Insurance acv vs rcv information

Home » Trend » Insurance acv vs rcv informationYour Insurance acv vs rcv images are available. Insurance acv vs rcv are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance acv vs rcv files here. Find and Download all royalty-free photos and vectors.

If you’re looking for insurance acv vs rcv images information linked to the insurance acv vs rcv topic, you have pay a visit to the right blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

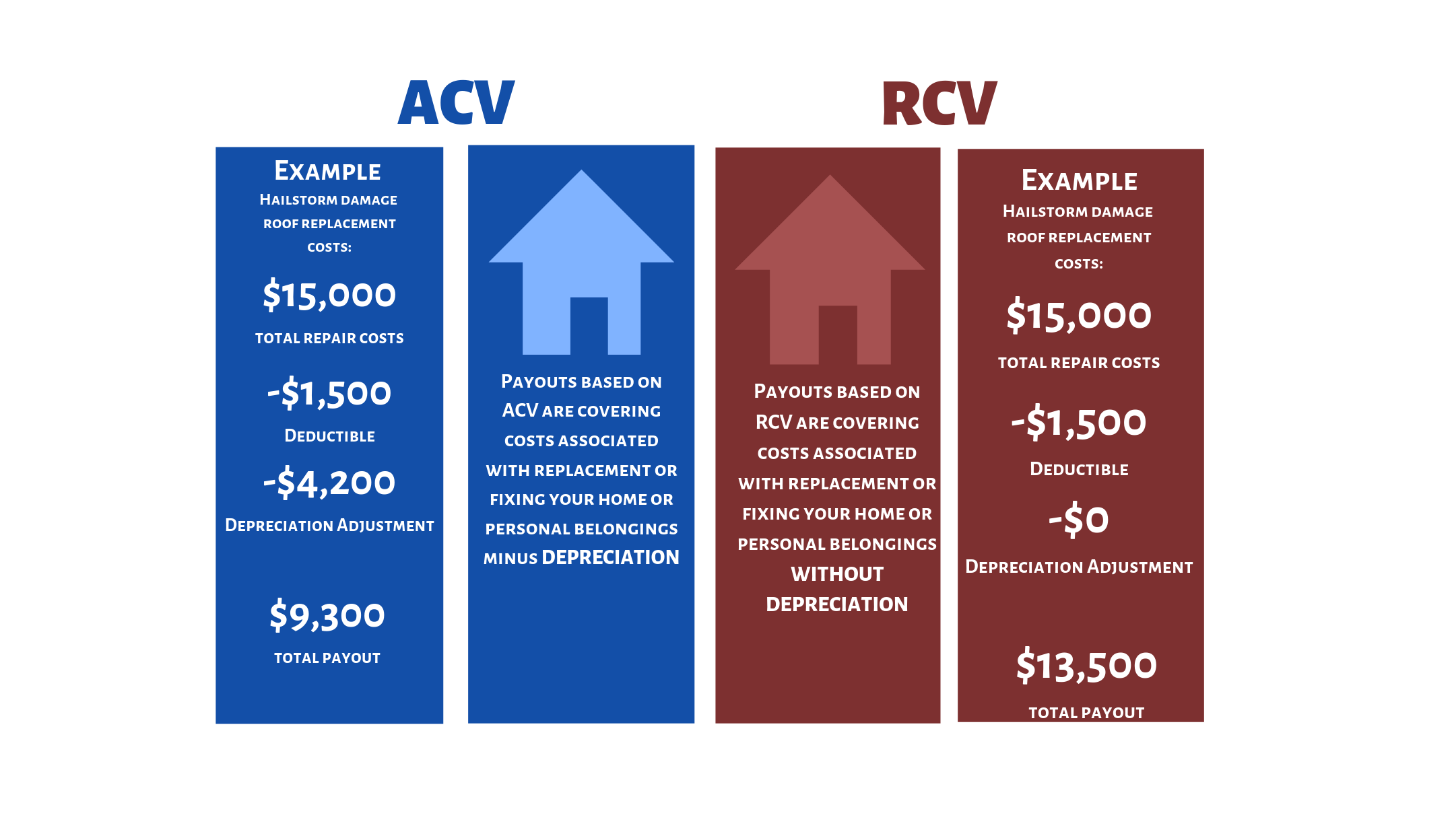

Insurance Acv Vs Rcv. There are several types of insurance policies for your home. They provide less in compensation when a claim is made. This means that your insurance claim will most likely cover the total cost of repairs or of a brand new item. With a replacement cost value (rcv) option, you can fully recover the costs.

