Insurance business intelligence Idea

Home » Trending » Insurance business intelligence IdeaYour Insurance business intelligence images are ready. Insurance business intelligence are a topic that is being searched for and liked by netizens today. You can Download the Insurance business intelligence files here. Get all free photos.

If you’re searching for insurance business intelligence pictures information connected with to the insurance business intelligence topic, you have pay a visit to the ideal blog. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Insurance Business Intelligence. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. Business intelligence for insurance companies: Providers with one easy application. Users will be able to ask questions to their claims data such as:

Business Intelligence Commercial Insurance Associates From youtube.com

Business Intelligence Commercial Insurance Associates From youtube.com

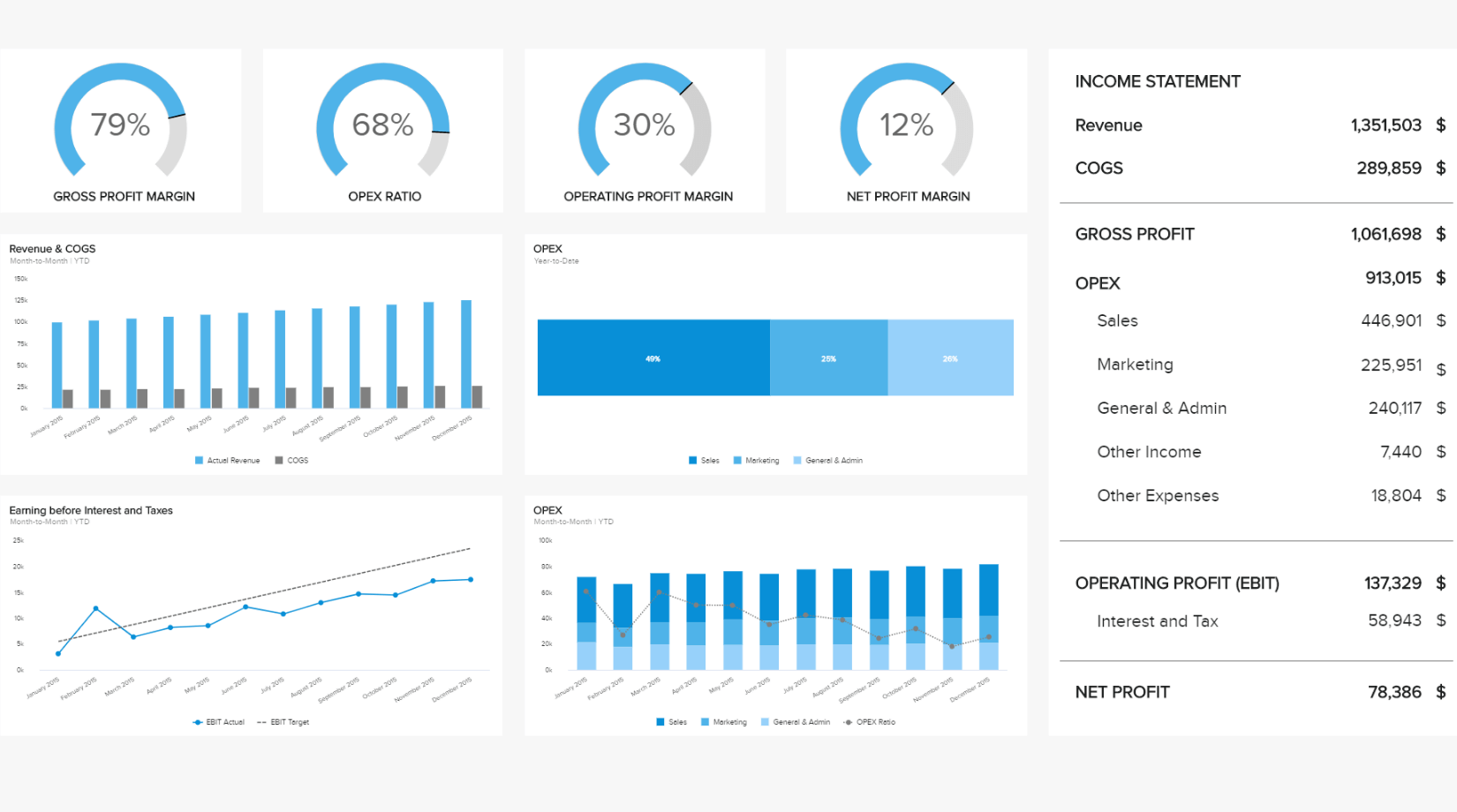

Business intelligence for insurance companies: As previously stated, business intelligence software employs data analytics to generate detailed visualizations from which. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. Besides, insurers need ways to plan for potential technological revolutions, evolving consumer habits, and regulatory changes. Business intelligence insurance can help pay for client lawsuits, medical costs from an injury, property damage, and other common risks. Combat fraud according to reports from the insurance information institute, fraud costs the insurance industry up to 70 billion dollars each year.

Besides, insurers need ways to plan for potential technological revolutions, evolving consumer habits, and regulatory changes.

In the past few decades, insurance companies have collected vast amounts of. Furthermore, it is also a helpful tool in serving the customers, making better financial decisions, and reduce fraud. Business intelligence insurance can help pay for client lawsuits, medical costs from an injury, property damage, and other common risks. Business intelligence improves the way things are done and improves predictions for risk management and underwriting. By identifying which areas of the business are performing well and which ones need attention, and identifying which ones need to be further developed, they can make. Business intelligence will allow insurers to utilize predictive analytics to swiftly identify suspicious claims early in the claims process.

Source: clipindustrie.com

Plugging it all in and summing it all up “data enrichment” is the name of the game in insurance business intelligence. As previously stated, business intelligence software employs data analytics to generate detailed visualizations from which. Combat fraud according to reports from the insurance information institute, fraud costs the insurance industry up to 70 billion dollars each year. Business intelligence will allow insurers to utilize predictive analytics to swiftly identify suspicious claims early in the claims process. If bi is data in action, then there is no better early example than actuarial history, which is the data science behind underwriting.

