Insurance broker bond Idea

Home » Trending » Insurance broker bond IdeaYour Insurance broker bond images are ready. Insurance broker bond are a topic that is being searched for and liked by netizens today. You can Get the Insurance broker bond files here. Find and Download all free vectors.

If you’re searching for insurance broker bond images information linked to the insurance broker bond interest, you have visit the right site. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Insurance Broker Bond. Insurance broker bonds may be necessary either at the company or individual level depending on the requirements of the states where you intend to do business. An insurance broker bond is a promise that brokers will develop legal strategies to assist clients and abide by laws in the state of practice. By granting the bond, the surety agency guarantees that the broker is financially capable of paying any claims put on the bond. What is an insurance broker bond?

Connecticut Auto Dealer Bond A Guide For Insurance Agents From bondexchange.com

Connecticut Auto Dealer Bond A Guide For Insurance Agents From bondexchange.com

Insurance broker bond if your dealership is planning to sell insurance products with an insurance broker on staff as part of the team, he or she needs to be bonded before getting or renewing his or her license, as required by the state department of insurance. Insurance broker bonds with no credit check. Insurance brokers typically must post a surety bond in addition to being licensed to sell, negotiate and transact insurance business. An insurance broker bond is a promise that brokers will develop legal strategies to assist clients and abide by laws in the state of practice. It also guarantees that they will develop risk mitigation strategies faithfully and in accordance with state laws and regulations. An insurance broker should be someone that an individual can trust with their private information.

Too many employees for an instant issue bond.

Having this bond goes one more step towards boosting a customer’s confidence in working with your agency. This type of surety bond is an agreement between three parties: Insurance broker bond is fairly easy to get, in most cases it does not require a credit check. How does the insurance broker bond work? A surety bond is not insurance. What is an insurance broker bond?

Source: dimirak.com

Source: dimirak.com

An insurance broker surety bond ensures insurance professionals fulfill their duties ethically and according to the laws of their city and state. Insurance broker bond if your dealership is planning to sell insurance products with an insurance broker on staff as part of the team, he or she needs to be bonded before getting or renewing his or her license, as required by the state department of insurance. It also guarantees that they will develop risk mitigation strategies faithfully and in accordance with state regulations. Besides obtaining a license, all freight brokers are required to carry broker bond insurance or freight broker bond. These bonds are instantly issued

Source: pinterest.com

Source: pinterest.com

It is a good suggestion to verify with the state, as all states have their very own requirements. An insurance broker bond is a promise that brokers will develop lawful strategies to assist their clients and abide by laws in the state of practice. Besides obtaining a license, all freight brokers are required to carry broker bond insurance or freight broker bond. An insurance broker should be someone that an individual can trust with their private information. This bond protects the public from any financial damages the california insurance broker may cause.

Source: bondexchange.com

Source: bondexchange.com

Insurance broker bonds with no credit check. A surety bond is a legally binding contract that will provide a guarantee to the north carolina department of insurance that the insurance broker will faithfully perform his or her obligations. What is an insurance broker bond? Regulated by each state, insurance brokers and agents sell or negotiate insurance policies in exchange for financial compensation. If the principal or his/her solicitors and employees fail to conduct ethical and lawful business, the bond protects consumers from financial loss up to the full amount of the bond.

Source: insanelycoastercrazy.blogspot.com

Source: insanelycoastercrazy.blogspot.com

This is a form of insurance that protects the shipper form any illegal, fraudulent, or unethical activity by the broker. Regulated by each state, insurance brokers and agents sell or negotiate insurance policies in exchange for financial compensation. Insurance brokers typically must post a surety bond in addition to being licensed to sell, negotiate and transact insurance business. As an insurance agent, additional insurance coverage is advised. The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”.

Source: bondexchange.com

Source: bondexchange.com

This means even if you have no credit or bad credit you can get the bond today. Most states require an insurance broker bond before you can start working. Bond911.com only provides instant issue bonds for companies with 5 or fewer employees. By granting the bond, the surety agency guarantees that the broker is financially capable of paying any claims put on the bond. If you are an insurance broker, or.

