Insurance claim accounting treatment Idea

Home » Trending » Insurance claim accounting treatment IdeaYour Insurance claim accounting treatment images are available. Insurance claim accounting treatment are a topic that is being searched for and liked by netizens now. You can Get the Insurance claim accounting treatment files here. Get all free photos.

If you’re looking for insurance claim accounting treatment images information linked to the insurance claim accounting treatment interest, you have come to the right blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Insurance Claim Accounting Treatment. In early 2014 to (1) refocus its efforts on making targeted improvements to insurance accounting under u.s. Insurance claims) any insurance reimbursement to an agency may be used to offset expenses related to the claim. The accounting for insurance claims will differ based on a variety of factors, including the nature of the claim, the amount of proceeds (or anticipated proceeds) and the timing of the loss and corresponding insurance recovery. The following particulars are obtained as regards the costs and book value of various assets affected by fire, the amount claimed and admitted by xy insurance co.

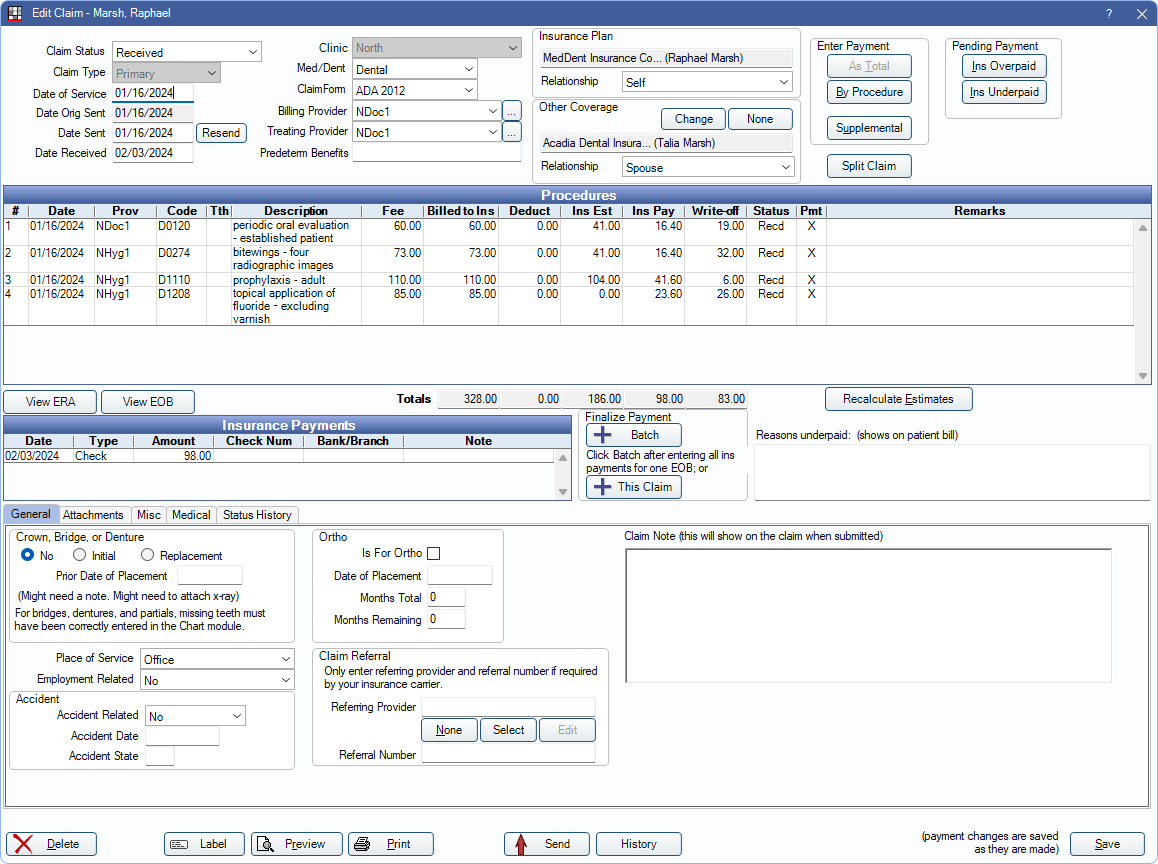

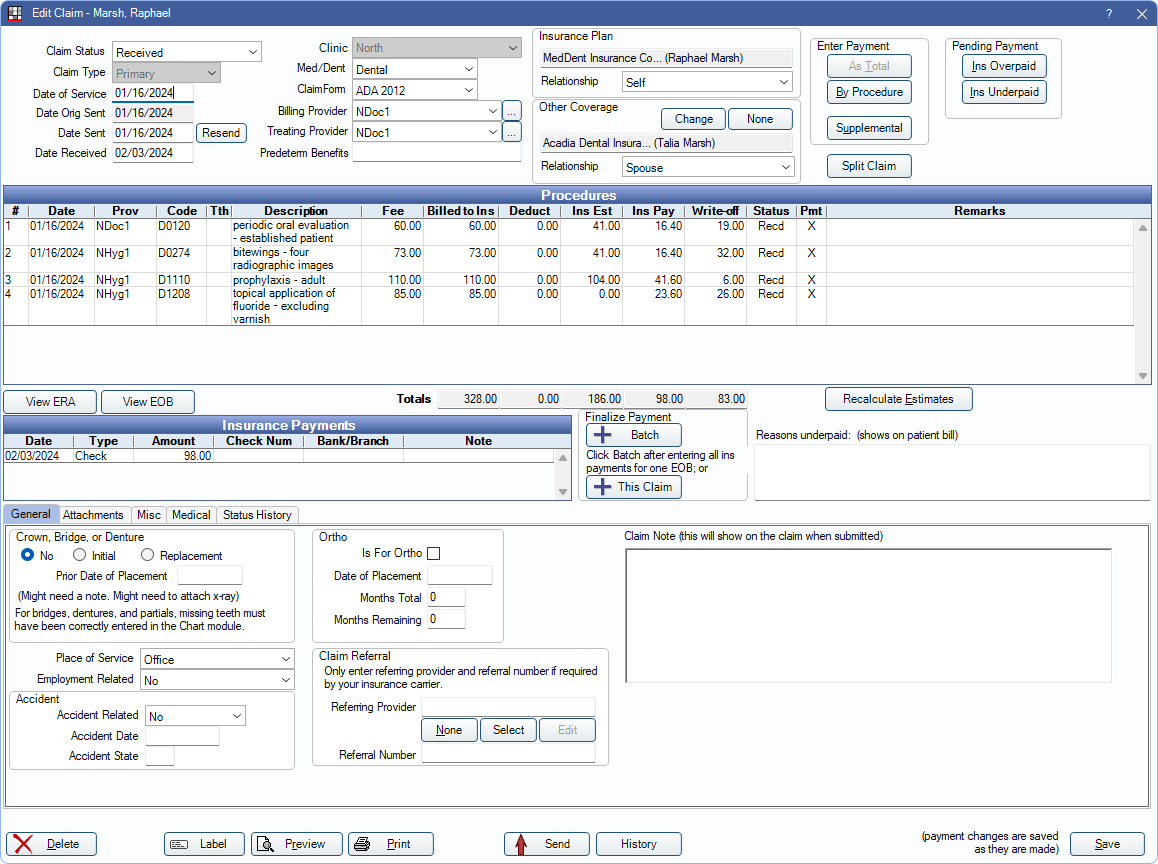

Open Dental Software Claim From opendental.com

Open Dental Software Claim From opendental.com

A fire occurred on 21st may 2010, in the factory of m/s ab traders. (a) whether said policy is surrendered to the insurance company: Insurance proceeds to settle a provision are accounted for as reimbursements under ias 37 provisions, contingent liabilities and contingent assets and are recognised as a separate asset (with related income) when recovery is virtually certain. This usually happens when net book value of the property (book value minus accumulated depreciation) is more than the amount reimbursed. The most reasonable approach to recording these proceeds is to wait until they have been received by the company. When the claim is finalised (if it is a accident claim) insurance company dr.

