Insurance bond vs bank guarantee information

Home » Trend » Insurance bond vs bank guarantee informationYour Insurance bond vs bank guarantee images are ready. Insurance bond vs bank guarantee are a topic that is being searched for and liked by netizens now. You can Download the Insurance bond vs bank guarantee files here. Find and Download all royalty-free images.

If you’re looking for insurance bond vs bank guarantee images information connected with to the insurance bond vs bank guarantee keyword, you have pay a visit to the ideal site. Our website always gives you hints for seeing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

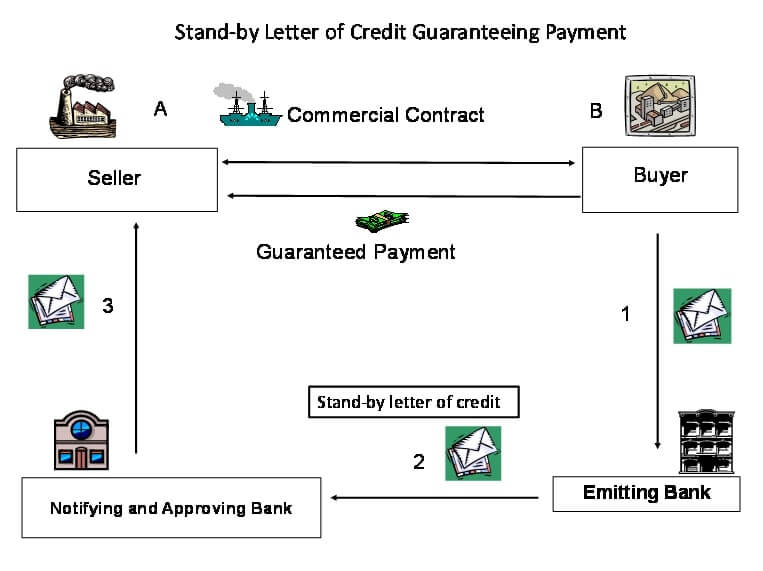

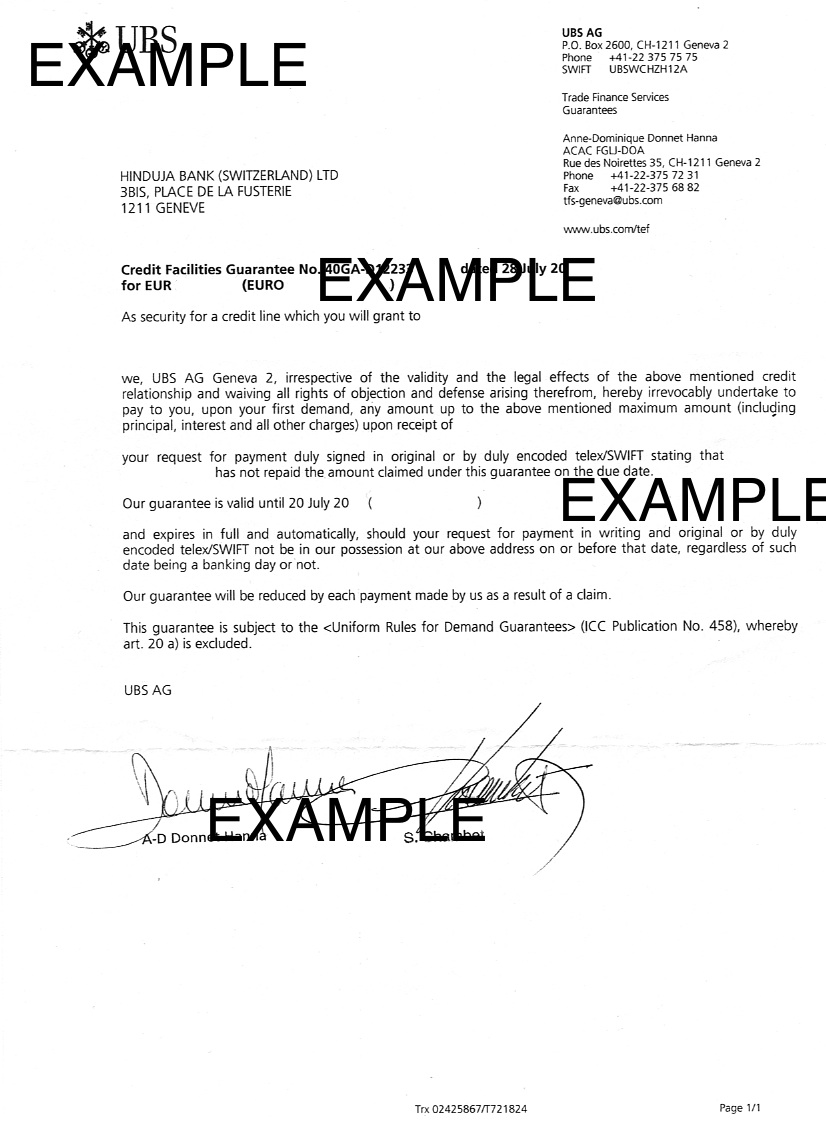

