Insurance carrier vs underwriter information

Home » Trend » Insurance carrier vs underwriter informationYour Insurance carrier vs underwriter images are available in this site. Insurance carrier vs underwriter are a topic that is being searched for and liked by netizens now. You can Download the Insurance carrier vs underwriter files here. Find and Download all free images.

If you’re searching for insurance carrier vs underwriter pictures information connected with to the insurance carrier vs underwriter interest, you have come to the right blog. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

Insurance Carrier Vs Underwriter. The insurance carrier is responsible for underwriting or establishing the underwriting criteria. Besides agents, an insurance carrier employs underwriters, customer service representatives, claims adjusters, and more. Nov 21, 2019 — but there’s an important difference between how a regular broker or brokerage works and how an insurance. An insurance carrier creates the product (the insurance policy).

Man holding tablet with text INSURANCE UNDERWRITER on From unitedfinalexpenseservices.com

Man holding tablet with text INSURANCE UNDERWRITER on From unitedfinalexpenseservices.com

These two positions are critical to the success of carriers and, overall, the industry,. Independent agents typically offer products from a variety of carriers, whereas captive or exclusive agents only sell the products of one insurer. An insurance agency sells it. Let’s look at an example for each of these. Four seasons insurance, for example, is an independent agent representing a variety of insurers and coverage types. They also assess individuals who are applying for life insurance policies.

If you ever need to file an insurance claim, you’ll be paired with an underwriter who represents the insurance carrier and will determine how much money you’re owed based on the extent of the loss.

The payout you receive comes directly from the insurance carrier, not the underwriter or the agent. They control the underwriting, claims, pricing, and the overall guidance of the company. An insurance carrier creates the product (the insurance policy). These two positions are critical to the success of carriers and, overall, the industry,. Your agent or broker has to present a solid case that will convince the underwriter that the risk you present is a good one. Both of these jobs are involved in helping people access various types of insurance coverage, however, insurance brokers work directly with clients to help find policies that meet their needs, while insurance underwriters decide the.

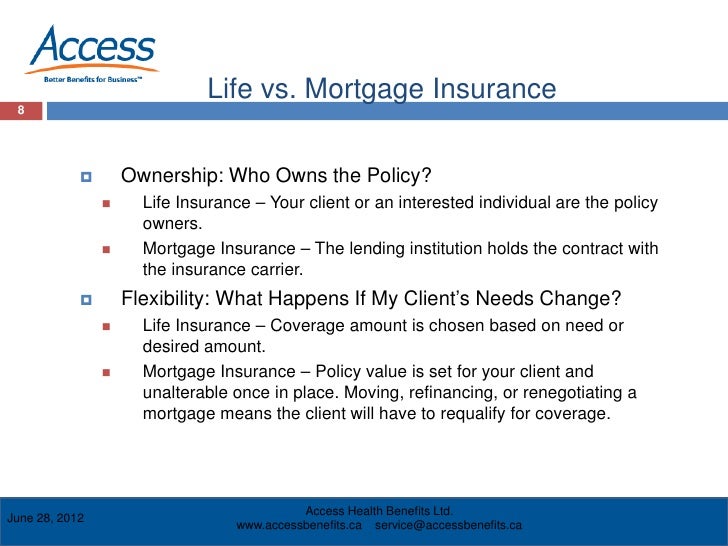

Source: psafinancial.com

Source: psafinancial.com

The insurance carrier is responsible for underwriting or establishing the underwriting criteria. An insurance carrier creates the product (the insurance policy). The carrier or the company provides the product whereas, the agencies provide the service and sell the insurance policies to the customers. If you ever need to file an insurance claim, you’ll be paired with an underwriter who represents the insurance carrier and will determine how much money you’re owed based on the extent of the loss. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately.

Source: insurancejournal.com

Source: insurancejournal.com

Insurance underwriters asses the risk of insuring a home, car or driver. The insurance carrier is the manufacturer. Your agent or broker has to present a solid case that will convince the underwriter that the risk you present is a good one. An insurance underwriter analyzes and assesses the risks in providing insurance to individuals and companies, and establishes the pricing of the insurance premium. Insurance underwriters determine if the contract is profitable for the insurer.

Source: olsoninsurance.org

Source: olsoninsurance.org

It might help to think of it like this: Insurance carriers are insurance companies or insurers, who have involvement in the insurance business. The carrier or the company provides the product whereas, the agencies provide the service and sell the insurance policies to the customers. Develop a plan to communicate with each carrier. These two positions are critical to the success of carriers and, overall, the industry,.

Source: insurancebrokermiyokoto.blogspot.com

Source: insurancebrokermiyokoto.blogspot.com

An insurance carrier a the company that provides insurance coverage. The insurance carrier is responsible for underwriting or establishing the underwriting criteria. Independent agents typically offer products from a variety of carriers, whereas captive or exclusive agents only sell the products of one insurer. Therefore, underwriters serve as the main link between the insurance carrier and the insurance agent. It also employs insurance agents, who handle claims and may help set up payments on behalf of a carrier.