In early 2014 to (1) refocus its efforts on making targeted improvements to insurance accounting under u.s.

In addition, any accounting for insurance proceeds will be affected by A fire occurred on 15th december, 2011 in the premises of d co. Problem and solution # 2. But assuming the same value for the asset as before, i would record this as follows in separate entries: Sometimes the insurance company will pay you less than the amount you paid. Insurance proceed on damaged property.

Source: tallygame.com

Source: tallygame.com

In addition, the inventory account is credited for. When the claim is agreed, set up an accounts receivable due from the insurance company. The recovery of a loss generally would be probable if there is a legally enforceable contract that stipulates the terms of the insurance coverage and the terms are not in dispute nor is there any reason to believe they would be disputed. The treatment of loss varies slightly according to the nature of the asset as explained below. Short sale − short sale means loss of sale due to the incident of fire and subsequent dislocation of the business.

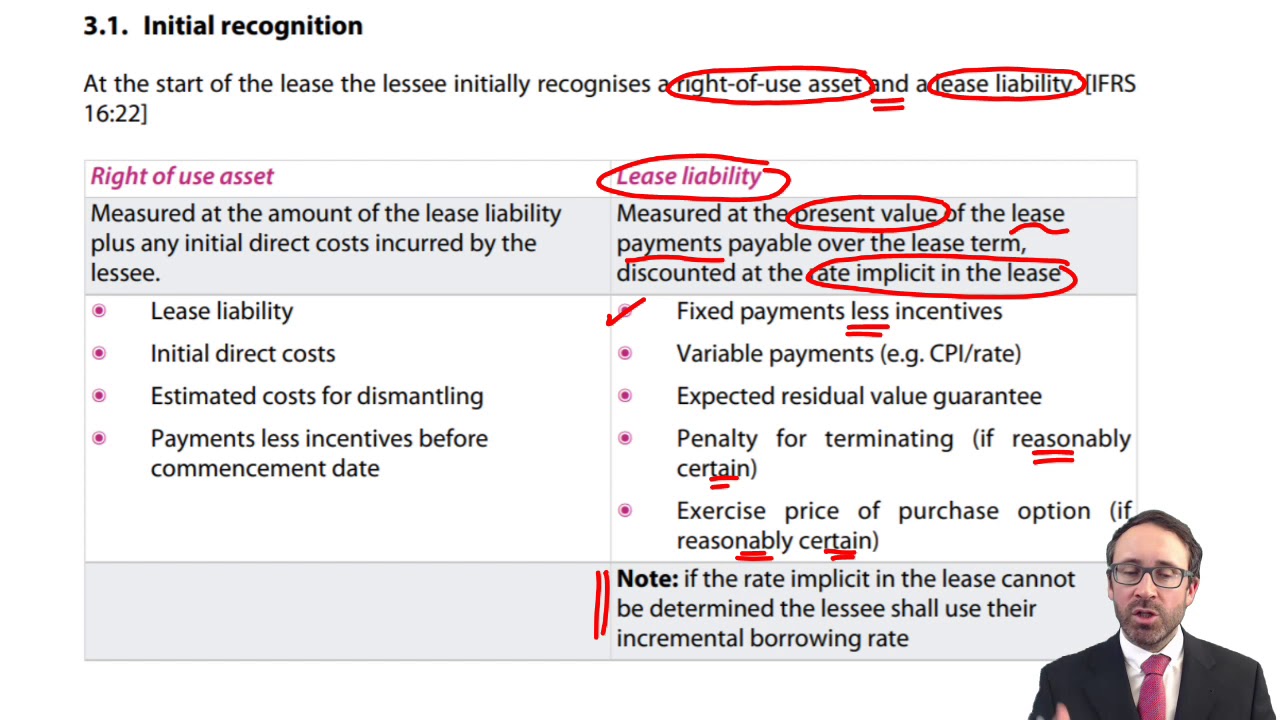

Source: youtube.com

Source: youtube.com

The treatment of loss varies slightly according to the nature of the asset as explained below. Presentation of insurance claims and related insurance recoveries), an insured entity must report a liability for all claims outstanding as of the balance sheet date, including claims that are covered by insurance. The following particulars are obtained as regards the costs and book value of various assets affected by fire, the amount claimed and admitted by xy insurance co. The process is split into three stages as follows: When the claim is finalised (if it is a accident claim) insurance company dr.

The journal entries below act as a quick reference for accounting for insurance proceeds. In addition, the inventory account is credited for. Retained, expended, and carried forward. Sometimes the insurance company will pay you less than the amount you paid. I have a client who has made insurance claims and has been paid out now substantially for the claim with some more to come on final agreement of the figures.

Source: medicaloffice.about.com

Source: medicaloffice.about.com

Insurance claims) any insurance reimbursement to an agency may be used to offset expenses related to the claim. When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. Obviously the business interruption element can go straight to p & l as deemed turnover. Insurance proceeds to settle a provision are accounted for as reimbursements under ias 37 provisions, contingent liabilities and contingent assets and are recognised as a separate asset (with related income) when recovery is virtually certain. Short sale − short sale means loss of sale due to the incident of fire and subsequent dislocation of the business.

Source: theupperhousecondos.com

Source: theupperhousecondos.com

A fire occurred on 21st may 2010, in the factory of m/s ab traders. The following particulars are obtained as regards the costs and book value of various assets affected by fire, the amount claimed and admitted by xy insurance co. The purpose of financial statements to evaluate the business. This usually happens when net book value of the property (book value minus accumulated depreciation) is more than the amount reimbursed. The treatment of loss varies slightly according to the nature of the asset as explained below.