ACV vs RCV Insurance Policies What Are the Differences From youtube.com

ACV vs RCV Insurance Policies What Are the Differences From youtube.com

These include indemnity, actual cash value (acv), replacement cost value (rcv) and depreciation. The insurance term “actual cash value” is the amount that a lost item was actually worth, a result of subtracting any depreciation the item has sustained prior to loss from the cost of replacement. That’s why replacement cost coverage for your damaged or stolen property is typically the most popular option, since it compensates you for the full cost of replacing your property. Most insurance providers base the reimbursement of your totaled vehicle on its actual cash value (acv), but there’s potential for a higher payout with replacement cost value (rcv) insurance, which is why it’s important to know. Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage. Rcv stands for replacement cost value this one is easy to understand and by far your best value!

Rcv stands for replacement cost value.

The rcv vs acv difference is based on the benefit being paid in both policies. Acv stands for actual cash value. Rcv insurance policies rcv stands for “replacement cost value” and it covers the cost to replace your roof with one of similar quality. Acv is your replacement (33). With an rcv policy, the insurance claim is based on the current $10,000 amount. Fortunately, most homeowners insurance provides certain coverage under these conditions.

Source: pinterest.com

Source: pinterest.com

Actual cash value (acv) acv is the amount to replace or fix your home and personal items, minus depreciation. Now, that you know how actual cash value and replacement cost values work on a homeowners policy, you are probably wondering which is the best option for you. The insurance term “actual cash value” is the amount that a lost item was actually worth, a result of subtracting any depreciation the item has sustained prior to loss from the cost of replacement. The acv is calculated by subtracting depreciation. Acv stands for actual cash value, and rcv means replacement cost value.

Source: youtube.com

Source: youtube.com

This means what the item. However, rcv insurance policies cost more money too. Understanding rcv and acv insurance. Replacement cost value (rcv) vs. They provide less in compensation when a claim is made.

Source: youtube.com

Source: youtube.com

Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage. Acv is your replacement (33). This type of policy pays you to repair or replace your property with similar kind and quality. It will give you more peace of mind, and help you recover from a covered loss. The main reason people choose an acv policy over rcv is because acv’s are typically cheaper per month/year.

Source: opic.texas.gov

Source: opic.texas.gov

To start off, the actual cash value, or acv for short, is a term used by insurance companies that are in reference to the actual cost of what an item is appraised at. The insurance term “actual cash value” is the amount that a lost item was actually worth, a result of subtracting any depreciation the item has sustained prior to loss from the cost of replacement. Replacement cost value (rcv) rcv is the amount to replace or. So as to say, if you’re someone who likes to save money, this might sound enticing on the surface. This means that your insurance claim will most likely cover the total cost of repairs or of a brand new item.

Source: opic.texas.gov

Source: opic.texas.gov

This means that your insurance claim will most likely cover the total cost of repairs or of a brand new item. The monthly insurance premiums are lower for an acv policy than an rcv policy. This means what the item. Which is better, acv or rcv? To start off, the actual cash value, or acv for short, is a term used by insurance companies that are in reference to the actual cost of what an item is appraised at.

Source: youngalfred.com

Source: youngalfred.com

Acv stands for actual cash value, and rcv means replacement cost value. Rcv pays you what it would cost to replace what is lost with a modern equivalent and usually come with higher premiums. Which is better, acv or rcv? I think the biggest item to understand is you will recover the depreciation on an rcv policy versus a. This type of policy pays you to repair or replace your property with similar kind and quality.

Source: oneeightyroofing.com

Source: oneeightyroofing.com

With an rcv policy, the insurance claim is based on the current $10,000 amount. If you have an rcv renters’ insurance policy or home policy, then you will be paid enough, less any deductible, for the actual cost to replace the item that was lost, stolen, or damaged. That’s why replacement cost coverage for your damaged or stolen property is typically the most popular option, since it compensates you for the full cost of replacing your property. To start off, the actual cash value, or acv for short, is a term used by insurance companies that are in reference to the actual cost of what an item is appraised at. Rcv stands for replacement cost value.

Source: pinterest.com

Source: pinterest.com

Actual cash value (acv) policies typically have lower premiums than rcv policies, and for good reason: Depreciation is a decrease in value based on things like age, or wear and tear. Now, that you know how actual cash value and replacement cost values work on a homeowners policy, you are probably wondering which is the best option for you. So after the same $2,000 deductible, insurance pays $8,000… twice as much as the previous example! Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage.