Source: nextgen.mployeradvisor.com

Source: nextgen.mployeradvisor.com

In a nutshell, the job of the insurance underwriter is to make sure the insurance company is making good bets. The insurance carrier is the manufacturer. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately. An insurance carrier creates the product (the insurance policy). In a nutshell, the job of the insurance underwriter is to make sure the insurance company is making good bets.

Source: presidioinsurance.com

Source: presidioinsurance.com

An insurance agency sells it. Underwriters in investment banking guarantee a minimum share price for a company. Underwriter and broker connections underwriters decide. Everybody talks about how underwriting is going to be replaced by computers, and for personal lines that may be true but commercial lines is a bit more stable. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately.

Source: groupplannersinc.com

Source: groupplannersinc.com

It might help to think of it like this: When a provider agrees to insure new policies, the insurance company is betting that the premiums policyholders pay them will outweigh the cost of the claims the company pays out. An insurance carrier creates the product (the insurance policy). Insurance premium an insurance premium is the amount of money that an individual is required to pay to an insurance company in order to receive insurance coverage. They also assess individuals who are applying for life insurance policies.

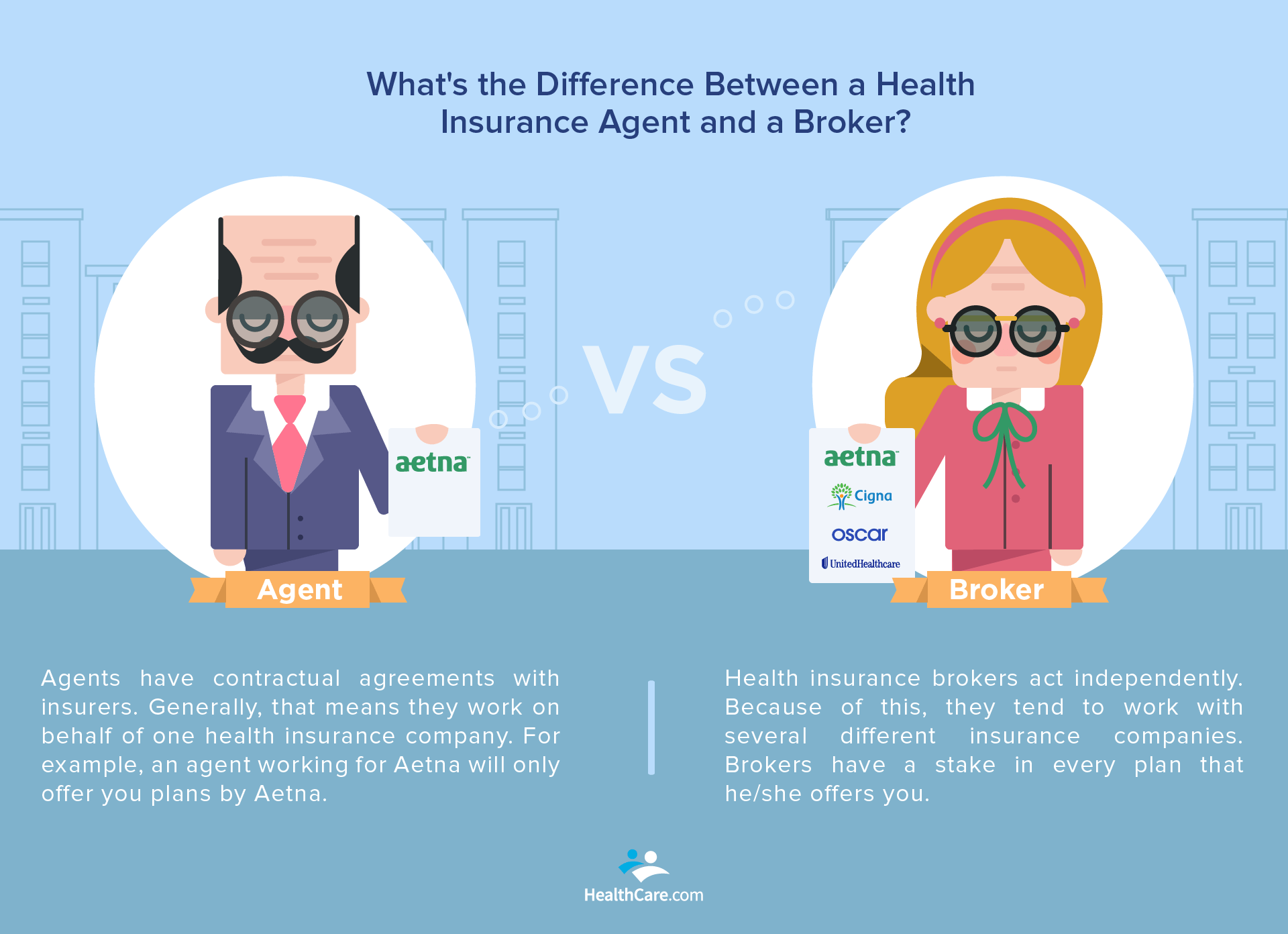

Source: healthcare.com

Source: healthcare.com

Thus, the relationship between an insurance carrier and an insurance agency is similar to that of a manufacturer and a distributor. Commercial banking underwriters assess the risk of lending to individuals or lenders and charge interest to cover the cost of assuming that risk. Insurance underwriters assume the risk of a future. Four seasons insurance, for example, is an independent agent representing a variety of insurers and coverage types. An insurance underwriter analyzes and assesses the risks in providing insurance to individuals and companies, and establishes the pricing of the insurance premium.

