Insurance companies create a pool of funds to handle Idea

Home » Trending » Insurance companies create a pool of funds to handle IdeaYour Insurance companies create a pool of funds to handle images are available in this site. Insurance companies create a pool of funds to handle are a topic that is being searched for and liked by netizens now. You can Get the Insurance companies create a pool of funds to handle files here. Get all royalty-free images.

If you’re looking for insurance companies create a pool of funds to handle images information linked to the insurance companies create a pool of funds to handle keyword, you have visit the right blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Insurance Companies Create A Pool Of Funds To Handle. This process is known as risk pooling and is performed by actuaries hired by the insurance company. Pension funds use a variety of different financial instruments to invest across different asset. A responsibility to pay for or fix a problem. Other activities include investing the accumulated funds and managing the portfolio.

Insurance Companies Create A Pool Of Funds To Handle From noclutter.cloud

Insurance Companies Create A Pool Of Funds To Handle From noclutter.cloud

Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. Property and casualty insurance companies usually invest around 30 percent of holdings in common stocks. Insurance pools lessen the financial burden on governments after catastrophes, such as hurricanes. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. It receives premium payments placed in loans or investments to accumulate funds to cover future benefits. Insurance involves pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur.

Here is an essay on the risks faced by insurance companies.

It receives premium payments placed in loans or investments to accumulate funds to cover future benefits. It receives premium payments placed in loans or investments to accumulate funds to cover future benefits. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. Alone, the companies could not afford the risk of taking on high risk accounts, but by pooling their assets. Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. The appeal of bonds is that they provide a much more predictable future cashflow, but also.

Source: moneygirlphilippines.com

Source: moneygirlphilippines.com

The amount a holder of an insurance policymust pay the insurance company for the protections the policy offers. The risk pools determine the likelihood of a loss occurring for a class and the price for that risk, which becomes the premium amount. Pooling is used as a way of providing high risk insurance. Here is an essay on the risks faced by insurance companies. In this section, we discuss two broad areas:

Source: usa-warranty.com

Source: usa-warranty.com

The business of insurance is based on dealing with uncertainty. Insurance companies offer insurance policies and annuities, which can be financial instruments. Pooling is used as a way of providing high risk insurance. Pension funds use a variety of different financial instruments to invest across different asset. Other activities include investing the accumulated funds and managing the portfolio.

Source: noclutter.cloud

Source: noclutter.cloud

The amount a holder of an insurance policymust pay the insurance company for the protections the policy offers. Insurance involves pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur. Pension funds use a variety of different financial instruments to invest across different asset. In this section, we discuss two broad areas: Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium rating category.

Source: thequint.com

Source: thequint.com

It is a financial intermediary handling individual savings. The amount a holder of an insurance policymust pay the insurance company for the protections the policy offers. It receives premium payments placed in loans or investments to accumulate funds to cover future benefits. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium rating category. Consumer to share liability with a company.

Source: signdesignomatic.blogspot.com

Source: signdesignomatic.blogspot.com

Property and casualty insurance companies usually invest around 30 percent of holdings in common stocks. Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. Insurance is a financial service that allows a. Insurance is a financial service that allows a. In insurance, the practice of risk pooling is where insurance companies join together to evenly spread out financial risk among contributors.

Source: reports.weforum.org

Source: reports.weforum.org

An entrepreneur keeps backup funds in a savings account so that if their business experiences a loss, they will be able to recuperate. Here is an essay on the risks faced by insurance companies. Managing your risk constitutes a major element of your financial plan. Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). Insurance companies create this pool of funds to handle risk.

