Insurance basics pdf india information

Home » Trend » Insurance basics pdf india informationYour Insurance basics pdf india images are available. Insurance basics pdf india are a topic that is being searched for and liked by netizens now. You can Download the Insurance basics pdf india files here. Get all royalty-free photos and vectors.

If you’re searching for insurance basics pdf india images information linked to the insurance basics pdf india topic, you have visit the ideal site. Our site always gives you hints for seeking the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Insurance Basics Pdf India. Insurance is a method for spreading the risk of a financial loss among a large number of people. Insurance companies collect premiums to provide for this protection. Auto insurance basics auto insurance protects against financial loss in the event of an accident. Students preparing for the upcoming insurance exam can make use of it and clear the easily in the first attempt.

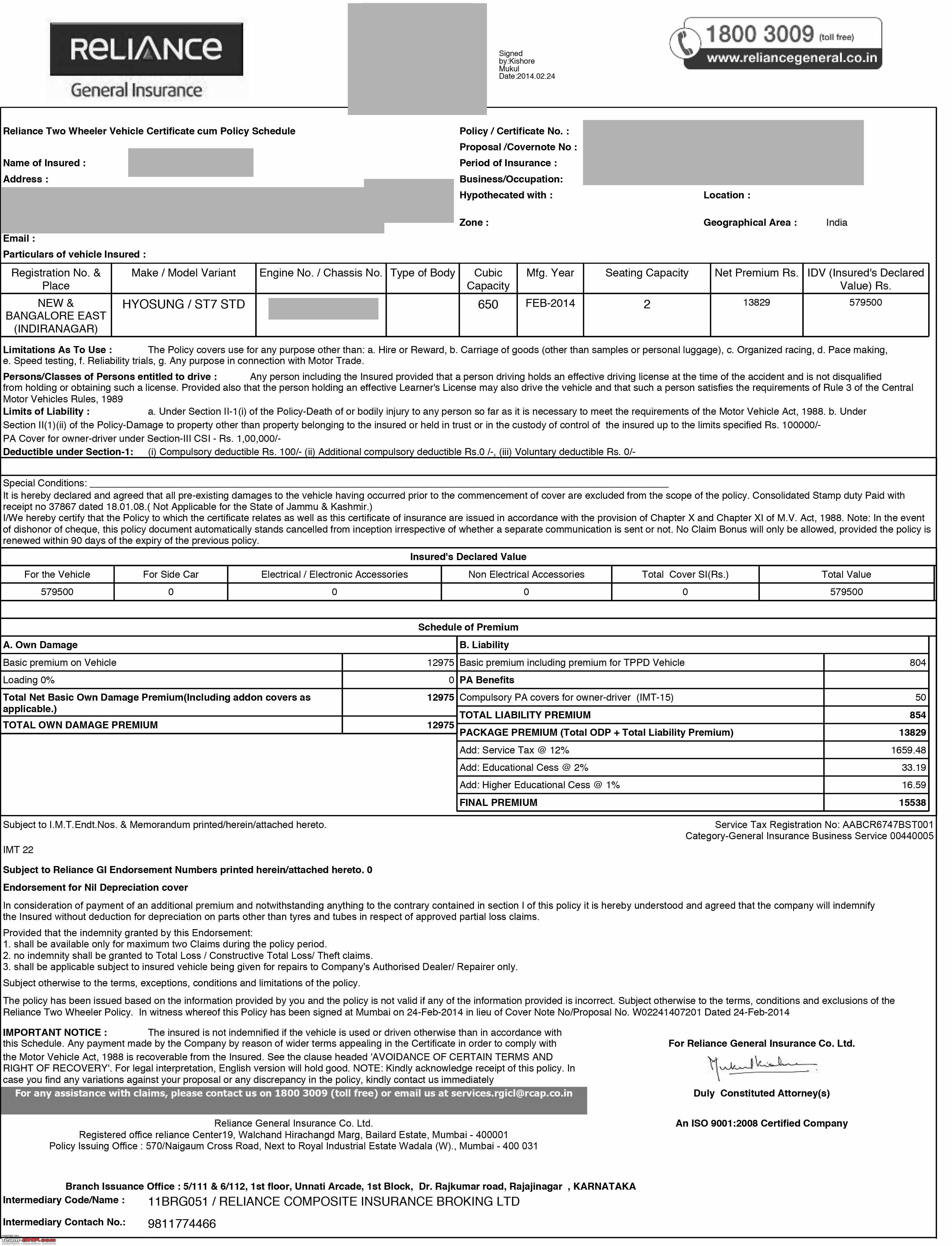

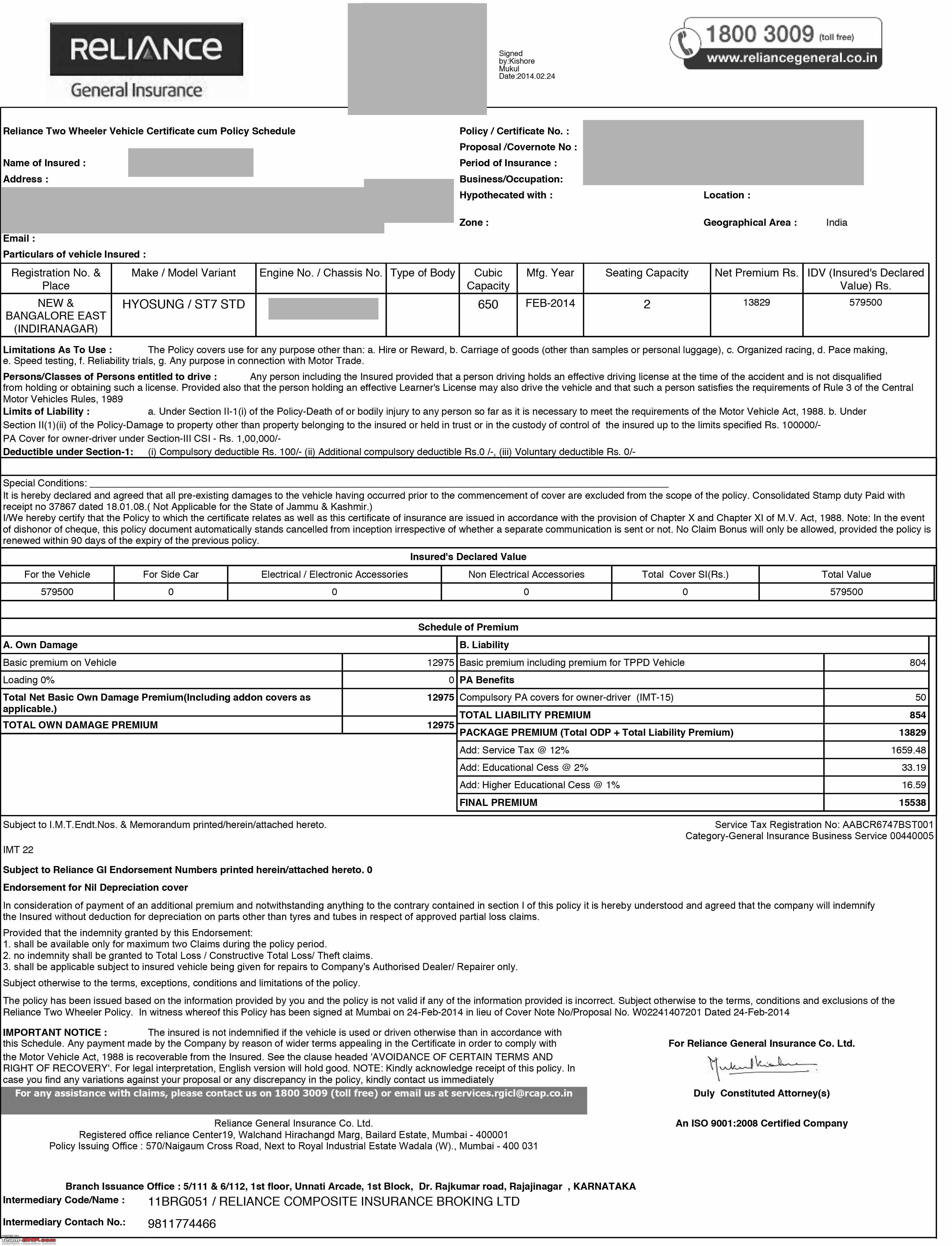

Motor Insurance Motor Insurance In India Pdf From motorinsurancewandogi.blogspot.com