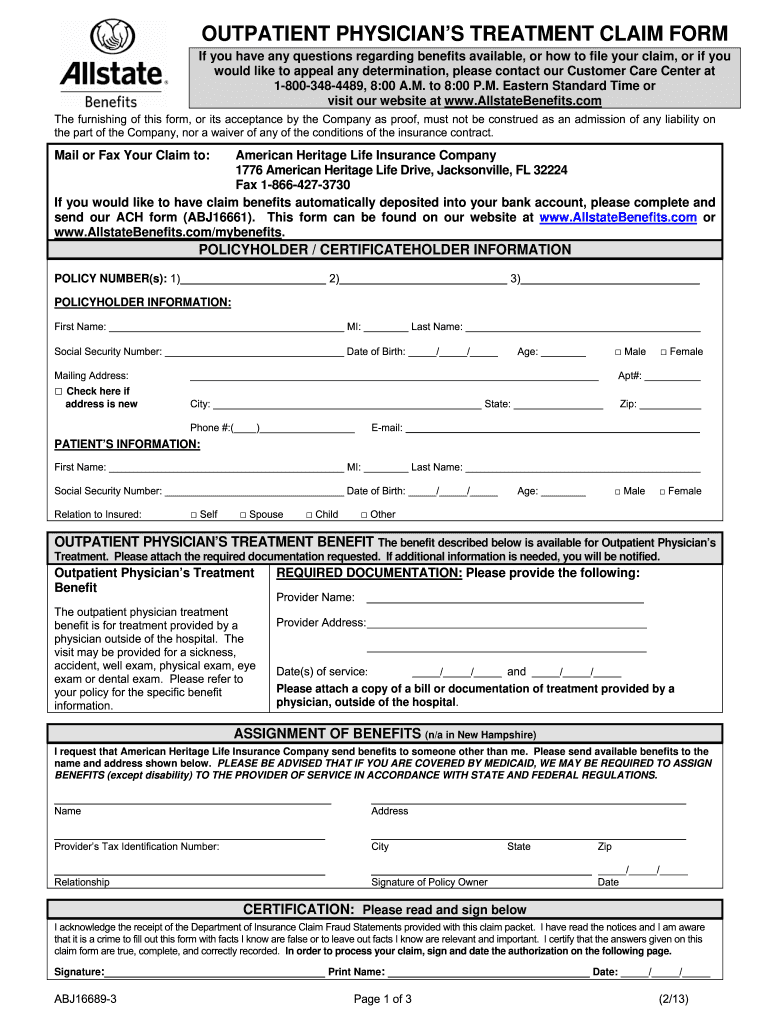

Source: templateroller.com

Source: templateroller.com

Any other proceeds from disposing of the inventory items will also be debited to cash. If you have occurred a loss like goods/asset, then the above entry will be. Or, (b) whether the said policy is kept alive, i.e., continuing. Insurance proceed on damaged property. A fire occurred on 21st may 2010, in the factory of m/s ab traders.

Source: brainkart.com

Source: brainkart.com

Write off the damaged inventory to the impairment of inventory account. In addition, the inventory account is credited for. Or, (b) whether the said policy is kept alive, i.e., continuing. But assuming the same value for the asset as before, i would record this as follows in separate entries: The amount recognised as a.

