Insurance broker distribution methods Idea

Home » Trending » Insurance broker distribution methods IdeaYour Insurance broker distribution methods images are available in this site. Insurance broker distribution methods are a topic that is being searched for and liked by netizens today. You can Download the Insurance broker distribution methods files here. Download all free photos and vectors.

If you’re searching for insurance broker distribution methods images information related to the insurance broker distribution methods topic, you have come to the ideal blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

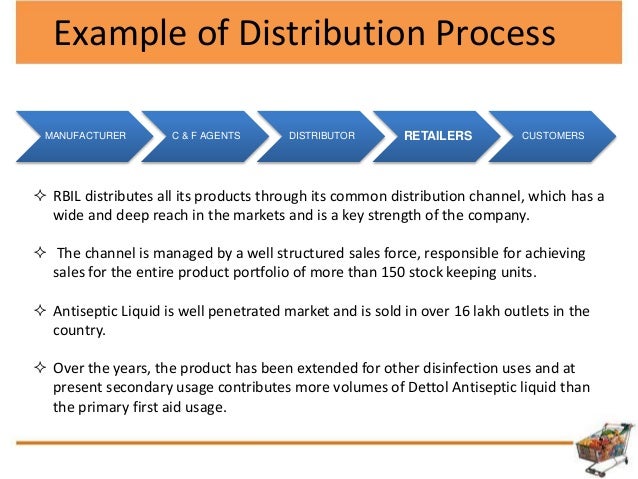

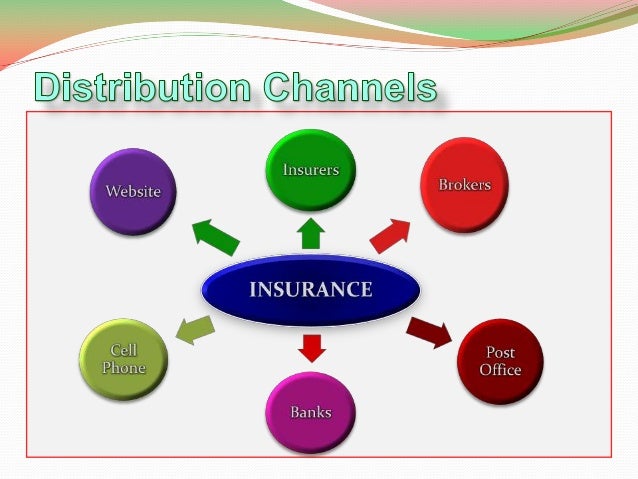

Insurance Broker Distribution Methods. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. Types of marketing systems marketing systems refer to the various methods for selling and marketing insurance products. The independent (american) agency system and the exclusive agency system account for the bulk of insurance sales. Like life/health insurance, most property/casualty insurance is sold through agents or brokers who are compensated on a commission basis, but some is sold by salaried representatives or by direct methods.