Source: pvv-insurance.com

Source: pvv-insurance.com

Such carriers employ agents, underwriters, surveyors, etc. When a provider agrees to insure new policies, the insurance company is betting that the premiums policyholders pay them will outweigh the cost of the claims the company pays out. They are the ones, under whose name issuance of insurance policies takes place. Thus, the relationship between an insurance carrier and an insurance agency is similar to that of a manufacturer and a distributor. It also employs insurance agents, who handle claims and may help set up payments on behalf of a carrier.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

Both of these jobs are involved in helping people access various types of insurance coverage, however, insurance brokers work directly with clients to help find policies that meet their needs, while insurance underwriters decide the. The insurance carrier is the manufacturer. But really, with a degree you can do better than insurance. Commercial banking underwriters assess the risk of lending to individuals or lenders and charge interest to cover the cost of assuming that risk. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately.

.png#keepProtocol “Insurance Agency vs Insurance Carrier What�s The Difference?") Source: blog.protexurelawyers.com

Let’s look at an example for each of these. An insurance agency sells it. Insurance underwriters determine if the contract is profitable for the insurer. May 30, 2020 — both of these jobs are involved in helping people access various types of insurance coverage, however, insurance brokers work directly with (1). Insurance premium an insurance premium is the amount of money that an individual is required to pay to an insurance company in order to receive insurance coverage.

Source: llucia-bitsofthoughts.blogspot.com

Source: llucia-bitsofthoughts.blogspot.com

Therefore, underwriters serve as the main link between the insurance carrier and the insurance agent. Some insurance companies communicate better than others, so you should take. They control the underwriting, claims, pricing, and the overall guidance of the company. Underwriters are the main link between an insurance. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately.

Source: insurox.com

Source: insurox.com

•carrier underwriter reviews the application for acceptance or declination per the program/underwriting guidelines. Insurance underwriters asses the risk of insuring a home, car or driver. Underwriter data helps insurance companies set premiums that are profitable to the company and yet affordable and attractive to the consumer. It also employs insurance agents, who handle claims and may help set up payments on behalf of a carrier. Thus, the relationship between an insurance carrier and an insurance agency is similar to that of a manufacturer and a distributor.

Source: gesselins.com

Source: gesselins.com

The insurance agency is the retail store. The carrier or the company provides the product whereas, the agencies provide the service and sell the insurance policies to the customers. When a provider agrees to insure new policies, the insurance company is betting that the premiums policyholders pay them will outweigh the cost of the claims the company pays out. The insurance carrier is responsible for underwriting or establishing the underwriting criteria. Underwriters in investment banking guarantee a minimum share price for a company.

Source: pawson.com

Source: pawson.com

An insurance underwriter analyzes and assesses the risks in providing insurance to individuals and companies, and establishes the pricing of the insurance premium. Insurance carriers are insurance companies or insurers, who have involvement in the insurance business. •carrier underwriter reviews the application for acceptance or declination per the program/underwriting guidelines. Four seasons insurance, for example, is an independent agent representing a variety of insurers and coverage types. They consider if the applicant meets certain criteria to qualify for an insurance policy.

Source: suzannebrownagency.com

Source: suzannebrownagency.com

Underwriter data helps insurance companies set premiums that are profitable to the company and yet affordable and attractive to the consumer. It concludes that the insurance carrier gives employment to rest. An insurance carrier creates the product (the insurance policy). An insurance carrier creates the product (the insurance policy). •carrier underwriter reviews the application for acceptance or declination per the program/underwriting guidelines.

Source: einsurance.com

Source: einsurance.com

Insurance premium an insurance premium is the amount of money that an individual is required to pay to an insurance company in order to receive insurance coverage. Underwriters use computer applications called “smart” systems to calculate risks more efficiently and accurately. Insurance underwriters determine if the contract is profitable for the insurer. Your agent or broker has to present a solid case that will convince the underwriter that the risk you present is a good one. When a provider agrees to insure new policies, the insurance company is betting that the premiums policyholders pay them will outweigh the cost of the claims the company pays out.

Source: revisi.net

Source: revisi.net

Commercial banking underwriters assess the risk of lending to individuals or lenders and charge interest to cover the cost of assuming that risk. An insurance carrier creates the product (the insurance policy). Independent agents typically offer products from a variety of carriers, whereas captive or exclusive agents only sell the products of one insurer. Insurance underwriters assume the risk of a future. Insurance underwriters asses the risk of insuring a home, car or driver.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance carrier vs underwriter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.