Insurance claim history on a house Idea

Home » Trend » Insurance claim history on a house IdeaYour Insurance claim history on a house images are ready in this website. Insurance claim history on a house are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance claim history on a house files here. Get all royalty-free photos and vectors.

If you’re looking for insurance claim history on a house images information related to the insurance claim history on a house topic, you have pay a visit to the right site. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Insurance Claim History On A House. Homeowners insurance claims typically stay on a national property claim database called the comprehensive loss underwriting exchange (clue) for five to seven years. Your personal record of claims (“claims for the subject”) and the claims on your home (“claims history for risk”). A home insurance incident that is logged on the cue insurance database stays there for six years after the claim (if there is one) is closed, unless proven incorrect during that time. How long does a home insurance claim stay on my record?

Pin on Residential Roofing From pinterest.com

Pin on Residential Roofing From pinterest.com

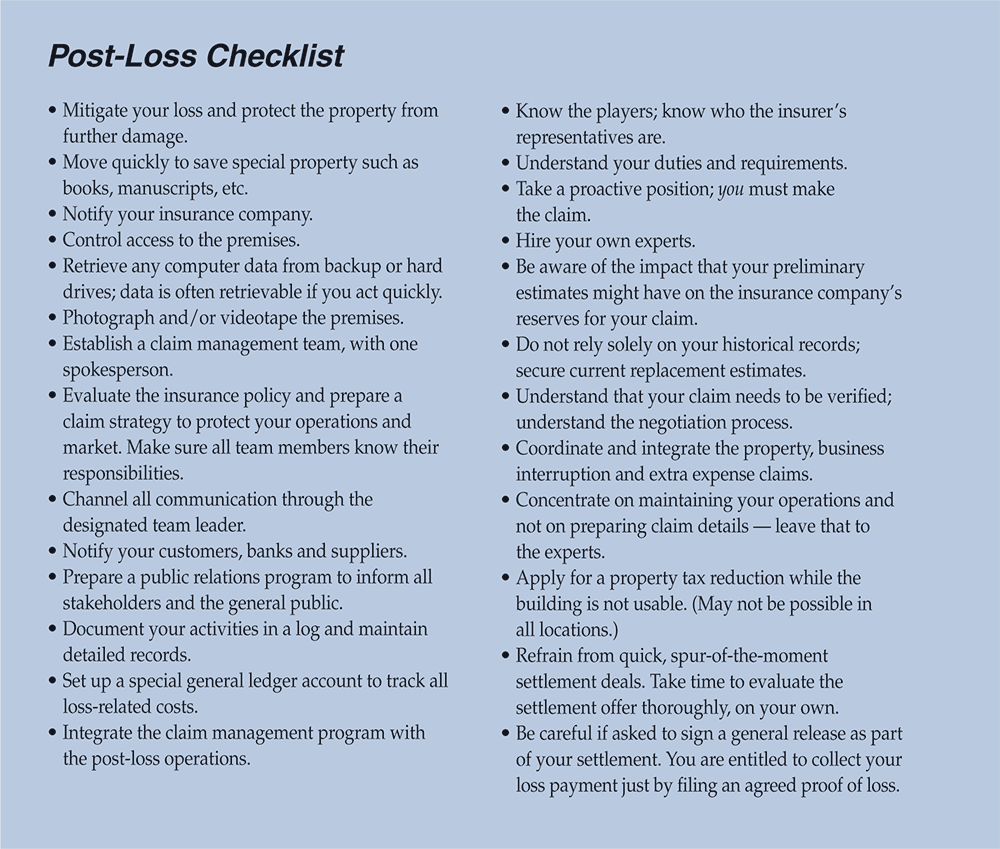

Any insurance claims you personally have made and claims tied to the house even before you lived there. Your insurance agent can run a comprehensive loss underwriting evaluation (clue) report on the past claims on the property. Clue reports compile insurance history about a location or vehicle. Submitting one will go on your claims history. Assist insureds in managing the property insurance claim process.6 preparing for and handling a property loss marsh their primary obligation is to the insurer. Rebuild cost of the property.

The clue personal property report, which pertains to homeowners insurance, is divided into two parts:

Your insurance agent can run a comprehensive loss underwriting evaluation (clue) report on the past claims on the property. The clue personal property report, which pertains to homeowners insurance, is divided into two parts: Having a claim needn’t be the end of the line as far as your insurance history is concerned. This reports past flood claims filed by the owner, but not flood damage at the property when no claim was filed. Here is a good faq on what a clue report is. Types of locks fitted to the external doors.

