Insurable risk examples information

Home » Trending » Insurable risk examples informationYour Insurable risk examples images are available in this site. Insurable risk examples are a topic that is being searched for and liked by netizens now. You can Get the Insurable risk examples files here. Find and Download all free photos and vectors.

If you’re searching for insurable risk examples pictures information related to the insurable risk examples keyword, you have come to the ideal site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

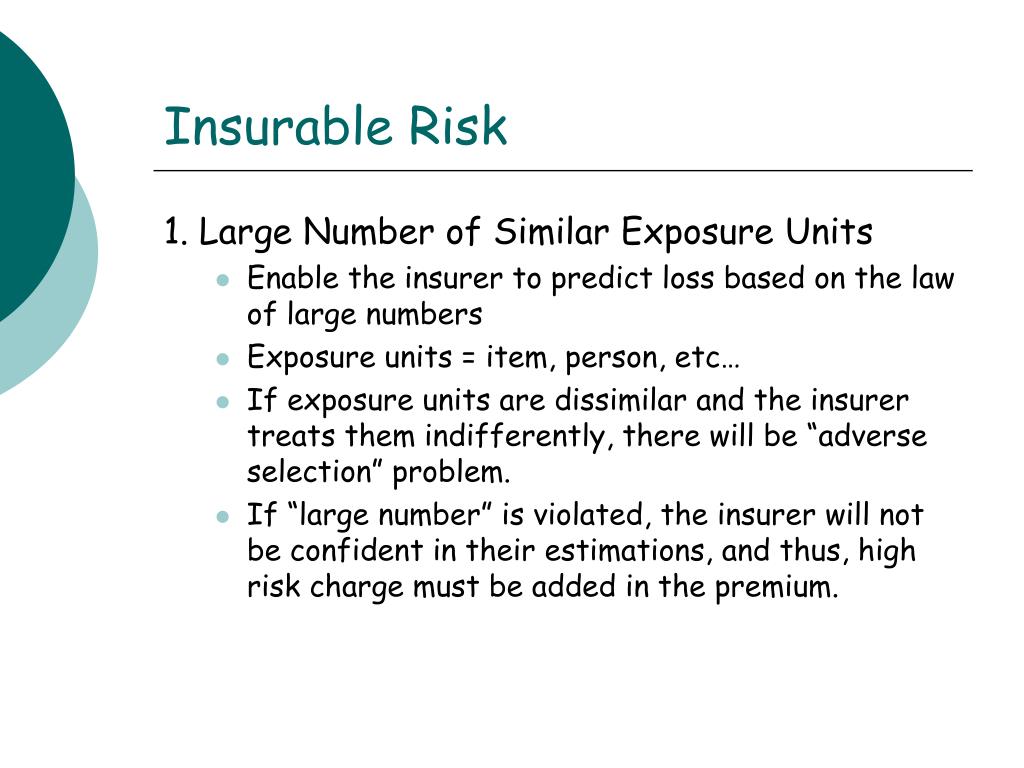

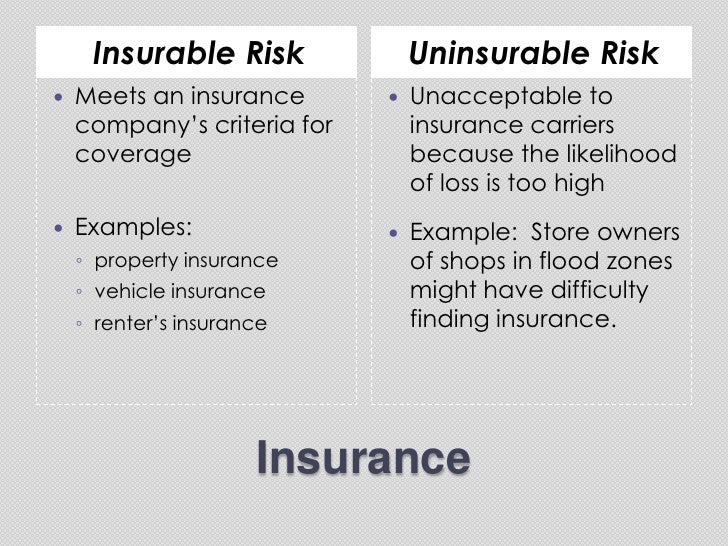

