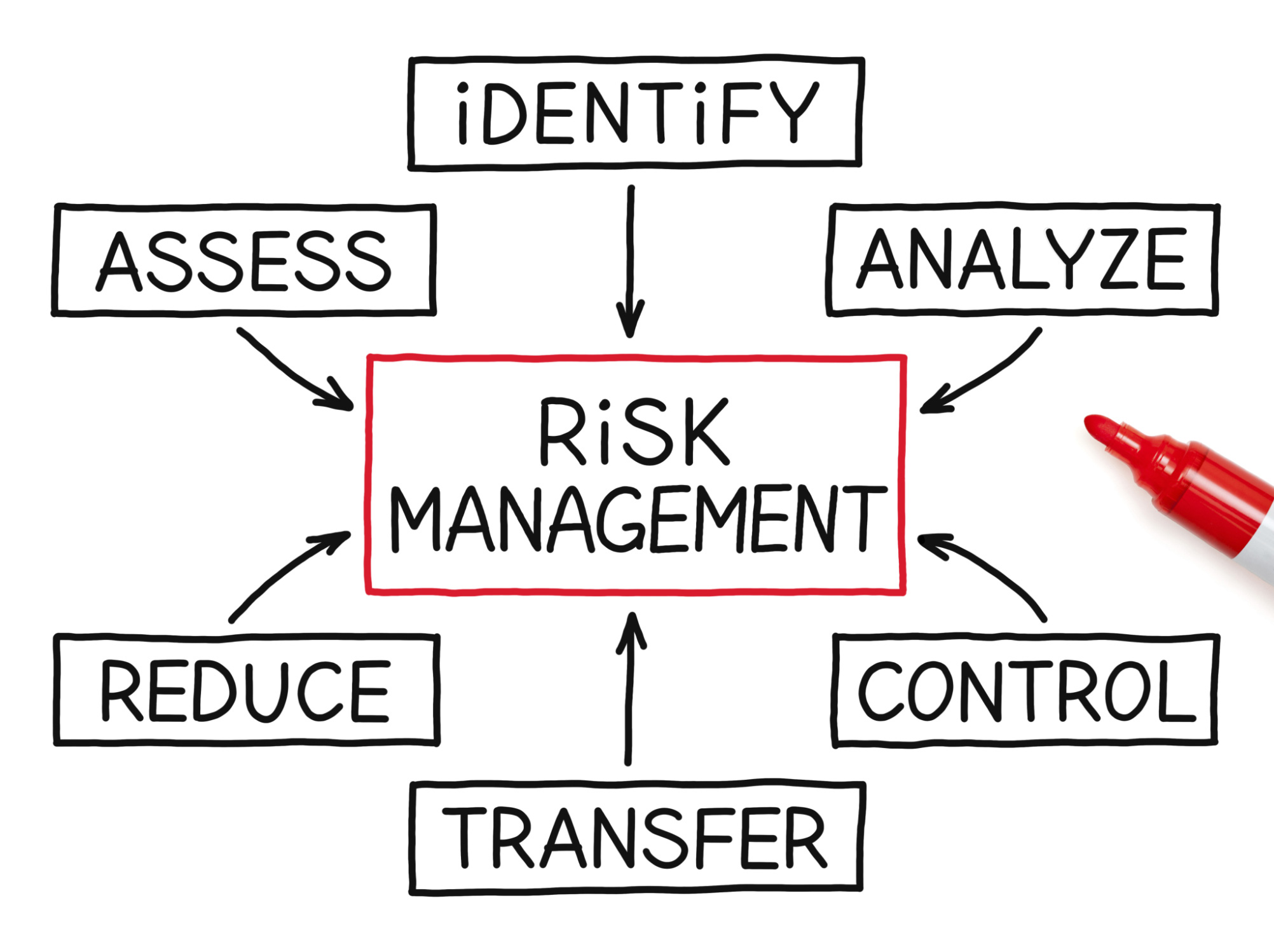

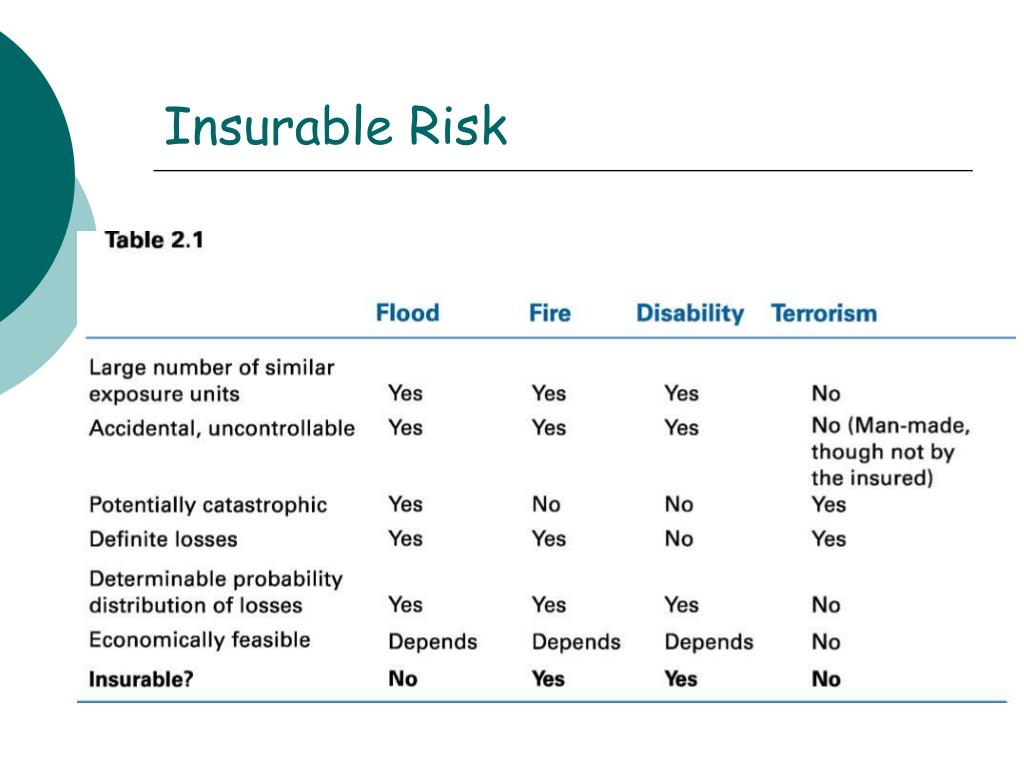

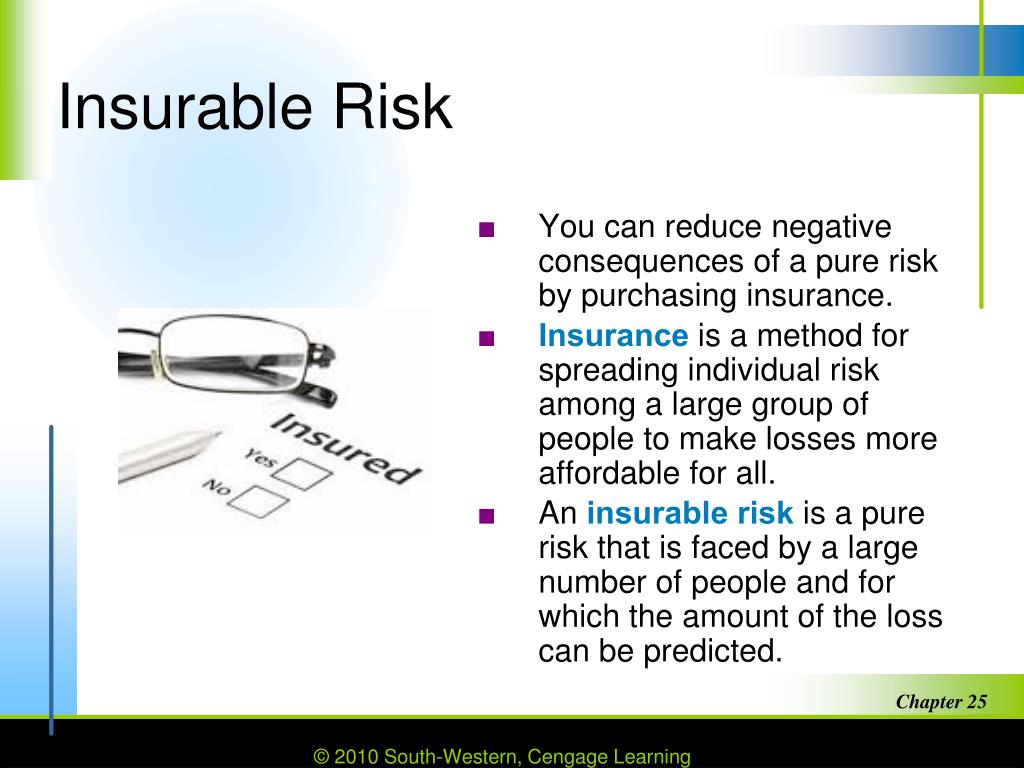

Insurable Risk. In return, the company agrees to pay you in the event you suffer a covered loss. There are eight fundamental characteristics of an insurable risk. Large number of exposure units. An insurable risk is one that meets the criteria of.

INSURANCE & RISK MANAGEMENT Fiducia Wealth Management From fiduciawealth.ca

INSURANCE & RISK MANAGEMENT Fiducia Wealth Management From fiduciawealth.ca

A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. Insurable risks are risks that insurance companies will cover. A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. A situation that an insurance company will protect you against because it is possible to calculate…. An insurable risk refers to a potential situation in which an insurance company evaluates the risk and determines insurability. Furthermore, what are the three main types of insurable risks?

Insurable risks are risks that insurance companies will cover.