AI on Twitter "Insurance Value Chain AI machinelearning From twitter.com

AI on Twitter "Insurance Value Chain AI machinelearning From twitter.com

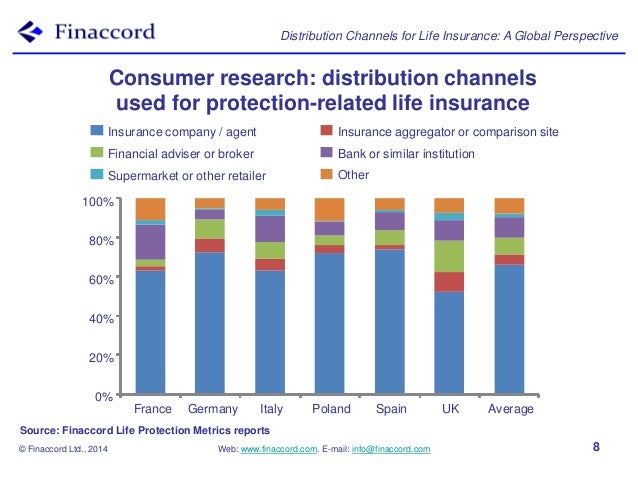

Digital marketing is substantially on the rise but along with this, we can’t undermine the efforts of agents or brokers in insurance marketing. In addition to agents and brokers, those attached to a particular company or those working. Insurance as a method of handling risk, or is legally compelled to use insurance, middlemen may be needed to find risk buyers and insurance sellers who are wvilling to contract at satisfactory terms and prices. In november 2019, the fca published guidance for insurance product manufacturers and distributors in general insurance distribution chains in order to clarify its expectations of firms in the general insurance and pure protection sector following idd changes related to product oversight and governance and broker remuneration. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. 58% of consumers are very likely to purchase motor insurance through an agent or broker (31% fairly likely and 8% neutral) 57% of consumers are very likely to purchase health insurance through an agent or broker (30% fairly likely and 10% neutral) source:

It also covers sales of insurance products through websites, including comparison websites if they allow concluding an insurance contract.