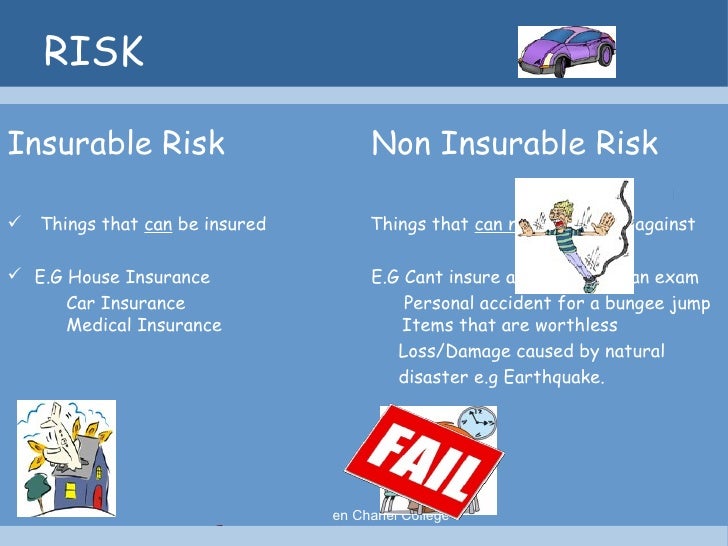

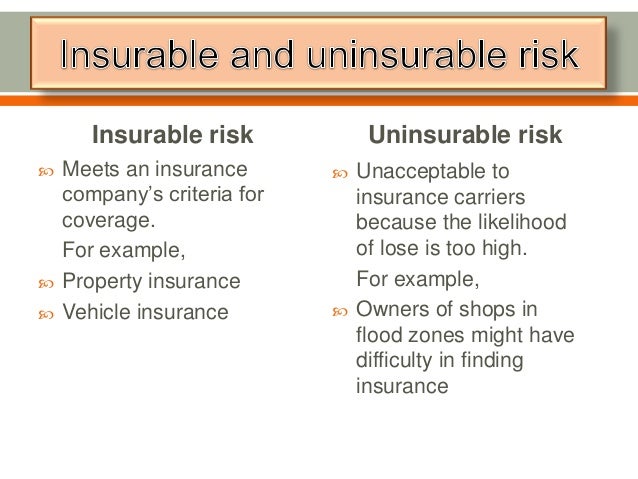

Insurable Risk Examples. In this case, the amount of insurable corresponds to the amount of risk involved. These include a wide range of losses, including those from fire, theft, or lawsuits. These risks are generally insurable. The probability (or chance) that a certain vehicle will be involved in an accident in year 2011 (out of the total vehicle insured that year 2011) can be determined from the number of vehicles that were involved in accidents in each of some previous years (out of the total vehicle.