Source: youtube.com

Source: youtube.com

This type of surety bond is an agreement between three parties: By posting a california insurance broker bond, principals (insurance brokers) pledge to handle all funds received appropriately and apply them to the services and products requested by the client. Most states require an insurance broker bond before you can start working. These bonds protect the public and require the insurance professional to adhere to strict guideline, rules, and insurance laws. Insurance brokers typically must post a surety bond in addition to being licensed to sell, negotiate and transact insurance business.

Source: insanelycoastercrazy.blogspot.com

Source: insanelycoastercrazy.blogspot.com

The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”. Insurance broker bonds with no credit check. In every surety bond, there are three parties: What is an insurance broker bond? These bonds are instantly issued

Source: pinterest.com

Source: pinterest.com

This type of surety bond is an agreement between three parties: Insurance broker bonds guarantee compliance with state insurance laws, providing protection to any person or business that may have been harmed as a result of a negligent act committed by a licensed insurance agent. Three parties sign off on a. Having this bond goes one more step towards boosting a customer’s confidence in working with your agency. In most cases, an insurance broker must file proof of a surety bond before he or she can obtain a business license.

Source: nfpsurety.com

Source: nfpsurety.com

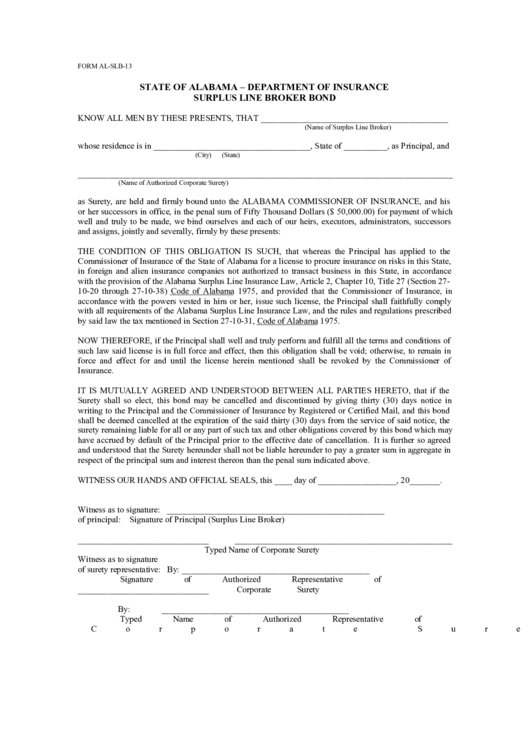

It is a good suggestion to verify with the state, as all states have their very own requirements. Additionally, some also work with their insured customers to develop risk mitigation strategies. The surety bond protects clients from potential fraudulent acts like price manipulation, or brokers falsifying information on claims. This type of surety bond is an agreement between three parties: Insurance adjusters, insurance agents, surplus lines brokers and 3rd celebration directors all might should be bonded to acquire a license.

Source: nfpsurety.com

Source: nfpsurety.com

How does the insurance broker bond work? In every surety bond, there are three parties: The principal, the obligee, and the surety. Insurance adjusters, insurance agents, surplus lines brokers and 3rd celebration directors all might should be bonded to acquire a license. In other states, individual brokers must insure themselves.