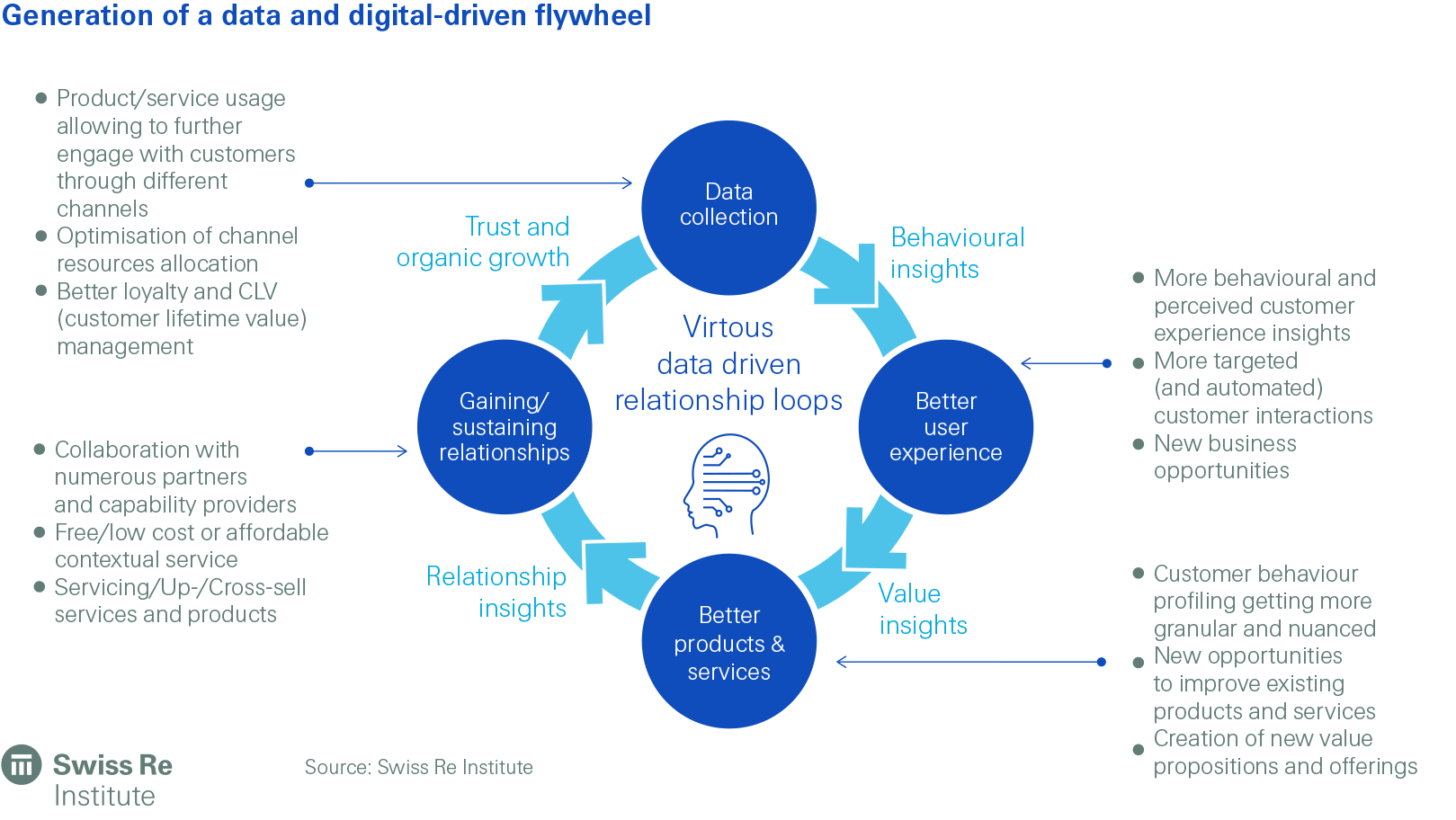

Look at trends from other insurers who have also begun their shift to digital, ask questions to your consumers, or analyze the results within your team. The human touch from an insurance agent, albeit from afar, is still vital. It also covers sales of insurance products through websites, including comparison websites if they allow concluding an insurance contract. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. In today’s world, insurance companies have a lot of delivery methods for their products and services. Lexisnexis risk solutions india consumer insurance study (amongst those without insurance)

Source: pinterest.com

Source: pinterest.com

These methods of selling are also called distribution systems. Agents and brokers are typically the key players in the insurance distribution channel, with market shares of 42% and 25% respectively. Look at trends from other insurers who have also begun their shift to digital, ask questions to your consumers, or analyze the results within your team. Insurance as a method of handling risk, or is legally compelled to use insurance, middlemen may be needed to find risk buyers and insurance sellers who are wvilling to contract at satisfactory terms and prices. Insurance companies employ a variety of different channels to offer and distribute their products.

Source: slideshare.net

Source: slideshare.net

The prime objective of an insurance broker is to gratify the interests of his customer. Hybrid distribution system, wholesaler and physical distribution type # 1. “the three major forms of. Appointed agents or independent brokers to distribute their products and services. Like life/health insurance, most property/casualty insurance is sold through agents or brokers who are compensated on a commission basis, but some is sold by salaried representatives or by direct methods.

Source: phoenixriskadvisors.com

Source: phoenixriskadvisors.com

Appointed agents or independent brokers to distribute their products and services. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. Large employers often obtain their group life and medical 8. Types of marketing systems marketing systems refer to the various methods for selling and marketing insurance products. In addition to agents and brokers, those attached to a particular company or those working.

Source: slideshare.net

Source: slideshare.net

The independent (american) agency system and the exclusive agency system account for the bulk of insurance sales. Large employers often obtain their group life and medical 8. Digital marketing is substantially on the rise but along with this, we can’t undermine the efforts of agents or brokers in insurance marketing. The customer must be given the opportunity to buy these components (product or service) separately. A variety of distribution channels are currently used in the marketplace, and some insurers utilize a combination of.

Source: twitter.com

Source: twitter.com

The customer must be given the opportunity to buy these components (product or service) separately. But now, as a result of the changes in the market mentioned above, the insurance industry has started to look for new distribution channels in the online space. In today’s world, insurance companies have a lot of delivery methods for their products and services. “the three major forms of. The independent (american) agency system and the exclusive agency system account for the bulk of insurance sales.

Source: ibai.org

Source: ibai.org

Brokers are important in the area of employee benefits, especially for larger employers. In addition to agents and brokers, those attached to a particular company or those working. • customer claims satisfaction is at historically high levels, leaving less ground for differentiation between insurers. These methods of selling are also called distribution systems. Insurers today leverage multiple distribution channels to reach and engage with their customers.

Source: capgemini.com

Source: capgemini.com

When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. Like life/health insurance, most property/casualty insurance is sold through agents or brokers who are compensated on a commission basis, but some is sold by salaried representatives or by direct methods. While some insurance companies like the direct distribution method, which cuts out the middleman and his or her commission, there�s still a need for agents, especially at a time when people are facing overwhelming challenges with finances and their health. A variety of distribution channels are currently used in the marketplace, and some insurers utilize a combination of. • customer claims satisfaction is at historically high levels, leaving less ground for differentiation between insurers.