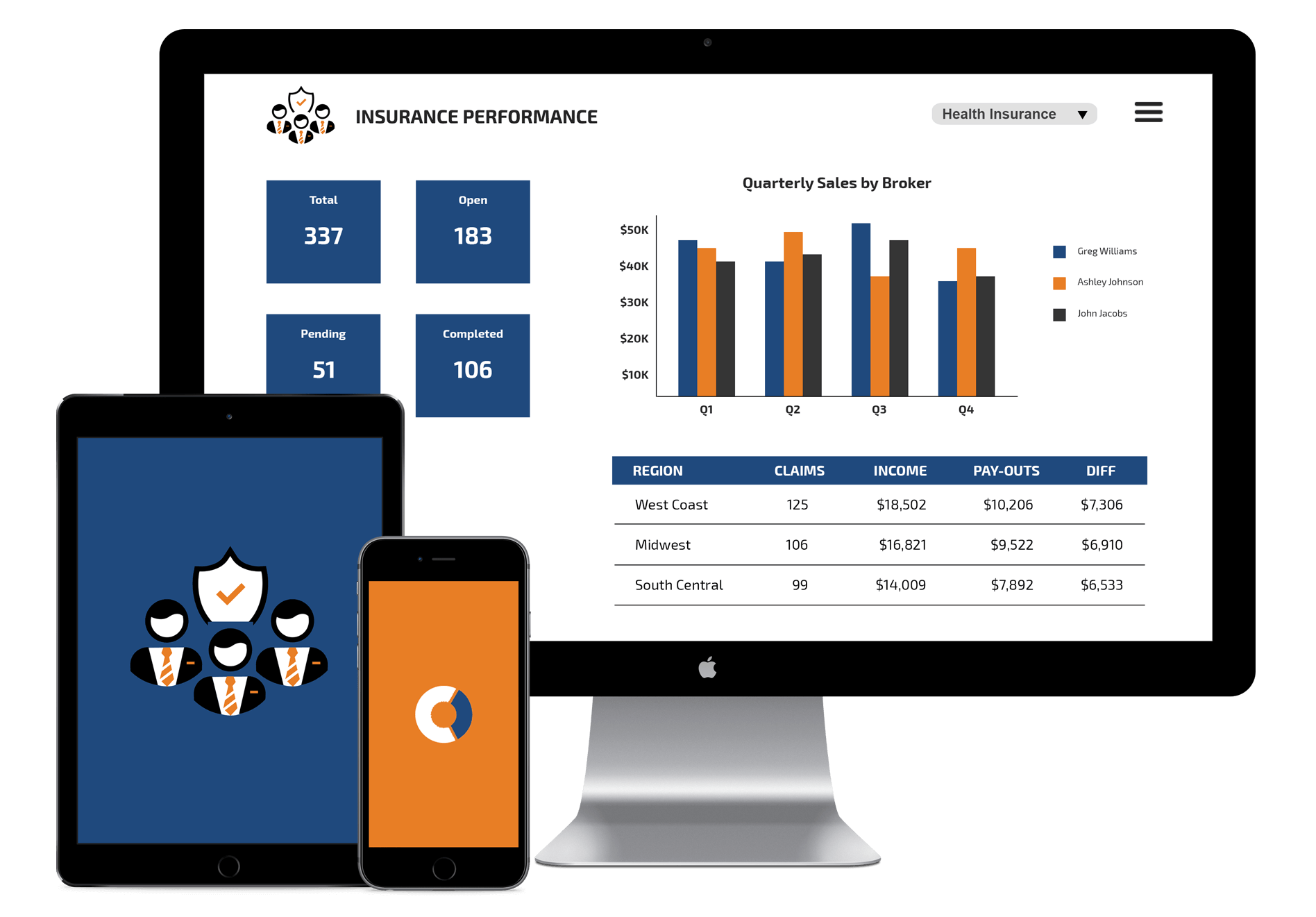

Combat fraud according to reports from the insurance information institute, fraud costs the insurance industry up to 70 billion dollars each year. We are witnessing a huge amount of investment being aimed at improving insurance business intelligence & analytics. Waterstreet extracts your data from your policy. In all sectors, the possibility of using machine learning algorithms and business intelligence brings a series of undeniable advantages. With insurance business intelligence solutions, sales managers and representatives can view detailed reports that represent individual products and agency performances in real time.

Source: meirc.com

Source: meirc.com

We are witnessing a huge amount of investment being aimed at improving insurance business intelligence & analytics. Insurance companies, like any other business, must look for ways to increase their profits. Furthermore, it is also a helpful tool in serving the customers, making better financial decisions, and reduce fraud. We are witnessing a huge amount of investment being aimed at improving insurance business intelligence & analytics. The waterstreet bi platform was built to specifically map your p&c insurance transaction data to a logical data model.

Source: fancsisshortstories.blogspot.com

Source: fancsisshortstories.blogspot.com

Business intelligence for insurance companies the article presents current status of it implementation in polish insurance companies. Insurance companies, like any other business, must look for ways to increase their profits. The waterstreet bi platform was built to specifically map your p&c insurance transaction data to a logical data model. These tools are designed to empower users, providing a robust reporting solution that is also user. In particular, insurance companies are normally interested in identifying insights, forecasting trends, managing.