Insurable Risk and NonInsurable Risk in English From toppr.com

Insurable Risk and NonInsurable Risk in English From toppr.com

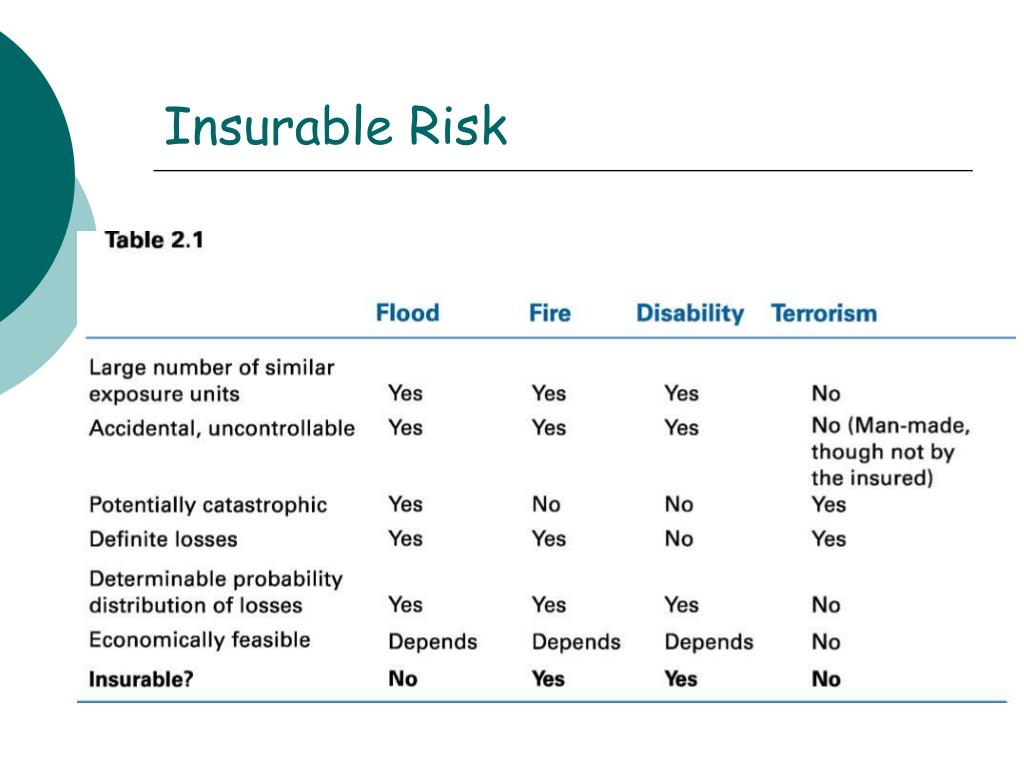

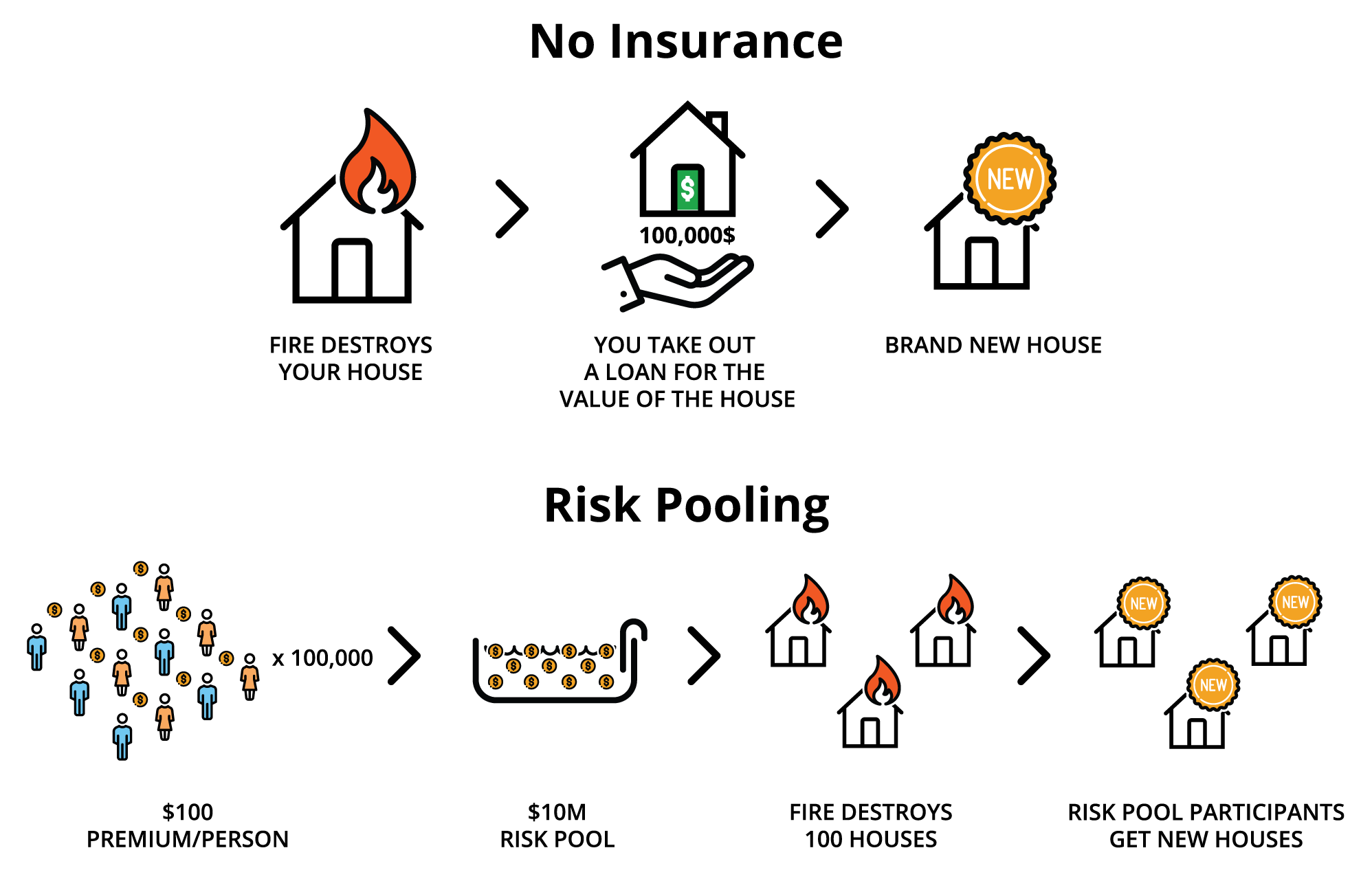

These risks are generally insurable. When you buy commercial insurance, you pay premiums to your insurance company. If a river floods 800 times in a century, the flood is an insurable risk. A building and its contents can be insured against fire, but additional clauses must be added for damage by hail, wind or riot. Personal risk, property risk, and liability risk. These include a wide range of losses, including those from fire, theft, or lawsuits.

These risks are generally insurable.

When you buy commercial insurance, you pay premiums to your insurance company. These include a wide range of losses, including those from fire, theft, or lawsuits. A building and its contents can be insured against fire, but additional clauses must be added for damage by hail, wind or riot. Litigation is the most common example of pure risk in liability. The statistics that have been used to estimate the premium for insurable risks are based on previous statistics. Employment practices liability (epl) insurance responds in these situations.

Source: slideserve.com

Source: slideserve.com

These risks are generally insurable. Only pure risks are insurable. When you buy commercial insurance, you pay premiums to your insurance company. Naturally, a hiring wave usually follows that initial hire, opening the door for employment practices to come under fire. The prime examples are property damage risks, such as earthquakes, hurricanes, floods, fires, accidents, etc.

Source: slideserve.com

Source: slideserve.com

It is open to loss, but not gain. Some examples of insurable risk. Examples of what an insurable risk is as explained: Naturally, a hiring wave usually follows that initial hire, opening the door for employment practices to come under fire. In this case, the amount of insurable corresponds to the amount of risk involved.