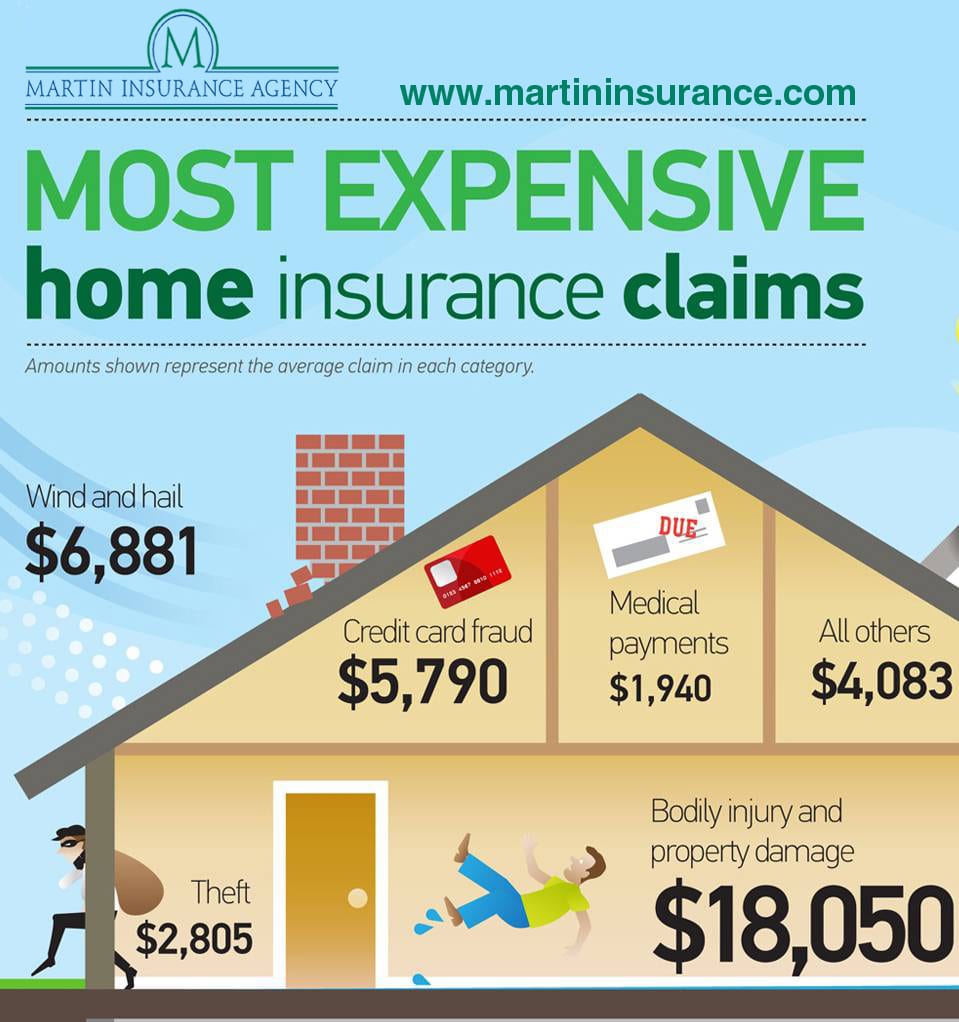

Source: martininsurance.com

Source: martininsurance.com

Do home insurance claims follow you? Rebuild cost of the property. The claim function exists to fulfill the insurer’s promises to its policyholders. Any insurance claims you personally have made and claims tied to the house even before you lived there. A clue report shows the claims filed for any house or car for the past seven years.

Source: allianz.ie

Source: allianz.ie

Homeowners insurance claims typically stay on a national property claim database called the comprehensive loss underwriting exchange (clue) for five to seven years. You will have to pay your deductible. Here is a good faq on what a clue report is. At intelligent insurance we take an objective view towards risk, and are typically able to arrange home insurance even if you’ve made multiple claims in the past. Call your insurance and request.