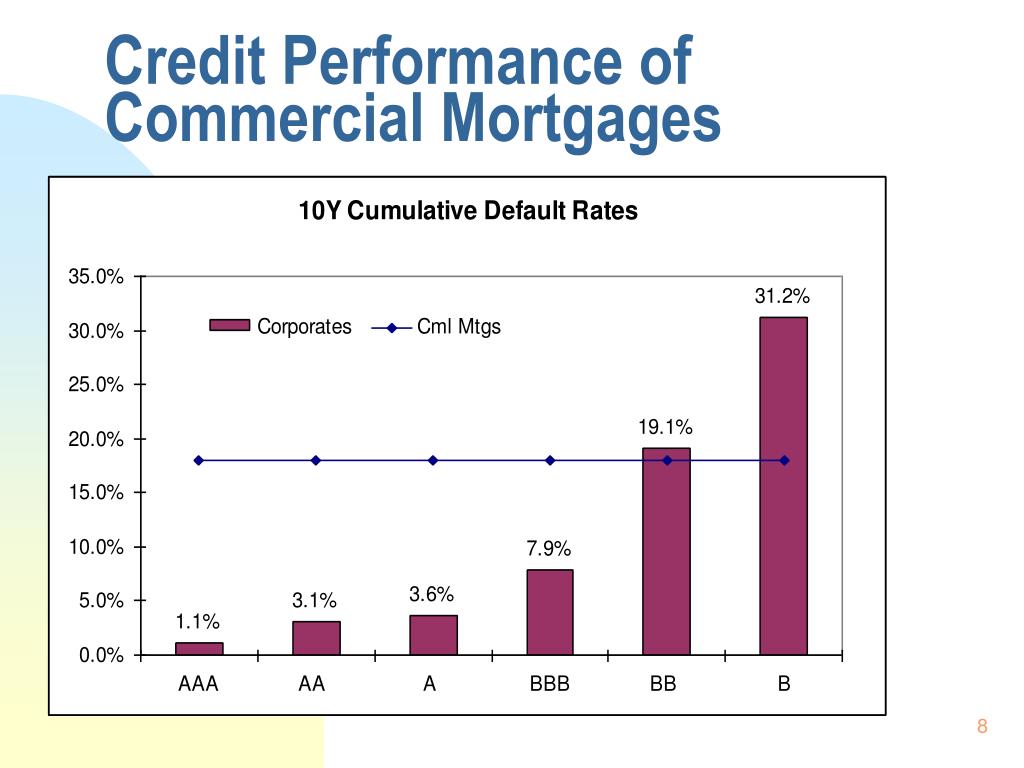

Source: slideserve.com

Source: slideserve.com

Pooling is used as a way of providing high risk insurance. In general, the larger the risk pool, the more. Insurance involves pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur. Insurance is a financial service that allows a. The appeal of bonds is that they provide a much more predictable future cashflow, but also.

Source: belghiti2007.e-monsite.com

Source: belghiti2007.e-monsite.com

The amount a holder of an insurance policymust pay the insurance company for the protections the policy offers. Pension funds use a variety of different financial instruments to invest across different asset. Therefore, an insurer needs to consider a wide range of possible risks and the outcome that may affect the current and future financial position. Managing your risk constitutes a major element of your financial plan. It is a financial intermediary handling individual savings.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Insurance companies create this pool of funds to handle risk. Introduction to the risks faced by insurance companies: Alone, the companies could not afford the risk of taking on high risk accounts, but by pooling their assets. The business of insurance is based on dealing with uncertainty. Insurance companies create a pool of funds to handle.

Source: slideshare.net

Source: slideshare.net

Introduction to the risks faced by insurance companies: In insurance, the practice of risk pooling is where insurance companies join together to evenly spread out financial risk among contributors. Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. Managing your risk constitutes a major element of your financial plan. The risk pools determine the likelihood of a loss occurring for a class and the price for that risk, which becomes the premium amount.

Source: signdesignomatic.blogspot.com

Source: signdesignomatic.blogspot.com

The amount a holder of an insurance policymust pay the insurance company for the protections the policy offers. Insurance is a financial service that allows a. It receives premium payments placed in loans or investments to accumulate funds to cover future benefits. This process is known as risk pooling and is performed by actuaries hired by the insurance company. Consumer to share liability with a company.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Here is an essay on the risks faced by insurance companies. Pension funds use a variety of different financial instruments to invest across different asset. Insurance companies create this pool of funds to handle risk. Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. An entrepreneur keeps backup funds in a savings account so that if their business experiences a loss, they will be able to recuperate.

Source: makalah82.blogspot.com

Source: makalah82.blogspot.com

When an insurance company needs to provide a payout, the money is removed from a pool of funds. An insurance pool is a collective pool of assets from multiple insurance companies. Introduction to the risks faced by insurance companies: In this section, we discuss two broad areas: Managing your risk constitutes a major element of your financial plan.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The business of insurance is based on dealing with uncertainty. Insurance companies create a pool of funds to handle. In this section, we discuss two broad areas: Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. The activities of insurance companies include underwriting insurance policies (including determining the acceptability of risks, the coverage terms, and the premium), billing and collecting premiums, and investigating and settling claims made under policies.

Source: 1investing.in

Source: 1investing.in

Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). Pooling is used as a way of providing high risk insurance. Insurance involves pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur. In this section, we discuss two broad areas: Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard.

Source: sriveshwealth.com

Source: sriveshwealth.com

This process is known as risk pooling and is performed by actuaries hired by the insurance company. Pension funds use a variety of different financial instruments to invest across different asset. An entrepreneur keeps backup funds in a savings account so that if their business experiences a loss, they will be able to recuperate. This process is known as risk pooling and is performed by actuaries hired by the insurance company. A financial service in which a consumer makes regular payments in exchange for a guarantee the costs associated with damages will be covered.

Source: signdesignomatic.blogspot.com

Source: signdesignomatic.blogspot.com

Pooling is used as a way of providing high risk insurance. Insurance is a financial service that allows a. The risk pools determine the likelihood of a loss occurring for a class and the price for that risk, which becomes the premium amount. Other activities include investing the accumulated funds and managing the portfolio. When an insurance company needs to provide a payout, the money is removed from a pool of funds.

Source: noclutter.cloud

Source: noclutter.cloud

Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). Insurance pools lessen the financial burden on governments after catastrophes, such as hurricanes. This process is known as risk pooling and is performed by actuaries hired by the insurance company. Insurance companies are highly regulated but sometimes they suffer from fraud and moral hazard. Property and casualty insurance companies usually invest around 30 percent of holdings in common stocks.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance companies create a pool of funds to handle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.