Source: dettoldiaries.blogspot.com

Source: dettoldiaries.blogspot.com

A company must manage a hybrid distribution system to avoid chaos and maximize efficiency, responsibilities, relationships and compensations among various channel members must be made clear. “the three major forms of. A company must manage a hybrid distribution system to avoid chaos and maximize efficiency, responsibilities, relationships and compensations among various channel members must be made clear. Brokers are important in the area of employee benefits, especially for larger employers. The customer must be given the opportunity to buy these components (product or service) separately.

Source: cbinsights.com

Source: cbinsights.com

Companies like progressive, geico, and hiscox are growing concerns that have begun to change how insurance is sold, purchased, and serviced. The human touch from an insurance agent, albeit from afar, is still vital. Insurance companies employ a variety of different channels to offer and distribute their products. Old definitions of agency types — captive, independent and direct channels — are less useful than they used to be. Brokers are important in the area of employee benefits, especially for larger employers.

Source: celent.com

Source: celent.com

Distribution system — the method by which an insurance company reaches its insureds—that is, as direct writer, wholesaler, agency system, or broker market. The insurance broker works as an intermediary between the person buying the insurance and the insurance company. Insurers today leverage multiple distribution channels to reach and engage with their customers. Like life/health insurance, most property/casualty insurance is sold through agents or brokers who are compensated on a commission basis, but some is sold by salaried representatives or by direct methods. Digital marketing is substantially on the rise but along with this, we can’t undermine the efforts of agents or brokers in insurance marketing.

Source: freshavocat.blogspot.com

Source: freshavocat.blogspot.com

But now, as a result of the changes in the market mentioned above, the insurance industry has started to look for new distribution channels in the online space. A company must manage a hybrid distribution system to avoid chaos and maximize efficiency, responsibilities, relationships and compensations among various channel members must be made clear. Insurance companies employ a variety of different channels to offer and distribute their products. An insurance broker is a person who on behalf of insurance company sells the insurance policy to a person. Insurance as a method of handling risk, or is legally compelled to use insurance, middlemen may be needed to find risk buyers and insurance sellers who are wvilling to contract at satisfactory terms and prices.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. If an ancillary product or service, which is not insurance based, is offered together with an insurance product, then the distributor must inform the customer about the components, costs, charges, and risks of each component. Insurance distribution means to sell, propose to sell, advise on or prepare in any other way the conclusion of insurance contracts. Types of marketing systems marketing systems refer to the various methods for selling and marketing insurance products. Old definitions of agency types — captive, independent and direct channels — are less useful than they used to be.

Source: freshavocat.blogspot.com

Source: freshavocat.blogspot.com

Like life/health insurance, most property/casualty insurance is sold through agents or brokers who are compensated on a commission basis, but some is sold by salaried representatives or by direct methods. The insurance broker works as an intermediary between the person buying the insurance and the insurance company. Insurance as a method of handling risk, or is legally compelled to use insurance, middlemen may be needed to find risk buyers and insurance sellers who are wvilling to contract at satisfactory terms and prices. “the three major forms of. Large employers often obtain their group life and medical 8.