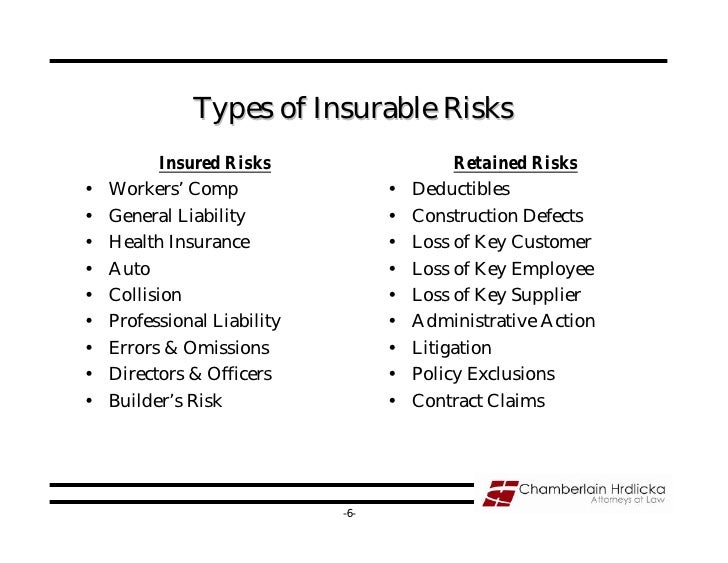

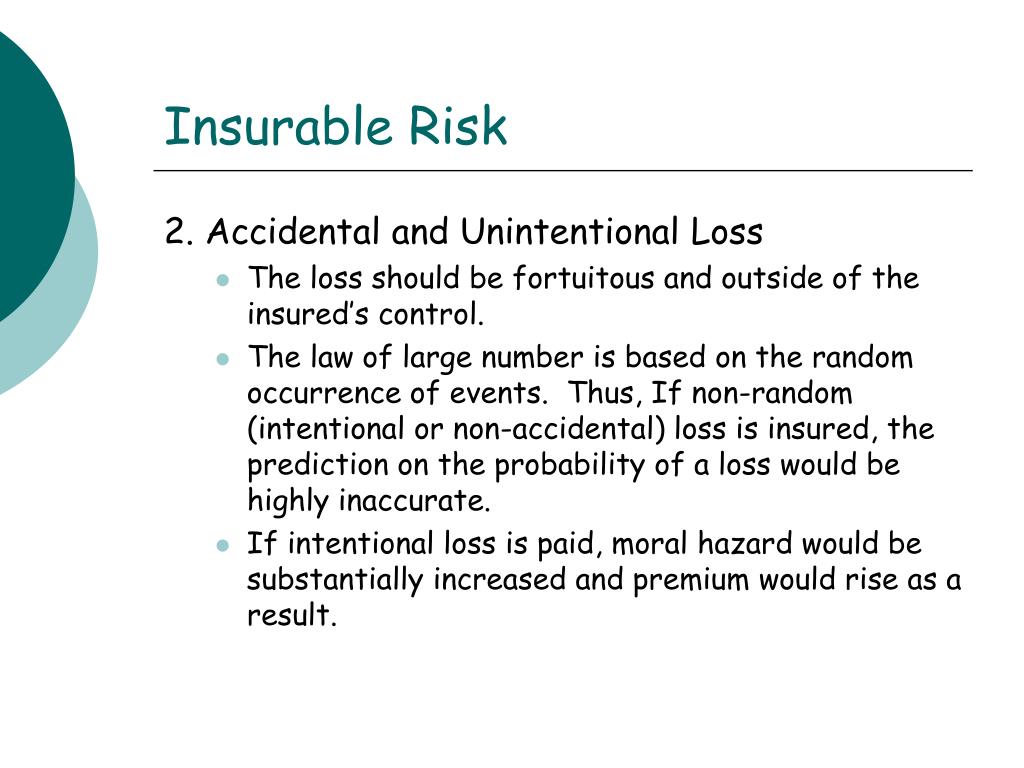

You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss. The loss must be accidental and unintentional. Insurable risks are the type of risks in which the insurer makes provision for or insures against because it is possible to collect, calculate and estimate the likely future losses. Pure risks, the ones that a human can’t control, come under this category. In case of a scenario where the loss is too huge that no insurer would want to pay for it,. Losses due to fire, theft, accidents, and even health and life risks are included.

Source: slideserve.com

Source: slideserve.com

The loss must be determinable and measurable. Whether a risk is insurable or not is not determined capriciously. In return, the company agrees to pay you in the event you suffer a covered loss. Harus ada sejumlah besar resiko yang sama dengan resiko itu, sehingga perusahaan asuransi dapat menggunakan hukum bilangan besar. Pure risks, the ones that a human can’t control, come under this category.

Source: fiduciawealth.ca

Source: fiduciawealth.ca

When you buy commercial insurance, you pay premiums to your insurance company. A pure risk ideally should have certain characteristics to be insurable. Losses due to fire, theft, accidents, and even health and life risks are included. These include being definable, accidental in nature, and part of a group of similar risks large enough to make losses predictable. When you buy commercial insurance, you pay premiums to your insurance company.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

An “insurable risk” is a danger of financial loss that an insurer is willing and able to cover. An “insurable risk” is a danger of financial loss that an insurer is willing and able to cover. What are the elements of an insurable risk? Insurable risks are risks that insurance companies will cover. Another characteristic of insurable risks is that the risk must be definable.

Source: slideshare.net

Source: slideshare.net

This typically requires that the risk have a few basic elements, including the fact that the risk must be random or due to chance and not something someone can control. Characteristics of an insurable risk from the point of view of insurance companies, private insurers only insure pure risks but not all pure risks are insurable. This means that the insurer can define the exact conditions under which the item is covered by the policy. In return, the company agrees to pay you in the event you suffer a covered loss. The item that is being covered must also have a precise value and must be definable meaning a house, car, diamond ring, etc.

Source: slideserve.com

Source: slideserve.com

Whether a risk is insurable or not is not determined capriciously. A pure risk ideally should have certain characteristics to be insurable. Insurable risks are the type of risks in which the insurer makes provision for or insures against because it is possible to collect, calculate and estimate the likely future losses. An insurable risk is a risk that meets the ideal criteria for efficient insurance. Another characteristic of insurable risks is that the risk must be definable.

Source: slideshare.net

Source: slideshare.net

Another characteristic of insurable risks is that the risk must be definable. Insurable risks have previous statistics which are used as a basis for estimating the premium. Whether a risk is insurable or not is not determined capriciously. The loss must be determinable and measurable. An insurable risk is a risk that meets the ideal criteria for efficient insurance.