Motor Insurance Motor Insurance In India Pdf From motorinsurancewandogi.blogspot.com

“life insurance business” means the business of effecting contracts of insurance upon human life, including any contract whereby the payment of money is assured on death (except death by accident only) and the happening The purpose of an insurance is to provide protection against the risk of any financial loss. Insurance is a contract whereby, in return for the payment of premium by the It is important to protect one’s property, which Insurance is a very old concept. Insurance is a mechanism by which the person exposed to the potential risk, arising out of the events beyond his control, transfers the financial loss;

So how do we do that?

Life insurance basics life insurance is an agreement between you (the insured) and an insurer. Insurance domain knowledge and basics. Insurance is a contract between the insurer and the insured person or a group. It is a contract between the policyholder and the insurance company. Insurance is a mechanism by which the person exposed to the potential risk, arising out of the events beyond his control, transfers the financial loss; It defines the notion of insurable risks and insurable interest.

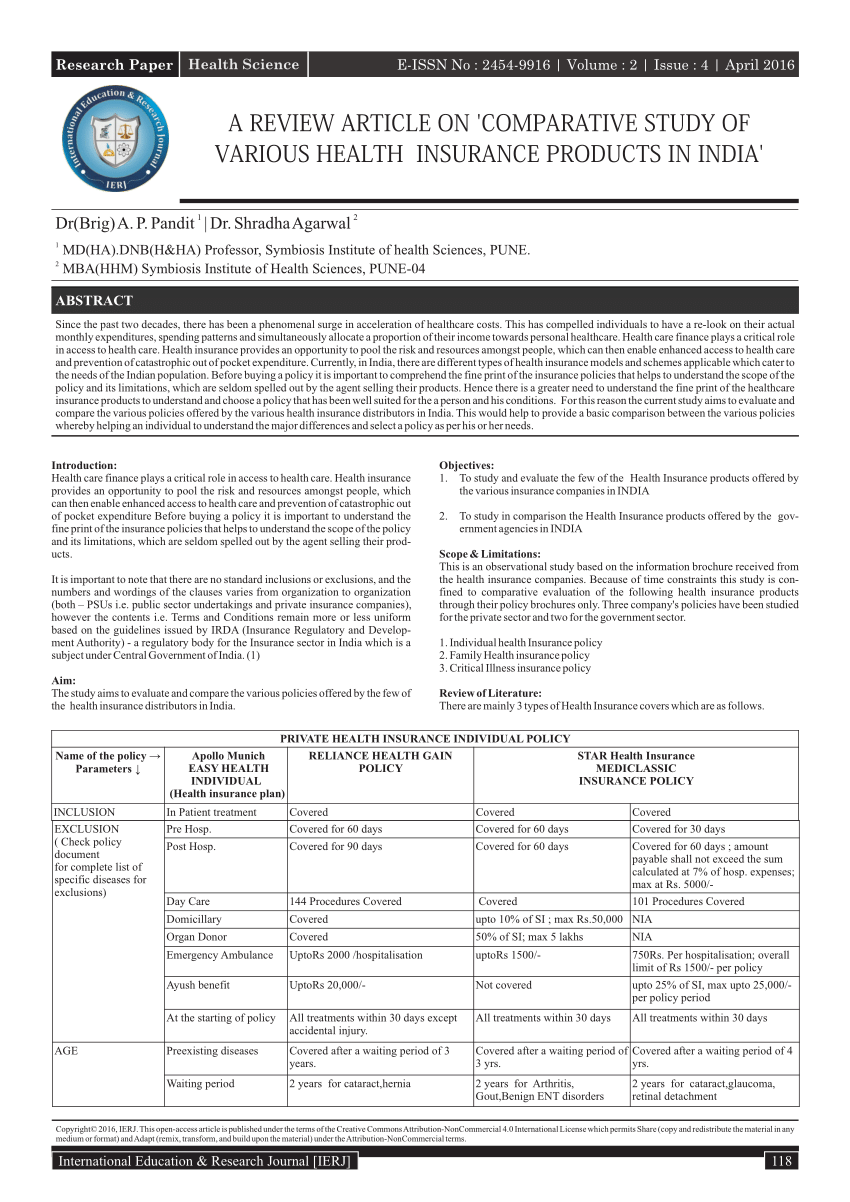

Source: researchgate.net

Source: researchgate.net

Due to the limited financial assistance, premiums for such policies also tend to be low. Insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company. “life insurance business” means the business of effecting contracts of insurance upon human life, including any contract whereby the payment of money is assured on death (except death by accident only) and the happening Insurer cedes a fixed percentage of liabilities, premiums and claims, irrespective of the sum insured. Auto insurance basics auto insurance protects against financial loss in the event of an accident.