Insurance Bond Vs Bank Guarantee. A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. This means the bank will face the financial risk on construction projects. Bank guarantees are usually on demand, whereas surety bonds may be conditional. The service provided by the insurance companies usually begins and ends with issuing the guarantee.

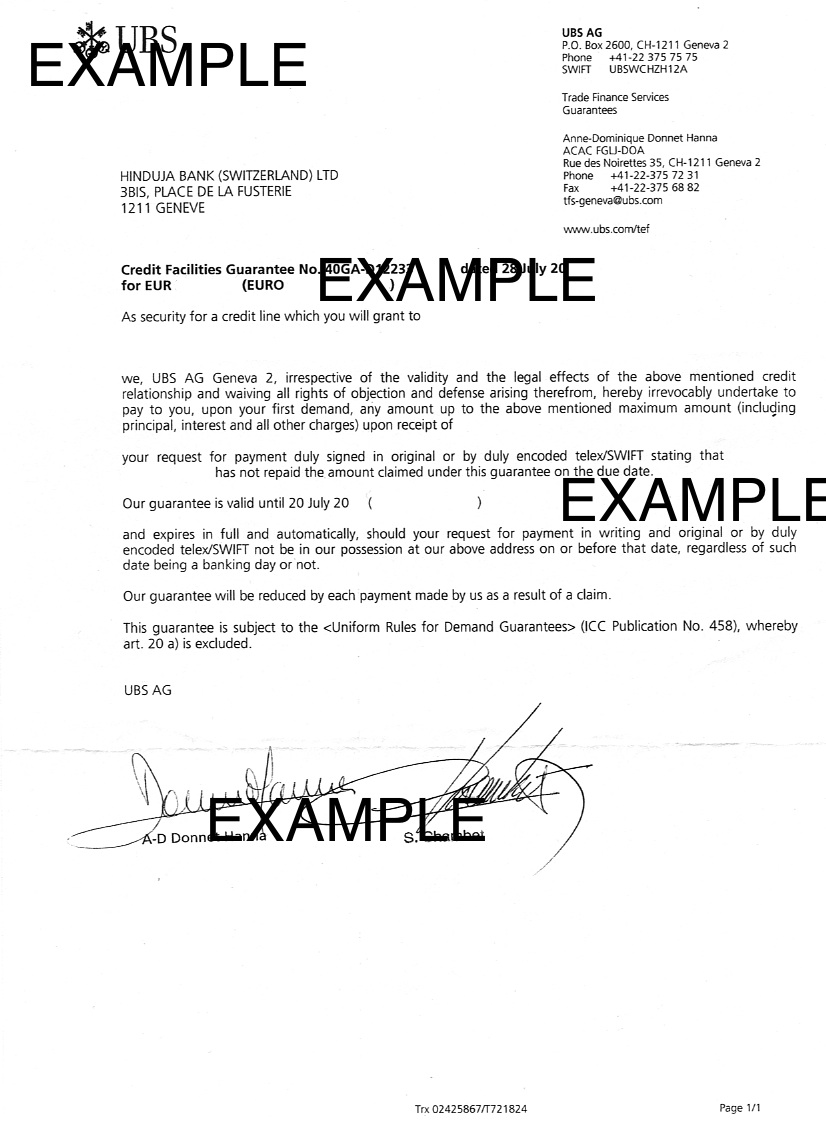

Letters of Credit versus Bank Guarantees 2018 Guide for From tradefinanceglobal.com

Letters of Credit versus Bank Guarantees 2018 Guide for From tradefinanceglobal.com

The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. This means the bank will face the financial risk on construction projects. Bank letters of credit • a bank loc is a cash guarantee to the owner, who can call on the loc on demand. Bank guarantees serve as a payment assurance given by the buyer to their counter parties. With surety, there is a performance risk. Parties involved in the contract.