Source: pinterest.com

Source: pinterest.com

Primary adjuster duties are to investigate, negotiate, and settle your loss. Call your insurance and request. Insurance companies share information with each other about a person�s and a house�s claims history in a giant database called the comprehensive loss underwriting exchange (also known as clue). Approximate year that the property was built. This will be the most concrete way of determining whether or not the home has flooded in the past.

Source: ashburnham-insurance.co.uk

Source: ashburnham-insurance.co.uk

The number of claims in either section will affect whether you can get insurance for your home, how much coverage you can. Claim history is one indicator of home condition, and there is a strong correlation between previous claims and probability of future claims. Insurance companies share information with each other about a person�s and a house�s claims history in a giant database called the comprehensive loss underwriting exchange (also known as clue). Many insurers, when faced with a property claim, require the insured to present an itemized list of contents included in the claim. The clue personal property report, which pertains to homeowners insurance, is divided into two parts:

Source: quotewizard.com

Source: quotewizard.com

Clue stands for comprehensive loss underwriting exchange and is a database of claim information. This reports past flood claims filed by the owner, but not flood damage at the property when no claim was filed. Do home insurance claims follow you? A home insurance incident that is logged on the cue insurance database stays there for six years after the claim (if there is one) is closed, unless proven incorrect during that time. The claims listed in the database will indicate losses on a home that go back five years.

Source: insurancerevolution.co.uk

Source: insurancerevolution.co.uk

Many insurers, when faced with a property claim, require the insured to present an itemized list of contents included in the claim. Homeowners insurance claims typically stay on a national property claim database called the comprehensive loss underwriting exchange (clue) for five to seven years. Insurance companies can report information to clue when you file a claim. Certainly, public insurance claims adjusters, such as the alex n. Call your insurance and request.

![Home Insurance Claims Cost [Infographic] Home Insurance Claims Cost [Infographic]](http://www.ironpointinsurance.com/wp-content/uploads/2014/12/Home-Insurance-Claims.png) Source: ironpointinsurance.com

Source: ironpointinsurance.com

Sill company, can help smooth the way through a claim if this issue should arise. Clue stands for comprehensive loss underwriting exchange and is a database of claim information. Call your insurance and request. Our team will talk through your claims history and home insurance requirements, and in most cases will be able to tailor cover. To get an online quote, you�ll need to know.

Source: iso.com

Source: iso.com

The clue personal property report, which pertains to homeowners insurance, is divided into two parts: The only exception being if you did not carry insurance. This reports past flood claims filed by the owner, but not flood damage at the property when no claim was filed. Insurance claims history on a house. Assist insureds in managing the property insurance claim process.6 preparing for and handling a property loss marsh their primary obligation is to the insurer.

Source: fortheloveofcaelan.blogspot.com

Source: fortheloveofcaelan.blogspot.com

Your insurance agent can run a comprehensive loss underwriting evaluation (clue) report on the past claims on the property. Call your insurance and request. Amount paid on the claim. The claims listed in the database will indicate losses on a home that go back five years. Any insurance claims you personally have made and claims tied to the house even before you lived there.

Source: loiselleinsurance.com

Source: loiselleinsurance.com

You will also need to obtain from all companies if you have switched insurance providers within that time frame. Adjusters will do what they can to assist you but it is not their obligation to prepare your claim. Most homeowners and auto insurance companies contribute claims history information to a database known as the comprehensive loss underwriting exchange (c.l.u.e.), which is. Your personal record of claims (“claims for the subject”) and the claims on your home (“claims history for risk”). Many insurers, when faced with a property claim, require the insured to present an itemized list of contents included in the claim.

Source: bookingready.com

Source: bookingready.com

A clue report provides vital history of a home�s insurance claims that is valuable to both homeowners and insurers. You could see an increase upon renewal. You will also need to obtain from all companies if you have switched insurance providers within that time frame. The year, value and type of claim. Call your insurance and request.