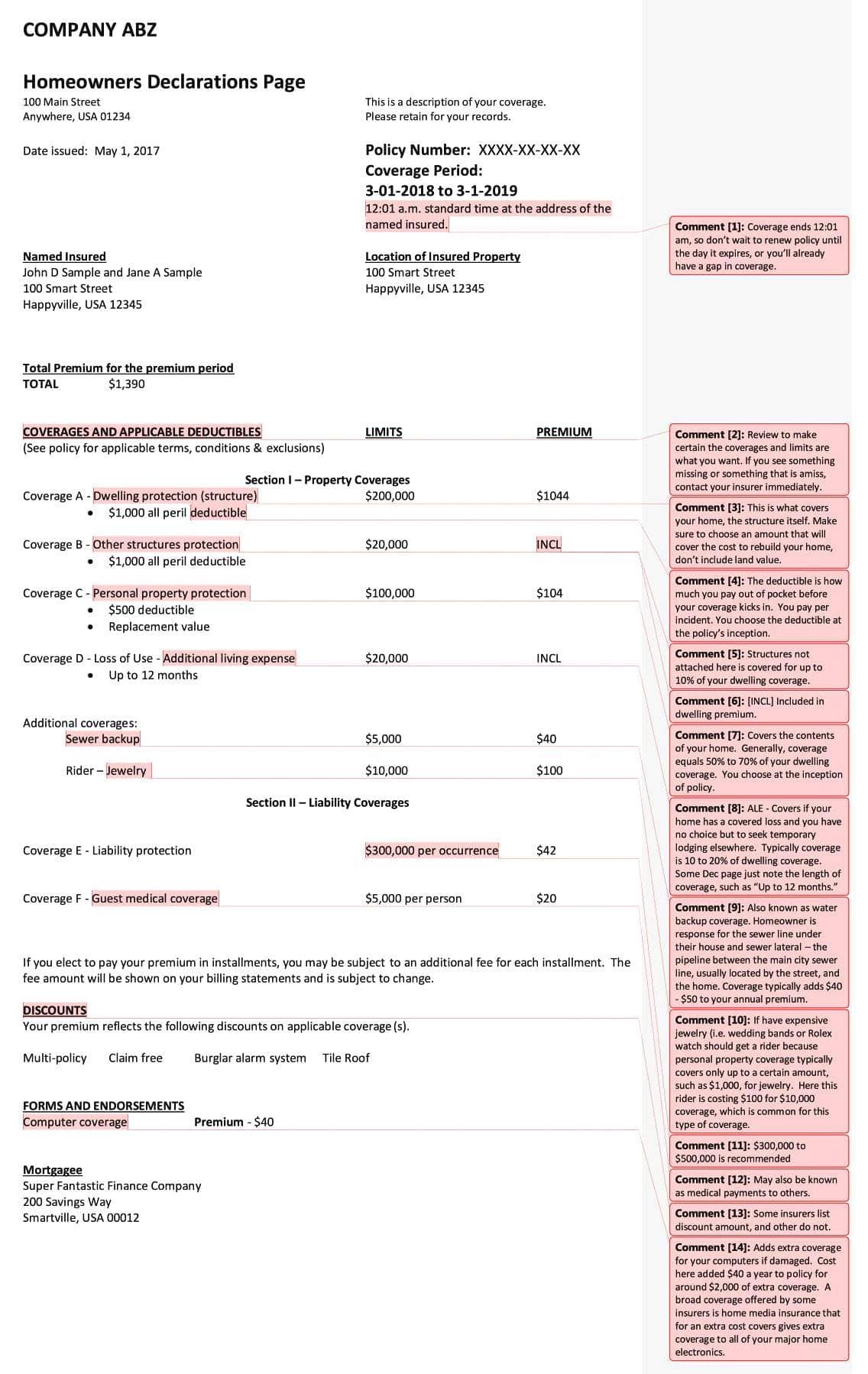

Source: youtube.com

Source: youtube.com

The party which transfers the potential loss is termed as the ‘insured’ and the party which These insurance plans only pay the financial liability to. Insurance companies collect premiums to provide for this protection. Insurance is a protection against financial loss arising on the happening of an unexpected event. “insurance is a social device which combines the risks of individuals into a group, using funds contributed by members of the group to pay for losses.” the essence of the insurance scheme is that it is a 1) social science 2) accumulation of funds 3) it involves a group of risks 4) transfer of risk to the whole group 2.3 background

Source: fullsportpress.net

Source: fullsportpress.net

Insurance is a contract between the insurer and the insured person or a group. Insurance basics let’s start by discussing some important insurance terms and concepts. Insurance association of india, insurance councils and committees thereof. Insurance is a contract between the insurer and the insured person or a group. Insurance is a method for spreading the risk of a financial loss among a large number of people.