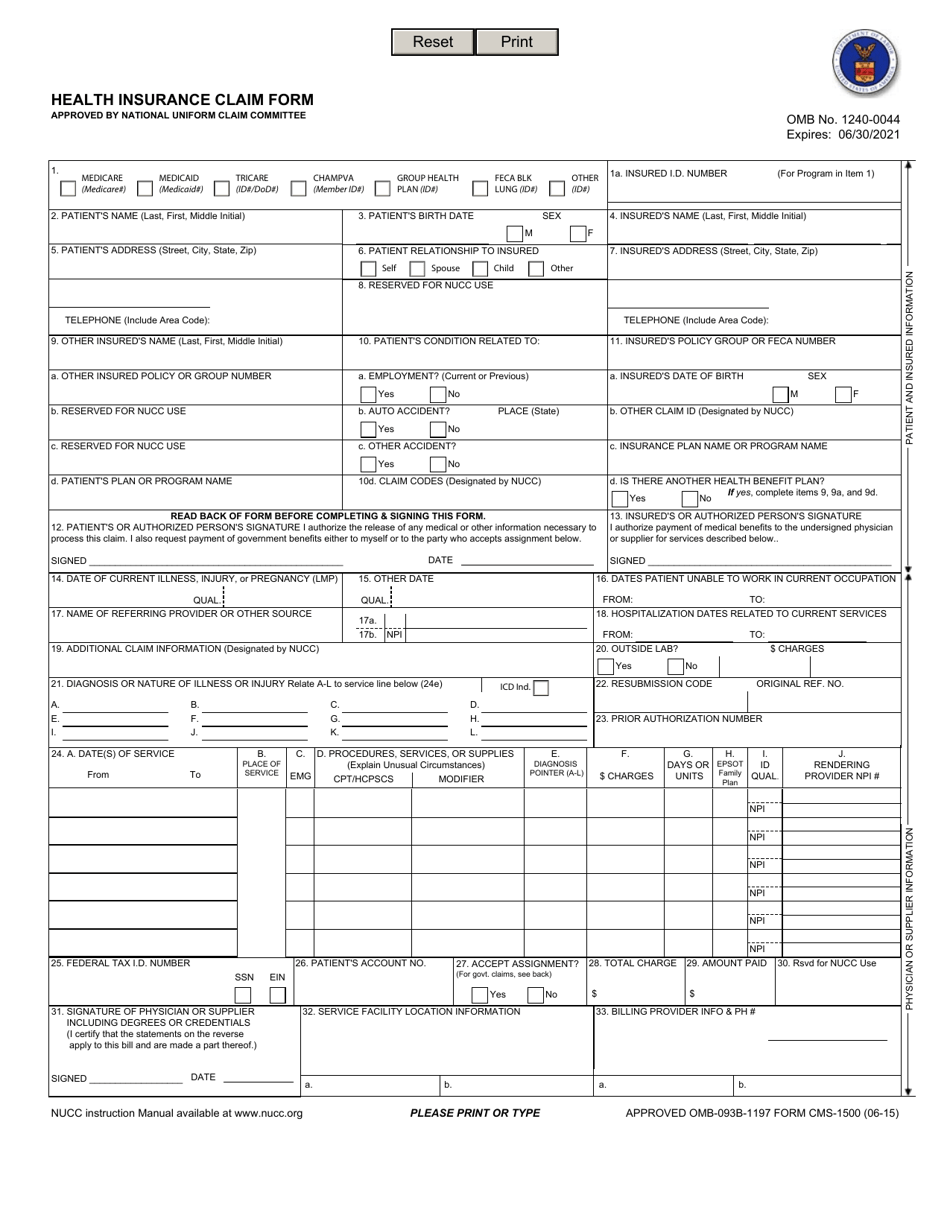

Source: pdffiller.com

Source: pdffiller.com

These terms are defined as follows: (a) whether said policy is surrendered to the insurance company: Any other proceeds from disposing of the inventory items will also be debited to cash. The purpose of financial statements to evaluate the business. Accounting treatment in the books of creditor depends on the following two conditions:

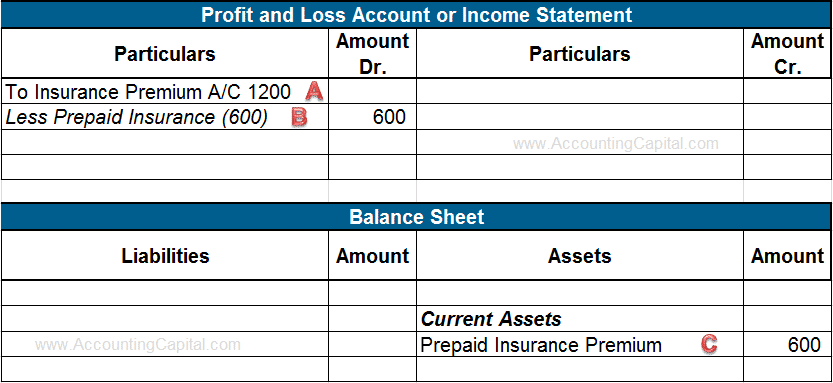