In case of accounting, surety will considered.

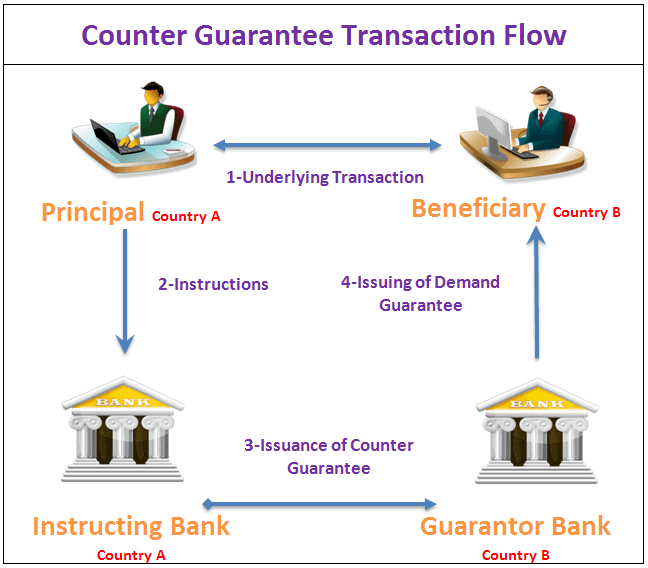

Insurance bonds are similar to bank guarantees, in that they are issued by a third party financial institution (usually an insurance company), and are payable on demand to the named beneficiary. The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. While bonds are technically a form of insurance, there are significant differences between bonds and insurance policies and bonds should not be purchased in place of liability insurance. Unlike a bank guarantee, there is no requirement to provide tangible collateral to support the guarantee, which can free up assets and working capital. A bank guarantee, sometimes called a letter of credit, is a way to transfer payment, while bank bonds or surety bonds provide a type of insurance against one party breaking the contract. Firstly, guarantees are underpinned by an indirect agreement between one of the two beneficiaries of a transaction (say, an importer of goods) and a third party (the bank guaranteeing the importer’s.

Source: letterofcredit.biz

Source: letterofcredit.biz

The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. For its part, banks usually require up to 100% fixed assets in the client�s current account or other compensations as an additional guarantee to the requested bond, hindering the company�s economic fluidity. Surety bonds are more financially flexible than bank guarantees. Guarantees and surety bonds 2 difference between a guarantee and a surety bond guarantee a guarantee is a distinct promise to pay and is not dependent on the principal obligation. Unlike a bank guarantee, there is no requirement to provide tangible collateral to support the guarantee, which can free up assets and working capital.