Source: motorinsurancewandogi.blogspot.com

Source: motorinsurancewandogi.blogspot.com

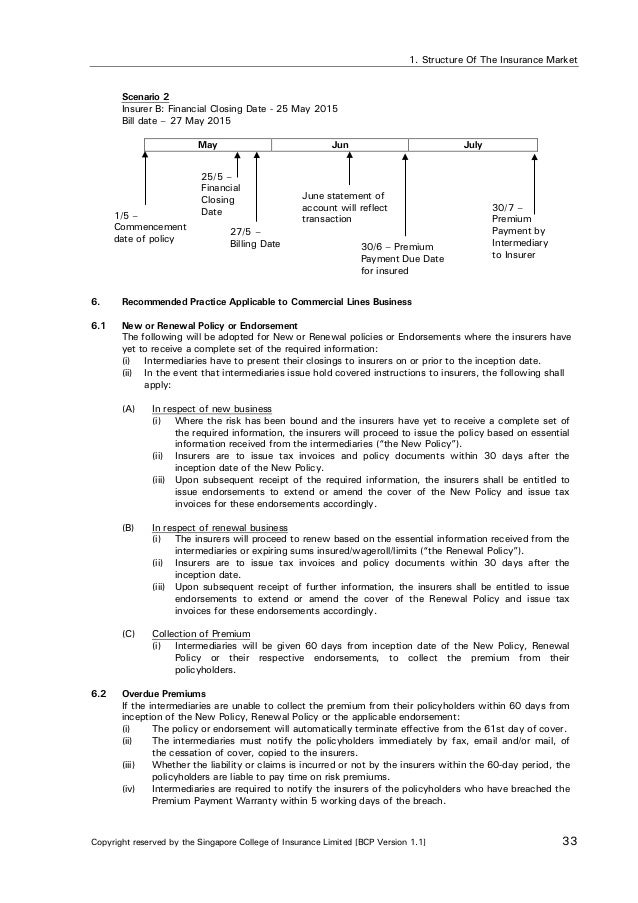

This is the maximum amount that can be ceded into a treaty. Proper life insurance coverage should provide you 70 opening of places of business requires prior approval of irda. It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988. “insurance is a social device which combines the risks of individuals into a group, using funds contributed by members of the group to pay for losses.” the essence of the insurance scheme is that it is a 1) social science 2) accumulation of funds 3) it involves a group of risks 4) transfer of risk to the whole group 2.3 background

Source: bookyage.com

Source: bookyage.com

Insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company. Insurance is a very old concept. Auto insurance provides property, liability and medical coverage: Exchange board of india and reserve bank of india. Basics of insurance let’s begin… introduction insurance is an important part of our economy.

