Insurance bad faith california Idea

Home » Trend » Insurance bad faith california IdeaYour Insurance bad faith california images are available in this site. Insurance bad faith california are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance bad faith california files here. Download all royalty-free images.

If you’re looking for insurance bad faith california pictures information linked to the insurance bad faith california interest, you have pay a visit to the right blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Insurance Bad Faith California. Damages for emotional distress resulting from the insurer’s bad faith; This sample complaint against an insurance company in california for bad faith includes causes of action for breach of contract, breach of covenant of good faith and fair dealing, negligence and declaratory relief. Specifically, this obligation requires that an insurer uphold certain standards when handling a claim put forth by a policyholder. When an insurance company wrongly denies a claim under a policy, the policy is breached, allowing the policyholder to sue for breach of contract.

Insurance Coverage/Bad Faith Attorney Irvine, CA Legal From legalnetwork.cc

Insurance Coverage/Bad Faith Attorney Irvine, CA Legal From legalnetwork.cc

California law allows consumers to bring bad faith tort action against their insurers for breaching the duty of good faith when refusing without proper cause to compensate its insured for a loss cover by the policy. When an insurance company wrongly denies a claim under a policy, the policy is breached, allowing the policyholder to sue for breach of contract. Damages for emotional distress resulting from the insurer’s bad faith; What is insurance bad faith? California law defines certain acts and conduct that can qualify as bad faith. Insurance companies are legally required to act in good faith and to use only fair claims practices.

In short, it can bring about one of two things:

This primer focuses on insurer conduct that may qualify as. Specifically, this obligation requires that an insurer uphold certain standards when handling a claim put forth by a policyholder. This can be through refusal to pay a policyholder’s legitimate claim or refusal to investigate a policyholder’s claim within a reasonable period. Some of these acts include, but are not limited to: What constitutes bad faith insurance in california insurance agreements are contracts that obligate the insured to pay premiums in exchange for compensation on legitimate claims that the insurer promises. This means that ensure must treat the claimant’s interests as.

Source: lainjurygroup.com

Source: lainjurygroup.com

These statutes detail exactly what constitutes good conduct by insurance providers, and what must be done to ensure that they are acting in good faith to their policyholders. It is an unwritten promise to treat you the insured fairly. And fair dealing based on the insurer’s failure or refusal to conduct a proper. Damages for emotional distress resulting from the insurer’s bad faith; A look at the law:

Source: thonbeck.com

Source: thonbeck.com

This can be through refusal to pay a policyholder’s legitimate claim or refusal to investigate a policyholder’s claim within a reasonable period. At its core, bad faith exists whenever an insurance company unreasonably fails to uphold its end of a bargain. When an insurance company wrongly denies a claim under a policy, the policy is breached, allowing the policyholder to sue for breach of contract. If you can prove the insurer acted with oppression, malice, or fraud, you may also be able to collect punitive damages (meant to punish the insurer). Costs of hiring a lawyer to defend the claim (attorney’s fees);

Source: attorneymeth.com

Source: attorneymeth.com

For each policy of insurance that we purchase in the state of california, there is a duty of good faith and fair dealing which is implied in the insurance contract. Here is what you need to know about the california statute of limitations for bad faith insurance claims. Put simply, if your california insurance company handles your insurance claim in bad faith, then you are entitled to all the damages that were caused by this bad faith conduct, including lost income, lost opportunity, emotional distress, attorney fees, interest, and other types of. Punitive damages are important in holding the insurance company accountable for. This sample complaint against an insurance company in california for bad faith includes causes of action for breach of contract, breach of covenant of good faith and fair dealing, negligence and declaratory relief.

Source: clarksonlawfirm.com

Source: clarksonlawfirm.com

Specifically, this obligation requires that an insurer uphold certain standards when handling a claim put forth by a policyholder. If you can prove the insurer acted with oppression, malice, or fraud, you may also be able to collect punitive damages (meant to punish the insurer). Misrepresentation of facts or policy To prove bad faith in california and most other states, you need to show that an insurer breached its duty of good faith “by refusing, without proper cause, to compensate its insured for a loss. What happens if an insurance company rejects an offer to settle the case, when the offer was within the policy limits of the insured?

Source: downtownlalaw.com

Source: downtownlalaw.com

In short, it can bring about one of two things: At its core, bad faith exists whenever an insurance company unreasonably fails to uphold its end of a bargain. The sample is 10 pages and can be easily modified for most situations. If you can prove the insurer acted with oppression, malice, or fraud, you may also be able to collect punitive damages (meant to punish the insurer). Insurance law is all they do and they do it very well.