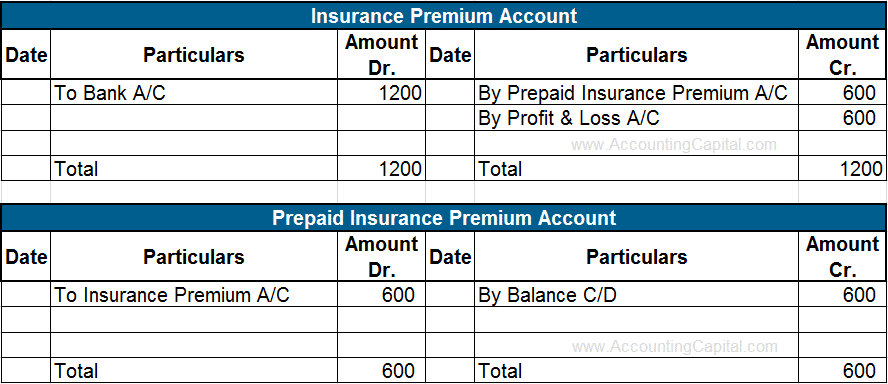

Source: accountingcapital.com

Source: accountingcapital.com

E) since you do not mention your firms industry, seek accounting guidance from your cpa firm. On admission of the claim: If forced to assign it to either case reserves or ibnr reserves, some will assign it to Insurance proceed on damaged property. The most reasonable approach to recording these proceeds is to wait until they have been received by the company.