Source: studylib.net

Source: studylib.net

Know more about insurance plans in india. 71 powers of irda for imposition of penalties for default in Exchange board of india and reserve bank of india. This is the maximum amount that can be ceded into a treaty. Insurance is a contract between the insurer and the insured person or a group.

Source: researchgate.net

Source: researchgate.net

It defines the notion of insurable risks and insurable interest. Insurance is a method for spreading the risk of a financial loss among a large number of people. Insurance domain knowledge and basics. Life insurance basics life insurance is an agreement between you (the insured) and an insurer. Treaty limit is a fixed amount.

Source: slideshare.net

Source: slideshare.net

Modes of compensation for the loss 5.4. Auto insurance provides property, liability and medical coverage: Without the protection insurance affords us, we would have to spend more time and money protecting ourselves from the risks of loss and less time in enjoying life and pursuing goals. Modes of compensation for the loss 5.4. Life vs general insurance 4.8.

Source: livemint.com

Source: livemint.com

The irda was established in 2000. Treaty limit is a fixed amount. 70 insurance companies to accept risk on an insurance policy only after receipt of premiums in advance. Suitable general insurance covers are necessary for every family. Basics of insurance let’s begin… introduction insurance is an important part of our economy.

Source: researchgate.net

Source: researchgate.net

Under the terms of a life insurance policy, the insurer promises to pay a certain sum to a person you choose (your beneficiary) upon your death, in exchange for your premium payments. A loss is paid out of the premiums collected from the insuring public. Insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company. Insurance is a contract between the insurer and the insured person or a group. Modes of compensation for the loss 5.4.

Source: researchgate.net

Source: researchgate.net

By spreading the risk, we are reducing the financial impact of an individual loss. Suitable general insurance covers are necessary for every family. Complaints are taken up by the website for redressal both with the companies and with the concerned regulators. Insurance domain knowledge and basics. Students preparing for the upcoming insurance exam can make use of it and clear the easily in the first attempt.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

Due to the limited financial assistance, premiums for such policies also tend to be low. It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988. Basics of insurance in india: Insurance companies collect premiums to provide for this protection. Life vs general insurance 4.8.

Insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company. 71 powers of irda for imposition of penalties for default in Complaints are taken up by the website for redressal both with the companies and with the concerned regulators. Modes of compensation for the loss 5.4. Insurance is a protection against financial loss arising on the happening of an unexpected event.

Source: researchgate.net

Source: researchgate.net

Due to the limited financial assistance, premiums for such policies also tend to be low. In part or in full to a third party. Suitable general insurance covers are necessary for every family. Life insurance basics life insurance is an agreement between you (the insured) and an insurer. Exchange board of india and reserve bank of india.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

These insurance plans only pay the financial liability to. Life insurance basics life insurance is an agreement between you (the insured) and an insurer. Suitable general insurance covers are necessary for every family. This is the maximum amount that can be ceded into a treaty. Insurance association of india, insurance councils and committees thereof.

Source: researchgate.net

Source: researchgate.net

It is a contract between the policyholder and the insurance company. Life insurance basics life insurance is an agreement between you (the insured) and an insurer. So how do we do that? Basics of insurance in india: Students preparing for the upcoming insurance exam can make use of it and clear the easily in the first attempt.

Source: researchgate.net

Source: researchgate.net

The party which transfers the potential loss is termed as the ‘insured’ and the party which It is important to protect one’s property, which Insurance domain knowledge and basics. Insurance the concept of insurance is really quite simple. Insurance is actually a contract between 2 parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party on happening of a certain event.

Source: authorstream.com

Source: authorstream.com

It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988. Treaty limit is a fixed amount. Insurer cedes a fixed percentage of liabilities, premiums and claims, irrespective of the sum insured. Life vs general insurance 4.8. Basics of insurance let’s begin… introduction insurance is an important part of our economy.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance basics pdf india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.