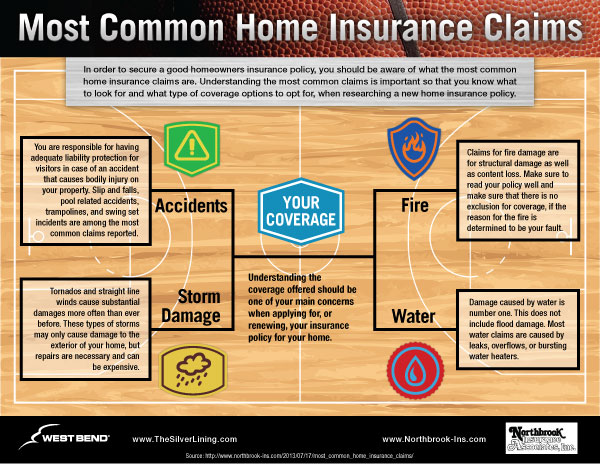

Source: thesilverlining.com

Source: thesilverlining.com

Our team will talk through your claims history and home insurance requirements, and in most cases will be able to tailor cover. Our team will talk through your claims history and home insurance requirements, and in most cases will be able to tailor cover. Approximate year that the property was built. Amount paid on the claim. Contact a sill public adjuster near you for help maximizing your business or residential property damage insurance claim.

Source: churchillpublicadjusters.com

Source: churchillpublicadjusters.com

Do home insurance claims follow you? Rebuild cost of the property. Clue stands for comprehensive loss underwriting exchange and is a database of claim information. Whether the property has suffered from a flood, structural movement, subsidence and whether it has been underpinned. The year, value and type of claim.

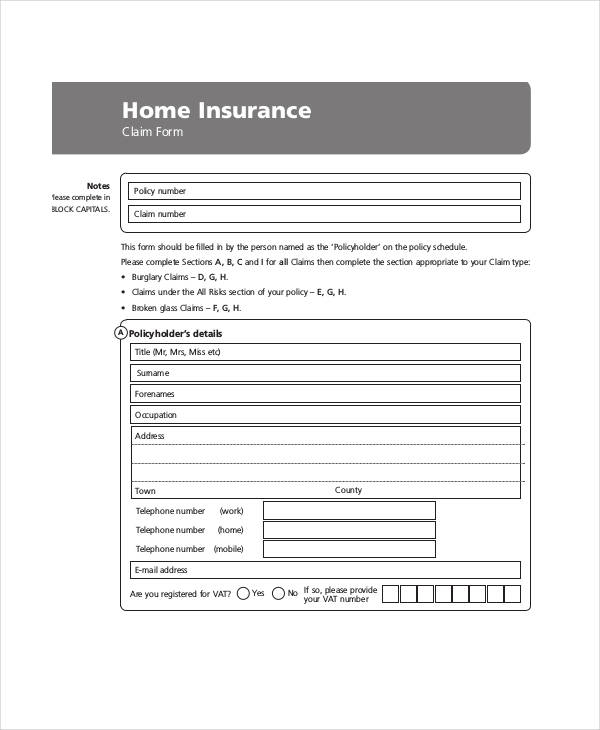

Source: sampleforms.com

Source: sampleforms.com

Claim adjusting is integral to establishing an insurer’s relationship to its policyholders. The reputation of the insurer in settling claims directly impacts the marketing and retention of policyholder insurance. Clue reports compile insurance history about a location or vehicle. An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. Approximate year that the property was built.

Source: pinterest.com

Source: pinterest.com

Yes, most home insurance companies provide information to the clue report, so your claims history follows you. It lists claims on your home or vehicle, even if you weren’t the owner at the time. Contact a sill public adjuster near you for help maximizing your business or residential property damage insurance claim. To find out if a home has had previous insurance claims, view a clue report or a home seller�s disclosure report. An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event.

Source: iii.org

Source: iii.org

Amount paid on the claim. Assist insureds in managing the property insurance claim process.6 preparing for and handling a property loss marsh their primary obligation is to the insurer. Insurance companies can report information to clue when you file a claim. Your personal record of claims (“claims for the subject”) and the claims on your home (“claims history for risk”). They have the right to demand those documents from the promises made in the new york standard fire insurance policy that has been adopted by most states.

Source: bemoneyaware.com

Source: bemoneyaware.com

Clue reports compile insurance history about a location or vehicle. Here is a good faq on what a clue report is. This reports past flood claims filed by the owner, but not flood damage at the property when no claim was filed. Adjusters will do what they can to assist you but it is not their obligation to prepare your claim. There is a chance it could get denied.

Source: adjustersinternational.com

Source: adjustersinternational.com

Approximate year that the property was built. Rebuild cost of the property. Adjusters will do what they can to assist you but it is not their obligation to prepare your claim. Having a claim needn’t be the end of the line as far as your insurance history is concerned. Insurance companies can report information to clue when you file a claim.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance claim history on a house by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.