Source: toppr.com

Source: toppr.com

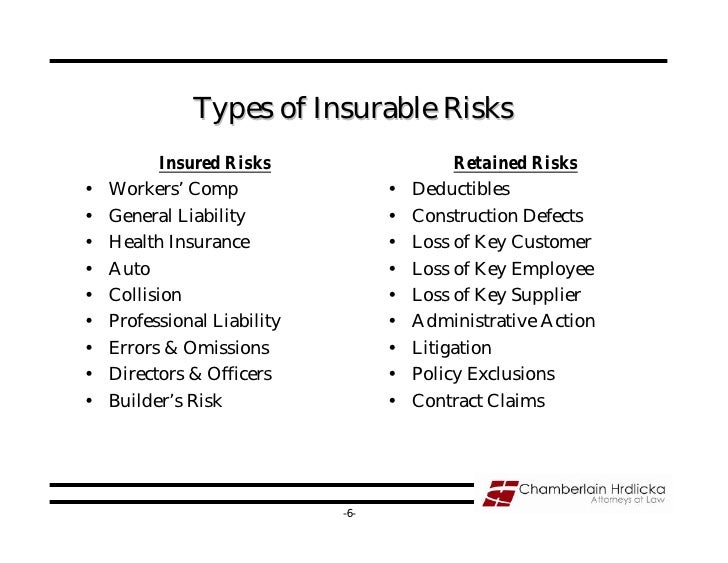

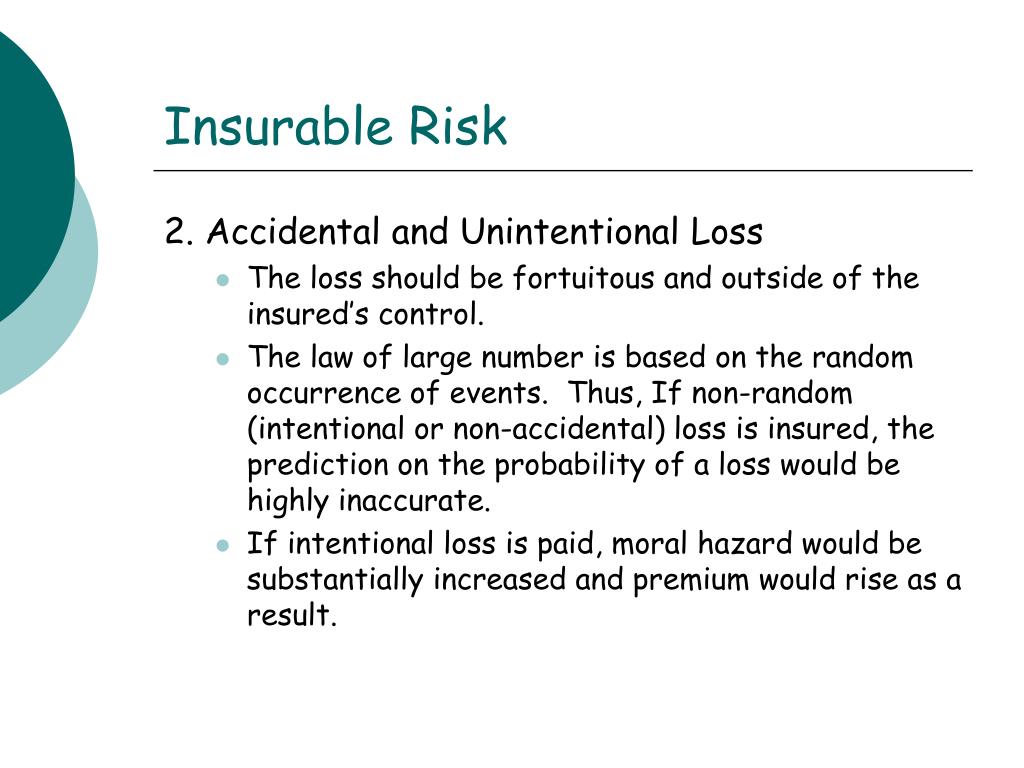

Insurance companies are in the business of making money, and they will not agree to insure a risk that is highly likely to occur or is inevitable. The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes. The insurance company cannot calculate the profitability of the risk and therefore they cannot work out a premium that the business must pay. Litigation is the most common example of pure risk in liability. In this case, the amount of insurable corresponds to the amount of risk involved.

Source: slideserve.com

Source: slideserve.com

Speculative risk has a chance of loss, profit, or a possibility that nothing happens. What is an example of insurable risk? What is an example of insurable risk? Employment practices liability (epl) insurance responds in these situations. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness.

Source: slideserve.com

Source: slideserve.com

Employment practices liability (epl) insurance responds in these situations. There are generally 3 types of risk that can be covered by insurance: When you buy commercial insurance, you pay premiums to your insurance company. What are examples of insurable risks? Speculative risk is not insurable.