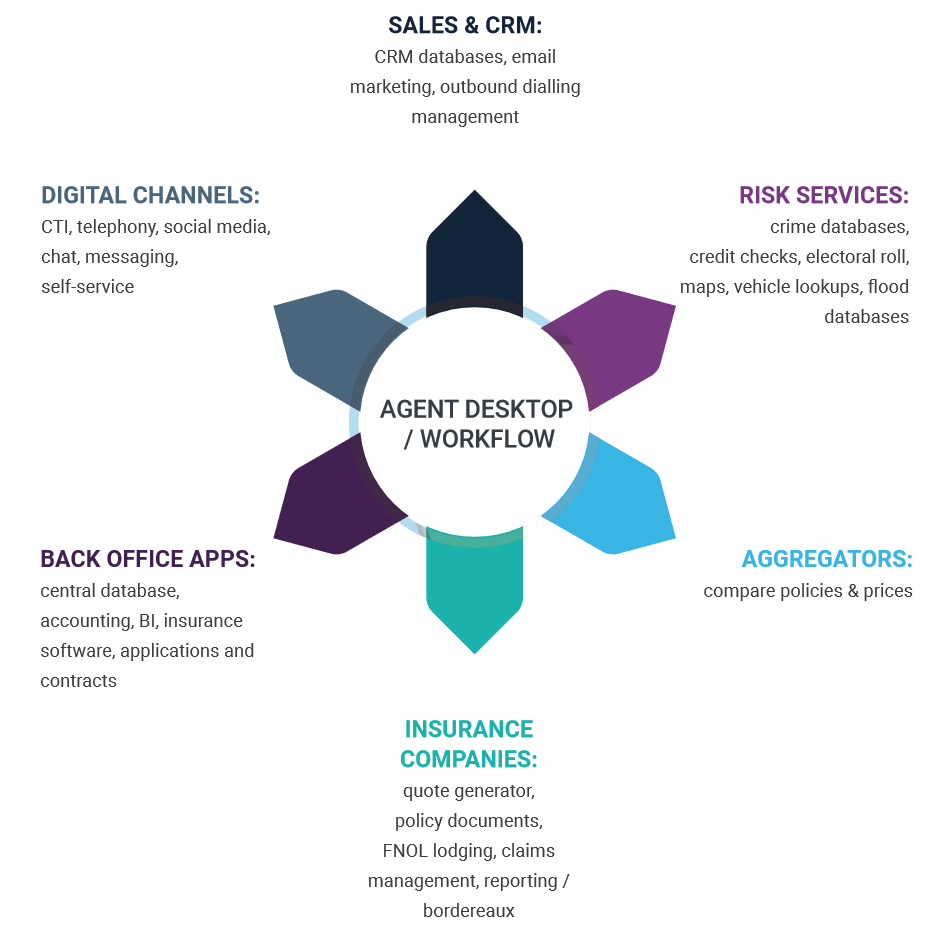

Source: the-digital-insurer.com

Source: the-digital-insurer.com

Insurance companies employ a variety of different channels to offer and distribute their products. But now, as a result of the changes in the market mentioned above, the insurance industry has started to look for new distribution channels in the online space. Insurance as a method of handling risk, or is legally compelled to use insurance, middlemen may be needed to find risk buyers and insurance sellers who are wvilling to contract at satisfactory terms and prices. 58% of consumers are very likely to purchase motor insurance through an agent or broker (31% fairly likely and 8% neutral) 57% of consumers are very likely to purchase health insurance through an agent or broker (30% fairly likely and 10% neutral) source: Companies like progressive, geico, and hiscox are growing concerns that have begun to change how insurance is sold, purchased, and serviced.

Source: slideshare.net

Source: slideshare.net

These methods of selling are also called distribution systems. Lexisnexis risk solutions india consumer insurance study (amongst those without insurance) An insurance broker is a person who on behalf of insurance company sells the insurance policy to a person. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. These methods of selling are also called distribution systems.

Source: blog.ovidlife.com

Source: blog.ovidlife.com

The independent (american) agency system and the exclusive agency system account for the bulk of insurance sales. Large employers often obtain their group life and medical 8. The human touch from an insurance agent, albeit from afar, is still vital. Lexisnexis risk solutions india consumer insurance study (amongst those without insurance) “the three major forms of.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

But now, as a result of the changes in the market mentioned above, the insurance industry has started to look for new distribution channels in the online space. It also covers sales of insurance products through websites, including comparison websites if they allow concluding an insurance contract. Insurance companies employ a variety of different channels to offer and distribute their products. When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data. Agents and brokers are typically the key players in the insurance distribution channel, with market shares of 42% and 25% respectively.