Source: tradefinanceglobal.com

Source: tradefinanceglobal.com

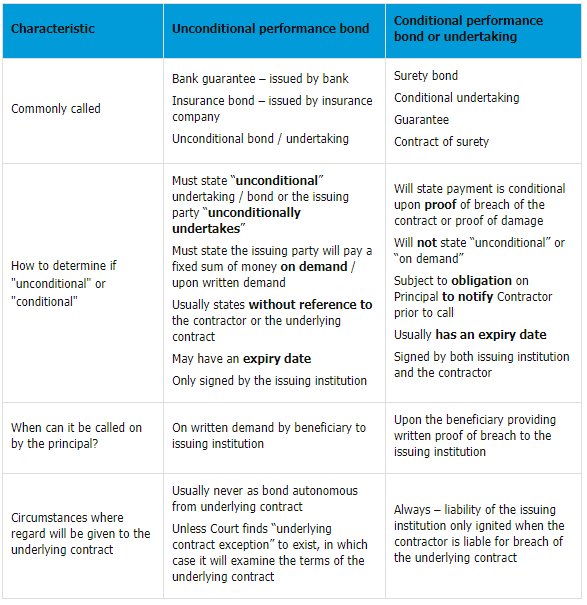

A bank guarantee, sometimes called a letter of credit, is a way to transfer payment, while bank bonds or surety bonds provide a type of insurance against one party breaking the contract. Bank letters of credit • a bank loc is a cash guarantee to the owner, who can call on the loc on demand. The main difference between bank guarantee and bonds is that in a bank guarantee the transfer of money is not directly from a buyer to the seller, but through the bank that acts as a guarantee, while in a bond the transaction takes place directly between the parties, if there is no failure on the side of the borrower. Guarantees and surety bonds 2 difference between a guarantee and a surety bond guarantee a guarantee is a distinct promise to pay and is not dependent on the principal obligation. Guarantee, the conditional bond or bank guarantee depends on the obligations owed by the contractor to the owner under the contract, and the contractor must be a party to it the absence of words typically found in unconditional bonds or bank guarantees such as “…on receipt of its

Source: issuu.com

Source: issuu.com

In case of accounting, surety will considered. Bank letters of credit • a bank loc is a cash guarantee to the owner, who can call on the loc on demand. On the other hand, surety bonds assure performance on a specific project or trade deal. The bank guarantee and the surety bond contain identical wording (generally) which states “it is unconditionally agreed that the financial institution will make the payment or payments to the principal without reference to the contractors and notwithstanding any notice given by the contractor not to pay same”. If the seller fulfills the contract terms without fail.

Source: de.slideshare.net

Source: de.slideshare.net

Bank guarantee vs surety bond. A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. The landlord is not required to inform the tenant that they have drawn on the bank guarantee prior to taking such action. Bg mt760 assures that the buyer will make the payment; The main difference between bank guarantee and bonds is that in a bank guarantee the transfer of money is not directly from a buyer to the seller, but through the bank that acts as a guarantee, while in a bond the transaction takes place directly between the parties, if there is no failure on the side of the borrower.

Source: alcoinsurance.com.sg

Source: alcoinsurance.com.sg

The facility allows the company greater financial flexibility by allowing the company to leverage off its capital base and enhance liquidity opportunities. The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. Bank guarantees and insurance bonds. There are three parties involved in the bond contract. In case of accounting, surety will considered.

Source: gov.uk

Source: gov.uk

Surety bonds are more financially flexible than bank guarantees. A guarantee is an independent, abstract own commitment of the insurer or bank that is separate from the main obligation. The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. Bank guarantee vs surety bond.

Source: gov.uk

Source: gov.uk

With surety, there is a performance risk. With surety, there is a performance risk. This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract. A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. Bg mt760 assures that the buyer will make the payment;

Source: everproconsultants.com

Source: everproconsultants.com

Bg mt760 assures that the buyer will make the payment; It is a guarantee by a surety provider (confusingly, usually an insurance company) of the performance of contractual obligations. Surety bonds are more financially flexible than bank guarantees. Parties involved in the contract. The guarantor (the bank) may not raise any objections or defenses based on the underlying transaction.

Source: importletterofcredit.com

Source: importletterofcredit.com

With surety, there is a performance risk. Bg mt760 assures that the buyer will make the payment; Unlike a bank guarantee, there is no requirement to provide tangible collateral to support the guarantee, which can free up assets and working capital. Bank guarantees are usually on demand, whereas surety bonds may be conditional. A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor.

Source: peynamt.blogspot.com

Source: peynamt.blogspot.com

If the seller fulfills the contract terms without fail. A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. With surety, there is a performance risk. It is a guarantee by a surety provider (confusingly, usually an insurance company) of the performance of contractual obligations. Bg mt760 assures that the buyer will make the payment;

Source: tradefinanceglobal.com

Source: tradefinanceglobal.com

If the security bond is covered by retail leases act 1994 (nsw), then the landlord must. The difference between a bank guarantee and an insurance bond is that issuers of insurance bonds do not typically require the bond to be secured by cash deposit. A bank guarantee, sometimes called a letter of credit, is a way to transfer payment, while bank bonds or surety bonds provide a type of insurance against one party breaking the contract. This means the guarantor pays upon the first written demand Firstly, guarantees are underpinned by an indirect agreement between one of the two beneficiaries of a transaction (say, an importer of goods) and a third party (the bank guaranteeing the importer’s.