Source: legalnetwork.cc

Source: legalnetwork.cc

Most bad faith law definitions, however, follow something close to california’s definition (which makes sense because california was the first to recognize bad faith tort). California law defines certain acts and conduct that can qualify as bad faith. Failure to defend and indemnify a policyholder may constitute “bad faith” by the insurer. California bad faith insurance law protects policyholders. Damages for emotional distress resulting from the insurer’s bad faith;

Source: gmlawyers.com

Source: gmlawyers.com

To prove bad faith in california and most other states, you need to show that an insurer breached its duty of good faith “by refusing, without proper cause, to compensate its insured for a loss. California bad faith insurance law protects policyholders. If you can prove the insurer acted with oppression, malice, or fraud, you may also be able to collect punitive damages (meant to punish the insurer). This includes claims denials, coverage issues, duty to defend, duty to indemnify, and erisa preemption law. In short, it can bring about one of two things:

Source: dianalegal.com

Source: dianalegal.com

What constitutes bad faith in california? Generally, every insurance policy has an implied obligation of good faith and fair dealing that neither the insurance company nor the insured will do. Put simply, if your california insurance company handles your insurance claim in bad faith, then you are entitled to all the damages that were caused by this bad faith conduct, including lost income, lost opportunity, emotional distress, attorney fees, interest, and other types of. Failure to defend and indemnify a policyholder may constitute “bad faith” by the insurer. Although it has no traditional bright line rule regarding bad faith, california has addressed bad faith insurance practices both through the unfair claims practices act (“ucpa”) and the common law doctrine of breach if the implied covenant of good faith and fair dealing.

Source: leivalawfirm.com

Source: leivalawfirm.com

In california, insurance companies are legally obligated to act in good faith. The sample is 10 pages and can be easily modified for most situations. California insurance bad faith lawsuits offer recovery of damages for all levels of harm the policyholder suffers. This sample complaint against an insurance company in california for bad faith includes causes of action for breach of contract, breach of covenant of good faith and fair dealing, negligence and declaratory relief. This instruction sets forth a claim for breach of the implied covenant of good faith.

Source: fleitmanlaw.com

Source: fleitmanlaw.com

California bad faith insurance statutes outline specific acts that can constitute bad faith. Fortunately, california law provides consumers with a remedy when their insurance company puts their own interests before those of the insured, which often means that the insurance carrier is breaching their duty of good faith and fair dealing to their insured when the carrier refuses without proper cause to compensate its insured for a loss covered by the policy, or fails to. Unreasonable denial of policy benefits What constitutes bad faith in california? What is insurance bad faith?

Source: bohnlaw.com

Source: bohnlaw.com

This can be through refusal to pay a policyholder’s legitimate claim or refusal to investigate a policyholder’s claim within a reasonable period. The following are some issues which frequently arise when litigating insurance bad faith cases. Failure to defend and indemnify a policyholder may constitute “bad faith” by the insurer. This primer focuses on insurer conduct that may qualify as. Some of these acts include, but are not limited to:

Source: dianekimsite.blogspot.com

Source: dianekimsite.blogspot.com

Bad faith occurs whenever an insurance company fails to uphold their end of the policy. In california, insurance companies are legally obligated to act in good faith. Although it has no traditional bright line rule regarding bad faith, california has addressed bad faith insurance practices both through the unfair claims practices act (“ucpa”) and the common law doctrine of breach if the implied covenant of good faith and fair dealing. The concept of “bad faith” arose in california as a way to punish insurance companies who unreasonably deny policy benefits and treat policyholders unfairly. What is insurance bad faith?

Source: nordstrom-law.com

Source: nordstrom-law.com

This can be through refusal to pay a policyholder’s legitimate claim or refusal to investigate a policyholder’s claim within a reasonable period. Insurance companies are legally required to act in good faith and to use only fair claims practices. Most bad faith law definitions, however, follow something close to california’s definition (which makes sense because california was the first to recognize bad faith tort). Specifically, this obligation requires that an insurer uphold certain standards when handling a claim put forth by a policyholder. This primer focuses on insurer conduct that may qualify as.

Source: richardswillislaw.com

Source: richardswillislaw.com

At its core, bad faith exists whenever an insurance company unreasonably fails to uphold its end of a bargain. If you can prove the insurer acted with oppression, malice, or fraud, you may also be able to collect punitive damages (meant to punish the insurer). Misrepresentation of facts or policy This sample complaint against an insurance company in california for bad faith includes causes of action for breach of contract, breach of covenant of good faith and fair dealing, negligence and declaratory relief. What constitutes bad faith in california?