Source: bankerscompliance.com

Source: bankerscompliance.com

Replacement cost value (rcv) is the actual total retail price of the item without any depreciation, no matter how much time has passed. Actual cash value (acv) acv is the amount to replace or fix your home and personal items, minus depreciation. Unlike acv, rcv doesn’t take into account the age or useful life of the loss/property damage, so you’ll get more cash value from your insurance provider. To truly understand the amount your homeowners insurance policy would pay to replace your stuff after a disaster, you need to know how replacement cost value (rcv) and actual cash value (acv. That’s why replacement cost coverage for your damaged or stolen property is typically the most popular option, since it compensates you for the full cost of replacing your property.

Source: restoremastersllc.com

Source: restoremastersllc.com

But unlike the acv policy, the $9,000 will also be covered by the insurance company after the work is completed. These include indemnity, actual cash value (acv), replacement cost value (rcv) and depreciation. So after the same $2,000 deductible, insurance pays $8,000… twice as much as the previous example! Acv stands for actual cash value. Rcv stands for replacement cost value this one is easy to understand and by far your best value!

Source: youtube.com

Source: youtube.com

Actual cash value (acv) policies typically have lower premiums than rcv policies, and for good reason: If you have an rcv renters’ insurance policy or home policy, then you will be paid enough, less any deductible, for the actual cost to replace the item that was lost, stolen, or damaged. These options include actual cash value (acv), replacement cost value (rcv) and extended replacement cost value. This type of policy pays you the replacement cost like rcv, minus the depreciated value. The acv is calculated by subtracting depreciation.

Source: insuranceagentofamerica.com

Source: insuranceagentofamerica.com

Depreciation is a decrease in value based on things like age, or wear and tear. The main reason people choose an acv policy over rcv is because acv’s are typically cheaper per month/year. Actual cash value (acv) policies typically have lower premiums than rcv policies, and for good reason: But unlike the acv policy, the $9,000 will also be covered by the insurance company after the work is completed. What is the difference between acv & rcv?

Source: youtube.com

Source: youtube.com

Rcv can be a great option if you have the budget. Acv stands for actual cash value, and rcv means replacement cost value. Acv can still provide you with a substantial level of protection, even if adding rcv would be prohibitive. Actual cash value (acv) acv is the amount to replace or fix your home and personal items, minus depreciation. Acv is your replacement (33).

Source: matheniainsurancegroup.com

Source: matheniainsurancegroup.com

When you have acv coverage, you’ll usually pay a lower premium than if you have rcv coverage. The main reason people choose an acv policy over rcv is because acv’s are typically cheaper per month/year. The rcv vs acv difference is based on the benefit being paid in both policies. Rcv can be a great option if you have the budget. Understanding rcv and acv insurance.

Source: slideshare.net

Source: slideshare.net

What is the difference between acv & rcv? For an rcv policy, you’ll get the first $6,000 actual cash value check, just like an acv policy. Rcv can be a great option if you have the budget. This means what the item. The coverage you have under your homeowners insurance policy will determine how much money you get from your insurer for your property damage claim.

Source: restorationadvocate.com

Source: restorationadvocate.com

Actual cash value (acv) when it comes to understanding insurance coverage there are numerous terms and language that most policyholders are unfamiliar with. To start off, the actual cash value, or acv for short, is a term used by insurance companies that are in reference to the actual cost of what an item is appraised at. Rcv can be a great option if you have the budget. It all comes down to what you need and want. What acv and rcv mean.

Source: chateaupublicadjusters.com

Source: chateaupublicadjusters.com

That’s why replacement cost coverage for your damaged or stolen property is typically the most popular option, since it compensates you for the full cost of replacing your property. Actual cash value (acv) policies typically have lower premiums than rcv policies, and for good reason: They provide less in compensation when a claim is made. Understanding rcv and acv insurance. For an rcv policy, you’ll get the first $6,000 actual cash value check, just like an acv policy.

Source: teenagersusanamaria.blogspot.com

Source: teenagersusanamaria.blogspot.com

A good insurance plan offers. These include indemnity, actual cash value (acv), replacement cost value (rcv) and depreciation. So as to say, if you’re someone who likes to save money, this might sound enticing on the surface. July 15, 2020 by carlos simpson. Acv stands for actual cash value, and rcv means replacement cost value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance acv vs rcv by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.