Source: lexology.com

Source: lexology.com

The landlord has the right to either cash in, or draw on the bank guarantee if the tenant breaches the lease or damages the property. There are three parties involved in the bond contract. This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract. If the seller fulfills the contract terms without fail. Bg mt760 assures that the buyer will make the payment;

One difference is that insurance is a direct agreement between the insurance provider and the policyholder, while a guarantee involves an indirect agreement between a beneficiary and a third party, along with the primary agreement between the principal and beneficiary. This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract. A bank guarantee, sometimes called a letter of credit, is a way to transfer payment, while bank bonds or surety bonds provide a type of insurance against one party breaking the contract. A bank guarantee, sometimes called a letter of credit, is a way to transfer payment, while bank bonds or surety bonds provide a type of insurance against one party breaking the contract. Bank guarantee vs surety bond.

A performance bond is usually issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. It is a guarantee by a surety provider (confusingly, usually an insurance company) of the performance of contractual obligations. This means the bank will face the financial risk on construction projects. When there is a task where a payment and performance bond is required then it will need a bid bond, to initially bid for the job. The guarantor (the bank) may not raise any objections or defenses based on the underlying transaction.

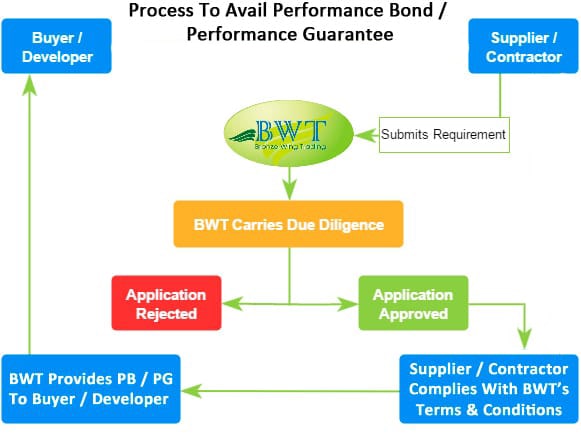

Source: bwtradefinance.com

Source: bwtradefinance.com

Guarantee, the conditional bond or bank guarantee depends on the obligations owed by the contractor to the owner under the contract, and the contractor must be a party to it the absence of words typically found in unconditional bonds or bank guarantees such as “…on receipt of its An insurance bond is not an insurance policy. Bank guarantees are usually on demand, whereas surety bonds may be conditional. Unlike a bank guarantee, there is no requirement to provide tangible collateral to support the guarantee, which can free up assets and working capital. When there is a task where a payment and performance bond is required then it will need a bid bond, to initially bid for the job.

Source: seputaranbank.blogspot.com

Source: seputaranbank.blogspot.com

On the other hand, surety bonds assure performance on a specific project or trade deal. The service provided by the insurance companies usually begins and ends with issuing the guarantee. With surety, there is a performance risk. This means the guarantor pays upon the first written demand • a payment bond (a.k.a.

Source: poyment.blogspot.com

Source: poyment.blogspot.com

Bank guarantees and insurance bonds. Bg mt760 assures that the buyer will make the payment; Guarantee, the conditional bond or bank guarantee depends on the obligations owed by the contractor to the owner under the contract, and the contractor must be a party to it the absence of words typically found in unconditional bonds or bank guarantees such as “…on receipt of its Bank guarantee vs surety bond. The bank guarantee and the surety bond contain identical wording (generally) which states “it is unconditionally agreed that the financial institution will make the payment or payments to the principal without reference to the contractors and notwithstanding any notice given by the contractor not to pay same”.

Source: paynemt.blogspot.com

Source: paynemt.blogspot.com

This means the guarantor pays upon the first written demand The landlord is not required to inform the tenant that they have drawn on the bank guarantee prior to taking such action. Bg mt760 assures that the buyer will make the payment; On the other hand, surety bonds assure performance on a specific project or trade deal. In case of accounting, surety will considered.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance bond vs bank guarantee by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.