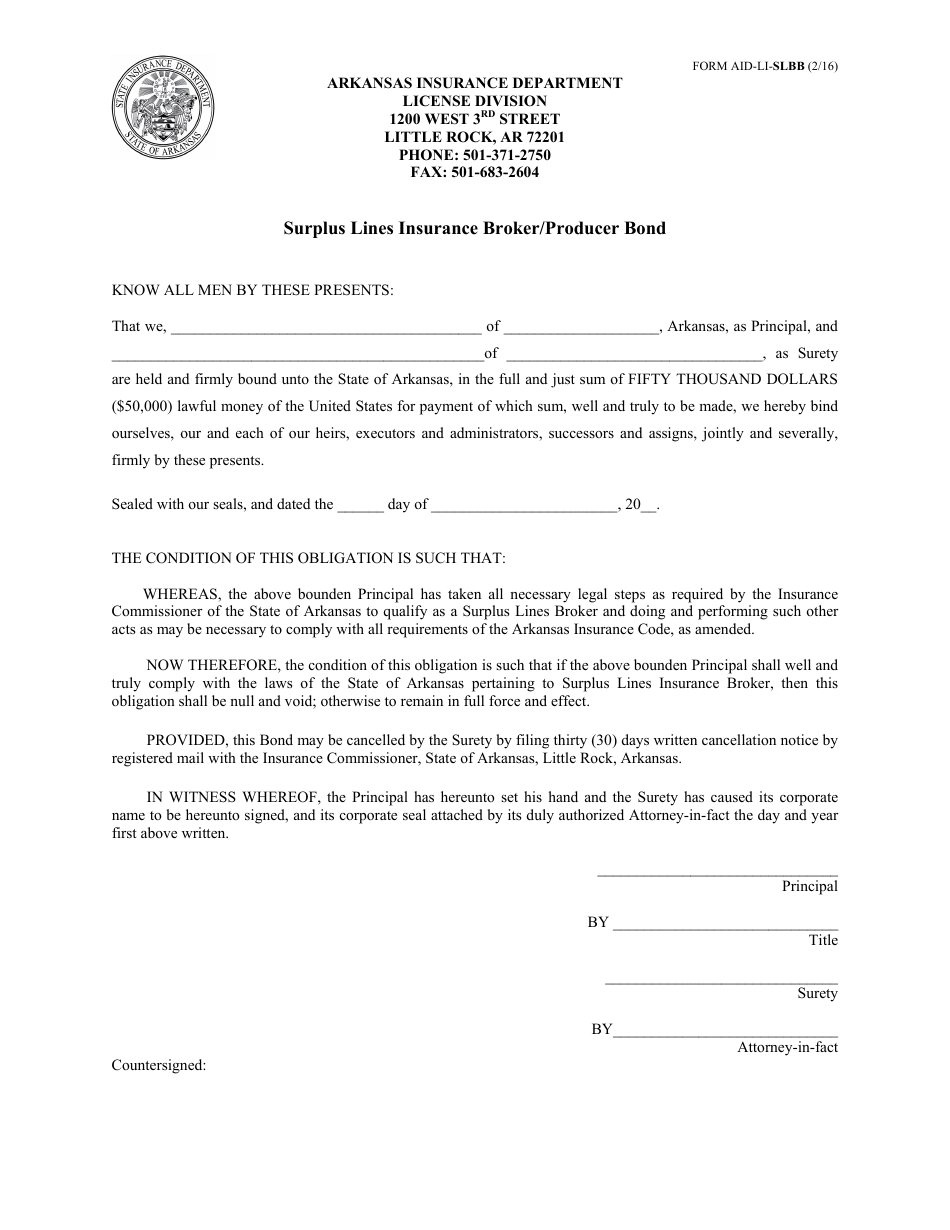

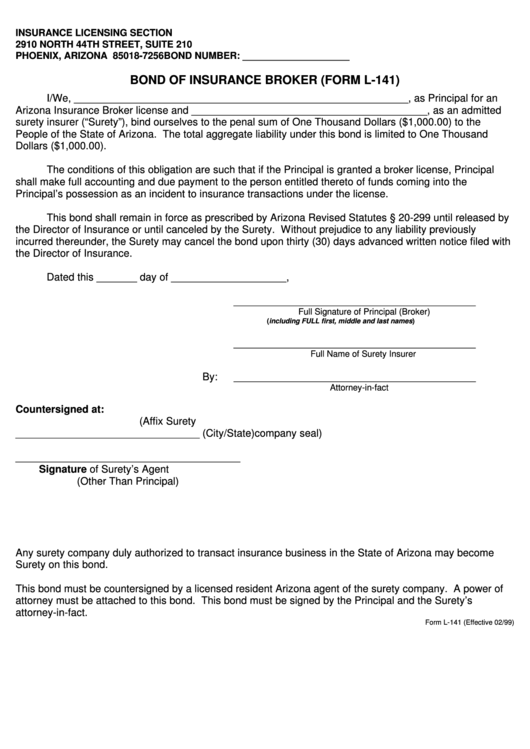

Source: templateroller.com

Source: templateroller.com

The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”. Insurance adjusters, insurance agents, surplus lines brokers and 3rd celebration directors all might should be bonded to acquire a license. The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”. In other states, individual brokers must insure themselves. An insurance broker bond is a type of license and permit bond which guarantees that insurance brokers account for insurance premiums they collect.

Source: awginsurance.com

Source: awginsurance.com

Insurance broker bond if your dealership is planning to sell insurance products with an insurance broker on staff as part of the team, he or she needs to be bonded before getting or renewing his or her license, as required by the state department of insurance. The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”. What is an insurance broker bond? These bonds are instantly issued In other states, individual brokers must insure themselves.

Source: formsbank.com

Source: formsbank.com

These bonds protect the public and require the insurance professional to adhere to strict guideline, rules, and insurance laws. In most cases, an insurance broker must file proof of a surety bond before he or she can obtain a business license. It also guarantees that they will develop risk mitigation strategies faithfully and in accordance with state laws and regulations. An insurance broker surety bond ensures insurance professionals fulfill their duties ethically and according to the laws of their city and state. The insurance provider issuing any surety bond, such as an insurance adjuster or broker bond, will even be known as the surety firm” or the bond company”.

Source: suretybonds.com

Source: suretybonds.com

Insurance broker bond if your dealership is planning to sell insurance products with an insurance broker on staff as part of the team, he or she needs to be bonded before getting or renewing his or her license, as required by the state department of insurance. Insurance broker bond is fairly easy to get, in most cases it does not require a credit check. It also guarantees that they will develop risk mitigation strategies faithfully and in accordance with state laws and regulations. #4 get an insurance broker bond. By posting a california insurance broker bond, principals (insurance brokers) pledge to handle all funds received appropriately and apply them to the services and products requested by the client.