Source: slideserve.com

Source: slideserve.com

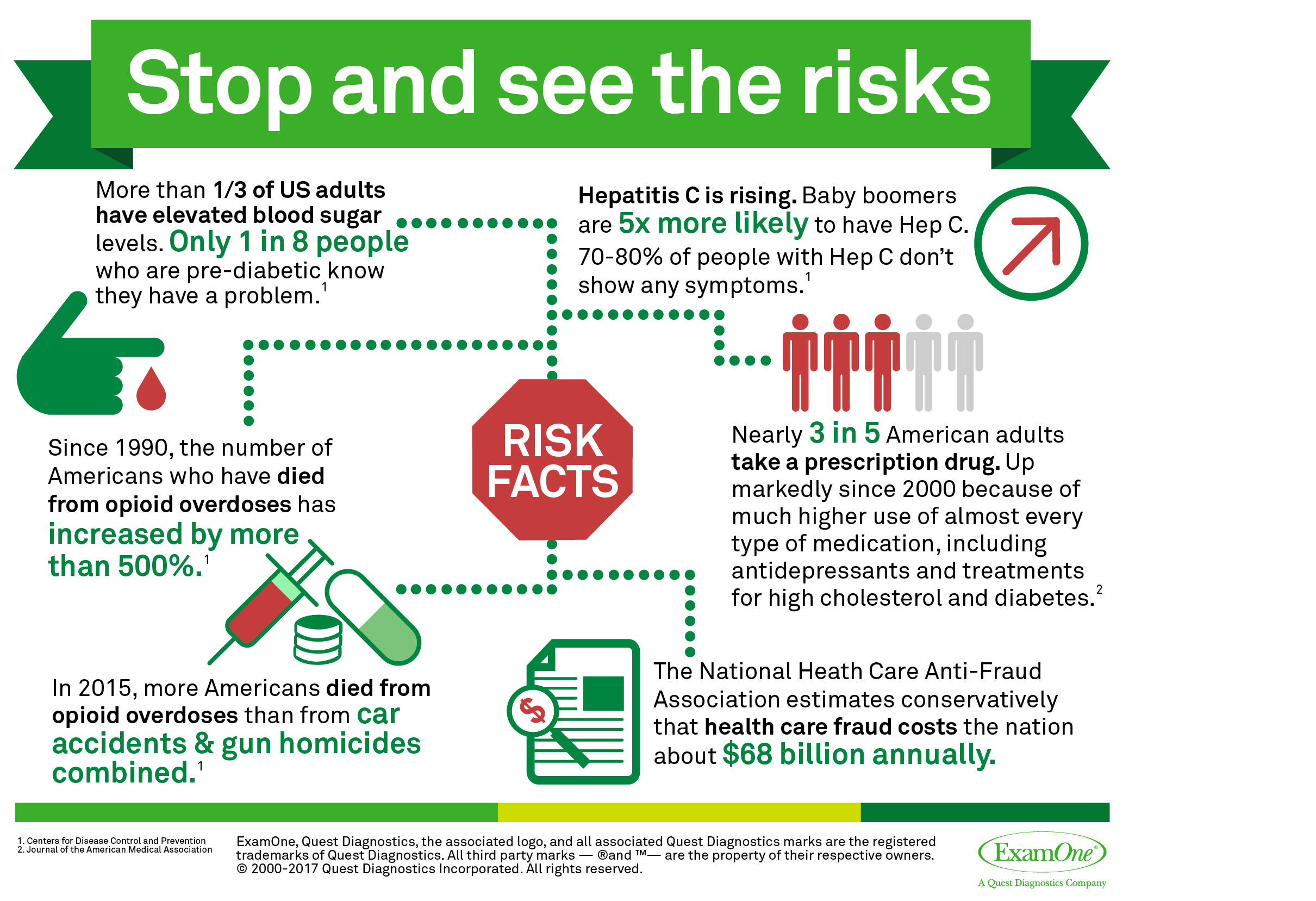

Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. These include a wide range of losses, including those from fire, theft, or lawsuits. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss. When you buy commercial insurance, you pay premiums to your insurance company.