Business intelligence platforms provide insurers with the vital tools to rapidly and decisively collect, store, report upon, and use information. Business intelligence for insurance companies: These tools are designed to empower users, providing a robust reporting solution that is also user. In the past few decades, insurance companies have collected vast amounts of. Once the information is properly cleaned, set up, built, and tagged, we can wrangle it in ways that “the data guys” simply lack the business insight to do.

Source: babel.sg

Source: babel.sg

Techinsurance helps business intelligence professionals compare insurance quotes from top u.s. By identifying which areas of the business are performing well and which ones need attention, and identifying which ones need to be further developed, they can make. These tools are designed to empower users, providing a robust reporting solution that is also user. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. He previously worked for frost & sullivan and infiniti research.

Source: youtube.com

Source: youtube.com

Insurance specific bi implementation the customer is a leading p&c insurer in india offering a range of products including accident, engineering, health, liability, marine, motor, property, travel and rural insurance for individuals and corporates. In the past few decades, insurance companies have collected vast amounts of. Providers with one easy application. Techinsurance helps business intelligence professionals compare insurance quotes from top u.s. Combat fraud according to reports from the insurance information institute, fraud costs the insurance industry up to 70 billion dollars each year.

Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. Business intelligence insurance can help pay for client lawsuits, medical costs from an injury, property damage, and other common risks. Business intelligence improves the way things are done and improves predictions for risk management and underwriting. Business intelligence helps to find a profitable opportunity. He previously worked for frost & sullivan and infiniti research.