Source: suretybonds.org

Source: suretybonds.org

Insurance broker bond is fairly easy to get, in most cases it does not require a credit check. A surety bond is a legally binding contract that will provide a guarantee to the north carolina department of insurance that the insurance broker will faithfully perform his or her obligations. To legally operate, insurance agents must be licensed in the states in which they operate. An insurance broker bond is a type of license and permit bond which guarantees that insurance brokers account for insurance premiums they collect. These bonds are required in most states as a part of licensing.

Source: formsbank.com

Source: formsbank.com

Insurance broker bonds seek advice from the insurance agent because the principal, the surety bond firm as the obligor and the federal government agency as the obligee. Having this bond goes one more step towards boosting a customer’s confidence in working with your agency. This means even if you have no credit or bad credit you can get the bond today. This type of surety bond is an agreement between three parties: These bonds are instantly issued

Source: insanelycoastercrazy.blogspot.com

Source: insanelycoastercrazy.blogspot.com

The principal, the obligee, and the surety. An insurance broker bond is a promise that brokers will develop legal strategies to assist clients and abide by laws in the state of practice. Insurance broker bonds may be necessary either at the company or individual level depending on the requirements of the states where you intend to do business. By granting the bond, the surety agency guarantees that the broker is financially capable of paying any claims put on the bond. Dmv surety bond / defective title bond;

Source: bondrepublic.com

Source: bondrepublic.com

What is an insurance broker bond? The surety bond protects clients from potential fraudulent acts like price manipulation, or brokers falsifying information on claims. This is a form of insurance that protects the shipper form any illegal, fraudulent, or unethical activity by the broker. This bond protects the public from any financial damages the california insurance broker may cause. Most states require an insurance broker bond before you can start working.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance broker bond by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.