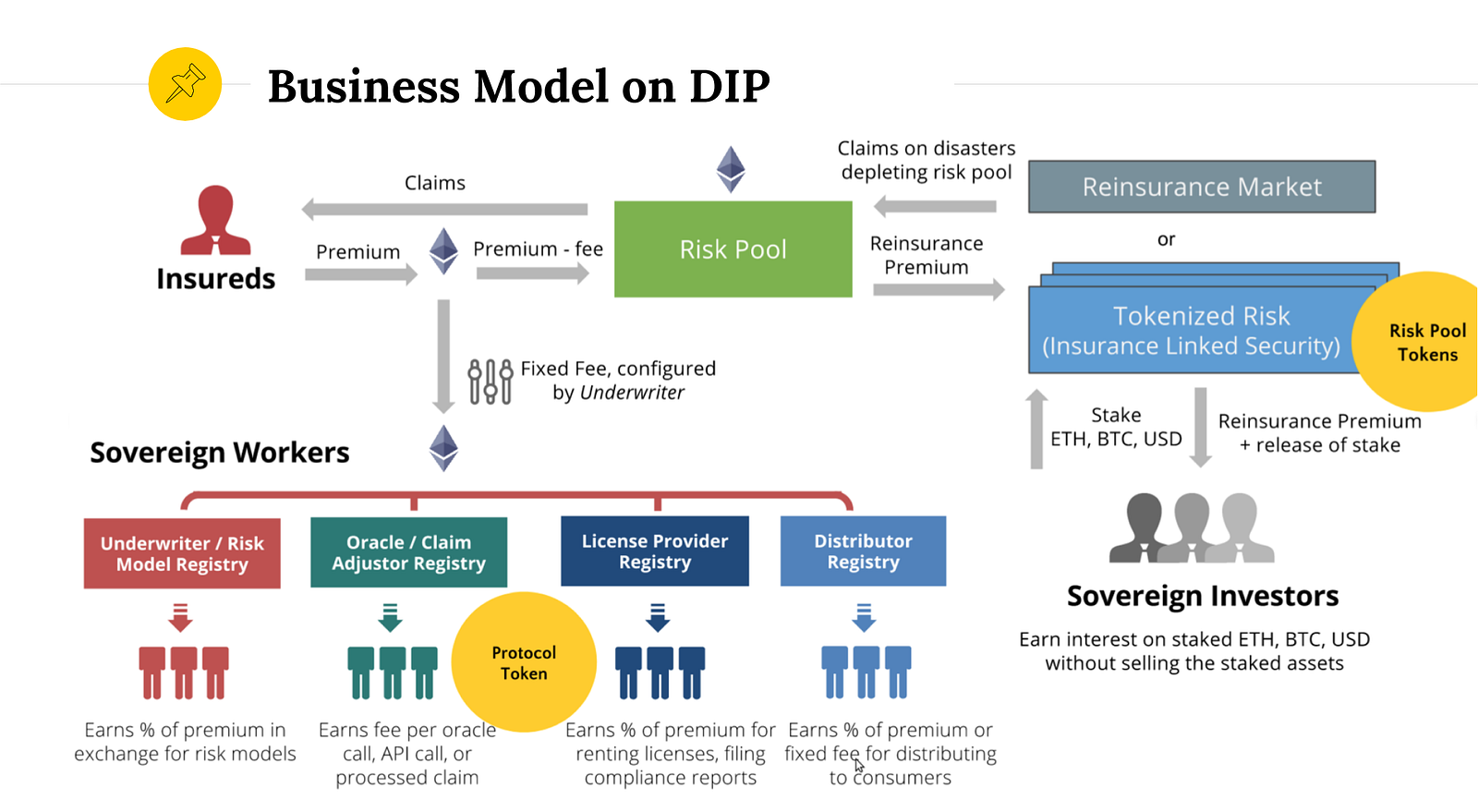

Source: blog.etherisc.com

Source: blog.etherisc.com

The prime objective of an insurance broker is to gratify the interests of his customer. The customer must be given the opportunity to buy these components (product or service) separately. In addition to agents and brokers, those attached to a particular company or those working. The insurance broker works as an intermediary between the person buying the insurance and the insurance company. Appointed agents or independent brokers to distribute their products and services.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance broker distribution methods by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.