Source: slideserve.com

Source: slideserve.com

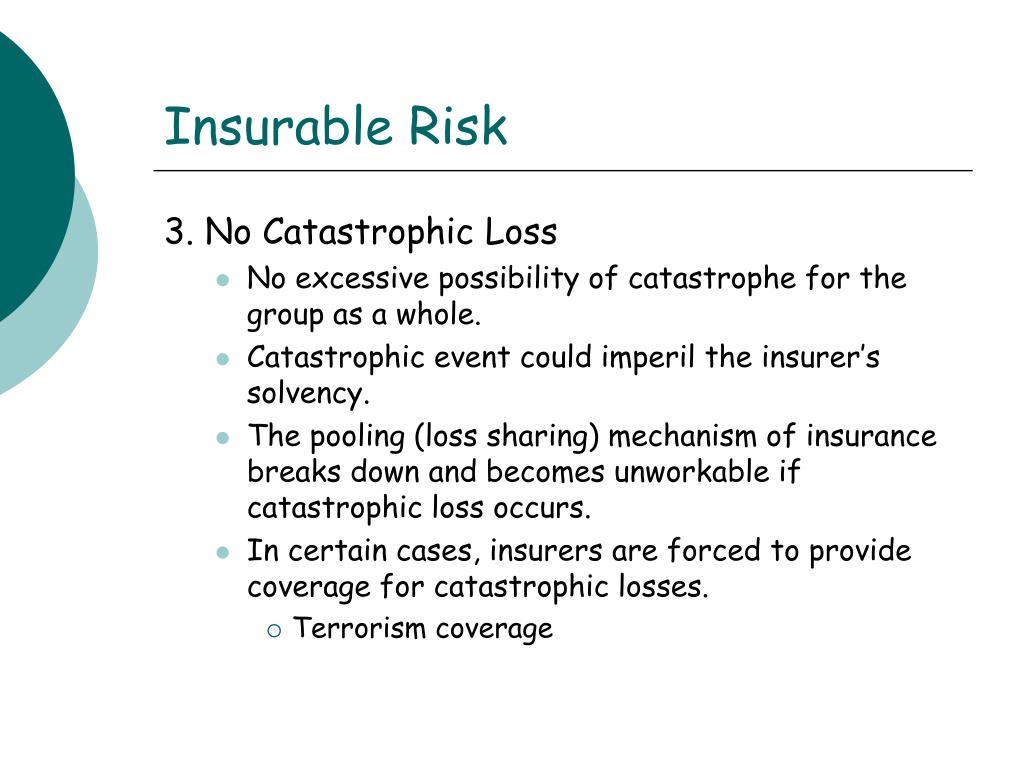

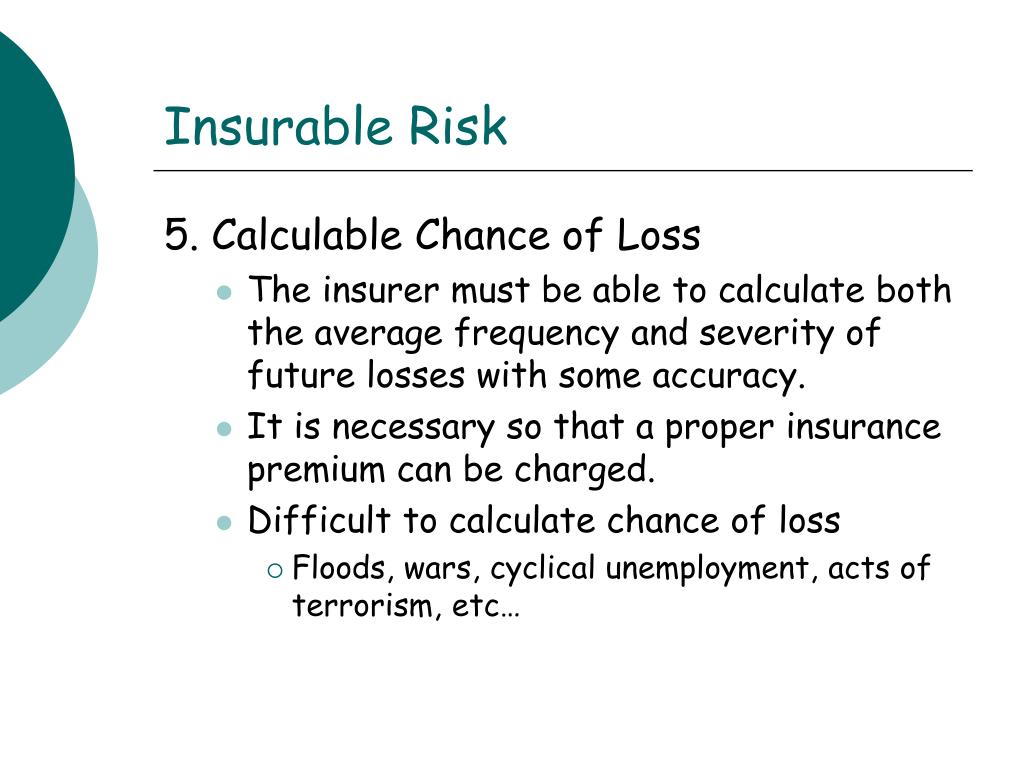

In return, the company agrees to pay you in the event you suffer a covered loss. Losses due to fire, theft, accidents, and even health and life risks are included. These elements are “due to chance,” definiteness and measurability, statistical predictability, lack of catastrophic exposure, random selection, and large loss exposure. The loss must be determinable and measurable. What are the elements of an insurable risk?

Source: slideserve.com

Source: slideserve.com

These elements are “due to chance,” definiteness and measurability, statistical predictability, lack of catastrophic exposure, random selection, and large loss exposure. Insurable risks are risks that insurance companies will cover. A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. What are the elements of an insurable risk? These include a wide range of losses, including those from fire, theft, or lawsuits.

Source: slideserve.com

Source: slideserve.com

An insurable risk is a risk that meets the ideal criteria for efficient insurance. In return, the company agrees to pay you in the event you suffer a covered loss. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk. Furthermore, what are the three main types of insurable risks? The loss should not be catastrophic.

Source: toppr.com

Source: toppr.com

Resiko yang dapat diasuransikan (insurable risk) dapat diukur dengan uang (financial value) : A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. The loss must be accidental and unintentional. Pure risks, the ones that a human can’t control, come under this category. The chance of loss must be calculable.

Source: advancedwealth.com

Source: advancedwealth.com

An “insurable risk” is a danger of financial loss that an insurer is willing and able to cover. As the post title mentions, an “insurable risk” is what insurers will cover. Insurable risks are the type of risks in which the insurer makes provision for or insures against because it is possible to collect, calculate and estimate the likely future losses. An insurable risk is one that meets the criteria of. You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss.

Source: embroker.com

Source: embroker.com