Source: legalnetwork.cc

Source: legalnetwork.cc

California bad faith insurance statutes outline specific acts that can constitute bad faith. California law defines certain acts and conduct that can qualify as bad faith. In california, insurance companies are legally obligated to act in good faith. This instruction sets forth a claim for breach of the implied covenant of good faith. Fortunately, california law provides consumers with a remedy when their insurance company puts their own interests before those of the insured, which often means that the insurance carrier is breaching their duty of good faith and fair dealing to their insured when the carrier refuses without proper cause to compensate its insured for a loss covered by the policy, or fails to.

Source: dianalegal.com

Source: dianalegal.com

The following are some issues which frequently arise when litigating insurance bad faith cases. When an insurance company wrongly denies a claim under a policy, the policy is breached, allowing the policyholder to sue for breach of contract. Put simply, if your california insurance company handles your insurance claim in bad faith, then you are entitled to all the damages that were caused by this bad faith conduct, including lost income, lost opportunity, emotional distress, attorney fees, interest, and other types of. Bad faith occurs whenever an insurance company fails to uphold their end of the policy. California insurance bad faith lawsuits offer recovery of damages for all levels of harm the policyholder suffers.

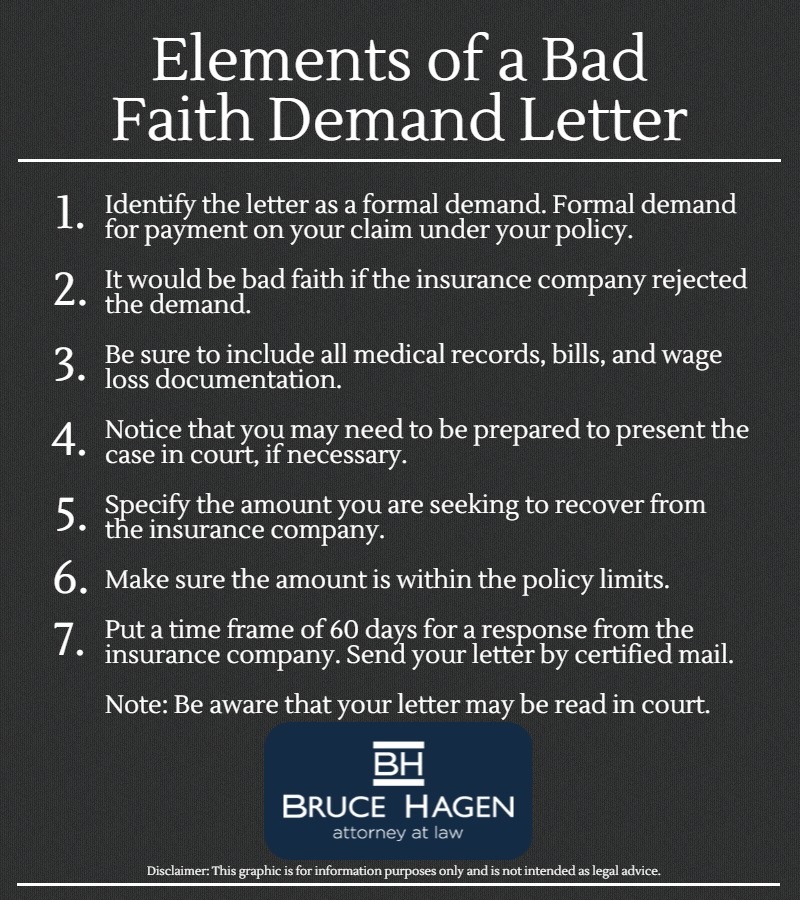

Source: hockani.com

Source: hockani.com

Most bad faith law definitions, however, follow something close to california’s definition (which makes sense because california was the first to recognize bad faith tort). At its core, bad faith exists whenever an insurance company unreasonably fails to uphold its end of a bargain. California bad faith insurance law protects policyholders. What is insurance bad faith? Generally, every insurance policy has an implied obligation of good faith and fair dealing that neither the insurance company nor the insured will do.

Source: dianalegal.com

Source: dianalegal.com

This instruction sets forth a claim for breach of the implied covenant of good faith. Although it has no traditional bright line rule regarding bad faith, california has addressed bad faith insurance practices both through the unfair claims practices act (“ucpa”) and the common law doctrine of breach if the implied covenant of good faith and fair dealing. To prove bad faith in california and most other states, you need to show that an insurer breached its duty of good faith “by refusing, without proper cause, to compensate its insured for a loss. Punitive damages are important in holding the insurance company accountable for. Some of these acts include, but are not limited to:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance bad faith california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.