Source: pathwaysinternational.com

Source: pathwaysinternational.com

Besides, insurers need ways to plan for potential technological revolutions, evolving consumer habits, and regulatory changes. Business intelligence for insurance companies the article presents current status of it implementation in polish insurance companies. Business intelligence insurance can help pay for client lawsuits, medical costs from an injury, property damage, and other common risks. Plugging it all in and summing it all up “data enrichment” is the name of the game in insurance business intelligence. Get the right coverage quickly.

Source: datapine.com

Source: datapine.com

Raghav is serves as analyst at emerj, covering ai trends across major industry updates, and conducting qualitative and quantitative research. By only paying for that period of cover, you will save by having less premiums but still having adequate risk cover. Get the right coverage quickly. He previously worked for frost & sullivan and infiniti research. Besides, insurers need ways to plan for potential technological revolutions, evolving consumer habits, and regulatory changes.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

Business intelligence for insurance companies the article presents current status of it implementation in polish insurance companies. Business intelligence improves the way things are done and improves predictions for risk management and underwriting. By identifying which areas of the business are performing well and which ones need attention, and identifying which ones need to be further developed, they can make. He previously worked for frost & sullivan and infiniti research. We are witnessing a huge amount of investment being aimed at improving insurance business intelligence & analytics.

Business intelligence platforms provide insurers with the vital tools to rapidly and decisively collect, store, report upon, and use information. As previously stated, business intelligence software employs data analytics to generate detailed visualizations from which. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. By combining business intelligence software with customer relationship management (crm) operations, insurance. With insurance business intelligence solutions, sales managers and representatives can view detailed reports that represent individual products and agency performances in real time.

Source: global.hitachi-solutions.com

Source: global.hitachi-solutions.com

Business intelligence for insurance companies: Insurance companies, like any other business, must look for ways to increase their profits. By identifying which areas of the business are performing well and which ones need attention, and identifying which ones need to be further developed, they can make. While many companies in other industries are still deciding how to acquire value from data, the insurance business has determined that business intelligence is the core to achieving its potential. The waterstreet bi platform was built to specifically map your p&c insurance transaction data to a logical data model.

Source: delimiter.com.au

Source: delimiter.com.au

Business intelligence improves the way things are done and improves predictions for risk management and underwriting. Get the right coverage quickly. Business intelligence improves the way things are done and improves predictions for risk management and underwriting. While many companies in other industries are still deciding how to acquire value from data, the insurance business has determined that business intelligence is the core to achieving its potential. Business intelligence will allow insurers to utilize predictive analytics to swiftly identify suspicious claims early in the claims process.

Source: pinterest.com

Source: pinterest.com

In particular, insurance companies are normally interested in identifying insights, forecasting trends, managing. Get the right coverage quickly. Business intelligence for insurance companies: In particular, insurance companies are normally interested in identifying insights, forecasting trends, managing. Techinsurance helps business intelligence professionals compare insurance quotes from top u.s.

Source: youtube.com

Source: youtube.com

Business intelligence will allow insurers to utilize predictive analytics to swiftly identify suspicious claims early in the claims process. These tools are designed to empower users, providing a robust reporting solution that is also user. Business intelligence for insurance companies: Techinsurance helps business intelligence professionals compare insurance quotes from top u.s. Business intelligence platforms provide insurers with the vital tools to rapidly and decisively collect, store, report upon, and use information.

Source: qlutter.io

Source: qlutter.io

By combining business intelligence software with customer relationship management (crm) operations, insurance. We are witnessing a huge amount of investment being aimed at improving insurance business intelligence & analytics. Plugging it all in and summing it all up “data enrichment” is the name of the game in insurance business intelligence. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. Insurance companies, like any other business, must look for ways to increase their profits.

Source: mpmsoftware.com

Source: mpmsoftware.com

Business intelligence improves the way things are done and improves predictions for risk management and underwriting. Business intelligence consists of different sets of technologies that analyze data at the initial level like policy application and fraud claim. Business intelligence can give insurance professionals the tools they need to make quick, confident, and accurate choices to keep customers satisfied. As previously stated, business intelligence software employs data analytics to generate detailed visualizations from which. By only paying for that period of cover, you will save by having less premiums but still having adequate risk cover.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance business intelligence by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.