Losses due to fire, theft, accidents, and even health and life risks are included. When you buy commercial insurance, you pay premiums to your insurance company. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk. Insurable risks are risks that insurance companies will cover. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: iedunote.com

Source: iedunote.com

The loss should not be catastrophic. Insurable risks are the ones that first and most importantly meet the insurance company’s criteria for coverage. Large number of exposure units. The premium must be economically feasible. Resiko tersebut apabila terjadi akan menimbulkan kerugian yang dapat diukur dengan uang jenis resiko yang sama (homogeneous exposures) :

Source: blog.examone.com

Source: blog.examone.com

There must be a large number of exposure units. You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss. A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. An “insurable risk” is a danger of financial loss that an insurer is willing and able to cover. Insurable risks are risks that insurance companies will cover.

Source: colourbox.com

Source: colourbox.com

An “insurable risk” is a danger of financial loss that an insurer is willing and able to cover. Pure risks, the ones that a human can’t control, come under this category. An insurable risk is a risk that meets the ideal criteria for efficient insurance. Large number of exposure units. A risk may not be termed as insurable if it is immeasurable, very large, certain or not definable.

Source: slideserve.com

Source: slideserve.com

A situation that an insurance company will protect you against because it is possible to calculate…. These elements are “due to chance,” definiteness and measurability, statistical predictability, lack of catastrophic exposure, random selection, and large loss exposure. In return, the company agrees to pay you in the event you suffer a covered loss. There must be a large number of exposure units. As the post title mentions, an “insurable risk” is what insurers will cover.

Source: slideserve.com

Source: slideserve.com

Harus ada sejumlah besar resiko yang sama dengan resiko itu, sehingga perusahaan asuransi dapat menggunakan hukum bilangan besar. Large number of exposure units. The premium must be economically feasible. There are eight fundamental characteristics of an insurable risk. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurable risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.