Source: blog.etherisc.com

Source: blog.etherisc.com

In this case, the amount of insurable corresponds to the amount of risk involved. The insurance company cannot calculate the profitability of the risk and therefore they cannot work out a premium that the business must pay. What is an example of insurable risk? If a river floods 800 times in a century, the flood is an insurable risk. Examples of what an insurable risk is as explained:

Source: slideshare.net

Source: slideshare.net

What is an example of insurable risk? What are examples of insurable risks? Only pure risks are insurable. These risks are generally insurable. Litigation is the most common example of pure risk in liability.

Source: slideshare.net

Source: slideshare.net

Gambling at the race track, or investing in the real estate market. Litigation is the most common example of pure risk in liability. The insurance company cannot calculate the profitability of the risk and therefore they cannot work out a premium that the business must pay. These risks are generally insurable. Speculative risk has a chance of loss, profit, or a possibility that nothing happens.

Source: slideshare.net

Source: slideshare.net

Insurable interest has to be proved in the following cases; Speculative risk has a chance of loss, profit, or a possibility that nothing happens. What is an example of insurable risk? The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes. The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes.

Source: slideshare.net

Source: slideshare.net

The prime examples are property damage risks, such as earthquakes, hurricanes, floods, fires, accidents, etc. Risk must permit a reasonable statistical estimate of the chance of loss in order to determine the amount of premium to be paid. The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes. Some such examples are narrated below: Only pure risks are insurable.

Source: slideserve.com

Source: slideserve.com

Litigation is the most common example of pure risk in liability. Pure risks associated with liability include litigation. These include a wide range of losses, including those from fire, theft, or lawsuits. What is insurable risk and examples? In return, the company agrees to pay you in the event you suffer a covered loss.

Source: slideserve.com

Source: slideserve.com

These include a wide range of losses, including those from fire, theft, or lawsuits. A startup faces mounds of insurable risk when the founder hires their very first employee. The insurance company cannot calculate the profitability of the risk and therefore they cannot work out a premium that the business must pay. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. There are generally 3 types of risk that can be covered by insurance:

Source: slideserve.com

Source: slideserve.com

These risks are generally insurable. These include a wide range of losses, including those from fire, theft, or lawsuits. The prime examples are property damage risks, such as earthquakes, hurricanes, floods, fires, accidents, etc. Litigation is the most common example of pure risk in liability. They are those risks against which it is possible collect, calculate, and estimate future losses.

Source: slideserve.com

Source: slideserve.com

The probability (or chance) that a certain vehicle will be involved in an accident in year 2011 (out of the total vehicle insured that year 2011) can be determined from the number of vehicles that were involved in accidents in each of some previous years (out of the total vehicle insured those years). All such risks are insurable in nature. Litigation is the most common example of pure risk in liability. Insurable risks refer to the risks that the insurer covers or makes provision for. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness.

Source: slideserve.com

Source: slideserve.com

Insurance companies are in the business of making money, and they will not agree to insure a risk that is highly likely to occur or is inevitable. Some examples of insurable risk include loss of life, health, fraud and damage or loss of the property from fire, water, weather and theft. Examples of what an insurable risk is as explained: Particular risk are usually insurable. Insurable interest has to be proved in the following cases;

Source: slideserve.com

Source: slideserve.com

Examples of what an insurable risk is as explained: Litigation is the most common example of pure risk in liability. These risks are not insured by insurance companies as insurance cost/risks are too high/remains the responsibility of the business. These risks are generally insurable. Particular risk are usually insurable.

Source: slideshare.net

Source: slideshare.net

Insurance companies are in the business of making money, and they will not agree to insure a risk that is highly likely to occur or is inevitable. Insurable risks refer to the risks that the insurer covers or makes provision for. The probability (or chance) that a certain vehicle will be involved in an accident in year 2011 (out of the total vehicle insured that year 2011) can be determined from the number of vehicles that were involved in accidents in each of some previous years (out of the total vehicle insured those years). Particular risk are usually insurable. It is open to loss, but not gain.

Source: embroker.com

Source: embroker.com

Some such examples are narrated below: In return, the company agrees to pay you in the event you suffer a covered loss. Examples of what an insurable risk is as explained: When you buy commercial insurance, you pay premiums to your insurance company. They are those risks against which it is possible collect, calculate, and estimate future losses.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurable risk examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.