Source: malaybicycle.blogspot.com

Source: malaybicycle.blogspot.com

From the following figures, calculate the amount of claim to be lodged with the insurance company for loss of stock: Presentation of insurance claims and related insurance recoveries), an insured entity must report a liability for all claims outstanding as of the balance sheet date, including claims that are covered by insurance. Accounting entries in the books of insured for fire claims: This usually happens when net book value of the property (book value minus accumulated depreciation) is more than the amount reimbursed. By doing so, there is no risk of recording a gain related to a payment that is never received.

Source: all-things-medical-billing.com

Source: all-things-medical-billing.com

E) since you do not mention your firms industry, seek accounting guidance from your cpa firm. Retained, expended, and carried forward. (a) whether said policy is surrendered to the insurance company: To identify the proper accounting treatment, first we need to determine if the insurance policy claim represents a loss recovery or gain contingency. These terms are defined as follows:

Source: malaybicycle.blogspot.com

Source: malaybicycle.blogspot.com

Insurance proceed on damaged property. The recovery of a loss generally would be probable if there is a legally enforceable contract that stipulates the terms of the insurance coverage and the terms are not in dispute nor is there any reason to believe they would be disputed. Receive the cash from the insurance company. Short sale − short sale means loss of sale due to the incident of fire and subsequent dislocation of the business. When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received.

Source: opendental.com

Source: opendental.com

Any other proceeds from disposing of the inventory items will also be debited to cash. If you need an introduction to general accounting for a better understanding of basic concepts. On admission of the claim: The most reasonable approach to recording these proceeds is to wait until they have been received by the company. Write off the damaged inventory to the impairment of inventory account.

Source: tallygame.com

Source: tallygame.com

Write off the damaged inventory to the impairment of inventory account. Presentation of insurance claims and related insurance recoveries), an insured entity must report a liability for all claims outstanding as of the balance sheet date, including claims that are covered by insurance. If the claim is the subject of litigation, a rebuttable presumption exists that realization is not probable. The following particulars are obtained as regards the costs and book value of various assets affected by fire, the amount claimed and admitted by xy insurance co. From the following figures, calculate the amount of claim to be lodged with the insurance company for loss of stock:

Source: youtube.com

Source: youtube.com

Receive the cash from the insurance company. I have a client who has made insurance claims and has been paid out now substantially for the claim with some more to come on final agreement of the figures. The difference of standard turnover and the actual turnover during the period of indemnity is called short sale. The money received from an insurance company for a claim involving a loss on inventory stock is debited to cash. Or, (b) whether the said policy is kept alive, i.e., continuing.

Source: accountingcapital.com

Source: accountingcapital.com

How liabilities, revenues, expenses, etc. A fire occurred on 21st may 2010, in the factory of m/s ab traders. It will ease your analytical pain and assist with claim filing and claim audits. Accounting treatment in the books of creditor depends on the following two conditions: E) since you do not mention your firms industry, seek accounting guidance from your cpa firm.

Source: accountingsoftware.com.ng

Source: accountingsoftware.com.ng

Or, (b) whether the said policy is kept alive, i.e., continuing. This usually happens when net book value of the property (book value minus accumulated depreciation) is more than the amount reimbursed. Insurance category impacts accounting practices. In early 2014 to (1) refocus its efforts on making targeted improvements to insurance accounting under u.s. To identify the proper accounting treatment, first we need to determine if the insurance policy claim represents a loss recovery or gain contingency.

Source: invoicetemplates.com

Source: invoicetemplates.com

Retained, expended, and carried forward. Accounting entries in the books of insured for fire claims: Insurance proceeds may reimburse some or all of the expenditure necessary to settle the provision. The recovery of a loss generally would be probable if there is a legally enforceable contract that stipulates the terms of the insurance coverage and the terms are not in dispute nor is there any reason to believe they would be disputed. If the amount of loss is material, it may be necessary to present the loss separately in the income statement.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance claim accounting treatment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.